A Closer Look at Palo Alto Networks's Options Market Dynamics

Author: Benzinga Insights | April 11, 2024 11:17am

Investors with a lot of money to spend have taken a bullish stance on Palo Alto Networks (NASDAQ:PANW).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PANW, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 9 options trades for Palo Alto Networks.

This isn't normal.

The overall sentiment of these big-money traders is split between 55% bullish and 44%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $35,350, and 8, calls, for a total amount of $313,290.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $180.0 to $310.0 for Palo Alto Networks over the last 3 months.

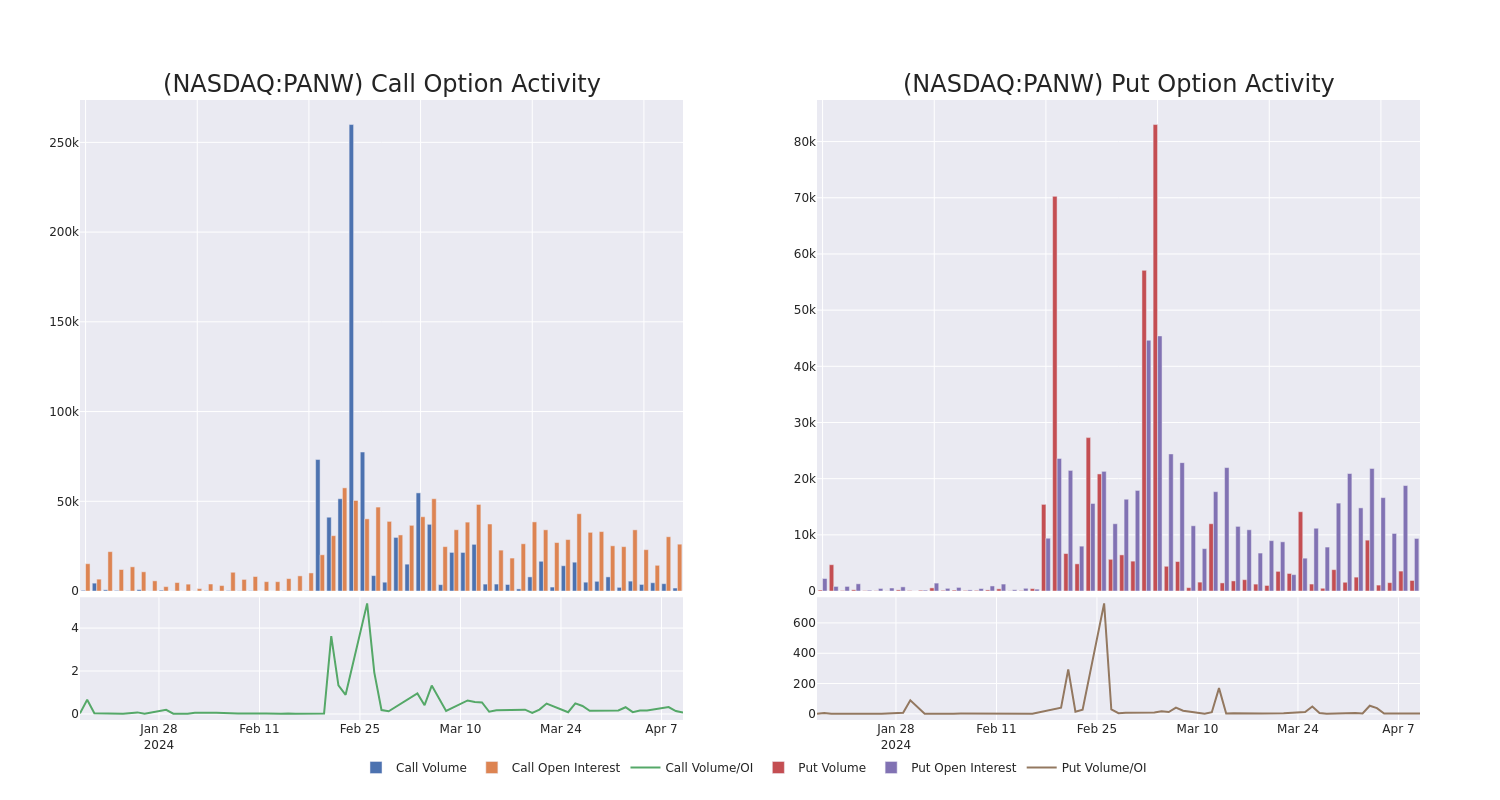

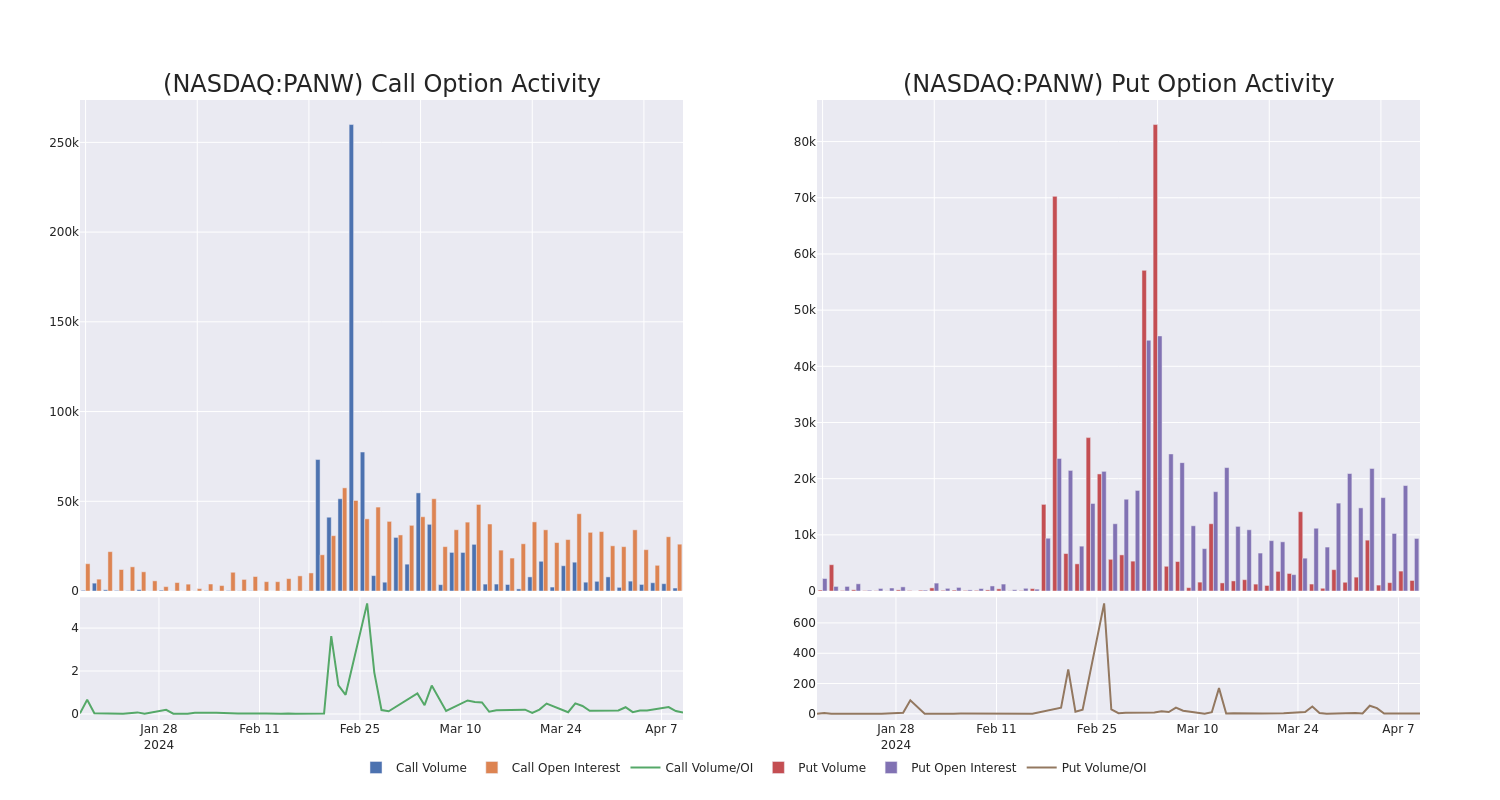

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Palo Alto Networks's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Palo Alto Networks's substantial trades, within a strike price spectrum from $180.0 to $310.0 over the preceding 30 days.

Palo Alto Networks Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| PANW |

CALL |

TRADE |

BULLISH |

06/21/24 |

$22.5 |

$22.25 |

$22.4 |

$280.00 |

$56.0K |

5.0K |

27 |

| PANW |

CALL |

TRADE |

BULLISH |

06/21/24 |

$13.5 |

