Analyst Ratings For Choice Hotels Intl

Author: Benzinga Insights | April 19, 2024 11:02am

In the latest quarter, 8 analysts provided ratings for Choice Hotels Intl (NYSE:CHH), showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

2 |

2 |

4 |

0 |

| Last 30D |

0 |

0 |

0 |

1 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

2 |

2 |

0 |

| 3M Ago |

0 |

1 |

0 |

1 |

0 |

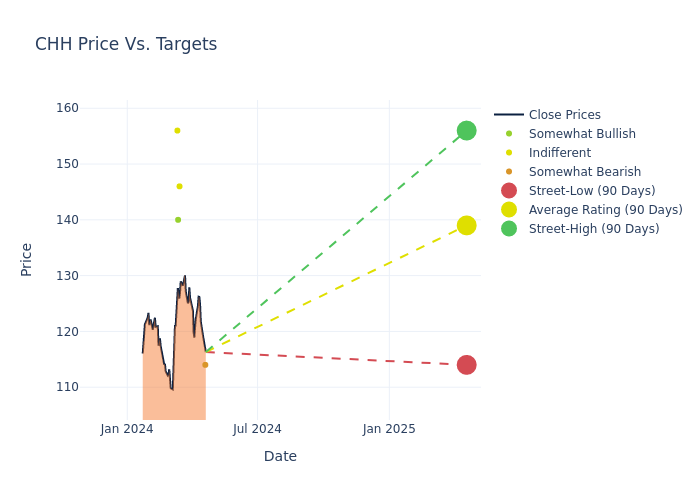

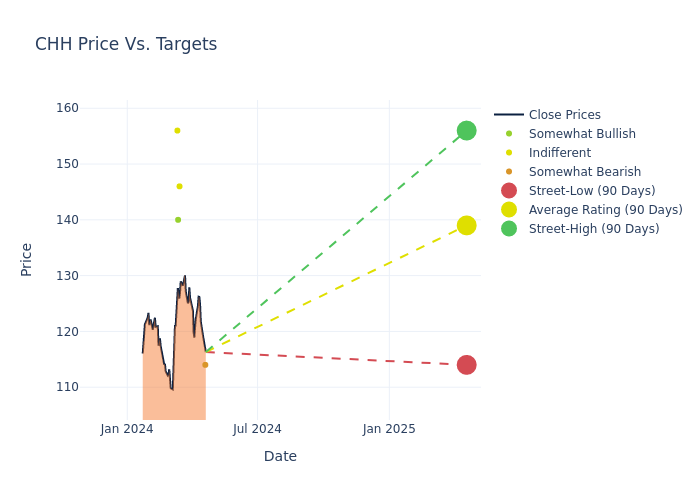

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $131.12, a high estimate of $156.00, and a low estimate of $114.00. Surpassing the previous average price target of $120.43, the current average has increased by 8.88%.

Interpreting Analyst Ratings: A Closer Look

The standing of Choice Hotels Intl among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Anthony Powell |

Barclays |

Lowers |

Underweight |

$114.00 |

$122.00 |

| Patrick Scholes |

Truist Securities |

Raises |

Hold |

$146.00 |

$142.00 |

| Michael Bellisario |

Baird |

Raises |

Outperform |

$140.00 |

$138.00 |

| Anthony Powell |

Barclays |

Raises |

Underweight |

$122.00 |

$119.00 |

| David Katz |

Jefferies |

Raises |

Hold |

$156.00 |

$96.00 |

| Brandt Montour |

Barclays |

Raises |

Underweight |

$119.00 |

$114.00 |

| Brandt Montour |

Barclays |

Raises |

Underweight |

$114.00 |

$112.00 |

| Michael Bellisario |

Baird |

Maintains |

Outperform |

$138.00 |

- |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Choice Hotels Intl. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Choice Hotels Intl compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Choice Hotels Intl's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Choice Hotels Intl's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Choice Hotels Intl analyst ratings.

All You Need to Know About Choice Hotels Intl

As of Dec. 31, 2023, Choice Hotels operated 633,000 rooms across 15 brands addressing the economy and midscale segments. Comfort Inn and Comfort Suites are the largest brands (27% of the company's total domestic rooms), while Ascend and Cambria (7% of total domestic rooms) are newer lifestyle and select-service brands. Choice closed on its Radisson acquisition in August 2022, which added around 70,000 rooms. Franchises account for 100% of total revenue, and the United States represent 79% of total rooms in 2023.

Financial Insights: Choice Hotels Intl

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Decline in Revenue: Over the 3 months period, Choice Hotels Intl faced challenges, resulting in a decline of approximately -0.99% in revenue growth as of 31 December, 2023. This signifies a reduction in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Choice Hotels Intl's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 8.04% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Choice Hotels Intl's ROE stands out, surpassing industry averages. With an impressive ROE of 53.34%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Choice Hotels Intl's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.25%, the company showcases efficient use of assets and strong financial health.

Debt Management: Choice Hotels Intl's debt-to-equity ratio is notably higher than the industry average. With a ratio of 47.24, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Understanding the Relevance of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CHH