Behind the Scenes of Abercrombie & Fitch's Latest Options Trends

Author: Benzinga Insights | April 17, 2024 03:46pm

Whales with a lot of money to spend have taken a noticeably bearish stance on Abercrombie & Fitch.

Looking at options history for Abercrombie & Fitch (NYSE:ANF) we detected 18 trades.

If we consider the specifics of each trade, it is accurate to state that 16% of the investors opened trades with bullish expectations and 83% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $451,704 and 10, calls, for a total amount of $559,827.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $105.0 to $160.0 for Abercrombie & Fitch over the recent three months.

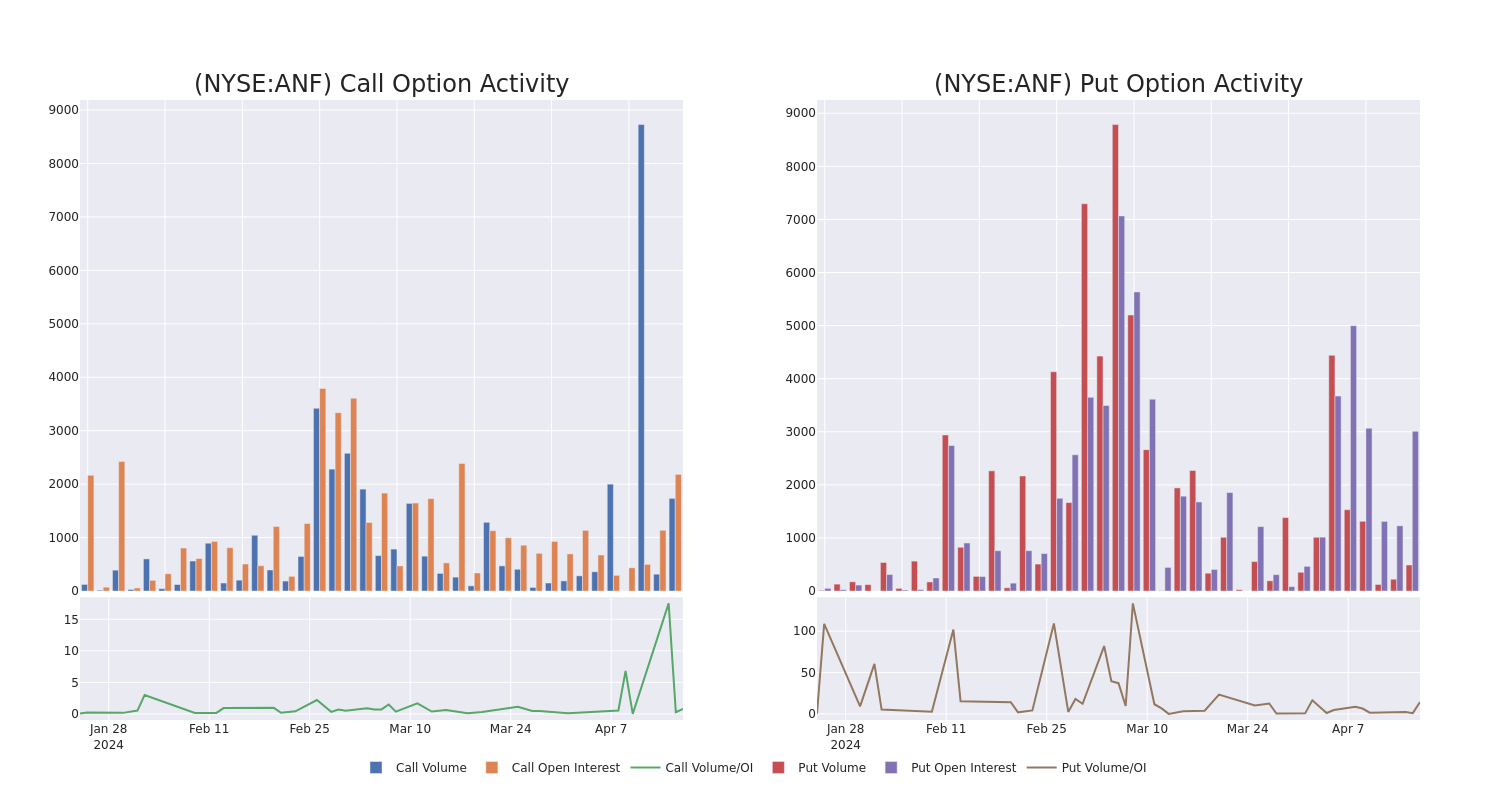

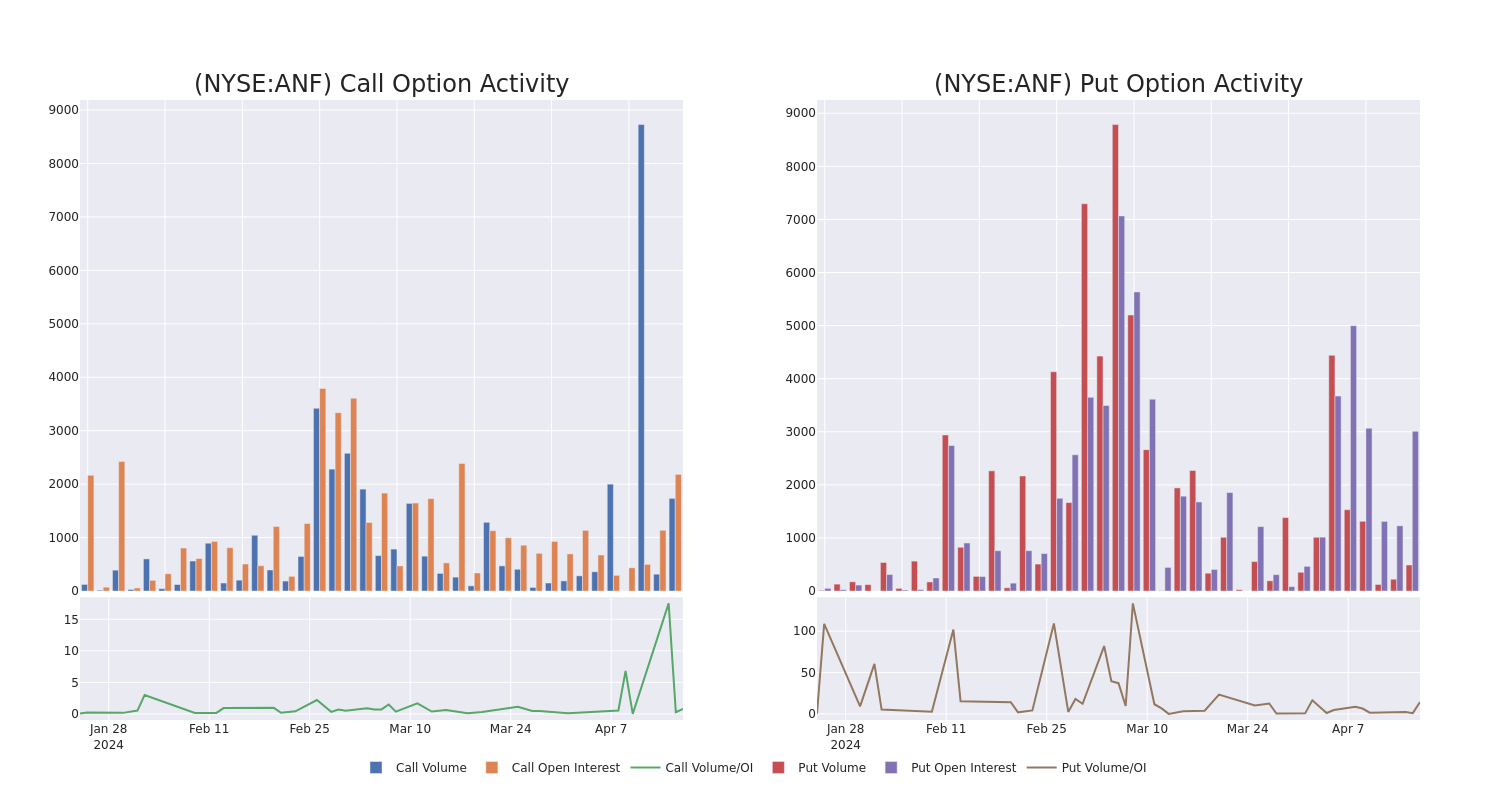

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Abercrombie & Fitch options trades today is 432.67 with a total volume of 2,225.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Abercrombie & Fitch's big money trades within a strike price range of $105.0 to $160.0 over the last 30 days.

Abercrombie & Fitch Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| ANF |

PUT |

SWEEP |

NEUTRAL |

01/17/25 |

$48.3 |

$47.0 |

$47.3 |

$155.00 |

$170.2K |

10 |

36 |

| ANF |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$6.6 |

$6.5 |

$6.5 |

$115.00 |

$130.0K |

632 |

201 |

| ANF |

PUT |

TRADE |

BULLISH |

01/17/25 |

$52.3 |

$50.6 |

$51.0 |

$160.00 |

$96.9K |

7 |

0 |

| ANF |

CALL |

SWEEP |

BEARISH |

01/17/25 |

$11.9 |

$11.8 |

$11.8 |

$160.00 |

$75.5K |

39 |

64 |

| ANF |

CALL |

