Decoding Union Pacific's Options Activity: What's the Big Picture?

Author: Benzinga Insights | April 12, 2024 11:33am

Investors with significant funds have taken a bearish position in Union Pacific (NYSE:UNP), a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in UNP usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 9 options transactions for Union Pacific. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 0% being bullish and 100% bearish. Of all the options we discovered, 8 are puts, valued at $832,749, and there was a single call, worth $33,569.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $210.0 and $250.0 for Union Pacific, spanning the last three months.

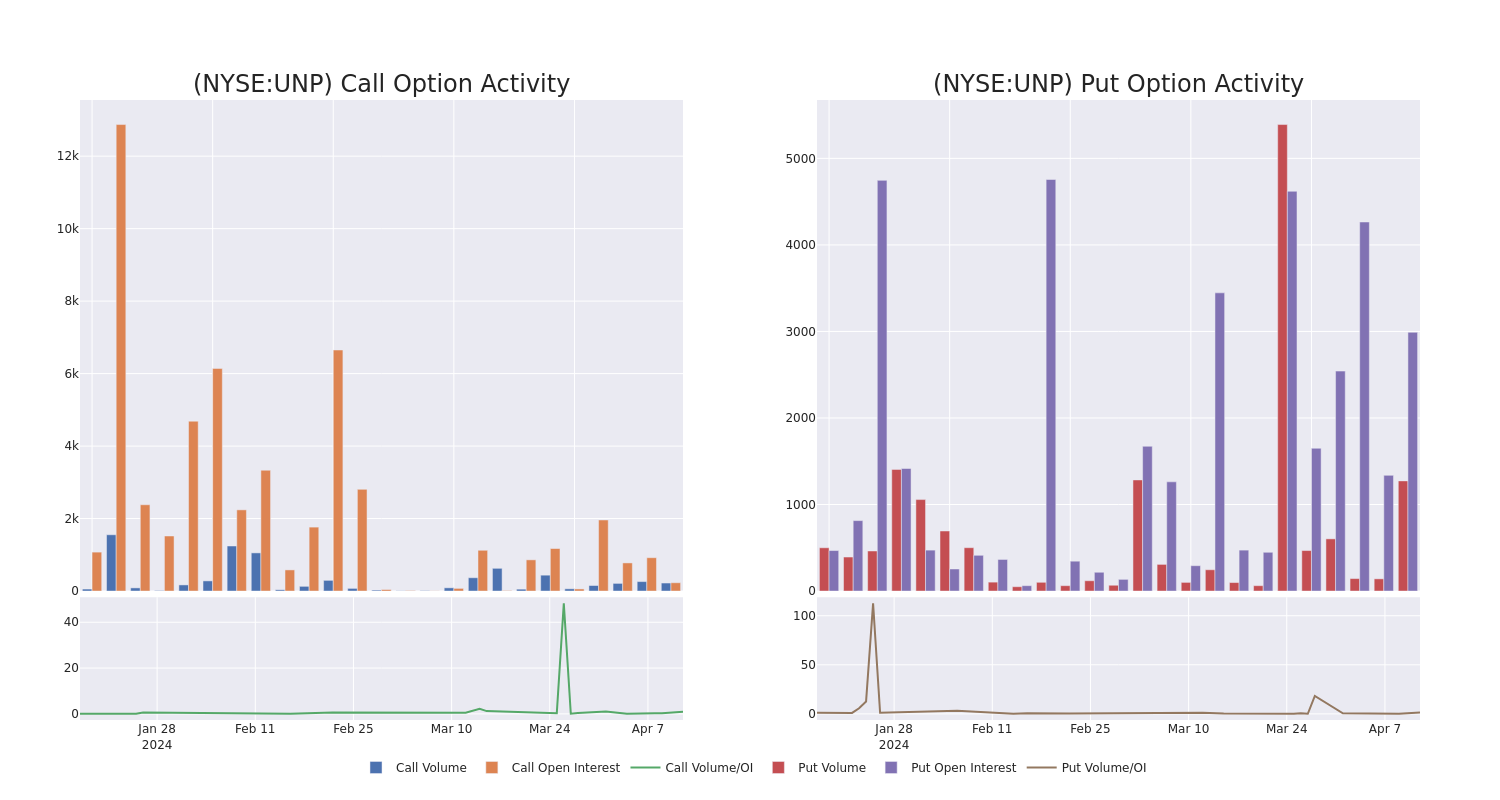

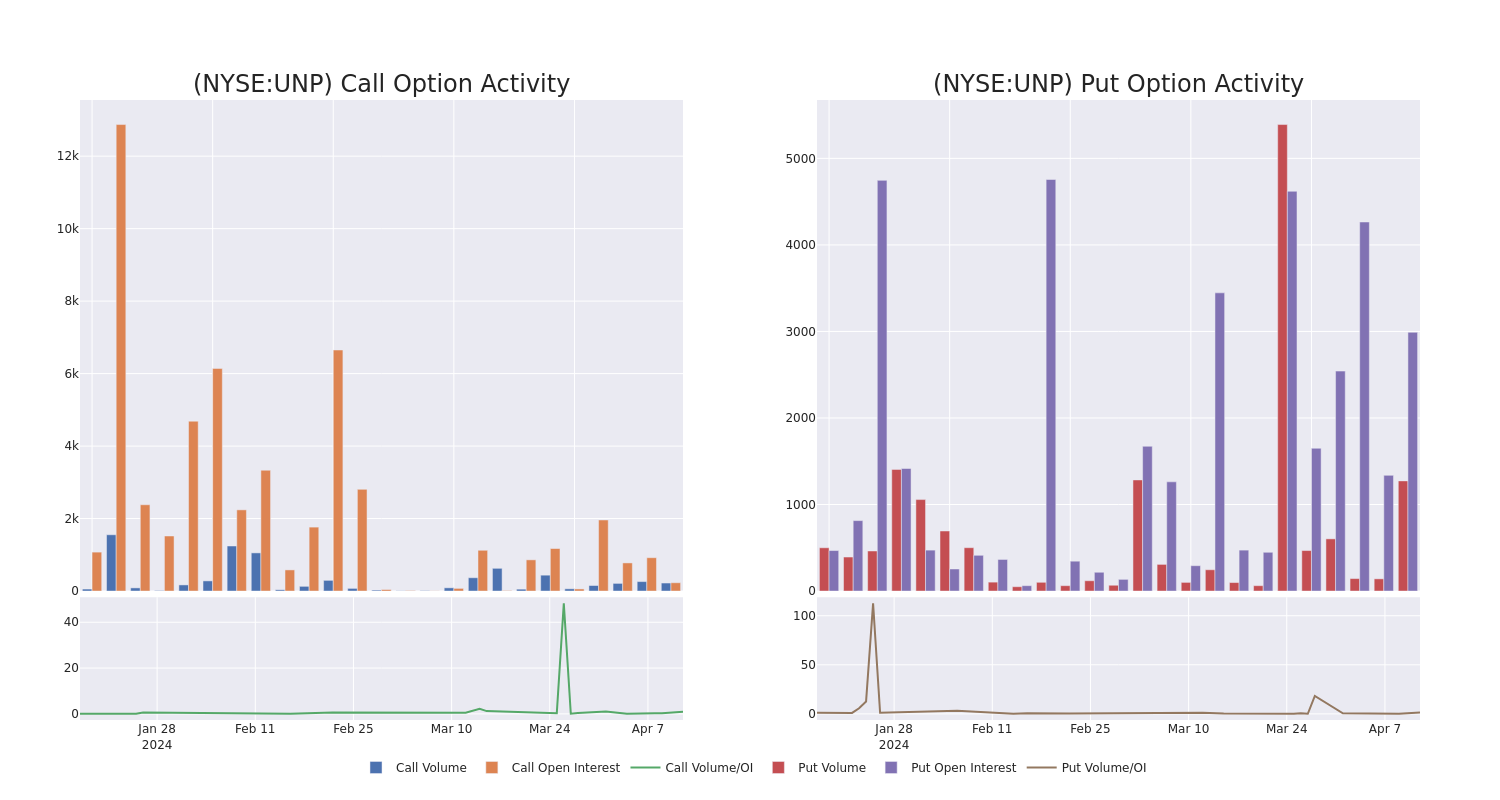

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Union Pacific's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Union Pacific's whale activity within a strike price range from $210.0 to $250.0 in the last 30 days.

Union Pacific 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| UNP |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$13.2 |

$12.8 |

$13.0 |

$245.00 |

$259.1K |

1.1K |

200 |

| UNP |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$17.2 |

$16.8 |

$16.8 |

$250.00 |

$134.4K |

262 |

110 |

| UNP |

PUT |

SWEEP |

BEARISH |

04/26/24 |

$8.0 |

$7.8 |

$7.85 |

$240.00 |

$115.4K |

1.1K |

452 |

| UNP |

PUT |

SWEEP |

BEARISH |

04/26/24 |

$8.3 |

$8.2 |

$8.3 |

$240.00 |

$109.5K |

1.1K |

133 |

| UNP |

PUT |

SWEEP |

BEARISH |

04/26/24 |

$8.3 |

$8.1 |

$8.3 |

