Unpacking the Latest Options Trading Trends in Block

Author: Benzinga Insights | April 11, 2024 10:01am

Financial giants have made a conspicuous bearish move on Block. Our analysis of options history for Block (NYSE:SQ) revealed 9 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 66% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $126,350, and 7 were calls, valued at $923,300.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $52.5 to $125.0 for Block over the last 3 months.

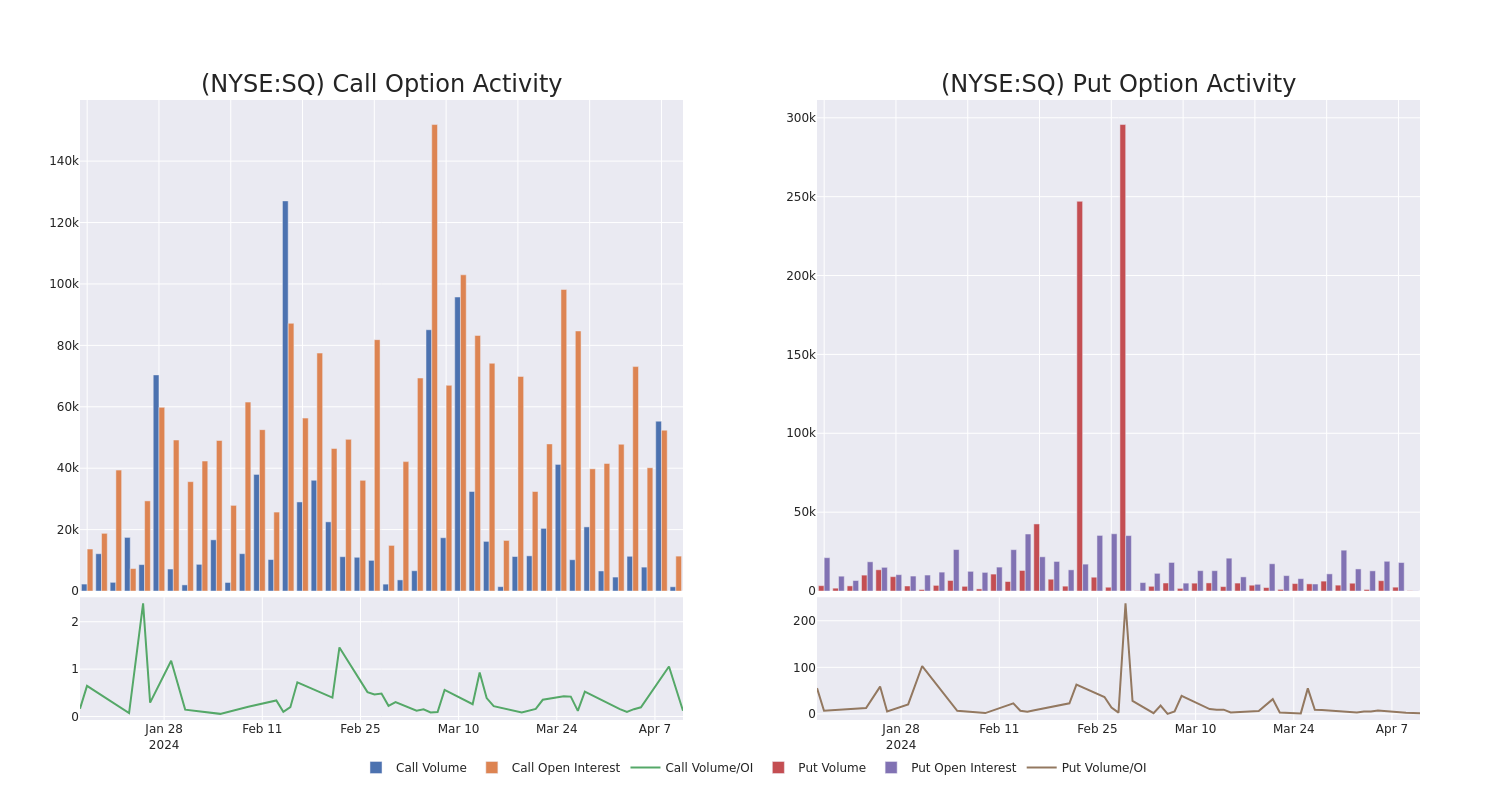

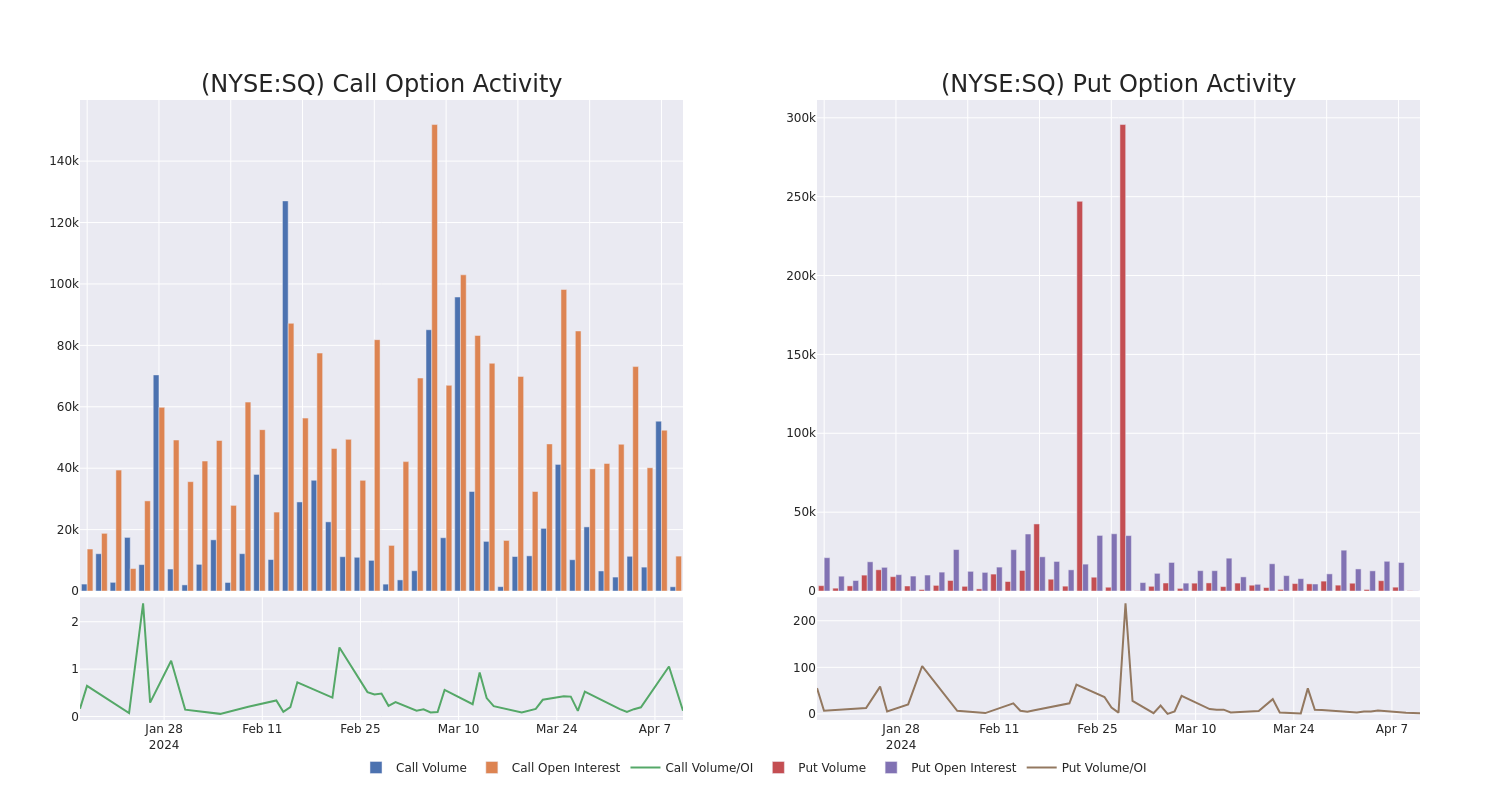

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Block's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Block's substantial trades, within a strike price spectrum from $52.5 to $125.0 over the preceding 30 days.

Block Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| SQ |

CALL |

TRADE |

BEARISH |

05/17/24 |

$5.9 |

$5.75 |

$5.8 |

$80.00 |

$435.0K |

9.9K |

752 |

| SQ |

CALL |

TRADE |

BEARISH |

01/16/26 |

$11.2 |

$11.15 |

$11.15 |

$125.00 |

$111.5K |

64 |

360 |

| SQ |

CALL |

TRADE |

BEARISH |

01/16/26 |

$11.25 |

$11.1 |

$11.1 |

$125.00 |

$111.0K |

64 |

160 |

| SQ |

PUT |

SWEEP |

BULLISH |

01/16/26 |

$6.8 |

$6.65 |

$6.65 |

$52.50 |

$96.4K |

126 |

2 |

| SQ |

CALL |

SWEEP |

BULLISH |

04/12/24 |

$2.04 |

$1.81 |

$2.04 |

$78.00 |

$81.6K |

1.2K |

2 |

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

In light of the recent options history for Block, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Block

- Trading volume stands at 454,131, with SQ's price up by 0.56%, positioned at $78.95.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 21 days.

What Analysts Are Saying About Block

In the last month, 5 experts released ratings on this stock with an average target price of $87.8.

- Consistent in their evaluation, an analyst from Mizuho keeps a Buy rating on Block with a target price of $106.

- Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for Block, targeting a price of $99.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a In-Line rating on Block with a target price of $75.

- In a cautious move, an analyst from Morgan Stanley downgraded its rating to Underweight, setting a price target of $60.

- An analyst from Mizuho persists with their Buy rating on Block, maintaining a target price of $99.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Block options trades with real-time alerts from Benzinga Pro.

Posted In: SQ