Decoding Micron Technology's Options Activity: What's the Big Picture?

Author: Benzinga Insights | April 19, 2024 11:17am

Deep-pocketed investors have adopted a bearish approach towards Micron Technology (NASDAQ:MU), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MU usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 36 extraordinary options activities for Micron Technology. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 38% leaning bullish and 61% bearish. Among these notable options, 18 are puts, totaling $1,119,927, and 18 are calls, amounting to $740,529.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $80.0 to $160.0 for Micron Technology over the last 3 months.

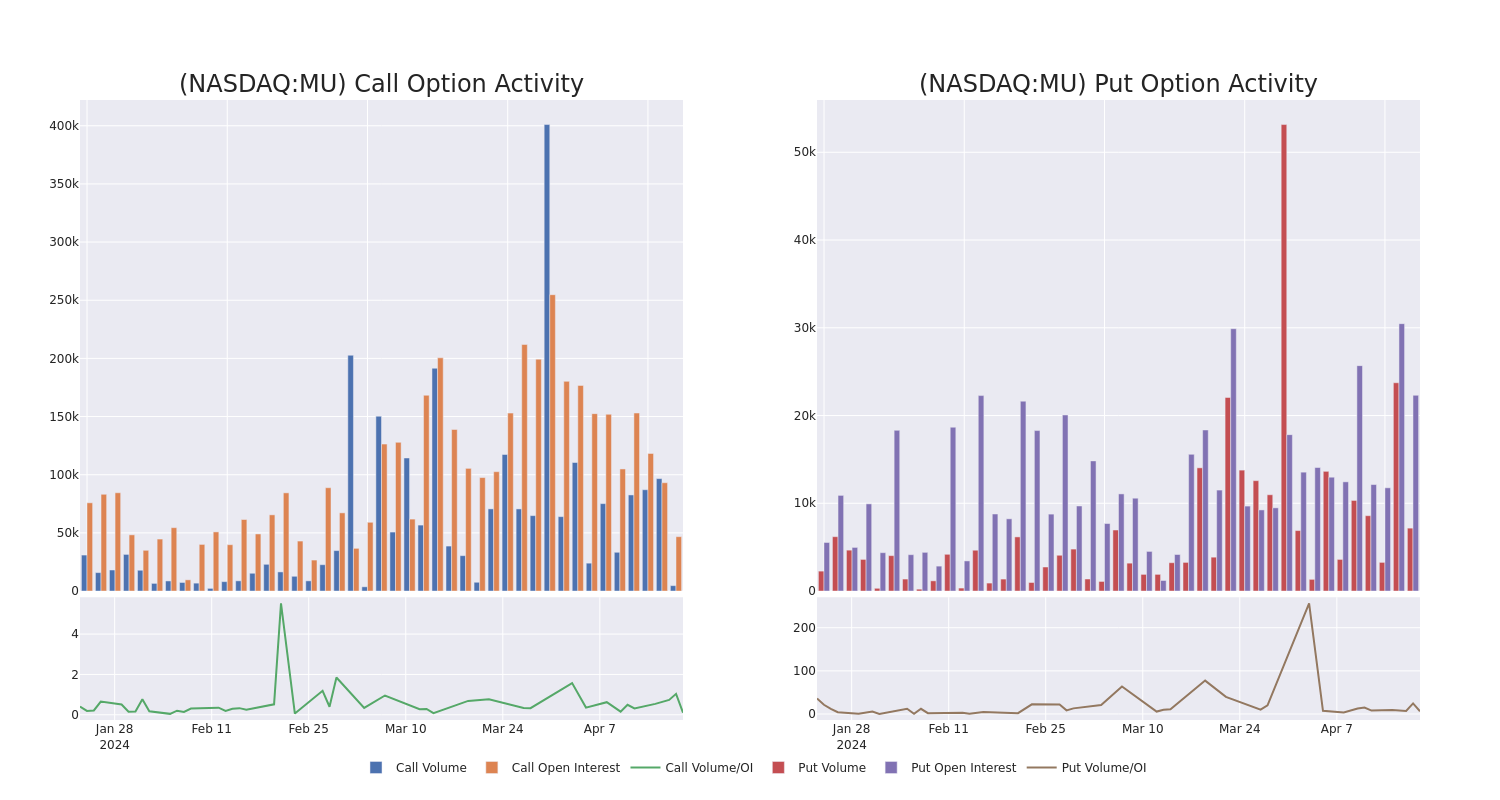

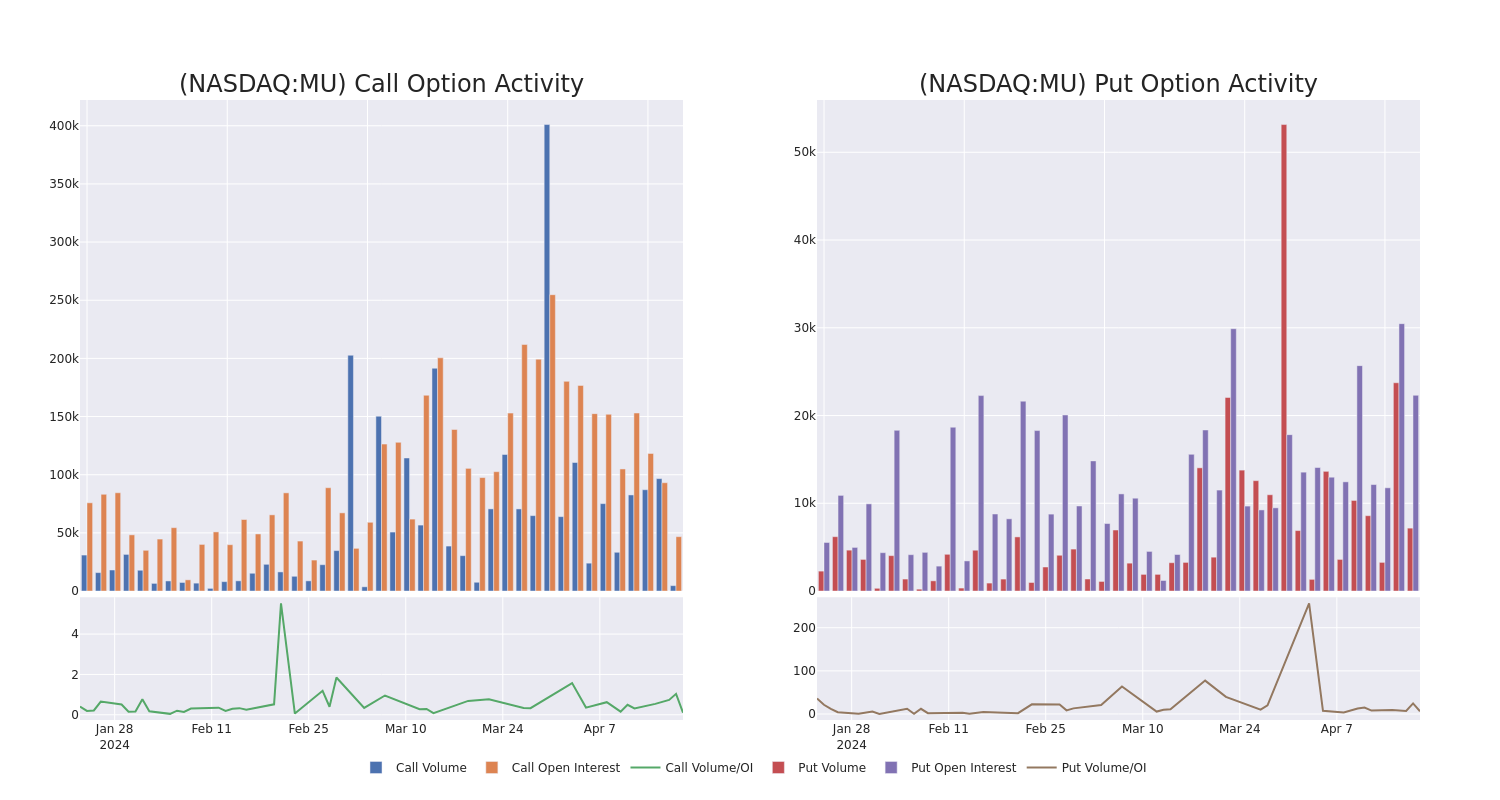

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Micron Technology's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Micron Technology's substantial trades, within a strike price spectrum from $80.0 to $160.0 over the preceding 30 days.

Micron Technology 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MU |

PUT |

TRADE |

BEARISH |

01/17/25 |

$9.5 |

$9.45 |

$9.5 |

$100.00 |

$190.0K |

2.9K |

714 |

| MU |

PUT |

SWEEP |

NEUTRAL |

01/17/25 |

$9.6 |

$9.5 |

$9.59 |

$100.00 |

$117.6K |

2.9K |

846 |

| MU |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$11.65 |

$11.5 |

$11.5 |

$120.00 |

$115.0K |

5.2K |

382 |

| MU |

CALL |

SWEEP |

BEARISH |

01/17/25 |

$11.55 |

$11.45 |

$11.45 |

$125.00 |

$114.5K |

1.8K |

60 |

| MU |

PUT |

TRADE |

BULLISH |

01/17/25 |

$31.25 |

$30.25 |

$30.25 |

$135.00 |

$105.8K |

333 |

35 |

About Micron Technology

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

In light of the recent options history for Micron Technology, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Micron Technology

- Trading volume stands at 9,494,208, with MU's price down by -2.82%, positioned at $108.77.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 68 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Micron Technology options trades with real-time alerts from Benzinga Pro.

Posted In: MU