Dell Technologies's Options: A Look at What the Big Money is Thinking

Author: Benzinga Insights | April 15, 2024 11:16am

Investors with a lot of money to spend have taken a bullish stance on Dell Technologies (NYSE:DELL).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DELL, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 14 options trades for Dell Technologies.

This isn't normal.

The overall sentiment of these big-money traders is split between 57% bullish and 42%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $100,800, and 13, calls, for a total amount of $716,136.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $110.0 to $150.0 for Dell Technologies over the recent three months.

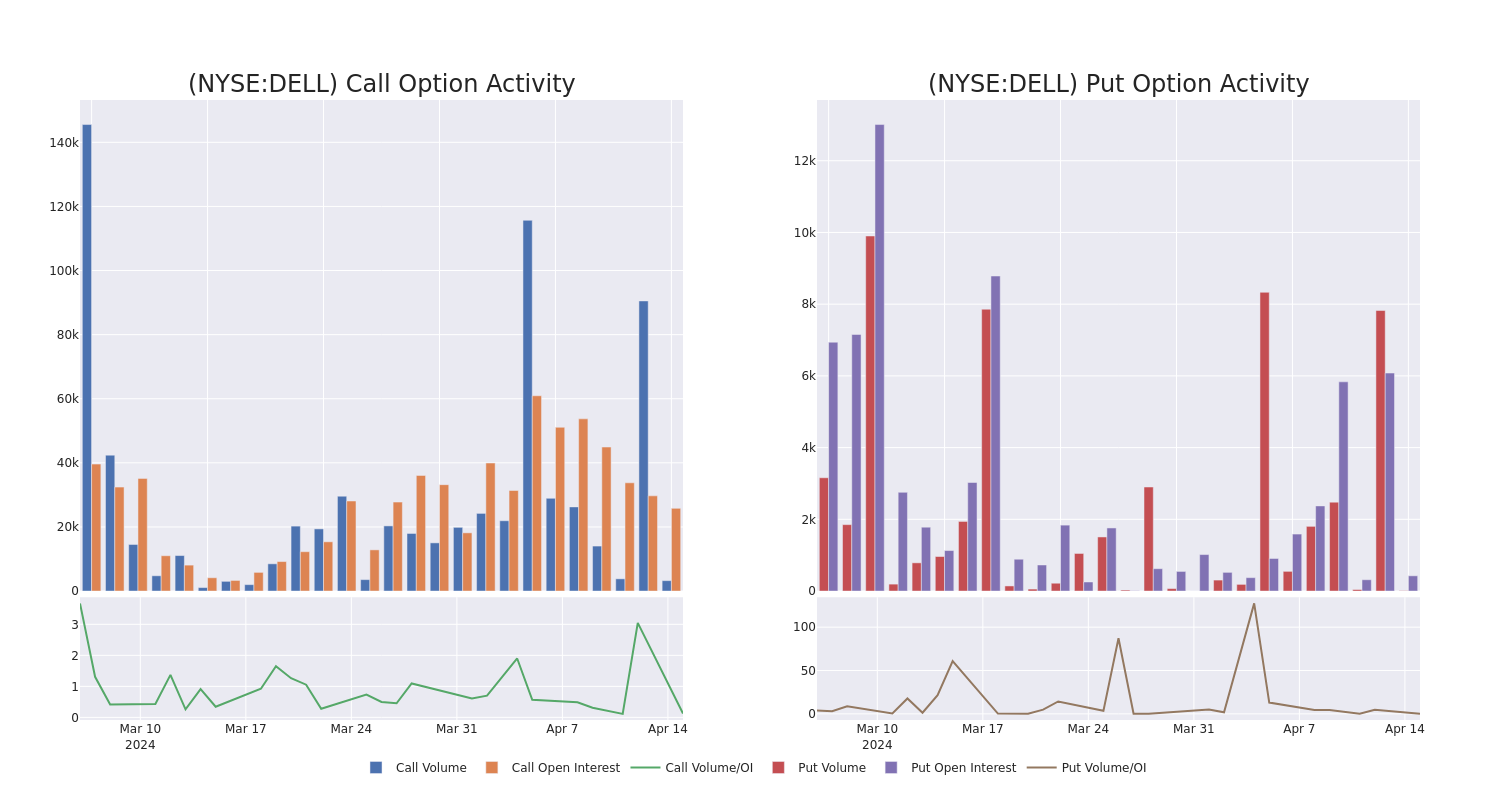

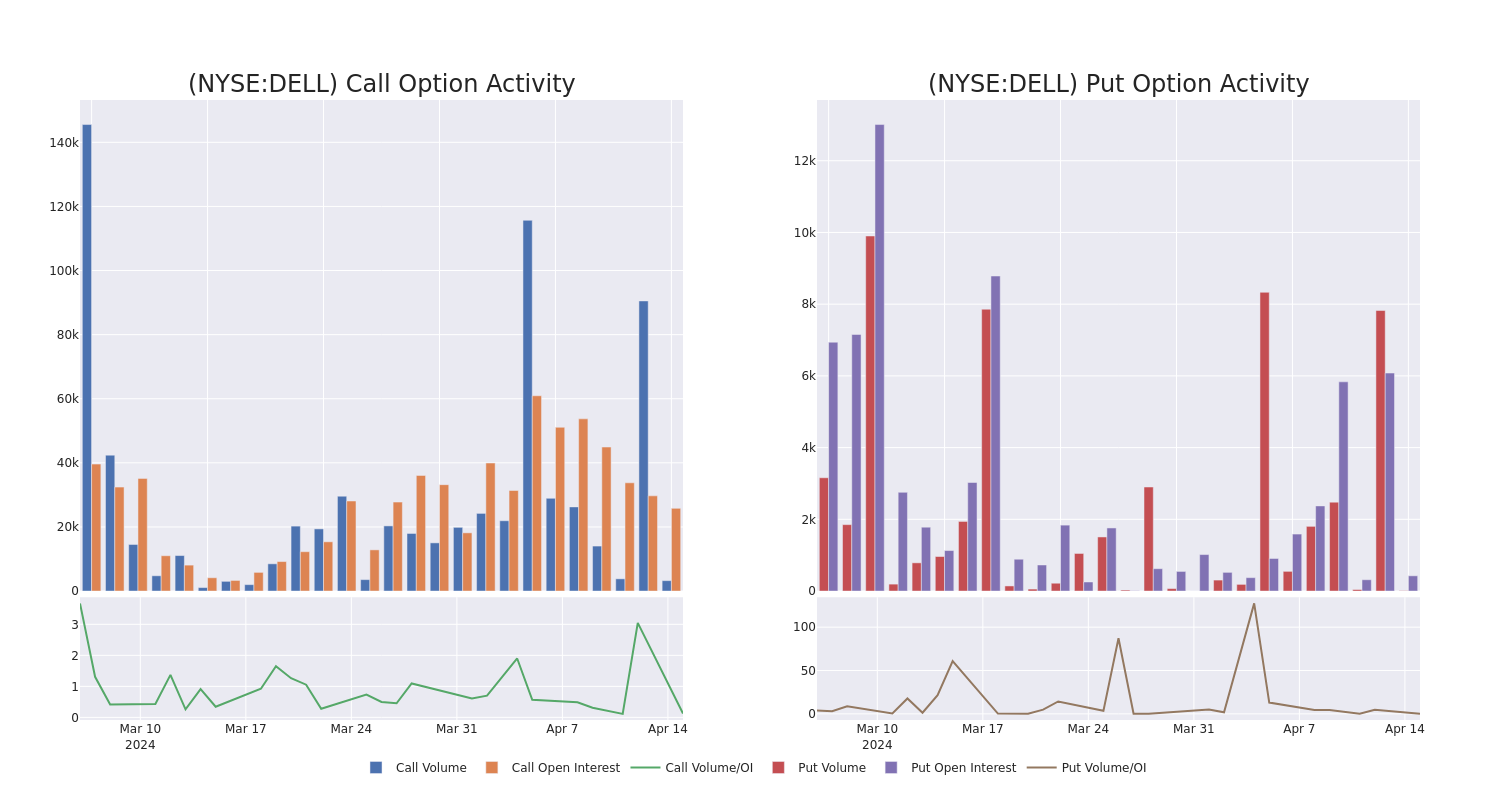

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Dell Technologies's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Dell Technologies's substantial trades, within a strike price spectrum from $110.0 to $150.0 over the preceding 30 days.

Dell Technologies 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| DELL |

CALL |

SWEEP |

BULLISH |

07/19/24 |

$18.8 |

$18.6 |

$18.8 |

