The Analyst Landscape: 4 Takes On Crown Castle

Author: Benzinga Insights | April 18, 2024 03:00pm

In the latest quarter, 4 analysts provided ratings for Crown Castle (NYSE:CCI), showcasing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

0 |

3 |

0 |

0 |

| Last 30D |

1 |

0 |

2 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

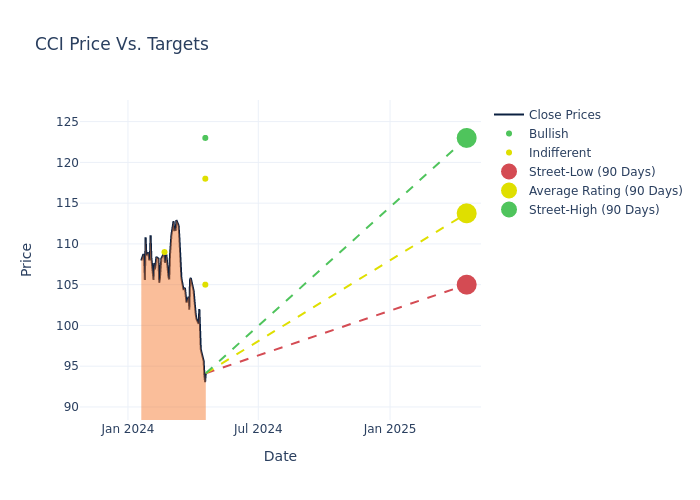

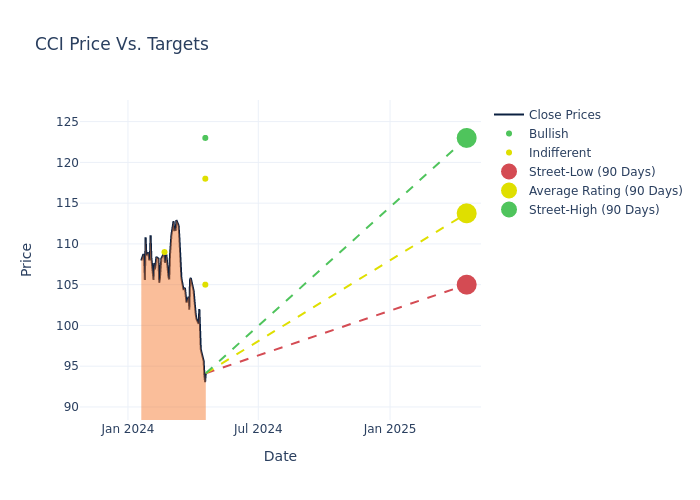

Analysts have recently evaluated Crown Castle and provided 12-month price targets. The average target is $113.75, accompanied by a high estimate of $123.00 and a low estimate of $105.00. A 1.3% drop is evident in the current average compared to the previous average price target of $115.25.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Crown Castle among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jonathan Petersen |

Jefferies |

Lowers |

Buy |

$123.00 |

$126.00 |

| Ari Klein |

BMO Capital |

Lowers |

Market Perform |

$105.00 |

$110.00 |

| Maher Yaghi |

Scotiabank |

Lowers |

Sector Perform |

$118.00 |

$133.00 |

| Jonathan Atkin |

RBC Capital |

Raises |

Sector Perform |

$109.00 |

$92.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Crown Castle. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Crown Castle compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Crown Castle's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Crown Castle's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Crown Castle analyst ratings.

About Crown Castle

Crown Castle International owns and leases roughly 40,000 cell towers in the United States. It also owns more than 85,000 route miles of fiber. It leases space on its towers to wireless service providers, which install equipment on the towers to support their wireless networks. The company's fiber is primarily leased by wireless service providers to set up small-cell network infrastructure and by enterprises for their internal connection needs. Crown Castle's towers and fiber are predominantly located in the largest U.S. cities. The company has a very concentrated customer base, with about 75% of its revenue coming from the big three U.S. mobile carriers. Crown Castle operates as a real estate investment trust.

Key Indicators: Crown Castle's Financial Health

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Decline in Revenue: Over the 3 months period, Crown Castle faced challenges, resulting in a decline of approximately -5.1% in revenue growth as of 31 December, 2023. This signifies a reduction in the company's top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 21.68%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Crown Castle's ROE stands out, surpassing industry averages. With an impressive ROE of 5.56%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.94%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Crown Castle's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 4.52.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CCI