Caterpillar's Options: A Look at What the Big Money is Thinking

Author: Benzinga Insights | April 19, 2024 11:02am

Investors with a lot of money to spend have taken a bullish stance on Caterpillar (NYSE:CAT).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CAT, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 40 uncommon options trades for Caterpillar.

This isn't normal.

The overall sentiment of these big-money traders is split between 72% bullish and 27%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $366,395, and 35 are calls, for a total amount of $1,278,400.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $290.0 to $440.0 for Caterpillar over the recent three months.

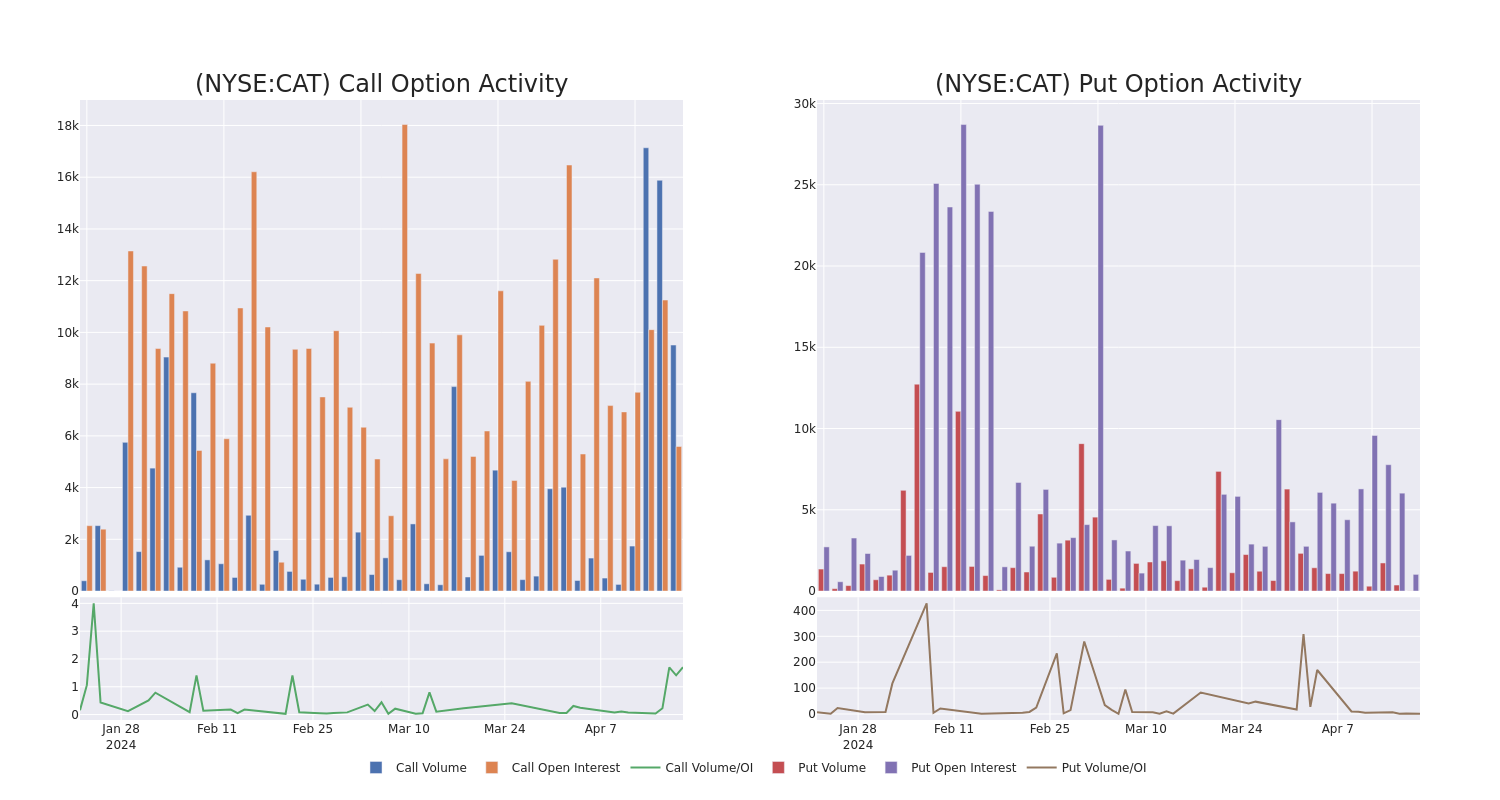

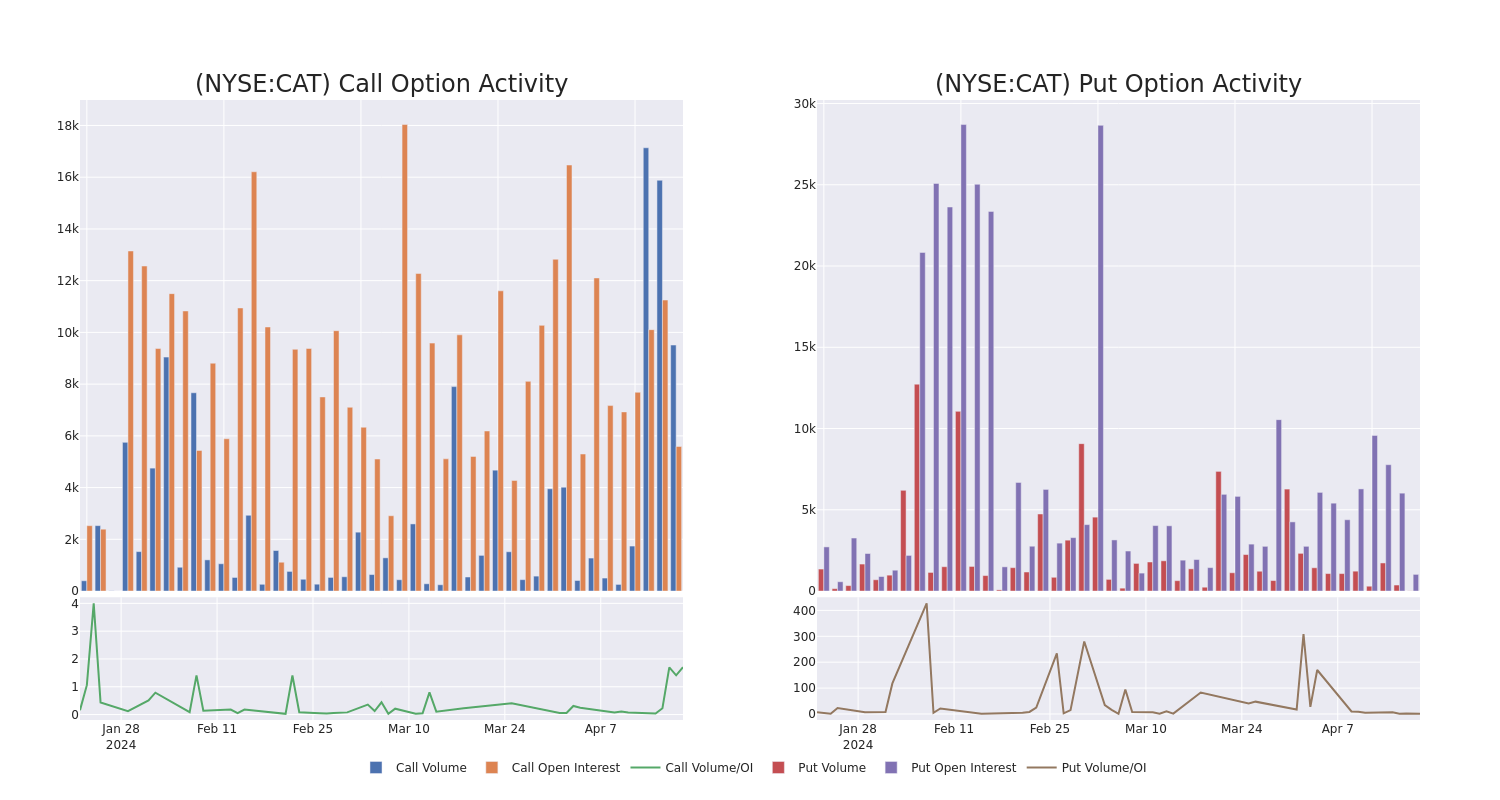

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Caterpillar's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Caterpillar's significant trades, within a strike price range of $290.0 to $440.0, over the past month.

Caterpillar Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CAT |

PUT |

SWEEP |

BULLISH |

06/21/24 |

$17.45 |

$17.05 |

$17.05 |

$360.00 |

$197.7K |

564 |

0 |

| CAT |

CALL |

SWEEP |

NEUTRAL |

06/21/24 |

$74.75 |

$72.9 |

$73.95 |

$290.00 |

$110.9K |

2.4K |

15 |

| CAT |

CALL |

SWEEP |

NEUTRAL |

05/17/24 |

$34.0 |

$33.85 |

$33.85 |

$330.00 |

$81.5K |

698 |

685 |

| CAT |

CALL |

TRADE |

BULLISH |

05/17/24 |

$61.25 |

$59.75 |

$60.65 |

$300.00 |

$78.8K |

1.5K |

14 |

| CAT |

PUT |

TRADE |

BULLISH |

01/17/25 |

$27.7 |

$27.4 |

$27.4 |

$350.00 |

$65.7K |

279 |

0 |

About Caterpillar

Caterpillar is the premier manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world's largest manufacturer of heavy equipment with over 13% market share in 2021. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Caterpillar Financial Services. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Caterpillar Financial Services provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

Having examined the options trading patterns of Caterpillar, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Caterpillar's Current Market Status

- With a trading volume of 649,620, the price of CAT is up by 0.26%, reaching $357.54.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 6 days from now.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Caterpillar, Benzinga Pro gives you real-time options trades alerts.

Posted In: CAT