Wheaton Precious Metals Options Trading: A Deep Dive into Market Sentiment

Author: Benzinga Insights | April 12, 2024 10:18am

Investors with a lot of money to spend have taken a bullish stance on Wheaton Precious Metals (NYSE:WPM).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with WPM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 8 uncommon options trades for Wheaton Precious Metals.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 50%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $194,630, and 5 are calls, for a total amount of $280,905.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $65.0 for Wheaton Precious Metals during the past quarter.

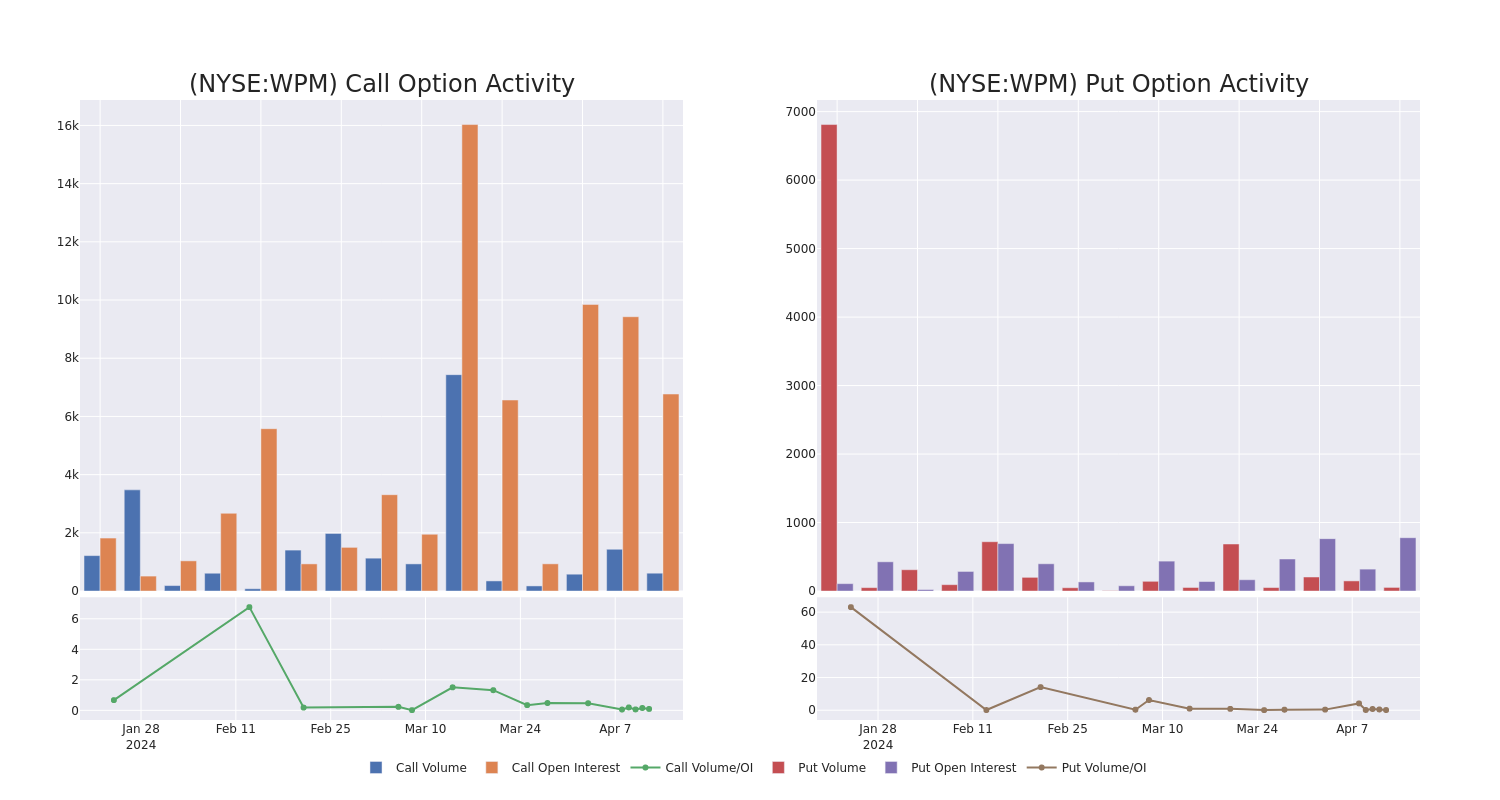

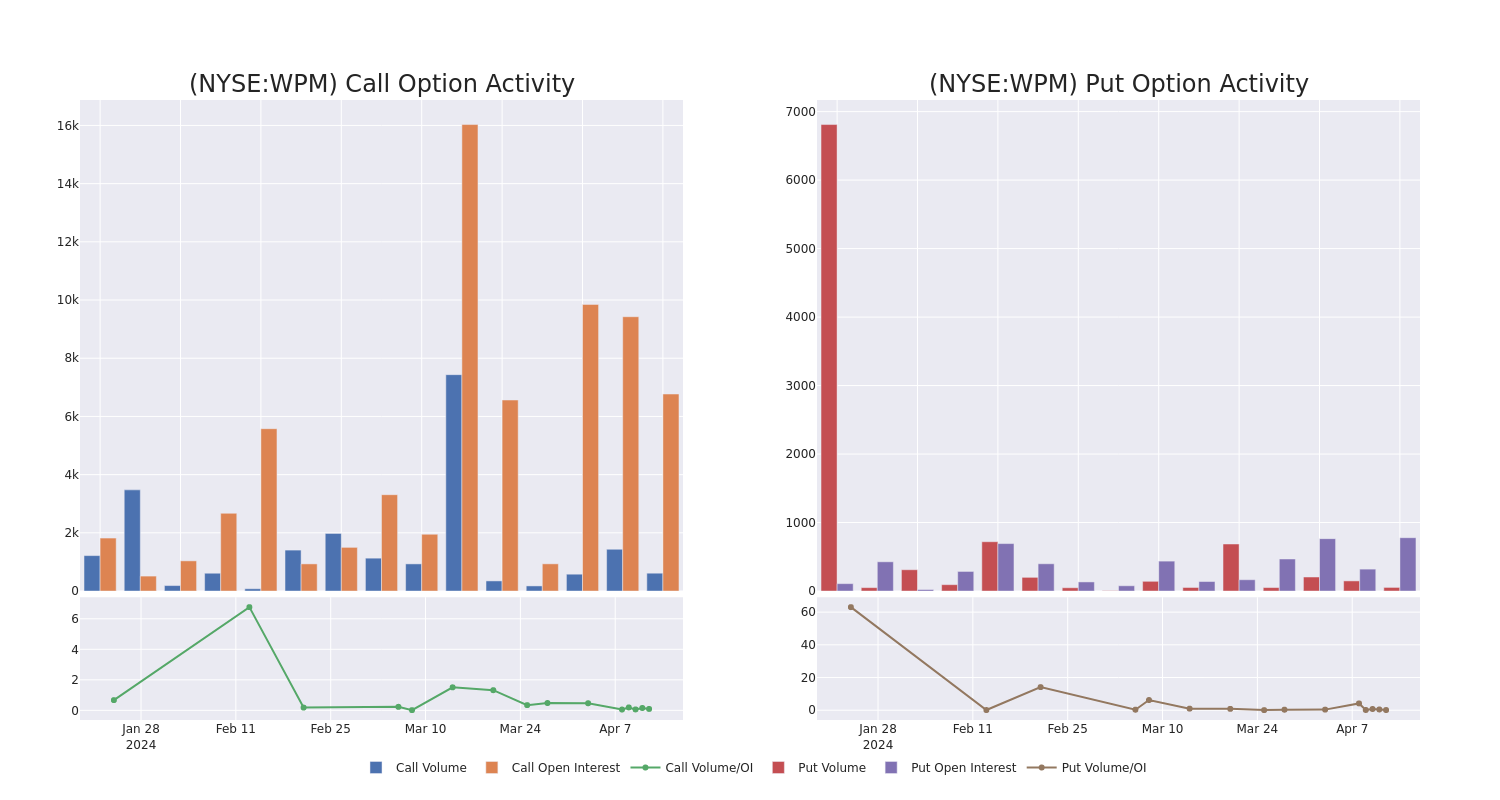

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Wheaton Precious Metals options trades today is 1078.43 with a total volume of 666.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Wheaton Precious Metals's big money trades within a strike price range of $40.0 to $65.0 over the last 30 days.

Wheaton Precious Metals Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| WPM |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$6.3 |

$6.2 |

$6.3 |

$55.00 |

$132.9K |

457 |

49 |

| WPM |

CALL |

SWEEP |

BULLISH |

09/20/24 |

$1.9 |

$1.85 |

$1.85 |

$65.00 |

$81.9K |

2.2K |

499 |

| WPM |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$20.1 |

