Decoding SoFi Techs's Options Activity: What's the Big Picture?

Author: Benzinga Insights | April 15, 2024 03:01pm

Investors with a lot of money to spend have taken a bearish stance on SoFi Techs (NASDAQ:SOFI).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SOFI, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 11 uncommon options trades for SoFi Techs.

This isn't normal.

The overall sentiment of these big-money traders is split between 36% bullish and 63%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $363,420, and 6 are calls, for a total amount of $183,189.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $0.5 to $20.0 for SoFi Techs over the recent three months.

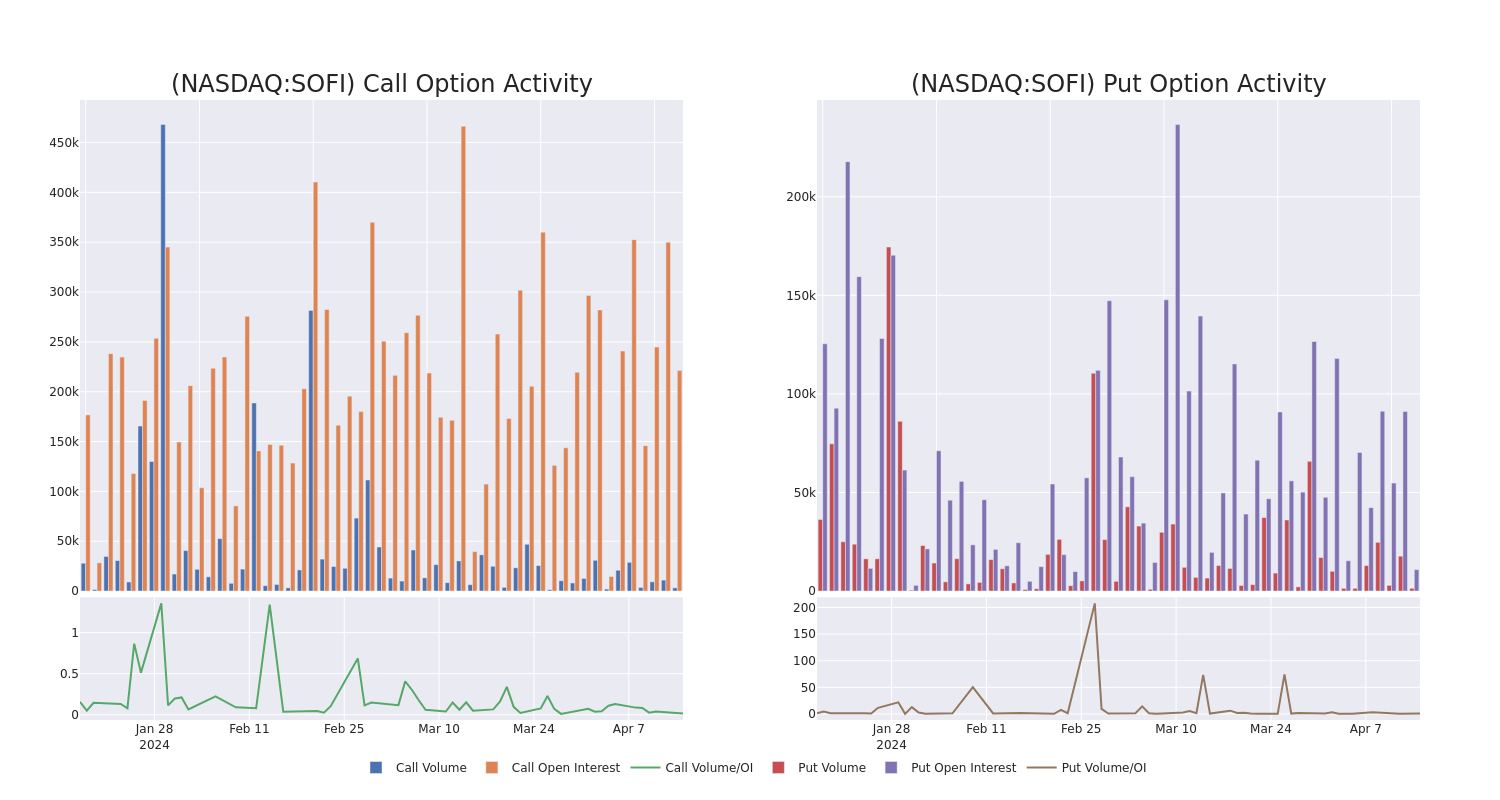

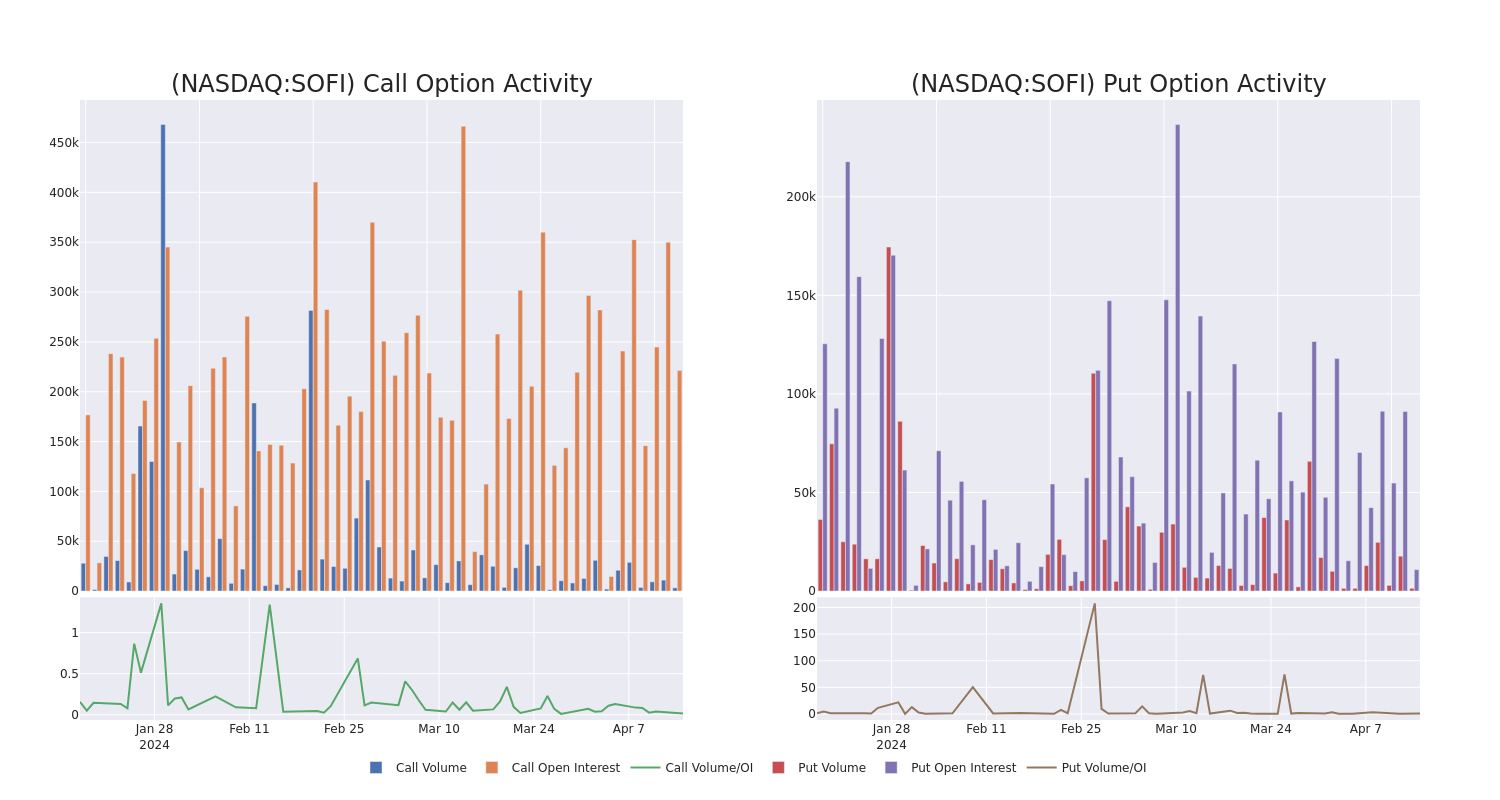

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in SoFi Techs's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to SoFi Techs's substantial trades, within a strike price spectrum from $0.5 to $20.0 over the preceding 30 days.

SoFi Techs Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| SOFI |

PUT |

SWEEP |

BEARISH |

01/16/26 |

$12.85 |

$12.15 |

$12.85 |

$20.00 |

$257.0K |

117 |

0 |

| SOFI |

CALL |

TRADE |

BEARISH |

01/16/26 |

$2.0 |

$1.99 |

$1.99 |

$10.00 |

$39.8K |

80.8K |

1.2K |

| SOFI |

CALL |

SWEEP |

BEARISH |

01/17/25 |

$7.25 |

$6.55 |

$6.83 |

$0.50 |

$33.6K |

221 |

50 |

| SOFI |

CALL |

TRADE |

BEARISH |

01/17/25 |

$1.02 |

$1.01 |

$1.01 |

$10.00 |

$29.1K |

124.7K |

856 |

| SOFI |

CALL |

SWEEP |