$110.00 |

$176.7K |

370 |

107 |

| DELL |

CALL |

SWEEP |

BULLISH |

06/21/24 |

$11.3 |

$11.0 |

$11.3 |

$120.00 |

$112.9K |

2.1K |

32 |

| DELL |

PUT |

TRADE |

BULLISH |

06/21/24 |

$10.2 |

$10.0 |

$10.08 |

$120.00 |

$100.8K |

425 |

9 |

| DELL |

CALL |

TRADE |

BULLISH |

05/17/24 |

$3.7 |

$3.5 |

$3.65 |

$125.00 |

$73.0K |

2.3K |

5 |

| DELL |

CALL |

SWEEP |

BEARISH |

06/21/24 |

$9.0 |

$8.9 |

$8.9 |

$125.00 |

$68.5K |

7.0K |

204 |

About Dell Technologies

Dell Technologies is a broad information technology vendor, primarily supplying hardware to enterprises. It is focused on premium personal computers and enterprise on-premises data center hardware. It holds top-three shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell is vertically integrated but has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales.

Dell Technologies's Current Market Status

- Currently trading with a volume of 2,511,270, the DELL's price is up by 0.88%, now at $118.8.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 45 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Dell Technologies with Benzinga Pro for real-time alerts.

Posted In: DELL