Coinbase Glb Stock: A Deep Dive Into Analyst Perspectives (27 Ratings)

Author: Benzinga Insights | April 17, 2024 12:01pm

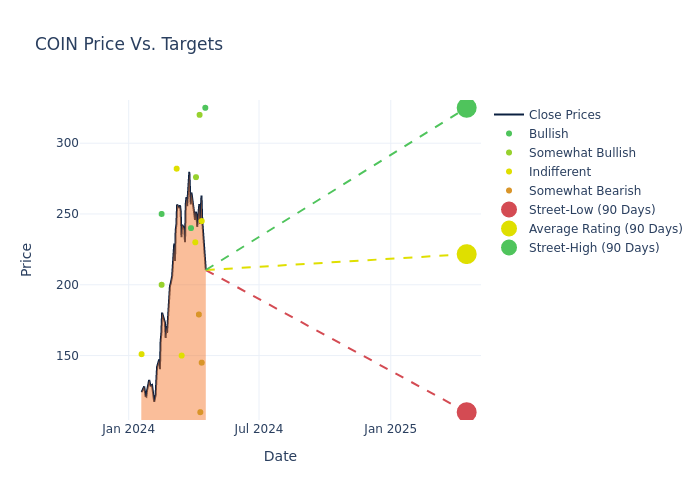

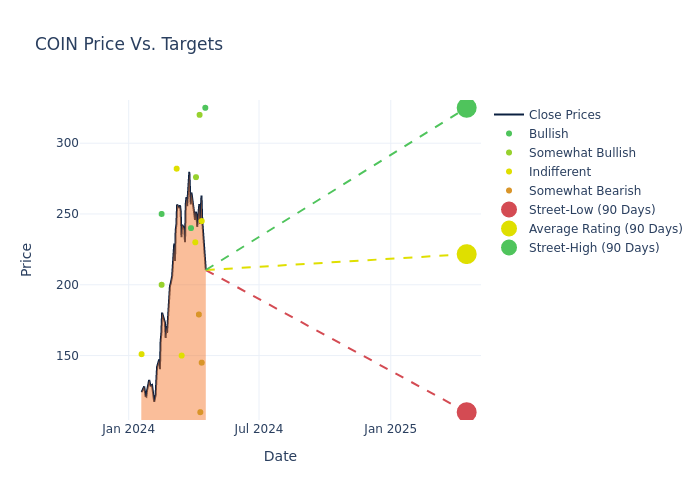

Across the recent three months, 27 analysts have shared their insights on Coinbase Glb (NASDAQ:COIN), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

8 |

9 |

5 |

1 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

3 |

2 |

3 |

0 |

| 2M Ago |

0 |

1 |

3 |

1 |

1 |

| 3M Ago |

2 |

4 |

4 |

1 |

0 |

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $205.33, a high estimate of $325.00, and a low estimate of $80.00. Surpassing the previous average price target of $149.27, the current average has increased by 37.56%.

Understanding Analyst Ratings: A Comprehensive Breakdown

A comprehensive examination of how financial experts perceive Coinbase Glb is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Joe Flynn |

Compass Point |

Raises |

Buy |

$325.00 |

$235.00 |

| Dan Dolev |

Mizuho |

Raises |

Underperform |

$145.00 |

$84.00 |

| Patrick Moley |

Piper Sandler |

Raises |

Neutral |

$245.00 |

$225.00 |

| Jason Kupferberg |

B of A Securities |

Raises |

Underperform |

$110.00 |

$92.00 |

| Devin Ryan |

JMP Securities |

Raises |

Market Outperform |

$320.00 |

$300.00 |

| Benjamin Budish |

Barclays |

Raises |

Underweight |

$179.00 |

$146.00 |

| Owen Lau |

Oppenheimer |

Raises |

Outperform |

$276.00 |

$200.00 |

| Kyle Voigt |

Keefe, Bruyette & Woods |

Raises |

Market Perform |

$230.00 |

$160.00 |

| Joseph Vafi |

Canaccord Genuity |

Maintains |

Buy |

$240.00 |

- |

| Devin Ryan |

JMP Securities |

Maintains |

Market Outperform |

$300.00 |

- |

| Kenneth Worthington |

JP Morgan |

Raises |

Neutral |

$150.00 |

$95.00 |

| Devin Ryan |

JMP Securities |

Raises |

Market Outperform |

$300.00 |

$220.00 |

| Will Nance |

Goldman Sachs |

Announces |

Neutral |

$282.00 |

- |

| Will Nance |

Goldman Sachs |

Announces |

Neutral |

$282.00 |

- |

| Dan Dolev |

Mizuho |

Raises |

Underperform |

$84.00 |

$60.00 |

| Will Nance |

Goldman Sachs |

Raises |

Sell |

$170.00 |

$124.00 |

| Devin Ryan |

JMP Securities |

Raises |

Market Outperform |

$220.00 |

$200.00 |

| Mike Colonnese |

HC Wainwright & Co. |

Raises |

Buy |

$250.00 |

$115.00 |

| Richard Repetto |

Piper Sandler |

Raises |

Neutral |

$165.00 |

$125.00 |

| Moshe Katri |

Wedbush |

Raises |

Outperform |

$200.00 |

$180.00 |

| Owen Lau |

Oppenheimer |

Raises |

Outperform |

$200.00 |

$160.00 |

| Kyle Voigt |

Keefe, Bruyette & Woods |

Raises |

Market Perform |

$160.00 |

$93.00 |

| Joseph Vafi |

Canaccord Genuity |

Raises |

Buy |

$240.00 |

$140.00 |

| Kenneth Worthington |

JP Morgan |

Maintains |

Neutral |

$80.00 |

$80.00 |

| Owen Lau |

Oppenheimer |

Maintains |

Outperform |

$160.00 |

$160.00 |

| Kenneth Worthington |

JP Morgan |

Announces |

Underweight |

$80.00 |

- |

| Peter Christiansen |

Citigroup |

Raises |

Neutral |

$151.00 |

$90.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Coinbase Glb. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Coinbase Glb compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Coinbase Glb's stock. This examination reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Coinbase Glb's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Coinbase Glb analyst ratings.

Unveiling the Story Behind Coinbase Glb

Founded in 2012, Coinbase is the leading cryptocurrency exchange platform in the United States. The company intends to be the safe and regulation-compliant point of entry for retail investors and institutions into the cryptocurrency economy. Users can establish an account directly with the firm, instead of using an intermediary, and many choose to allow Coinbase to act as a custodian for their cryptocurrency, giving the company breadth beyond that of a traditional financial exchange. While the company still generates the majority of its revenue from transaction fees charged to its retail customers, Coinbase uses internal investment and acquisitions to expand into adjacent businesses, such as prime brokerage and data analytics.

Financial Milestones: Coinbase Glb's Journey

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Coinbase Glb's remarkable performance in 3 months is evident. As of 31 December, 2023, the company achieved an impressive revenue growth rate of 51.61%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: Coinbase Glb's net margin is impressive, surpassing industry averages. With a net margin of 28.66%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Coinbase Glb's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.48% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.16%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Coinbase Glb's debt-to-equity ratio is below the industry average. With a ratio of 0.48, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: COIN