Lucid Gr Unusual Options Activity

Author: Benzinga Insights | April 19, 2024 12:16pm

Investors with significant funds have taken a bearish position in Lucid Gr (NASDAQ:LCID), a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in LCID usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 9 options transactions for Lucid Gr. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 22% being bullish and 77% bearish. Of all the options we discovered, 8 are puts, valued at $1,339,015, and there was a single call, worth $30,200.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $1.0 to $3.0 for Lucid Gr during the past quarter.

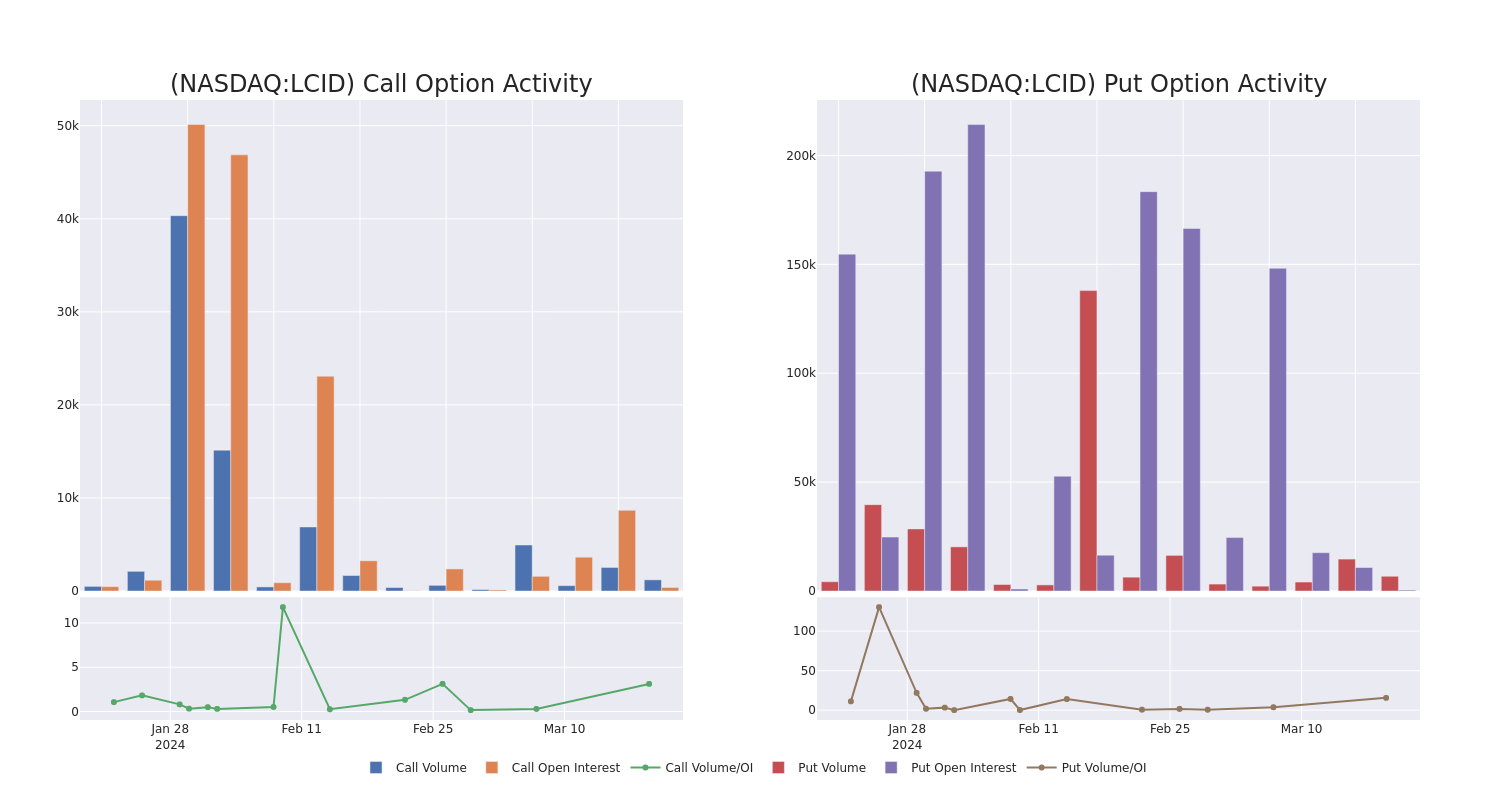

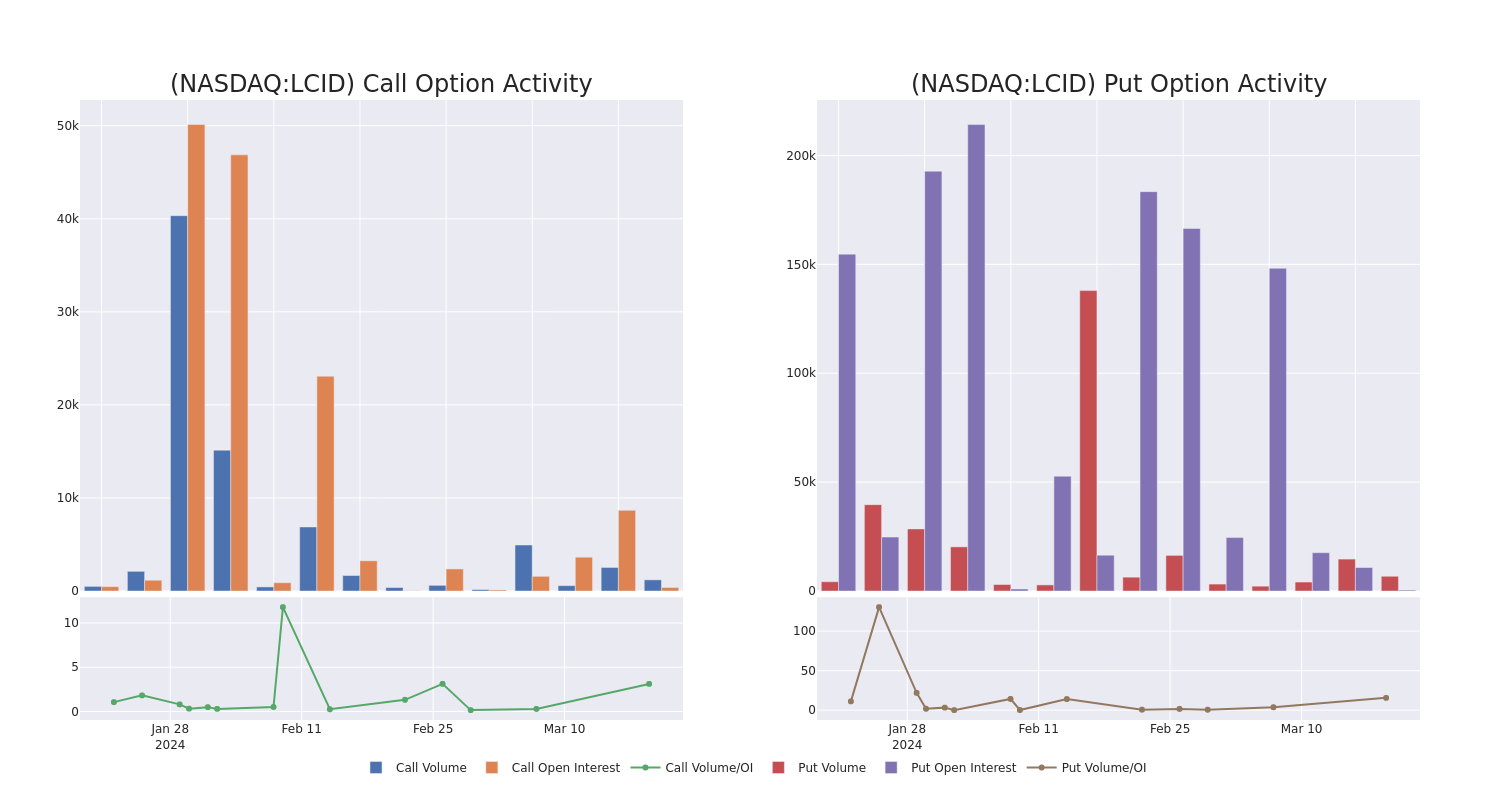

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lucid Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lucid Gr's substantial trades, within a strike price spectrum from $1.0 to $3.0 over the preceding 30 days.

Lucid Gr 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| LCID |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$0.67 |

$0.58 |

$0.67 |

$2.00 |

$334.0K |

28.6K |

5.0K |

| LCID |

PUT |

TRADE |

BEARISH |

01/17/25 |

$0.68 |

$0.6 |

$0.66 |

$2.00 |

$222.3K |

28.6K |

8.5K |

| LCID |

PUT |

SWEEP |

BEARISH |

08/16/24 |

$0.69 |

$0.65 |

$0.69 |

$2.50 |

$207.0K |

6.3K |

4.8K |

| LCID |

PUT |

TRADE |

BULLISH |

05/17/24 |

$0.76 |

$0.68 |

$0.7 |

$3.00 |

$140.0K |

67.7K |

1 |

| LCID |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$1.36 |

$1.24 |

$1.36 |

$3.00 |

$132.0K |

149.9K |

2.1K |

About Lucid Gr

Lucid Group Inc is a technology and automotive company. It develops the next generation of electric vehicle (EV) technologies. It is a vertically integrated company that designs, engineers, and builds electric vehicles, EV powertrains, and battery systems in-house using our own equipment and factory.

In light of the recent options history for Lucid Gr, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Lucid Gr

- With a volume of 6,608,517, the price of LCID is up 0.2% at $2.44.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 17 days.

Expert Opinions on Lucid Gr

1 market experts have recently issued ratings for this stock, with a consensus target price of $3.0.

- An analyst from Morgan Stanley persists with their Underweight rating on Lucid Gr, maintaining a target price of $3.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Lucid Gr, Benzinga Pro gives you real-time options trades alerts.

Posted In: LCID