$18.8 |

$18.8 |

$40.00 |

$78.9K |

186 |

8 |

| WPM |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$4.9 |

$4.7 |

$4.76 |

$50.00 |

$47.7K |

915 |

101 |

| WPM |

CALL |

TRADE |

BULLISH |

01/17/25 |

$16.0 |

$15.3 |

$16.0 |

$40.00 |

$40.0K |

328 |

0 |

About Wheaton Precious Metals

Wheaton Precious Metals Corp is a precious metal streaming company. The company has entered into over 20 long-term purchase agreements with 17 different mining companies, for the purchase of precious metals and cobalt. It has streaming agreements covering approximately 19 operating mines and 9 development stage projects. The company's projects include Vale's Salobo mine and silver streams on Glencore's Antamina mine and Goldcorp's Penasquito mine.

After a thorough review of the options trading surrounding Wheaton Precious Metals, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Wheaton Precious Metals Standing Right Now?

- Currently trading with a volume of 673,725, the WPM's price is up by 2.31%, now at $53.84.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 27 days.

Expert Opinions on Wheaton Precious Metals

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $53.0.

- An analyst from TD Securities upgraded its action to Buy with a price target of $53.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Wheaton Precious Metals, Benzinga Pro gives you real-time options trades alerts.

Posted In: WPM