Intel Options Trading: A Deep Dive into Market Sentiment

Author: Benzinga Insights | April 18, 2024 11:04am

Investors with a lot of money to spend have taken a bullish stance on Intel (NASDAQ:INTC).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with INTC, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 24 uncommon options trades for Intel.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 50%, bearish.

Out of all of the special options we uncovered, 10 are puts, for a total amount of $603,395, and 14 are calls, for a total amount of $812,181.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $19.0 to $70.0 for Intel over the recent three months.

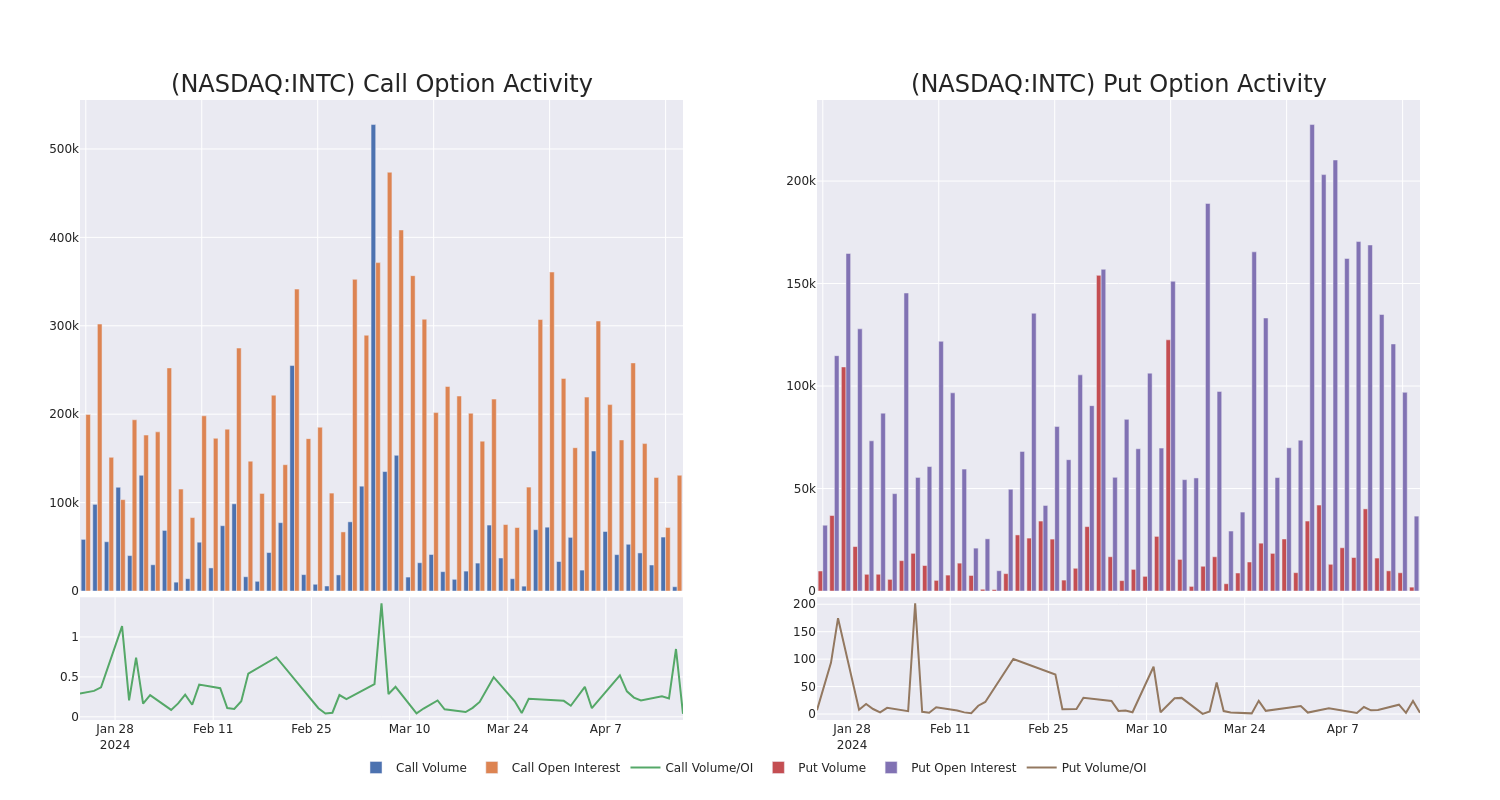

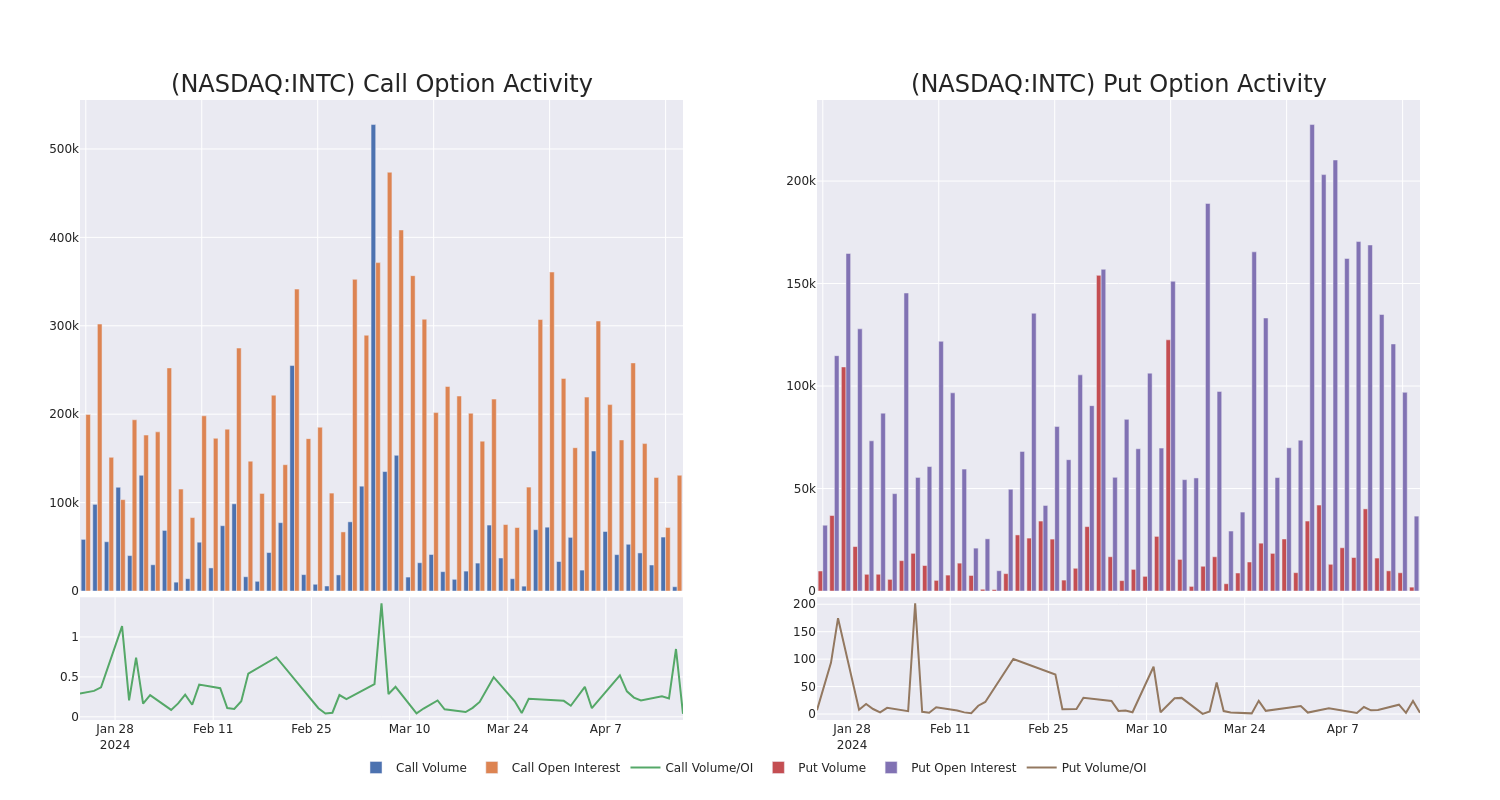

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Intel's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Intel's substantial trades, within a strike price spectrum from $19.0 to $70.0 over the preceding 30 days.

Intel 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| INTC |

PUT |

SWEEP |

BULLISH |

06/20/25 |

$2.02 |

$1.94 |

$1.94 |

$28.00 |

$185.0K |

463 |

952 |

| INTC |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$1.24 |

$1.22 |

$1.22 |

$40.00 |

$122.2K |

5.2K |

373 |

| INTC |

CALL |

TRADE |

BULLISH |

04/26/24 |

$1.8 |

$1.8 |

$1.8 |

$34.50 |

$108.0K |

611 |

21 |

| INTC |

CALL |

SWEEP |

NEUTRAL |

01/17/25 |

$1.19 |

$1.18 |

$1.19 |

$50.00 |

$96.4K |

49.9K |

1.2K |

| INTC |

CALL |

SWEEP |

BULLISH |

01/17/25 |

$1.53 |

$1.52 |

$1.53 |

$47.00 |

$92.2K |

11.8K |

292 |

About Intel

Intel is a leading digital chipmaker, focused on the design and manufacturing of microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors and was the prime proponent of Moore's law for advances in semiconductor manufacturing. Intel remains the market share leader in central processing units in both the PC and server end markets. Intel has also been expanding into new adjacencies, such as communications infrastructure, automotive, and the Internet of Things. Further, Intel expects to leverage its chip manufacturing capabilities into an outsourced foundry model where it constructs chips for others.

Following our analysis of the options activities associated with Intel, we pivot to a closer look at the company's own performance.

Where Is Intel Standing Right Now?

- Trading volume stands at 8,159,226, with INTC's price down by -0.43%, positioned at $35.52.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 7 days.

What The Experts Say On Intel

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $47.0.

- An analyst from Wells Fargo persists with their Equal-Weight rating on Intel, maintaining a target price of $43.

- An analyst from Benchmark has revised its rating downward to Buy, adjusting the price target to $62.

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Intel, targeting a price of $40.

- Consistent in their evaluation, an analyst from Susquehanna keeps a Neutral rating on Intel with a target price of $40.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Neutral with a new price target of $50.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Intel with Benzinga Pro for real-time alerts.

Posted In: INTC