BEARISH |

05/03/24 |

$0.6 |

$0.58 |

$0.58 |

$7.50 |

$29.0K |

8.2K |

595 |

About SoFi Techs

SoFi is a financial-services company that was founded in 2011 and is based in San Francisco. Initially known for its student loan refinancing business, the company has expanded its product offerings to include personal loans, credit cards, mortgages, investment accounts, banking services, and financial planning. The company intends to be a one-stop shop for its clients' finances and operates solely through its mobile app and website. Through its acquisition of Galileo in 2020, the company also offers payment and account services for debit cards and digital banking.

Present Market Standing of SoFi Techs

- With a trading volume of 24,275,757, the price of SOFI is down by -2.46%, reaching $7.15.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 14 days from now.

Expert Opinions on SoFi Techs

In the last month, 4 experts released ratings on this stock with an average target price of $10.125.

- Maintaining their stance, an analyst from Jefferies continues to hold a Buy rating for SoFi Techs, targeting a price of $12.

- Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $10.

- An analyst from Keefe, Bruyette & Woods upgraded its action to Market Perform with a price target of $7.

- An analyst from Citigroup has revised its rating downward to Buy, adjusting the price target to $11.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for SoFi Techs, Benzinga Pro gives you real-time options trades alerts.

Posted In: SOFI