Smart Money Is Betting Big In CHWY Options

Author: Benzinga Insights | April 11, 2024 01:02pm

Deep-pocketed investors have adopted a bearish approach towards Chewy (NYSE:CHWY), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CHWY usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Chewy. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 12% leaning bullish and 87% bearish. Among these notable options, 3 are puts, totaling $94,840, and 5 are calls, amounting to $205,003.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $15.0 to $25.0 for Chewy over the recent three months.

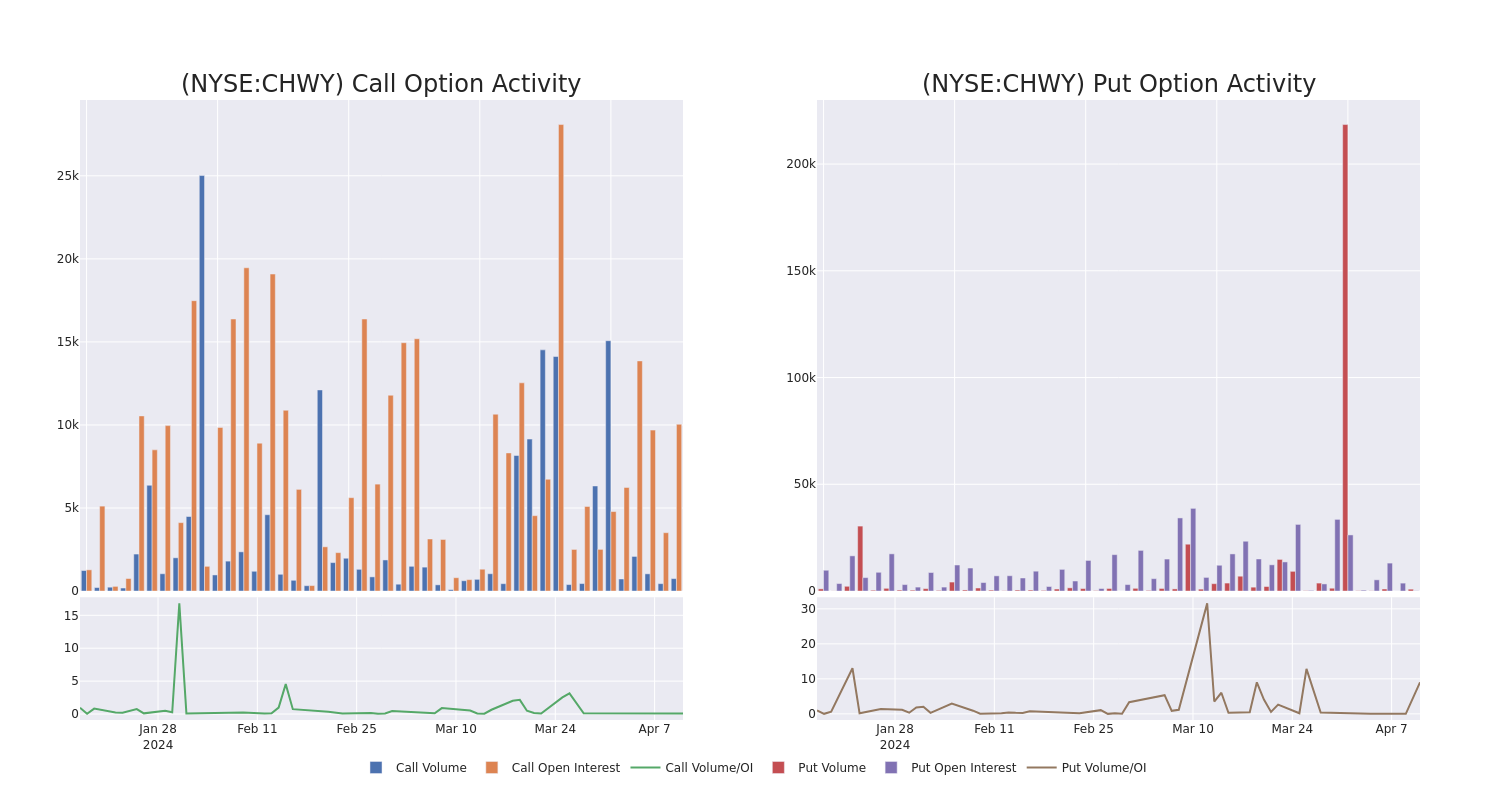

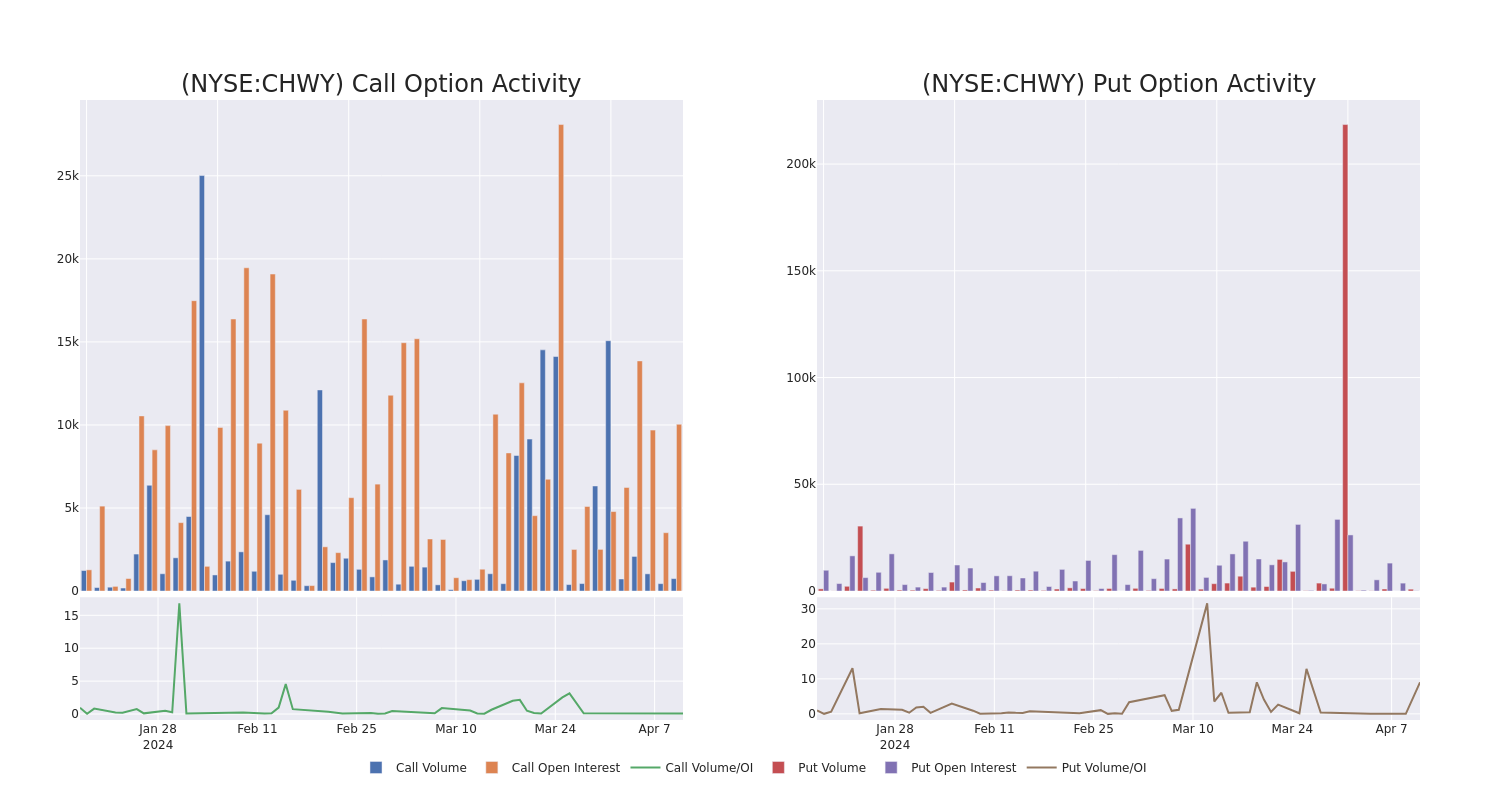

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Chewy's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Chewy's significant trades, within a strike price range of $15.0 to $25.0, over the past month.

Chewy 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CHWY |

CALL |

SWEEP |

BEARISH |

10/18/24 |

$4.8 |

$4.7 |

$4.7 |

$15.00 |

$59.2K |

918 |

79 |

| CHWY |

CALL |

SWEEP |

BEARISH |

01/17/25 |

$4.55 |

$4.5 |

$4.5 |

$17.50 |

$45.0K |

2.4K |

151 |

| CHWY |

CALL |

SWEEP |

BEARISH |

06/21/24 |

$1.28 |

$1.26 |

$1.26 |

$20.00 |

$37.8K |

4.6K |

488 |

| CHWY |

CALL |

SWEEP |

BEARISH |

10/18/24 |

$4.75 |

$4.7 |

$4.7 |

$15.00 |

$37.1K |

918 |

0 |

| CHWY |

PUT |

SWEEP |

BULLISH |

10/18/24 |

$7.95 |

$7.85 |

$7.85 |

$25.00 |

$36.1K |

97 |

1 |

About Chewy

