Trade Desk's Options Frenzy: What You Need to Know

Author: Benzinga Insights | April 18, 2024 02:04pm

Financial giants have made a conspicuous bullish move on Trade Desk. Our analysis of options history for Trade Desk (NASDAQ:TTD) revealed 14 unusual trades.

Delving into the details, we found 78% of traders were bullish, while 21% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $820,467, and 7 were calls, valued at $516,755.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $80.0 to $140.0 for Trade Desk during the past quarter.

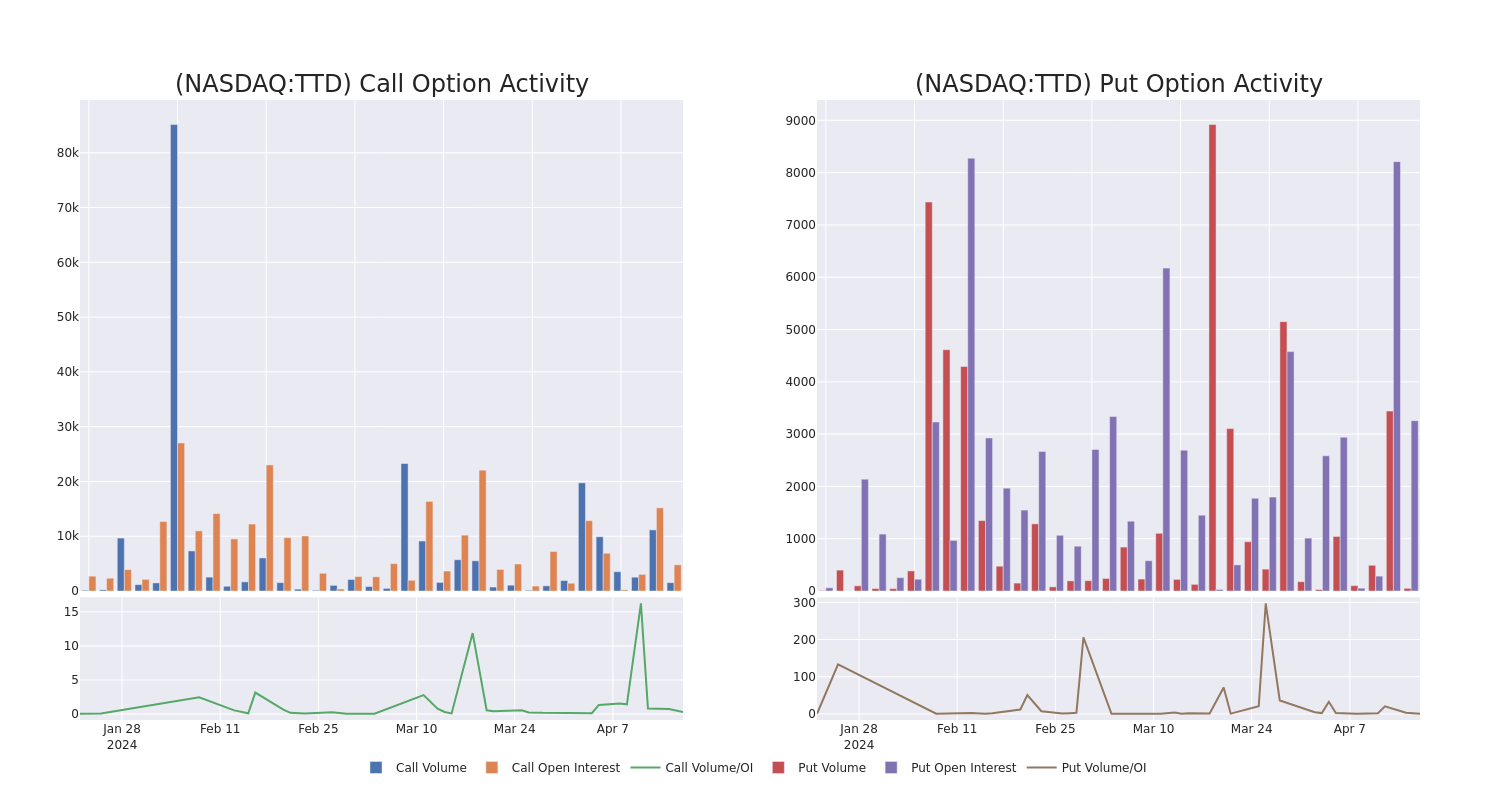

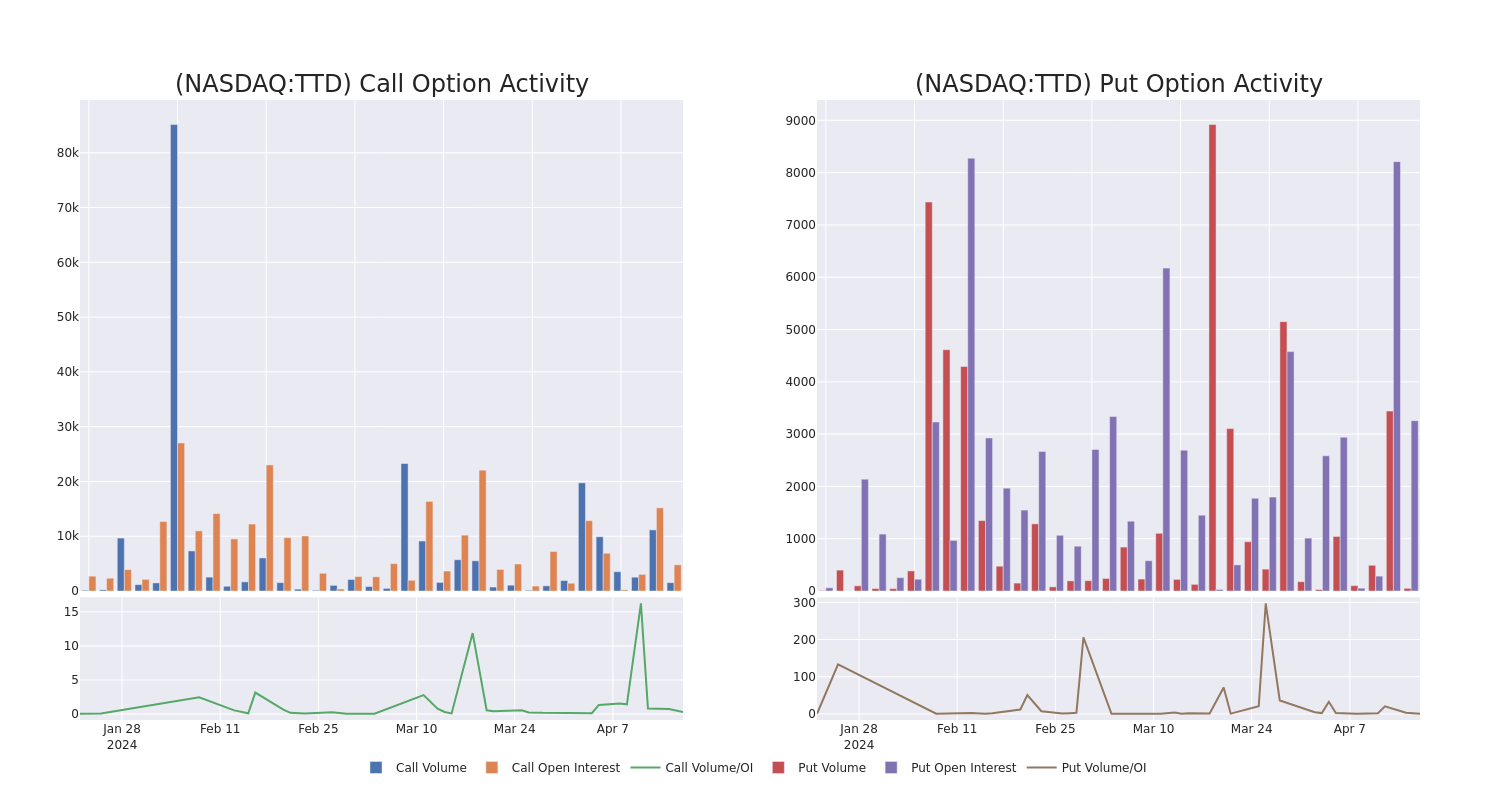

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Trade Desk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Trade Desk's substantial trades, within a strike price spectrum from $80.0 to $140.0 over the preceding 30 days.

Trade Desk Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| TTD |

PUT |

SWEEP |

BULLISH |

06/21/24 |

$7.65 |

$7.6 |

$7.6 |

$82.50 |

$594.3K |

1.9K |

796 |

| TTD |

CALL |

TRADE |

BULLISH |

06/21/24 |

$6.8 |

$6.75 |

$6.8 |

$82.50 |

$136.0K |

1.0K |

710 |

| TTD |

CALL |

TRADE |

BULLISH |

06/21/24 |

$6.75 |

$6.7 |

$6.75 |

$82.50 |

$135.0K |

1.0K |

110 |

| TTD |

CALL |

SWEEP |

BULLISH |

06/21/24 |

$6.75 |

$6.7 |

$6.75 |

$82.50 |

$73.5K |

1.0K |

1 |

| TTD |

PUT |

TRADE |

BEARISH |

01/17/25 |

$49.1 |

$48.85 |

$49.1 |

$130.00 |

$54.0K |

1 |

22 |

About Trade Desk

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on different devices like computers, smartphones, and connected TVs. It utilizes data to optimize the performance of ad impressions purchased. The firm's platform is referred to as a demand-side platform in the digital ad industry. The firm generates its revenue from fees based on a percentage of what its clients spend on advertising.

Having examined the options trading patterns of Trade Desk, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Trade Desk

- Trading volume stands at 895,488, with TTD's price up by 0.7%, positioned at $80.69.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 20 days.

What The Experts Say On Trade Desk

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $100.0.

- An analyst from Needham downgraded its action to Buy with a price target of $100.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Trade Desk, Benzinga Pro gives you real-time options trades alerts.

Posted In: TTD