Navigating 4 Analyst Ratings For Unum Gr

Author: Benzinga Insights | April 11, 2024 01:01pm

During the last three months, 4 analysts shared their evaluations of Unum Gr (NYSE:UNM), revealing diverse outlooks from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

3 |

1 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

1 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

1 |

1 |

0 |

0 |

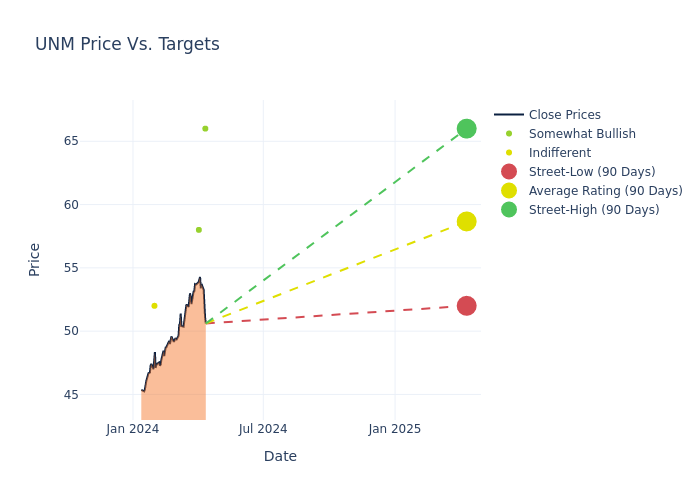

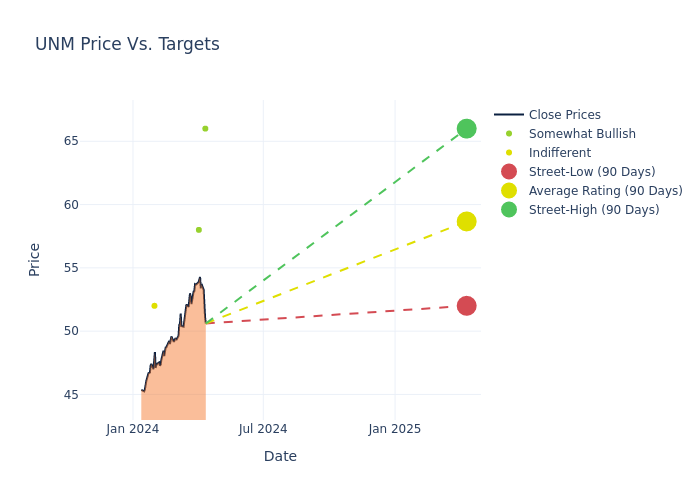

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $60.0, a high estimate of $66.00, and a low estimate of $52.00. This current average reflects an increase of 5.26% from the previous average price target of $57.00.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Unum Gr among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Elyse Greenspan |

Wells Fargo |

Raises |

Overweight |

$66.00 |

$64.00 |

| Jimmy Bhullar |

JP Morgan |

Raises |

Overweight |

$58.00 |

$56.00 |

| Elyse Greenspan |

Wells Fargo |

Raises |

Overweight |

$64.00 |

$61.00 |

| Alex Scott |

Goldman Sachs |

Raises |

Neutral |

$52.00 |

$47.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Unum Gr. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Unum Gr compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Unum Gr's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Unum Gr's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Unum Gr analyst ratings.

Delving into Unum Gr's Background

Unum Group is a provider of group and individual income protection insurance products in the United States, the United Kingdom, Poland, and other countries. It is the largest domestic disability insurer, with the majority of premiums generated from employer plans. The company also offers a complementary portfolio of other insurance products, including long-term care insurance, life insurance, and employer- and employee-paid group benefits. It has the following operating business segments: Unum US, Unum International, and Colonial Life. The majority of the revenue is earned from the Unum US segment. The firm markets its products primarily through brokers.

Unum Gr: Financial Performance Dissected

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Unum Gr's remarkable performance in 3 months is evident. As of 31 December, 2023, the company achieved an impressive revenue growth rate of 4.33%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Unum Gr's net margin excels beyond industry benchmarks, reaching 10.58%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.43%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Unum Gr's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.54%, the company showcases efficient use of assets and strong financial health.

Debt Management: Unum Gr's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.36.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: UNM