Looking At Wayfair's Recent Unusual Options Activity

Author: Benzinga Insights | April 15, 2024 11:16am

Benzinga's options scanner just detected over 13 options trades for Wayfair (NYSE:W) summing a total amount of $1,238,483.

At the same time, our algo caught 11 for a total amount of 1,195,382.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $75.0 for Wayfair over the recent three months.

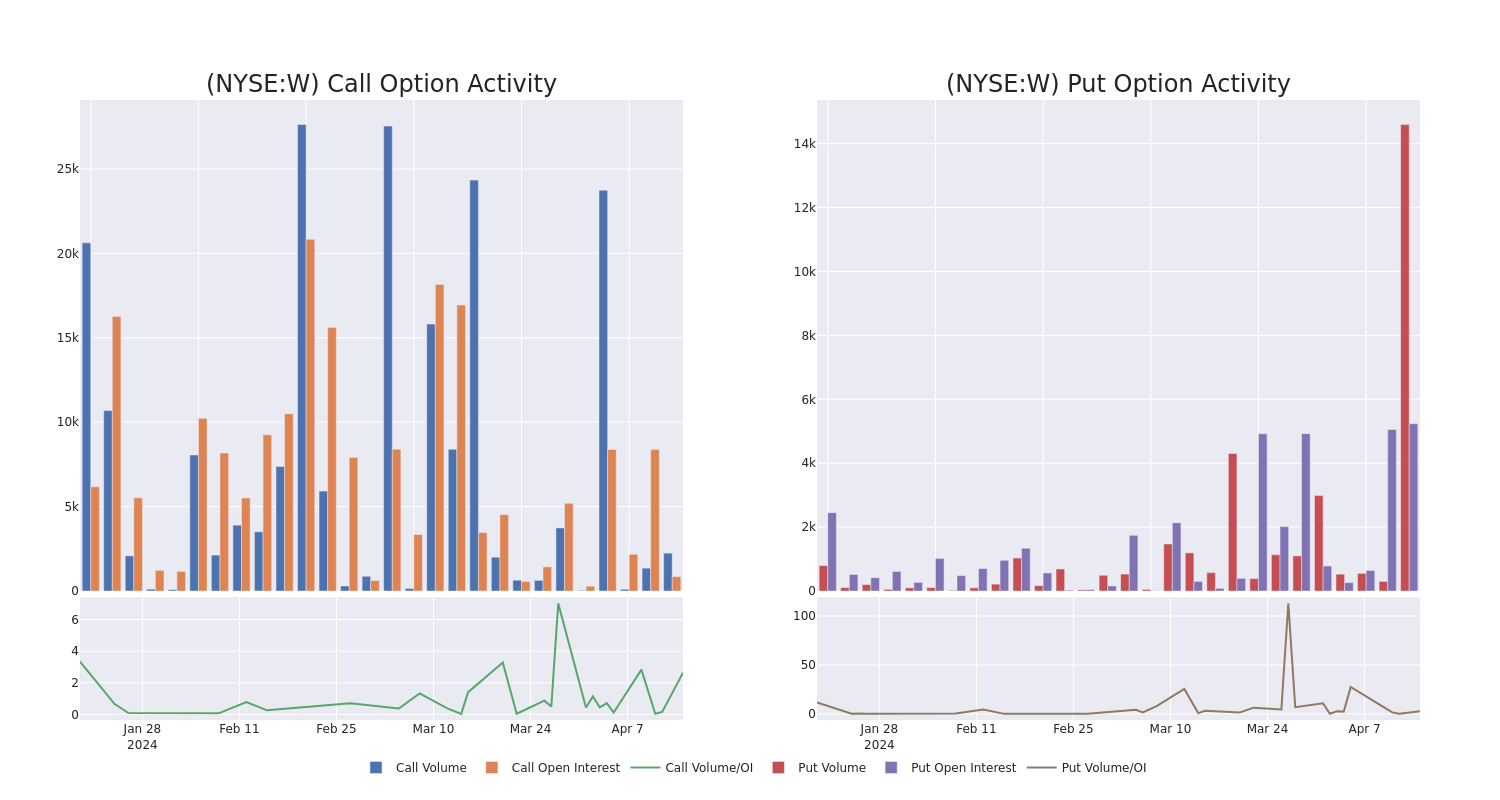

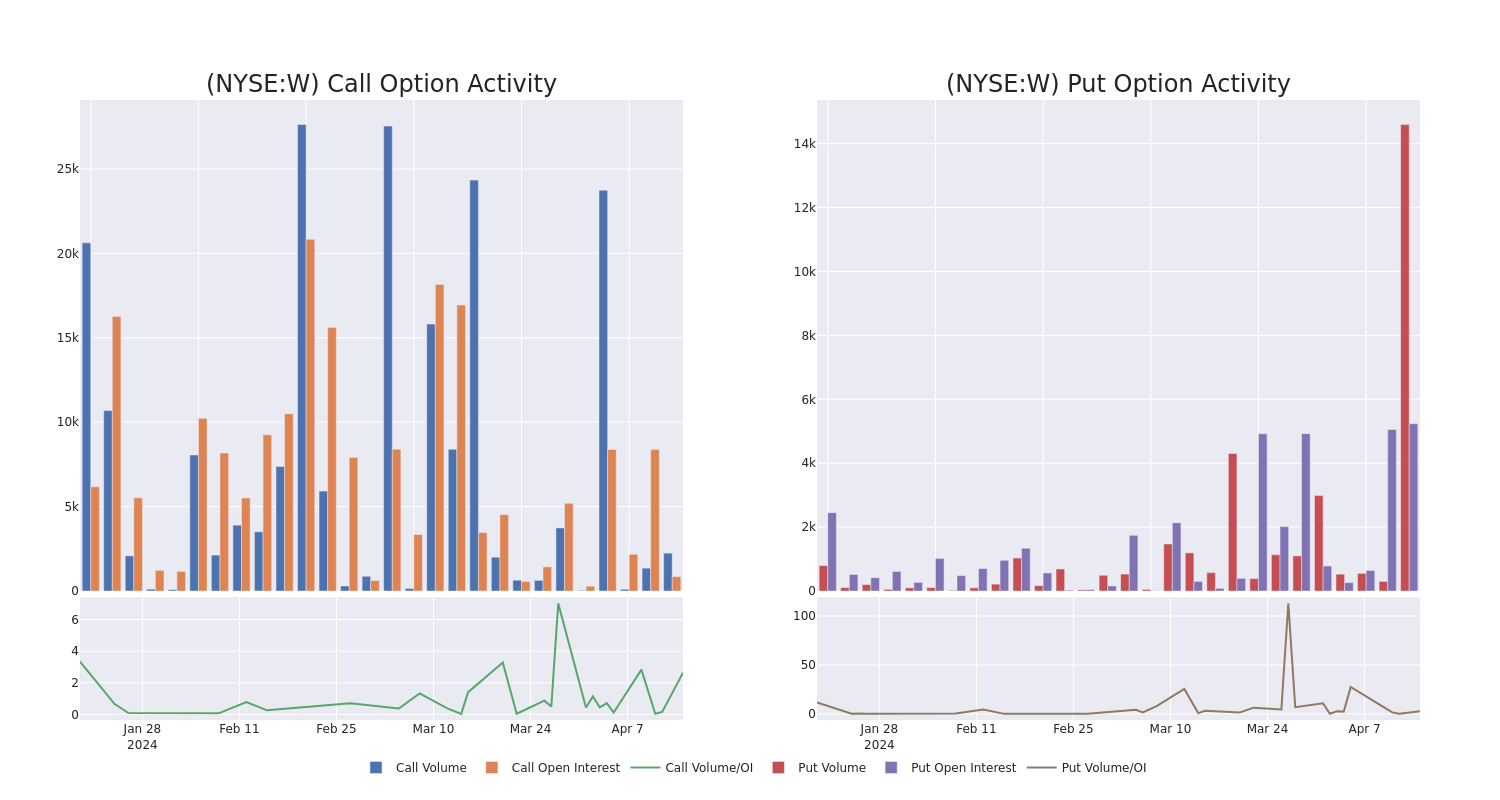

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Wayfair's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wayfair's whale trades within a strike price range from $60.0 to $75.0 in the last 30 days.

Wayfair Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| W |

PUT |

SWEEP |

BULLISH |

05/17/24 |

$6.55 |

$6.45 |

$6.5 |

$60.00 |

$212.5K |

5.2K |

707 |

| W |

PUT |

SWEEP |

BULLISH |

05/17/24 |

$6.6 |

$6.45 |

$6.5 |

$60.00 |

$187.2K |

5.2K |

1.3K |

| W |

PUT |

SWEEP |

BULLISH |

05/17/24 |

$6.65 |

$6.45 |

$6.5 |

$60.00 |

$167.7K |

5.2K |

1.9K |

| W |

PUT |

SWEEP |

BULLISH |

05/17/24 |

$6.65 |

$6.5 |

$6.5 |

$60.00 |

$119.6K |

5.2K |

1.1K |

| W |

CALL |

SWEEP |

BEARISH |

05/03/24 |

$3.9 |

$3.7 |

$3.7 |

$61.00 |

$114.7K |

332 |

310 |

About Wayfair

Wayfair engages in e-commerce in the United States (87% of 2023 sales), Canada, the United Kingdom, Germany, and Ireland. At the end of 2023, the firm offered more than 30 million products from more than 20,000 suppliers under the brands Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold. Its offerings include furniture, everyday and seasonal decor, decorative accents, housewares, and other home goods. Wayfair was founded in 2002 and began trading publicly in 2014.

In light of the recent options history for Wayfair, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Wayfair

- Currently trading with a volume of 1,102,530, the W's price is down by -5.0%, now at $57.32.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 17 days.

Professional Analyst Ratings for Wayfair

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $76.4.

- In a cautious move, an analyst from Morgan Stanley downgraded its rating to Overweight, setting a price target of $80.

- An analyst from Mizuho has revised its rating downward to Buy, adjusting the price target to $72.

- Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for Wayfair, targeting a price of $85.

- In a positive move, an analyst from Evercore ISI Group has upgraded their rating to Outperform and adjusted the price target to $80.

- An analyst from Loop Capital has decided to maintain their Hold rating on Wayfair, which currently sits at a price target of $65.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Wayfair options trades with real-time alerts from Benzinga Pro.

Posted In: W