What the Options Market Tells Us About Airbnb

Author: Benzinga Insights | April 19, 2024 11:03am

High-rolling investors have positioned themselves bullish on Airbnb (NASDAQ:ABNB), and it's important for retail traders to take note.

\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ABNB often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 8 options trades for Airbnb. This is not a typical pattern.

The sentiment among these major traders is split, with 50% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $104,310, and 7 calls, totaling $254,299.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $135.0 and $190.0 for Airbnb, spanning the last three months.

Analyzing Volume & Open Interest

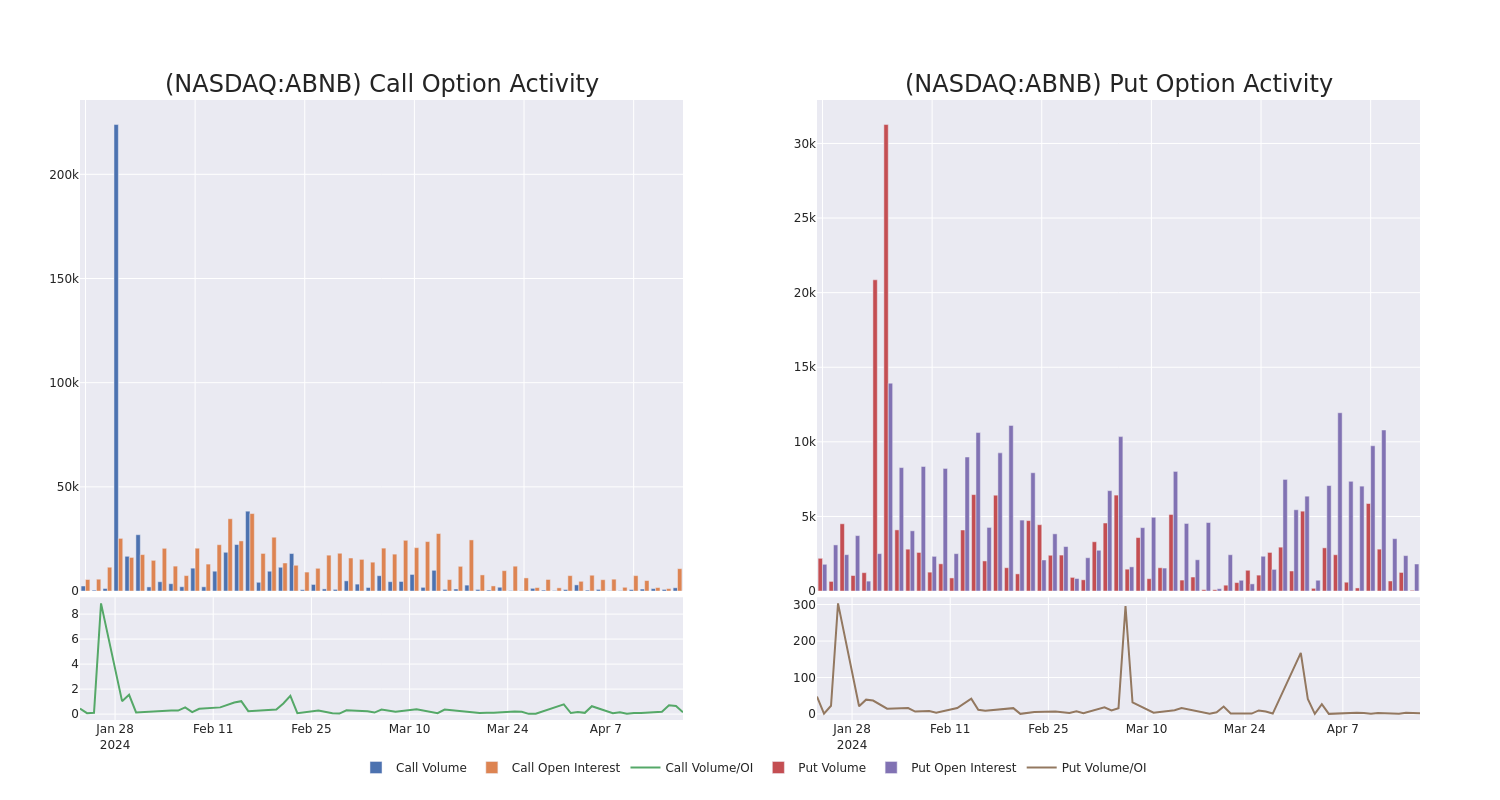

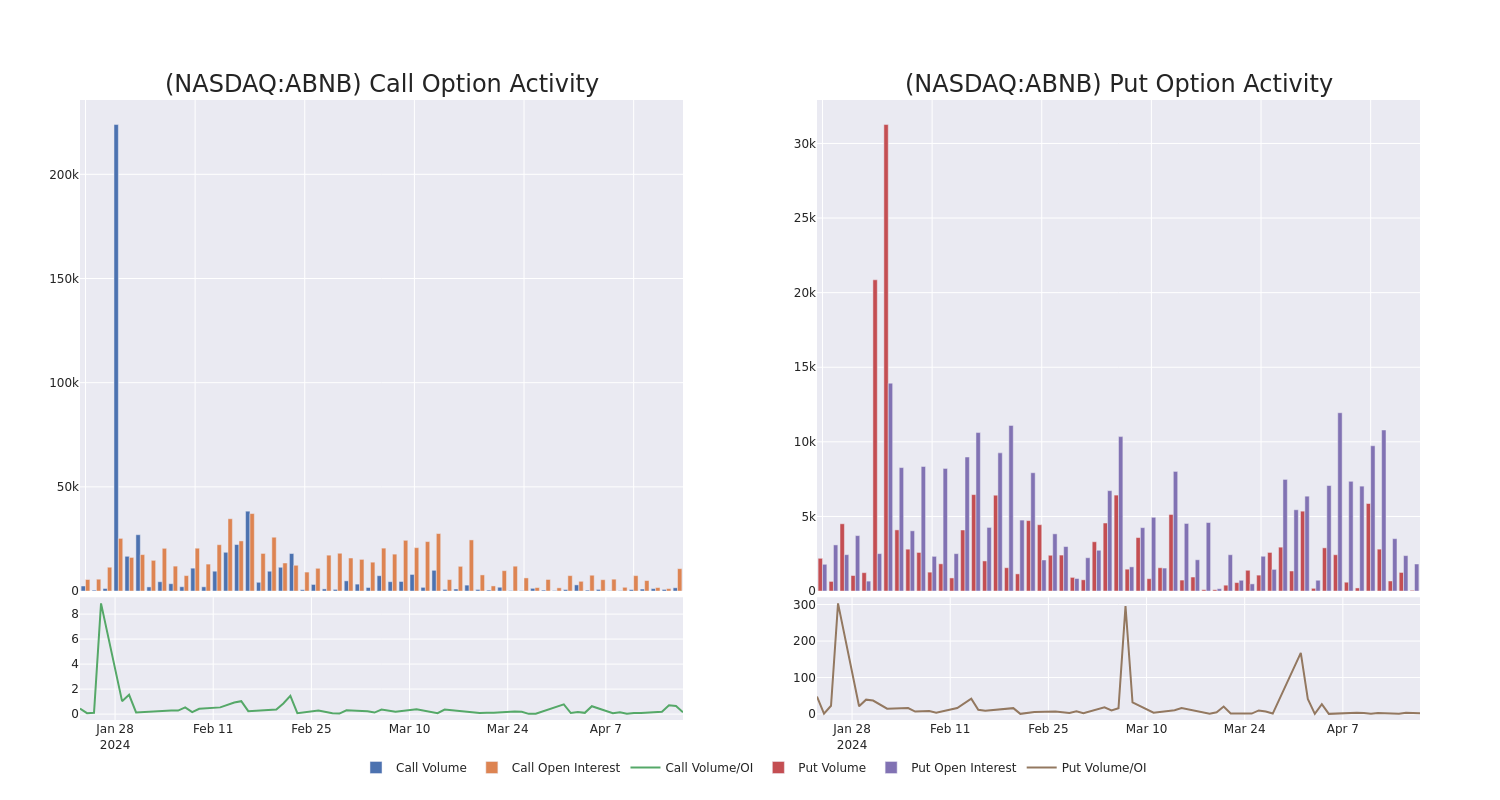

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Airbnb's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Airbnb's whale trades within a strike price range from $135.0 to $190.0 in the last 30 days.

Airbnb Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| ABNB |

PUT |

TRADE |

BULLISH |

01/16/26 |

$17.25 |

$17.1 |

$17.1 |

$135.00 |

$104.3K |

894 |

0 |

| ABNB |

CALL |

SWEEP |

BULLISH |

01/16/26 |

$35.2 |

$35.1 |

$35.2 |

$170.00 |

$49.2K |

429 |

172 |

| ABNB |

CALL |

SWEEP |

BEARISH |

04/19/24 |

$25.25 |

$24.65 |

$24.65 |

$135.00 |

$44.3K |

1.4K |

1 |

| ABNB |

CALL |

SWEEP |

BULLISH |

01/16/26 |

$35.2 |

$34.85 |

$35.2 |

$170.00 |

$38.7K |

429 |

178 |

| ABNB |

CALL |

TRADE |

BULLISH |

06/21/24 |

$7.0 |

$5.65 |

$7.0 |

$170.00 |

$35.0K |

2.0K |

0 |

About Airbnb

Started in 2008, Airbnb is the world's largest online alternative accommodation travel agency, also offering booking services for boutique hotels and experiences. Airbnb's platform offered 7.7 million active accommodation listings as of Dec. 31, 2023. Listings from the company's over 5 million hosts are spread over almost every country in the world. In 2023, 50% of revenue was from the North American region. Transaction fees for online bookings account for all its revenue.

In light of the recent options history for Airbnb, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Airbnb

- Currently trading with a volume of 702,305, the ABNB's price is down by -0.37%, now at $159.51.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 18 days.

Professional Analyst Ratings for Airbnb

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $164.4.

- An analyst from Tigress Financial persists with their Buy rating on Airbnb, maintaining a target price of $195.

- An analyst from Benchmark downgraded its action to Buy with a price target of $190.

- Reflecting concerns, an analyst from Wedbush lowers its rating to Neutral with a new price target of $160.

- An analyst from B. Riley Securities has revised its rating downward to Neutral, adjusting the price target to $150.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Underweight rating on Airbnb with a target price of $127.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Airbnb options trades with real-time alerts from Benzinga Pro.

Posted In: ABNB