AT&T Unusual Options Activity For April 11

Author: Benzinga Insights | April 11, 2024 12:01pm

Financial giants have made a conspicuous bearish move on AT&T. Our analysis of options history for AT&T (NYSE:T) revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $306,521, and 3 were calls, valued at $129,535.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $15.0 to $20.0 for AT&T during the past quarter.

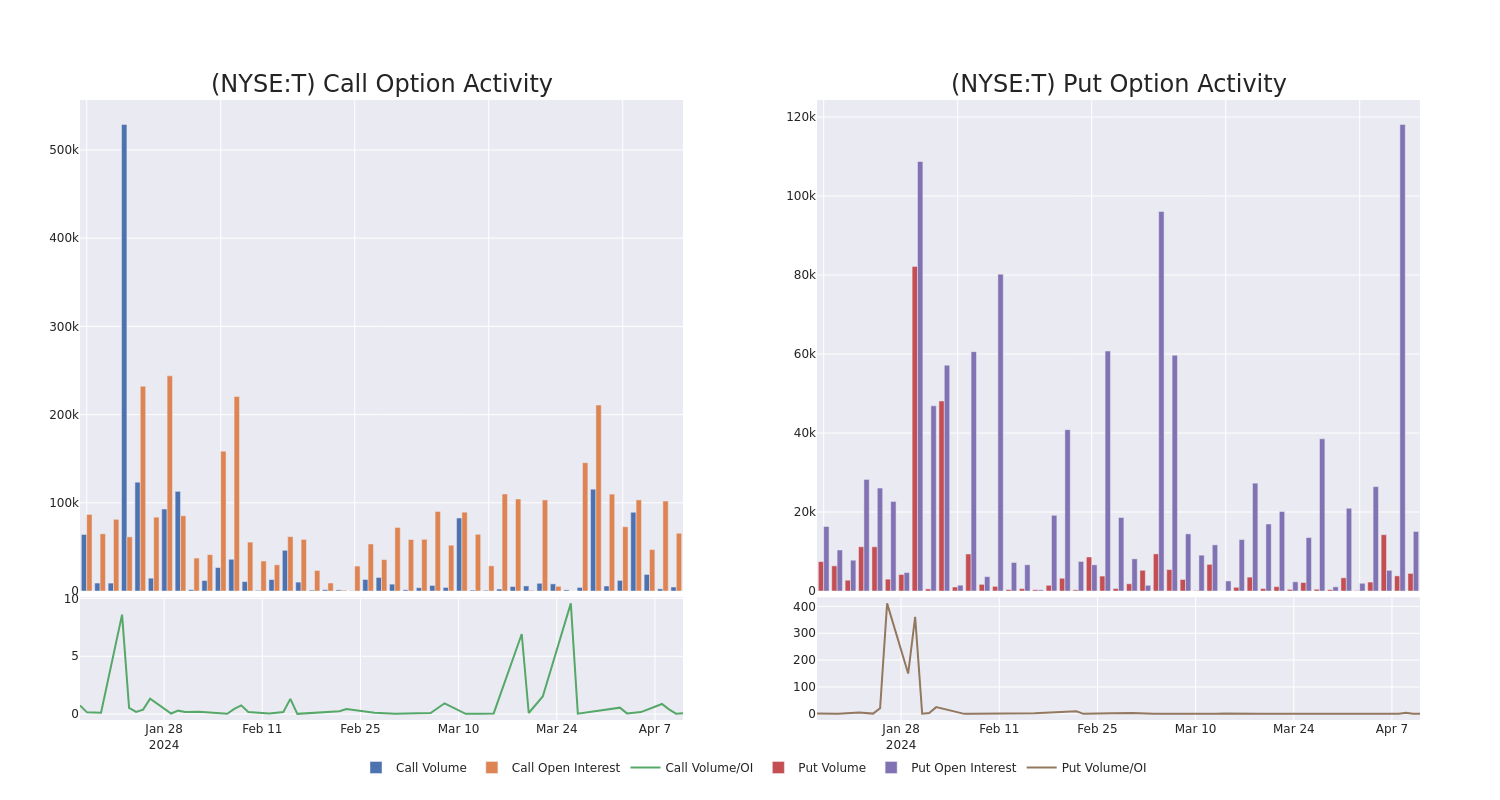

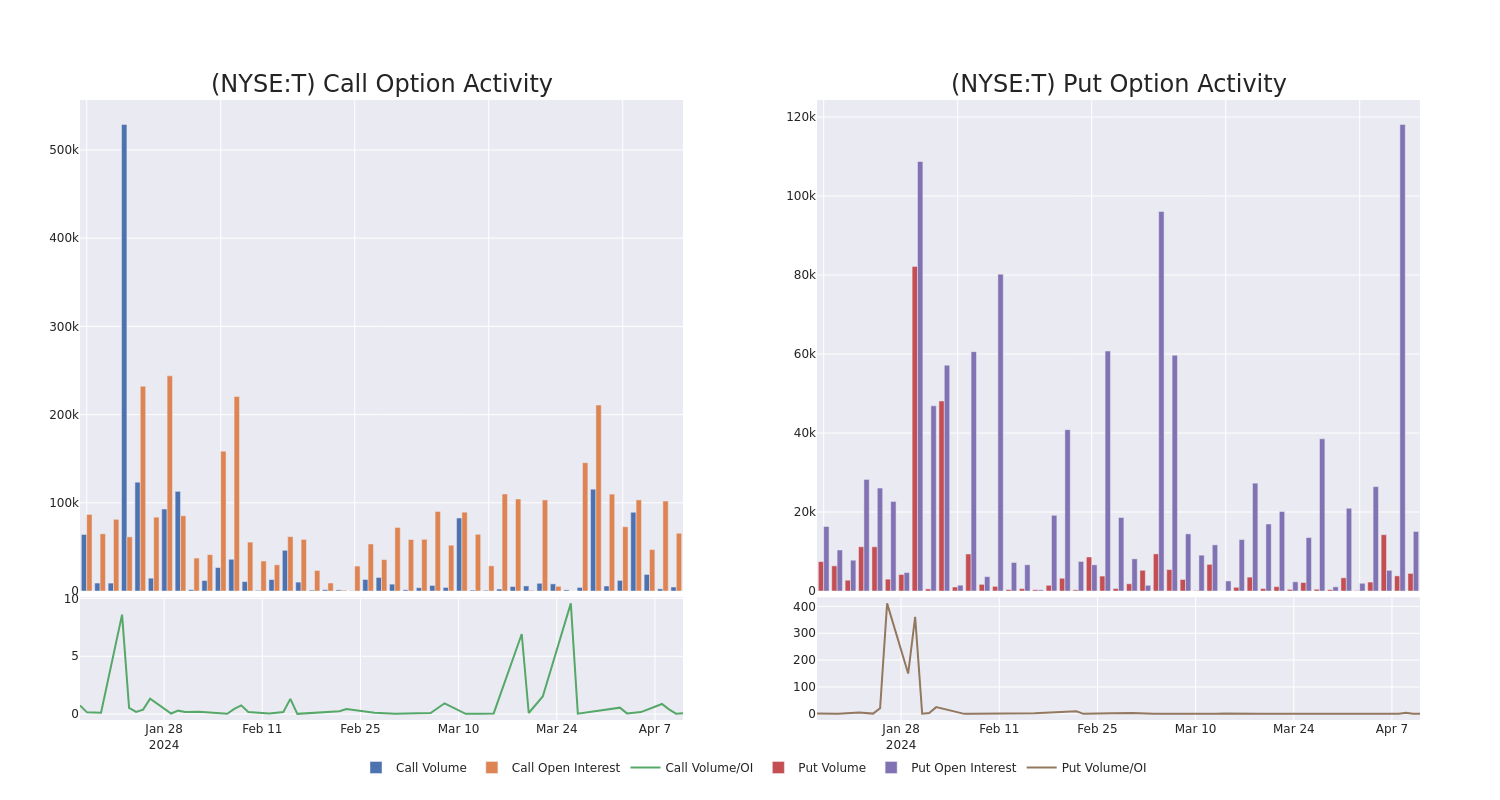

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for AT&T's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AT&T's whale activity within a strike price range from $15.0 to $20.0 in the last 30 days.

AT&T Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| T |

PUT |

SWEEP |

BEARISH |

06/21/24 |

$3.5 |

$3.4 |

$3.5 |

$20.00 |

$113.7K |

2.6K |

66 |

| T |

PUT |

SWEEP |

BULLISH |

09/20/24 |

$1.21 |

$1.19 |

$1.19 |

$17.00 |

$80.6K |

7.8K |

658 |

| T |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$0.27 |

$0.25 |

$0.25 |

$18.00 |

$67.8K |

64.9K |

114 |

| T |

PUT |

TRADE |

BULLISH |

09/20/24 |

$1.21 |

$1.19 |

$1.19 |

$17.00 |

$39.1K |

7.8K |

1.3K |

| T |

PUT |

TRADE |

BEARISH |

09/20/24 |

$0.75 |

$0.72 |

$0.74 |

$16.00 |

$37.0K |

4.5K |

42 |

About AT&T

The wireless business contributes about two thirds of AT&T's revenue following the spinoff of Warner Media. The firm is the third-largest U.S. wireless carrier, connecting 71 million postpaid and 17 million prepaid phone customers. Fixed-line enterprise services, which account for about 17% of revenue, include internet access, private networking, security, voice, and wholesale network capacity. Residential fixed-line services, about 11% of revenue, primarily consist of broadband internet access. AT&T also has a sizable presence in Mexico, serving 22 million customers, but this business only accounts for 3% of revenue. The firm still holds a 70% equity stake in satellite television provider DirecTV but does not consolidate this business in its financial statements.

AT&T's Current Market Status

- With a volume of 14,343,666, the price of T is down -1.37% at $16.5.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 13 days.

Expert Opinions on AT&T

1 market experts have recently issued ratings for this stock, with a consensus target price of $17.0.

- In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $17.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for AT&T, Benzinga Pro gives you real-time options trades alerts.

Posted In: T