Broadcom's Options: A Look at What the Big Money is Thinking

Author: Benzinga Insights | April 19, 2024 10:18am

Whales with a lot of money to spend have taken a noticeably bearish stance on Broadcom.

Looking at options history for Broadcom (NASDAQ:AVGO) we detected 30 trades.

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 63% with bearish.

From the overall spotted trades, 21 are puts, for a total amount of $1,555,937 and 9, calls, for a total amount of $340,205.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $1000.0 to $1800.0 for Broadcom during the past quarter.

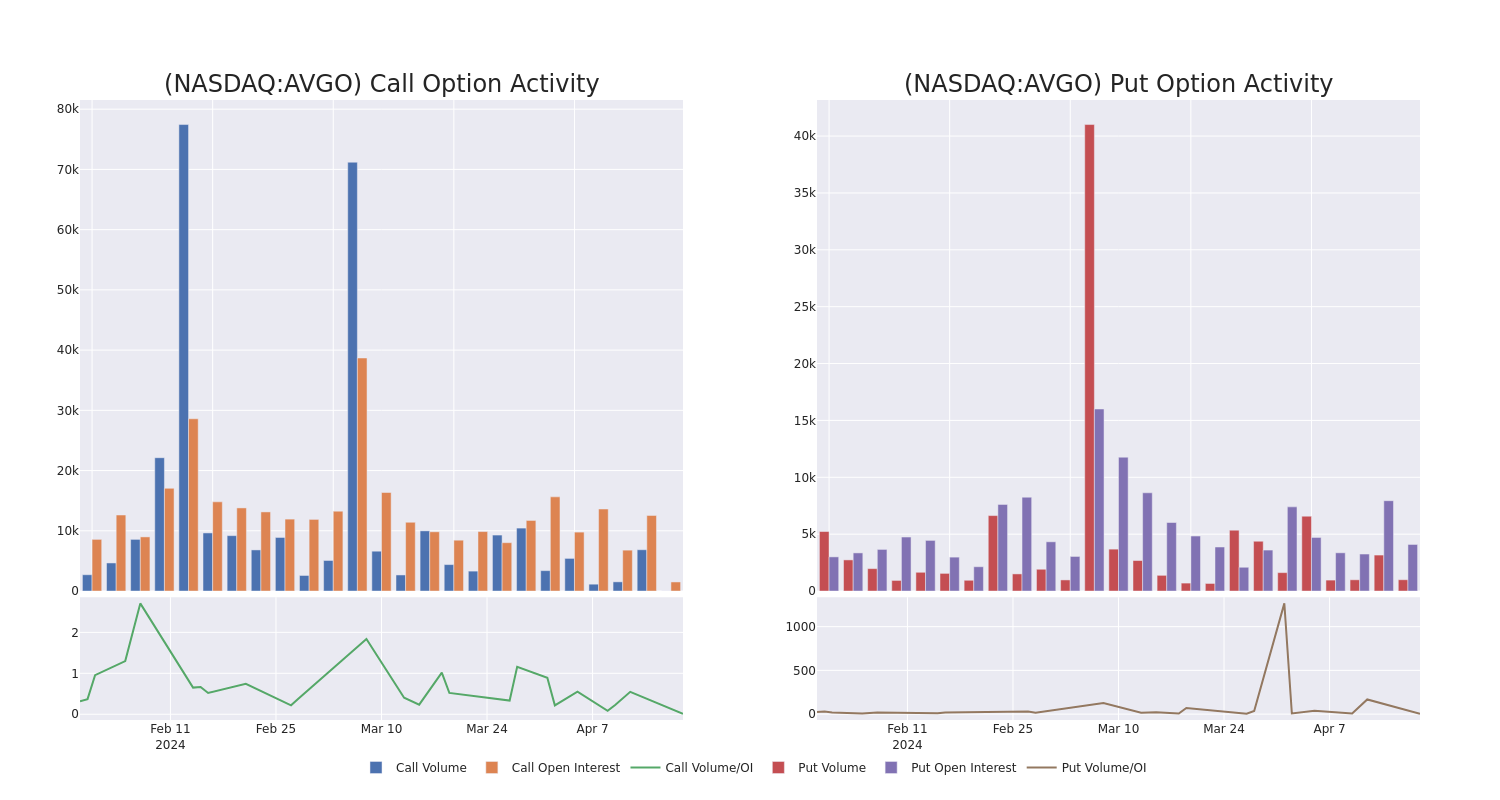

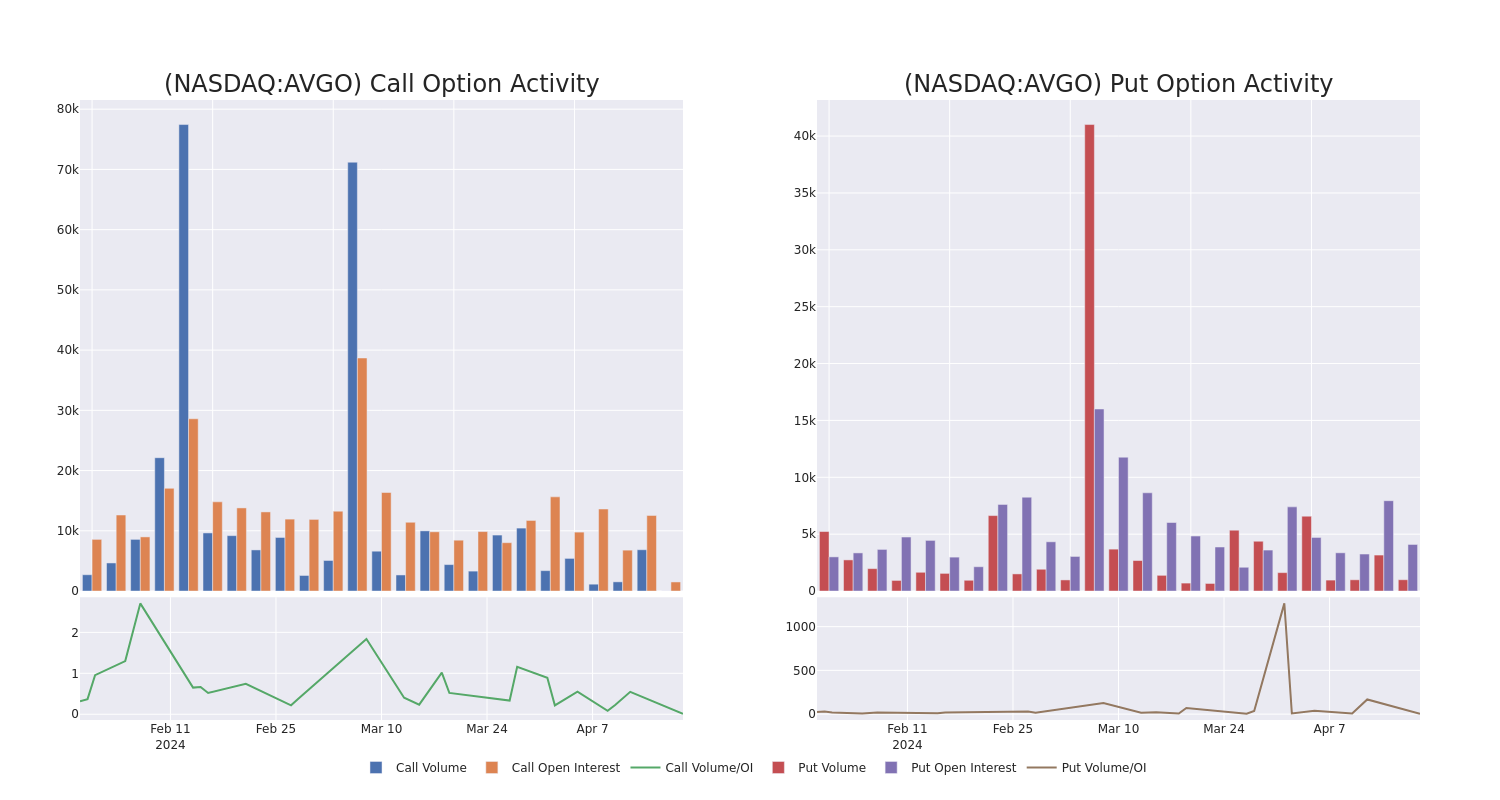

Volume & Open Interest Trends

In today's trading context, the average open interest for options of Broadcom stands at 219.4, with a total volume reaching 997.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Broadcom, situated within the strike price corridor from $1000.0 to $1800.0, throughout the last 30 days.

Broadcom Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| AVGO |

PUT |

SWEEP |

BEARISH |

04/19/24 |

$77.4 |

$74.2 |

$77.35 |

$1335.00 |

$293.9K |

195 |

50 |

| AVGO |

PUT |

TRADE |

BULLISH |

04/19/24 |

$93.2 |

$88.2 |

$88.2 |

$1345.00 |

$167.5K |

173 |

30 |

| AVGO |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$19.4 |

$17.8 |

$17.8 |

$1260.00 |

$115.7K |

663 |

172 |

| AVGO |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$17.5 |

$13.7 |

$17.5 |

$1260.00 |

$105.0K |

663 |

172 |

| AVGO |

PUT |

SWEEP |

NEUTRAL |

08/16/24 |

$92.0 |

$91.9 |

$91.9 |

$1240.00 |

$101.0K |

71 |

11 |

About Broadcom

Broadcom is the sixth-largest semiconductor company globally and has expanded into various software businesses, with over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. It is primarily a fabless designer but holds some manufacturing in-house, like for its best-of-breed FBAR filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments.Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as Brocade, CA Technologies, and Symantec in software.

In light of the recent options history for Broadcom, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Broadcom

- Trading volume stands at 276,660, with AVGO's price down by -0.59%, positioned at $1251.61.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 41 days.

Expert Opinions on Broadcom

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $1544.0.

- Showing optimism, an analyst from TD Cowen upgrades its rating to Outperform with a revised price target of $1500.

- An analyst from Benchmark has revised its rating downward to Buy, adjusting the price target to $1720.

- An analyst from Rosenblatt has revised its rating downward to Buy, adjusting the price target to $1500.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Broadcom with a target price of $1500.

- In a cautious move, an analyst from Deutsche Bank downgraded its rating to Buy, setting a price target of $1500.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Broadcom with Benzinga Pro for real-time alerts.

Posted In: AVGO