Behind the Scenes of CrowdStrike Holdings's Latest Options Trends

Author: Benzinga Insights | April 16, 2024 10:16am

Whales with a lot of money to spend have taken a noticeably bearish stance on CrowdStrike Holdings.

Looking at options history for CrowdStrike Holdings (NASDAQ:CRWD) we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 70% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $189,883 and 5, calls, for a total amount of $155,861.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $150.0 to $450.0 for CrowdStrike Holdings during the past quarter.

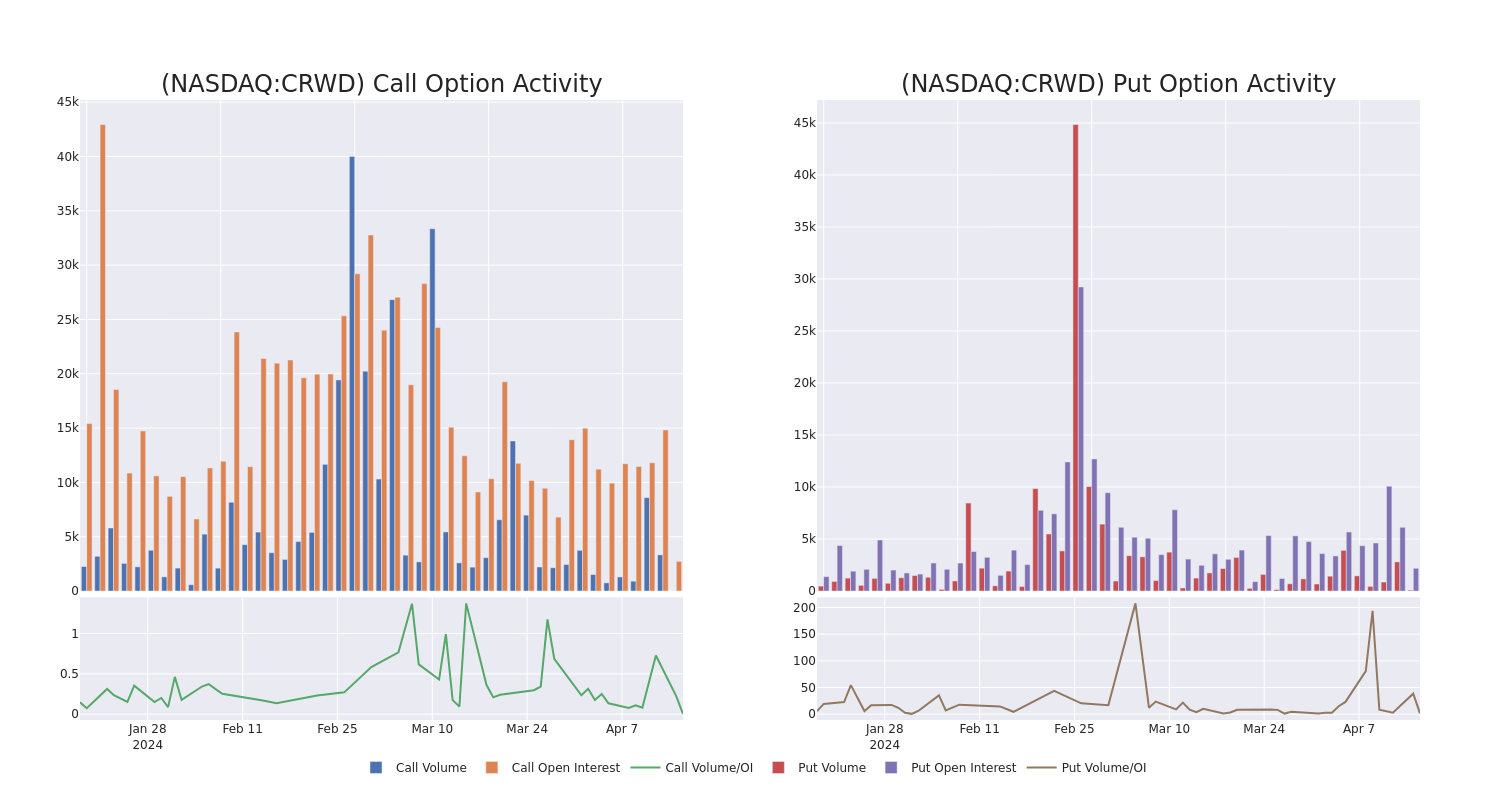

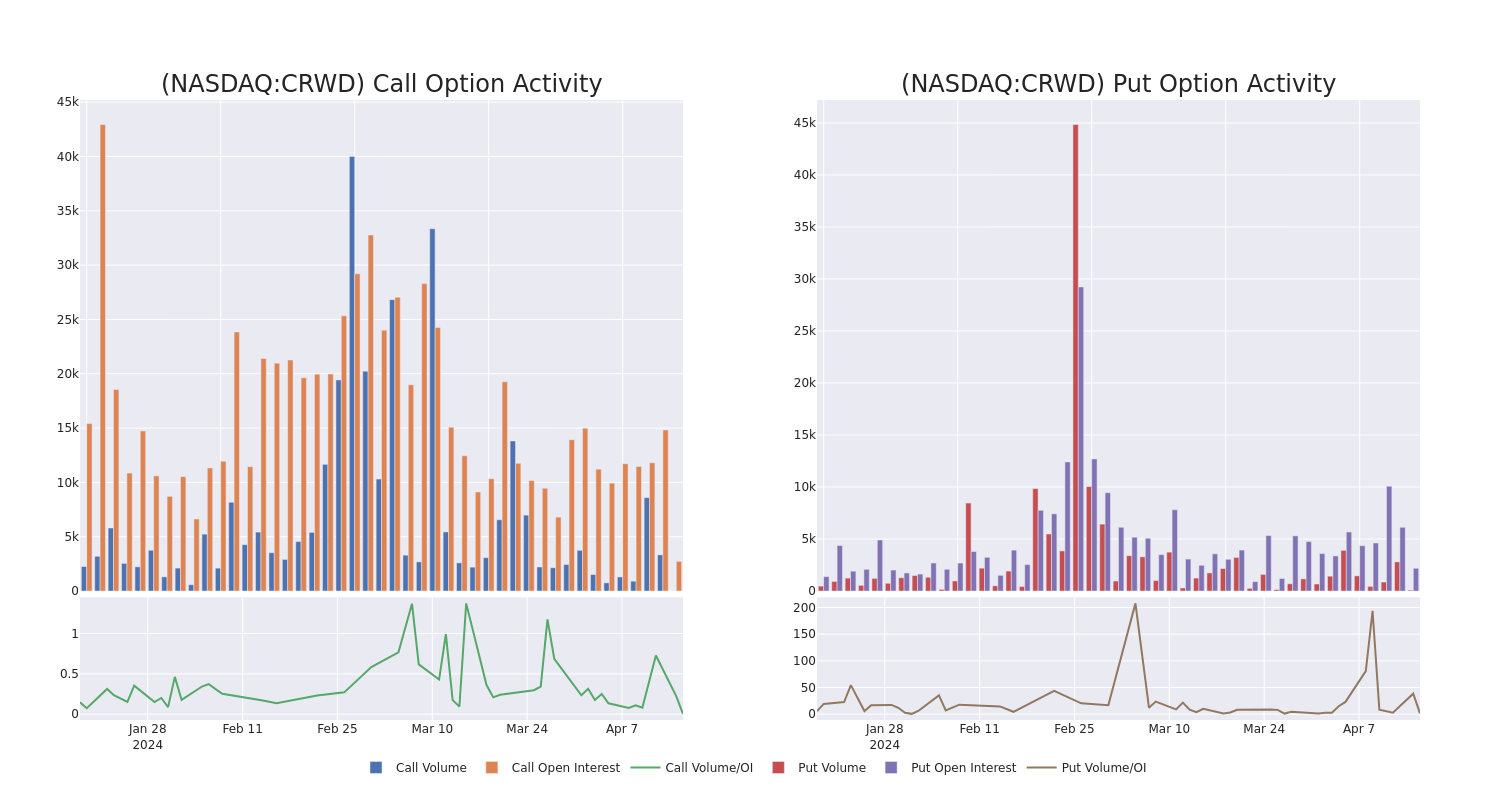

Volume & Open Interest Trends

In today's trading context, the average open interest for options of CrowdStrike Holdings stands at 545.44, with a total volume reaching 97.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in CrowdStrike Holdings, situated within the strike price corridor from $150.0 to $450.0, throughout the last 30 days.

CrowdStrike Holdings Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CRWD |

CALL |

TRADE |

BEARISH |

04/17/25 |

$125.1 |

$123.0 |

$123.5 |

$200.00 |

$61.7K |

16 |

0 |

| CRWD |

PUT |

TRADE |

BEARISH |

04/19/24 |

$30.05 |

$28.75 |

$30.05 |

$330.00 |

$60.1K |

1.0K |

13 |

| CRWD |

PUT |

SWEEP |

BEARISH |

04/26/24 |

$12.6 |

$12.35 |

$12.55 |

$307.50 |

$47.6K |

28 |

39 |

| CRWD |

CALL |

TRADE |

BEARISH |

05/17/24 |

$7.65 |

$7.25 |

$7.25 |

$320.00 |

$36.2K |

1.7K |

3 |

| CRWD |

CALL |

SWEEP |

BULLISH |

11/21/25 |

$33.9 |

$32.25 |

$33.01 |

$450.00 |

$33.0K |

24 |

0 |

About CrowdStrike Holdings

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike's primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

Having examined the options trading patterns of CrowdStrike Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of CrowdStrike Holdings

- With a trading volume of 319,898, the price of CRWD is up by 0.09%, reaching $299.77.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 43 days from now.

Professional Analyst Ratings for CrowdStrike Holdings

In the last month, 2 experts released ratings on this stock with an average target price of $385.0.

- An analyst from Macquarie has decided to maintain their Outperform rating on CrowdStrike Holdings, which currently sits at a price target of $370.

- Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for CrowdStrike Holdings, targeting a price of $400.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for CrowdStrike Holdings with Benzinga Pro for real-time alerts.

Posted In: CRWD