Behind the Scenes of Abbott Laboratories's Latest Options Trends

Author: Benzinga Insights | April 18, 2024 01:31pm

Investors with significant funds have taken a bearish position in Abbott Laboratories (NYSE:ABT), a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in ABT usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 9 options transactions for Abbott Laboratories. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 44% being bullish and 55% bearish. Of all the options we discovered, 8 are puts, valued at $437,896, and there was a single call, worth $27,300.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $75.0 and $125.0 for Abbott Laboratories, spanning the last three months.

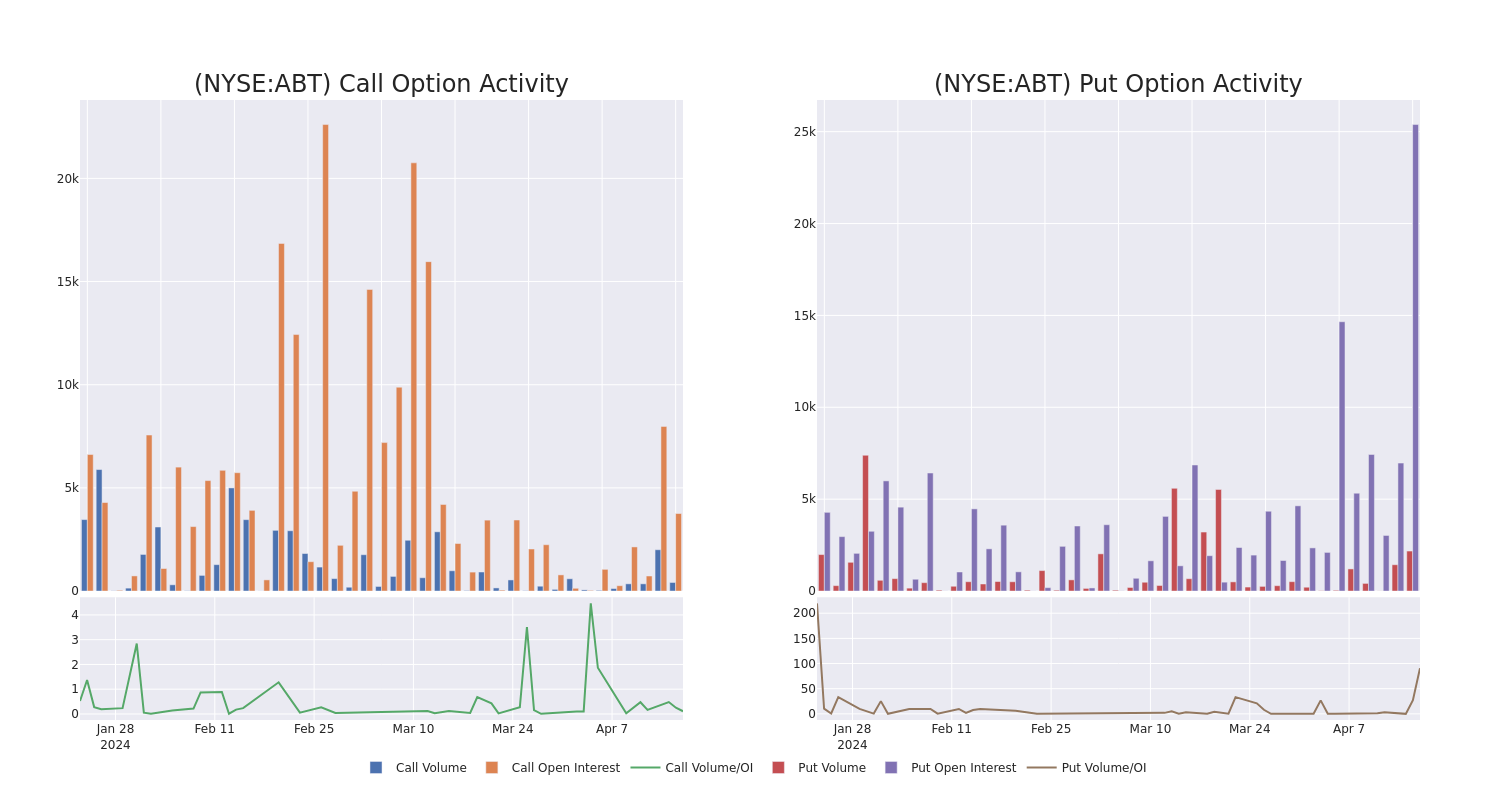

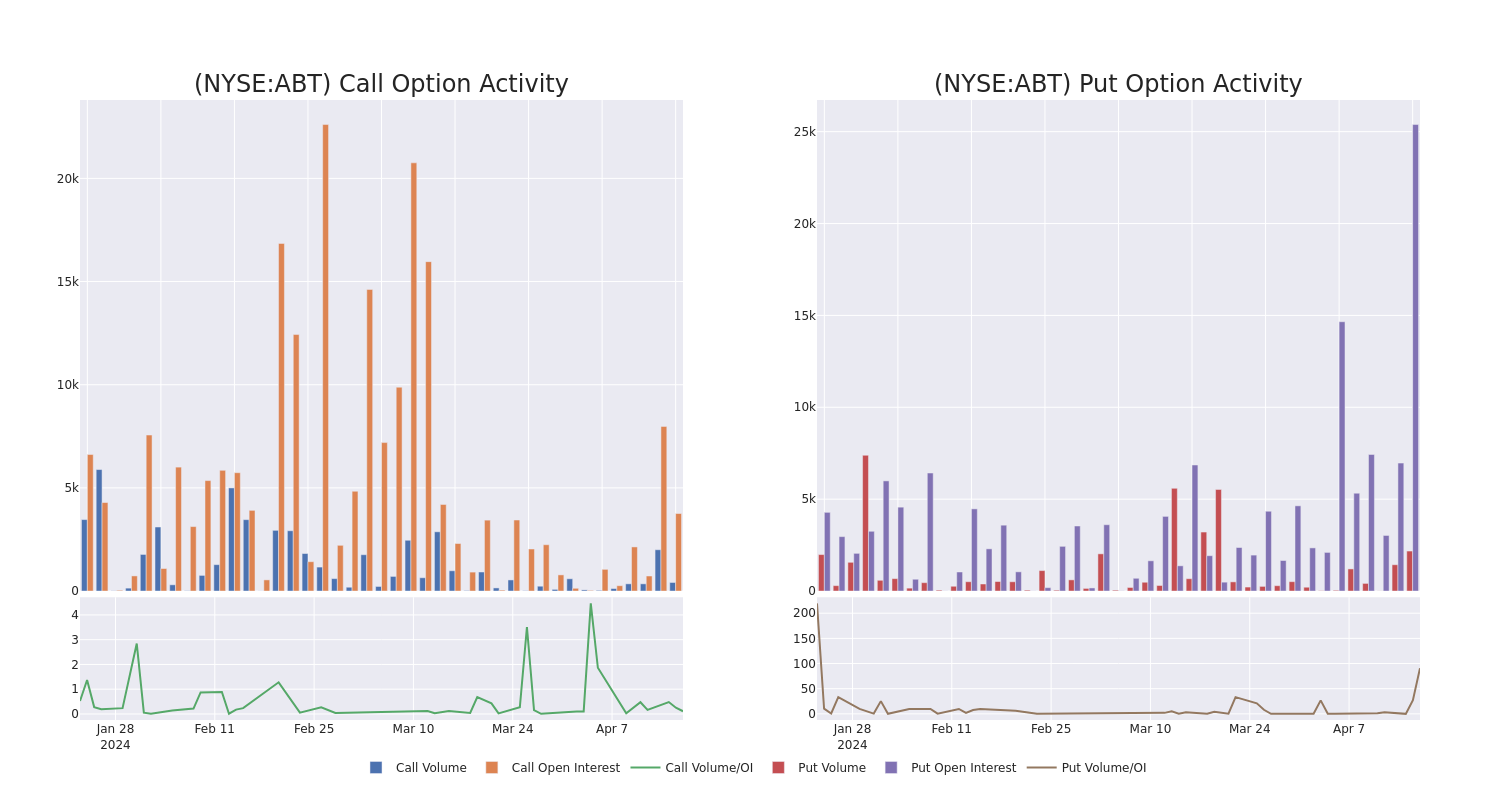

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Abbott Laboratories's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Abbott Laboratories's whale trades within a strike price range from $75.0 to $125.0 in the last 30 days.

Abbott Laboratories 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| ABT |

PUT |

TRADE |

BEARISH |

05/17/24 |

$19.6 |

$18.55 |

$19.22 |

$125.00 |

$94.1K |

84 |

0 |

| ABT |

PUT |

TRADE |

BULLISH |

01/17/25 |

$12.1 |

$12.05 |

$12.05 |

$115.00 |

$79.5K |

3.0K |

73 |

| ABT |

PUT |

TRADE |

BEARISH |

01/17/25 |

$4.75 |

$4.7 |

$4.75 |

$100.00 |

$60.3K |

3.3K |

9 |

| ABT |

PUT |

TRADE |

BEARISH |

05/17/24 |

$1.75 |

$1.68 |

