Expert Ratings For Carlisle Companies

Author: Benzinga Insights | April 18, 2024 09:00am

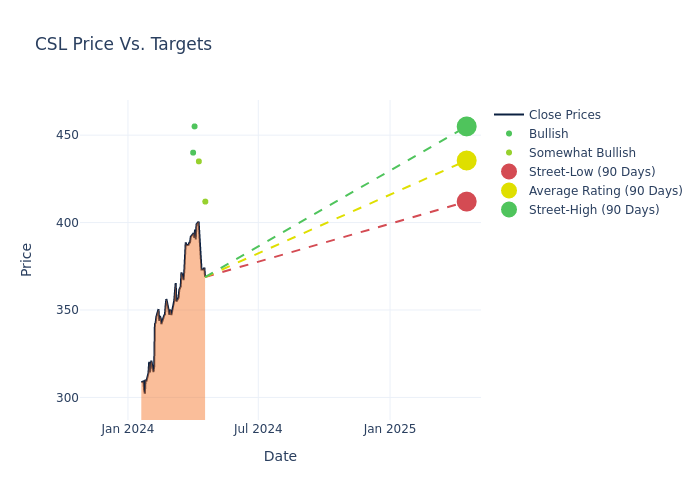

Carlisle Companies (NYSE:CSL) has been analyzed by 6 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

4 |

0 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

2 |

3 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

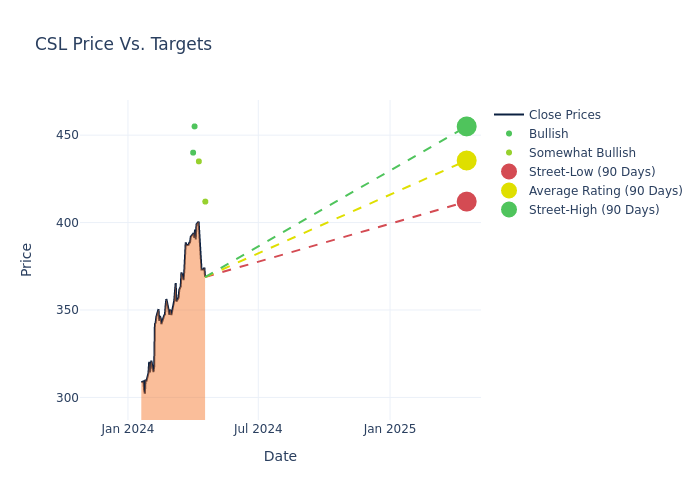

The 12-month price targets, analyzed by analysts, offer insights with an average target of $424.5, a high estimate of $455.00, and a low estimate of $400.00. Witnessing a positive shift, the current average has risen by 11.71% from the previous average price target of $380.00.

Interpreting Analyst Ratings: A Closer Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Carlisle Companies. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Bryan Blair |

Oppenheimer |

Raises |

Outperform |

$412.00 |

$405.00 |

| Timothy Wojs |

Baird |

Raises |

Outperform |

$435.00 |

$400.00 |

| Susan Maklari |

Goldman Sachs |

Announces |

Buy |

$455.00 |

- |

| Garik Shmois |

Loop Capital |

Raises |

Buy |

$440.00 |

$375.00 |

| Bryan Blair |

Oppenheimer |

Raises |

Outperform |

$405.00 |

$355.00 |

| Timothy Wojs |

Baird |

Raises |

Outperform |

$400.00 |

$365.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Carlisle Companies. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Carlisle Companies compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Carlisle Companies's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Capture valuable insights into Carlisle Companies's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Carlisle Companies analyst ratings.

Unveiling the Story Behind Carlisle Companies

Carlisle Companies Inc is a holding company. The company manufactures and sells single-ply roofing products and warranted systems and accessories for the commercial building industry. The company is organized into two segments including Carlisle Construction Materials and Carlisle Weatherproofing Technologies. The company's product portfolio includes moisture protection products, protective roofing underlayments, integrated air and vapor barriers, spray polyurethane foam and coating systems, and others. The majority of the company's revenue comes from the Carlisle Construction Materials segment, and more than half of the total revenue is earned in the United States.

Unraveling the Financial Story of Carlisle Companies

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Decline in Revenue: Over the 3 months period, Carlisle Companies faced challenges, resulting in a decline of approximately -1.95% in revenue growth as of 31 December, 2023. This signifies a reduction in the company's top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Carlisle Companies's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 18.19% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Carlisle Companies's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 7.13%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Carlisle Companies's ROA stands out, surpassing industry averages. With an impressive ROA of 3.05%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Carlisle Companies's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.82.

What Are Analyst Ratings?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CSL