$240.00 |

$75.5K |

1.1K |

136 |

About Union Pacific

Omaha, Nebraska-based Union Pacific is the largest public railroad in North America. Operating on more than 30,000 miles of track in the western two thirds of the US, UP generated $24 billion of revenue in 2023 by hauling coal, industrial products, intermodal containers, agriculture goods, chemicals, fertilizers, and automotive goods. UP owns about one fourth of Mexican railroad Ferromex and historically derives roughly 10% of its revenue hauling freight to and from Mexico.

Current Position of Union Pacific

- Trading volume stands at 400,182, with UNP's price down by -0.52%, positioned at $234.94.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 13 days.

What Analysts Are Saying About Union Pacific

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $257.6.

- Consistent in their evaluation, an analyst from Benchmark keeps a Buy rating on Union Pacific with a target price of $266.

- An analyst from Goldman Sachs has decided to maintain their Buy rating on Union Pacific, which currently sits at a price target of $274.

- An analyst from JP Morgan has decided to maintain their Neutral rating on Union Pacific, which currently sits at a price target of $243.

- An analyst from Susquehanna persists with their Neutral rating on Union Pacific, maintaining a target price of $255.

- An analyst from Jefferies has revised its rating downward to Hold, adjusting the price target to $250.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Union Pacific options trades with real-time alerts from Benzinga Pro.

Posted In: UNP