TRADE |

BEARISH |

05/24/24 |

$6.7 |

$5.4 |

$5.65 |

$120.00 |

$56.5K |

961 |

350 |

About Abercrombie & Fitch

Abercrombie & Fitch Co is a specialty retailer that sells casual clothing, personal-care products, and accessories for men, women, and children. It sells direct to consumers through its stores and websites, which include the Abercrombie & Fitch, Abercrombie kids, and Hollister brands. Most stores are in the United States, but the company does have many stores in Canada, Europe, and Asia. All stores are leased. Abercrombie ships to well over 100 countries via its websites. The company sources its merchandise from dozens of vendors that are primarily located in Asia and Central America. Abercrombie has two distribution centers in Ohio to support its North American operations. It uses third-party distributors for sales in Europe and Asia.

After a thorough review of the options trading surrounding Abercrombie & Fitch, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Abercrombie & Fitch

- Currently trading with a volume of 699,113, the ANF's price is up by 1.55%, now at $117.69.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 35 days.

Expert Opinions on Abercrombie & Fitch

1 market experts have recently issued ratings for this stock, with a consensus target price of $130.0.

- An analyst from Argus Research persists with their Buy rating on Abercrombie & Fitch, maintaining a target price of $130.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Abercrombie & Fitch, Benzinga Pro gives you real-time options trades alerts.

Posted In: ANF