$13.25 |

$13.4 |

$300.00 |

$53.6K |

3.1K |

11 |

| PANW |

CALL |

TRADE |

BEARISH |

09/20/24 |

$64.4 |

$64.1 |

$64.1 |

$230.00 |

$51.2K |

327 |

0 |

| PANW |

CALL |

TRADE |

BULLISH |

01/17/25 |

$96.1 |

$95.7 |

$96.1 |

$200.00 |

$38.4K |

2.6K |

0 |

| PANW |

PUT |

SWEEP |

BEARISH |

06/21/24 |

$25.25 |

$25.05 |

$25.25 |

$290.00 |

$35.3K |

1.2K |

0 |

About Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 85,000 customers across the world, including more than three fourths of the Global 2000.

Having examined the options trading patterns of Palo Alto Networks, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Palo Alto Networks Standing Right Now?

- With a volume of 645,950, the price of PANW is up 0.71% at $283.0.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 40 days.

Expert Opinions on Palo Alto Networks

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $340.0.

- An analyst from Stifel downgraded its action to Buy with a price target of $330.

- An analyst from Redburn Atlantic persists with their Buy rating on Palo Alto Networks, maintaining a target price of $350.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Palo Alto Networks, Benzinga Pro gives you real-time options trades alerts.

Posted In: PANW