$1.75 |

$105.00 |

$52.5K |

7.8K |

191 |

| ABT |

PUT |

SWEEP |

BEARISH |

11/15/24 |

$8.35 |

$8.2 |

$8.35 |

$110.00 |

$51.7K |

104 |

0 |

About Abbott Laboratories

Abbott manufactures and markets cardiovascular and diabetes devices, adult and pediatric nutritional products, diagnostic equipment and testing kits, and branded generic drugs. Products include pacemakers, implantable cardioverter defibrillators, neuromodulation devices, coronary stents, catheters, infant formula, nutritional liquids for adults, continuous glucose monitors, and immunoassays and point-of-care diagnostic equipment. Abbott derives approximately 60% of sales outside the United States.

Abbott Laboratories's Current Market Status

- Trading volume stands at 2,716,156, with ABT's price down by -0.84%, positioned at $105.01.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 91 days.

What Analysts Are Saying About Abbott Laboratories

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $126.0.

- An analyst from Citigroup has decided to maintain their Buy rating on Abbott Laboratories, which currently sits at a price target of $128.

- An analyst from RBC Capital persists with their Outperform rating on Abbott Laboratories, maintaining a target price of $125.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Abbott Laboratories, targeting a price of $125.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Abbott Laboratories with Benzinga Pro for real-time alerts.

Posted In: ABT