Prologis Unusual Options Activity

Author: Benzinga Insights | April 18, 2024 12:31pm

Deep-pocketed investors have adopted a bearish approach towards Prologis (NYSE:PLD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PLD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for Prologis. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 9% leaning bullish and 90% bearish. Among these notable options, 9 are puts, totaling $301,665, and 2 are calls, amounting to $89,070.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $95.0 to $125.0 for Prologis over the recent three months.

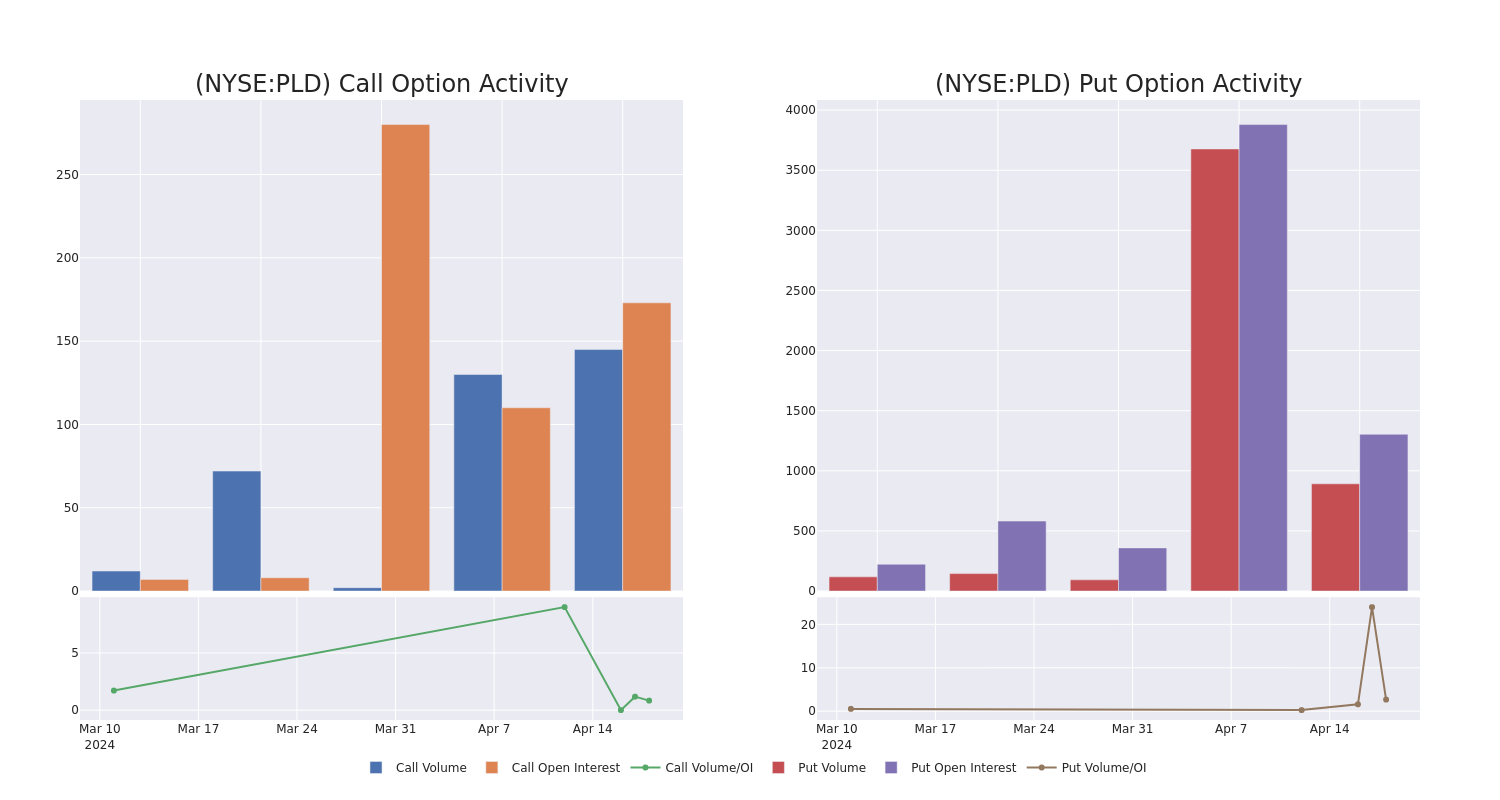

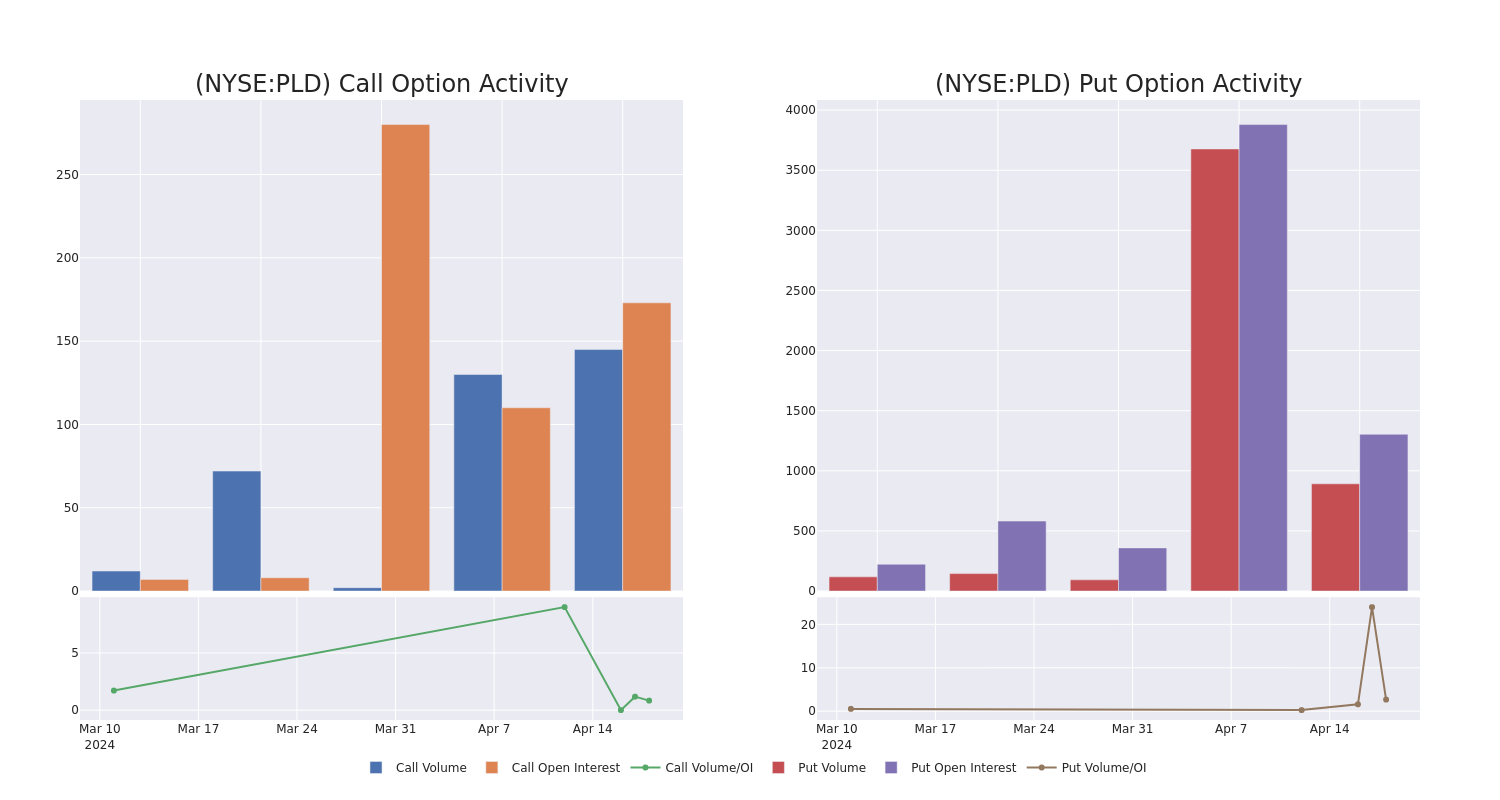

Volume & Open Interest Development

In today's trading context, the average open interest for options of Prologis stands at 211.0, with a total volume reaching 1,037.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Prologis, situated within the strike price corridor from $95.0 to $125.0, throughout the last 30 days.

Prologis Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| PLD |

CALL |

TRADE |

BULLISH |

01/16/26 |

$14.6 |

$13.6 |

$14.6 |

$110.00 |

$61.3K |

7 |

0 |

| PLD |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$7.2 |

$7.0 |

$7.2 |

$100.00 |

$48.9K |

410 |

132 |

| PLD |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$7.1 |

$7.0 |

$7.1 |

$100.00 |

$39.0K |

410 |

1 |

| PLD |

PUT |

SWEEP |

BEARISH |

08/16/24 |

$3.9 |

$3.9 |

$3.9 |

$100.00 |

$39.0K |

159 |

100 |

| PLD |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$7.3 |

$7.0 |

$7.2 |

$100.00 |

$32.4K |

410 |

285 |

About Prologis

Prologis was formed by the June 2011 merger of AMB Property and Prologis Trust. The company develops, acquires, and operates around 1.2 billion square feet of high-quality industrial and logistics facilities across the globe. The company also has a strategic capital business segment that has around $60 billion of third-party AUM. The company is organized into four global divisions (Americas, Europe, Asia, and other Americas) and operates as a real estate investment trust.

In light of the recent options history for Prologis, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Prologis

- With a trading volume of 2,648,011, the price of PLD is down by -2.04%, reaching $104.32.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 89 days from now.

Expert Opinions on Prologis

In the last month, 5 experts released ratings on this stock with an average target price of $133.4.

- An analyst from Barclays persists with their Overweight rating on Prologis, maintaining a target price of $141.

- An analyst from UBS has decided to maintain their Buy rating on Prologis, which currently sits at a price target of $138.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Prologis with a target price of $135.

- Consistent in their evaluation, an analyst from Mizuho keeps a Neutral rating on Prologis with a target price of $130.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a In-Line rating on Prologis with a target price of $123.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Prologis, Benzinga Pro gives you real-time options trades alerts.

Posted In: PLD