Chewy is the largest e-commerce pet care retailer in the US, generating $11.2 billion in 2023 sales across pet food, treats, hard goods, and pharmacy categories. The firm was founded in 2011, acquired by PetSmart in 2017, and tapped public markets as a stand-alone company in 2019 after spending a couple of years developing under the aegis of the pet superstore chain. The firm generates sales from pet food, treats, over-the-counter medications, medical prescription fulfillment, and hard goods, like crates, leashes, and bowls.

Having examined the options trading patterns of Chewy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Chewy Standing Right Now?

- With a volume of 9,675,119, the price of CHWY is up 4.48% at $18.18.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 48 days.

What Analysts Are Saying About Chewy

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $20.1.

- An analyst from RBC Capital has decided to maintain their Outperform rating on Chewy, which currently sits at a price target of $22.

- An analyst from Needham downgraded its action to Buy with a price target of $25.

- An analyst from Piper Sandler has decided to maintain their Neutral rating on Chewy, which currently sits at a price target of $19.

- An analyst from Mizuho has revised its rating downward to Neutral, adjusting the price target to $18.

- An analyst from B of A Securities has decided to maintain their Underperform rating on Chewy, which currently sits at a price target of $16.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Chewy, Benzinga Pro gives you real-time options trades alerts.

Posted In: CHWY