Check Out What Whales Are Doing With DKNG

Author: Benzinga Insights | April 19, 2024 10:18am

Investors with a lot of money to spend have taken a bullish stance on DraftKings (NASDAQ:DKNG).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with DKNG, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 8 options trades for DraftKings.

This isn't normal.

The overall sentiment of these big-money traders is split between 62% bullish and 37%, bearish.

Out of all of the options we uncovered, 7 are puts, for a total amount of $693,495, and there was 1 call, for a total amount of $224,500.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $23.0 to $45.0 for DraftKings during the past quarter.

Volume & Open Interest Trends

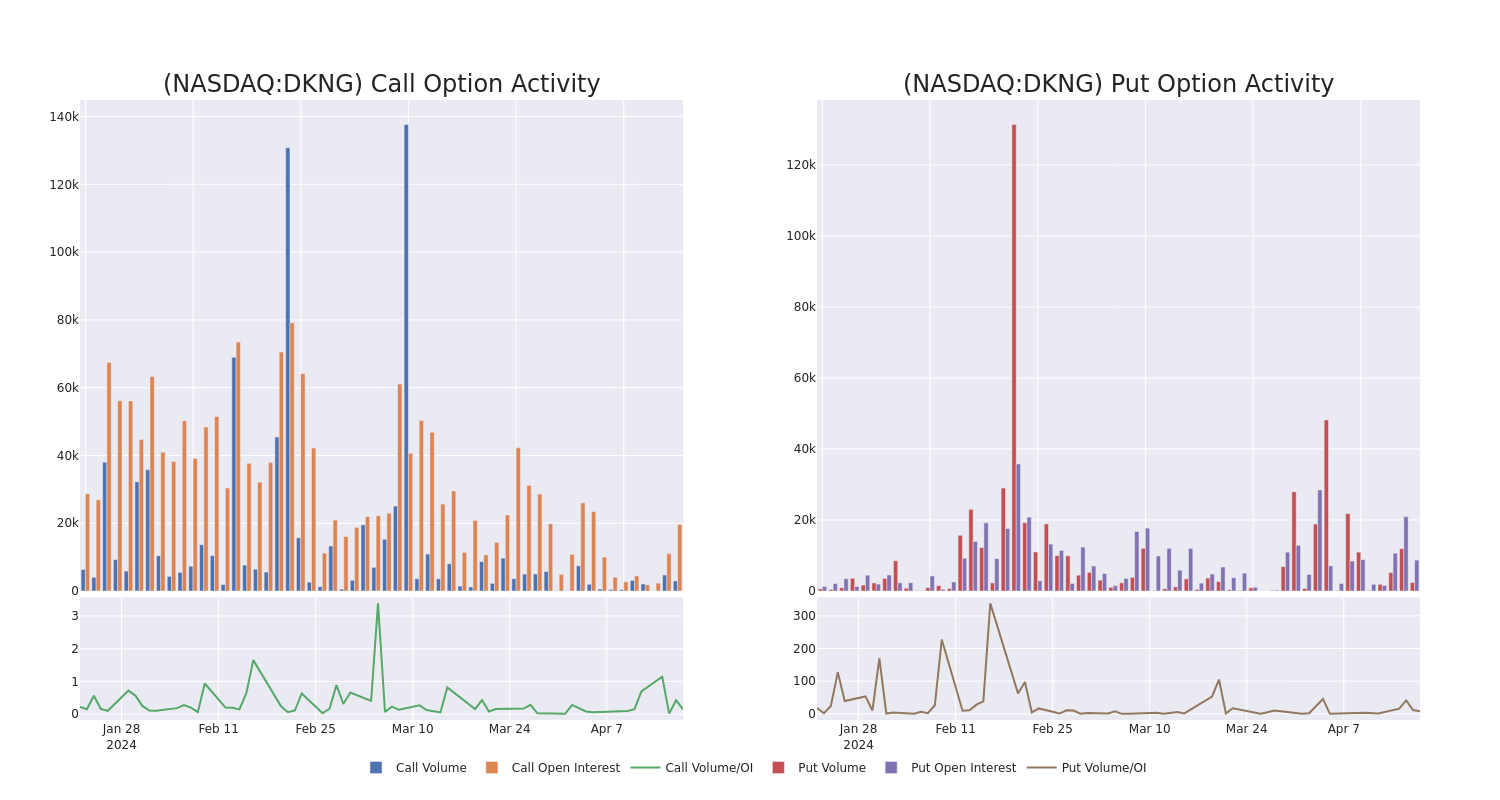

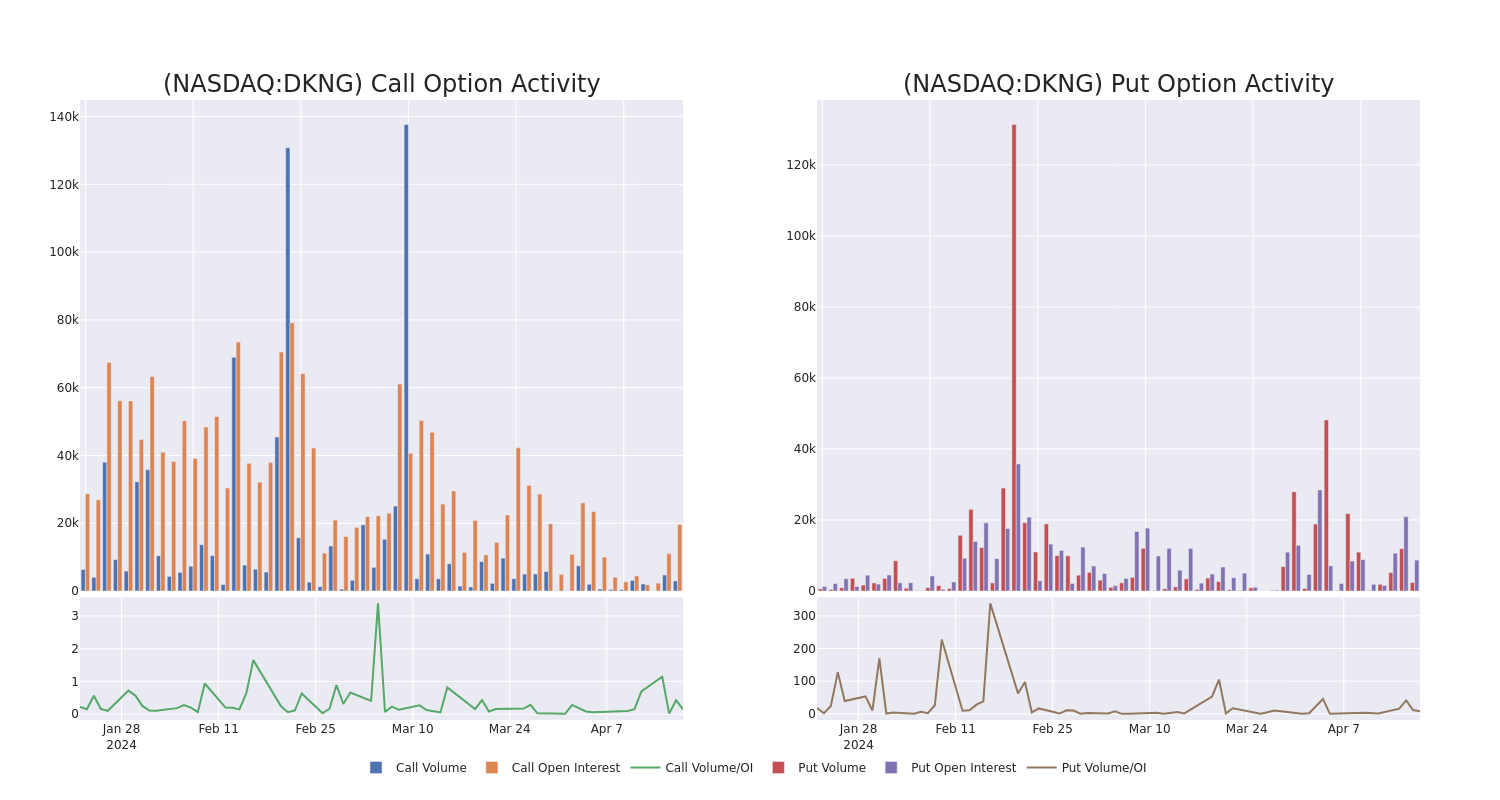

In today's trading context, the average open interest for options of DraftKings stands at 1745.0, with a total volume reaching 4,726.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in DraftKings, situated within the strike price corridor from $23.0 to $45.0, throughout the last 30 days.

DraftKings Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| DKNG |

CALL |

TRADE |

BEARISH |

08/15/25 |

$23.85 |

$22.45 |

$22.45 |

$23.00 |

$224.5K |

0 |

0 |

| DKNG |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$2.82 |

$2.54 |

$2.6 |

$45.00 |

$177.7K |

4.1K |

600 |

| DKNG |

PUT |

SWEEP |

BEARISH |

04/26/24 |

$1.96 |

$1.94 |

$1.95 |

$43.50 |

$156.0K |

1.0K |

860 |

| DKNG |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$2.85 |

$2.51 |

$2.65 |

$45.00 |

$116.4K |

4.1K |

1.8K |

| DKNG |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$2.7 |

$2.67 |

$2.7 |

$45.00 |

$106.7K |

4.1K |

410 |

About DraftKings

DraftKings got its start in 2012 as an innovator in daily fantasy sports. Then, following a Supreme Court ruling in 2018 that allowed states to legalize online sports wagering, the company expanded into online sports and casino gambling, where it generally holds the number two or three revenue share position across states in which it competes. DraftKings is now live with online sports betting in 24 states (46% of the US population) and iGaming in seven states (11% of US), with both products available to around 40% of Canada's population. The company also operates a non-fungible token commissioned-based marketplace and develops and licenses online gaming products.

In light of the recent options history for DraftKings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of DraftKings

- Trading volume stands at 1,399,083, with DKNG's price up by 1.73%, positioned at $42.36.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 13 days.

What Analysts Are Saying About DraftKings

5 market experts have recently issued ratings for this stock, with a consensus target price of $54.2.

- Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on DraftKings with a target price of $54.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on DraftKings with a target price of $55.

- An analyst from JMP Securities has revised its rating downward to Market Outperform, adjusting the price target to $52.

- In a cautious move, an analyst from Goldman Sachs downgraded its rating to Buy, setting a price target of $60.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for DraftKings, targeting a price of $50.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for DraftKings with Benzinga Pro for real-time alerts.

Posted In: DKNG