What 15 Analyst Ratings Have To Say About Mastercard

Author: Benzinga Insights | April 11, 2024 11:00am

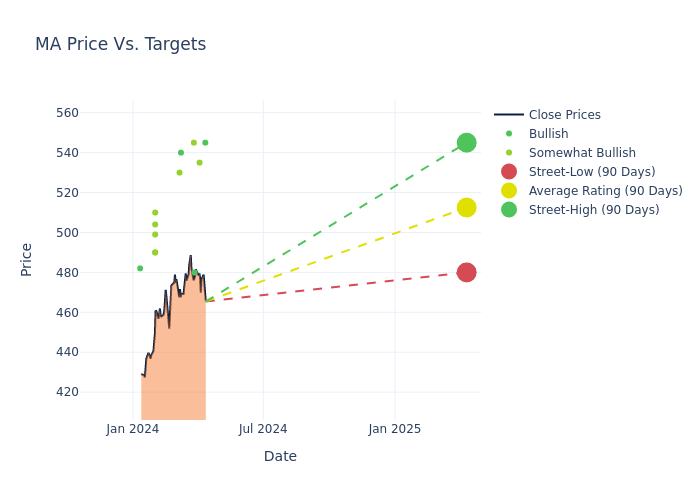

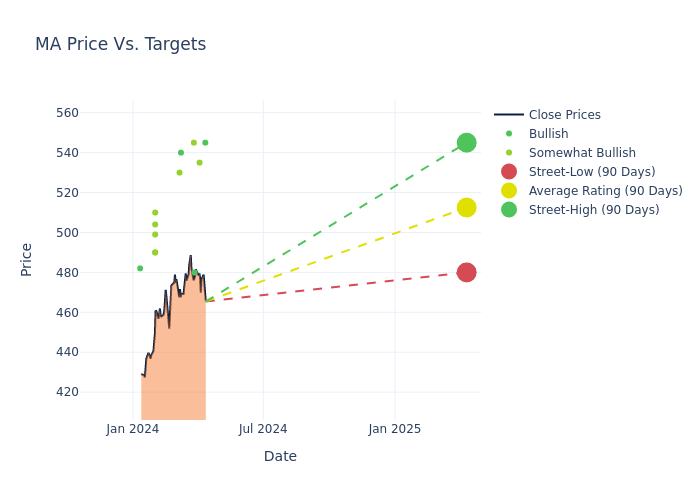

Providing a diverse range of perspectives from bullish to bearish, 15 analysts have published ratings on Mastercard (NYSE:MA) in the last three months.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

7 |

8 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

2 |

0 |

0 |

0 |

| 2M Ago |

1 |

1 |

0 |

0 |

0 |

| 3M Ago |

4 |

5 |

0 |

0 |

0 |

Insights from analysts' 12-month price targets are revealed, presenting an average target of $508.33, a high estimate of $545.00, and a low estimate of $462.00. This current average reflects an increase of 6.62% from the previous average price target of $476.75.

Analyzing Analyst Ratings: A Detailed Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Mastercard. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Bryan Bergin |

TD Cowen |

Announces |

Buy |

$545.00 |

- |

| James Friedman |

Susquehanna |

Maintains |

Positive |

$535.00 |

- |

| Dan Dolev |

Mizuho |

Maintains |

Buy |

$480.00 |

$480.00 |

| David Togut |

Evercore ISI Group |

Raises |

Outperform |

$545.00 |

$530.00 |

| Trevor Williams |

Jefferies |

Raises |

Buy |

$540.00 |

$520.00 |

| Donald Fandetti |

Wells Fargo |

Raises |

Overweight |

$530.00 |

$490.00 |

| Daniel Perlin |

RBC Capital |

Raises |

Outperform |

$499.00 |

$432.00 |

| Dominick Gabriele |

Oppenheimer |

Maintains |

Outperform |

$510.00 |

- |

| Alex Markgraff |

Keybanc |

Raises |

Overweight |

$490.00 |

$475.00 |

| Dan Dolev |

Mizuho |

Raises |

Buy |

$480.00 |

$462.00 |

| John Davis |

Raymond James |

Raises |

Outperform |

$504.00 |

$452.00 |

| Rufus Hone |

BMO Capital |

Raises |

Outperform |

$490.00 |

$480.00 |

| Trevor Williams |

Jefferies |

Raises |

Buy |

$520.00 |

$495.00 |

| Dan Dolev |

Mizuho |

Raises |

Buy |

$462.00 |

$420.00 |

| Trevor Williams |

Jefferies |

Raises |

Buy |

$495.00 |

$485.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Mastercard. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Mastercard compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Mastercard's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

For valuable insights into Mastercard's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Mastercard analyst ratings.

Discovering Mastercard: A Closer Look

Mastercard is the second-largest payment processor in the world, having processed close to over $9 trillion in volume during 2023. Mastercard operates in over 200 countries and processes transactions in over 150 currencies.

Mastercard's Economic Impact: An Analysis

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Over the 3 months period, Mastercard showcased positive performance, achieving a revenue growth rate of 12.57% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 42.62%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Mastercard's ROE excels beyond industry benchmarks, reaching 42.16%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Mastercard's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.8% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Mastercard's debt-to-equity ratio stands notably higher than the industry average, reaching 2.26. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: MA