Smart Money Is Betting Big In OXY Options

Author: Benzinga Insights | April 10, 2024 01:15pm

Deep-pocketed investors have adopted a bullish approach towards Occidental Petroleum (NYSE:OXY), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in OXY usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Occidental Petroleum. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 50% bearish. Among these notable options, 3 are puts, totaling $262,520, and 11 are calls, amounting to $785,809.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $55.0 to $85.0 for Occidental Petroleum over the recent three months.

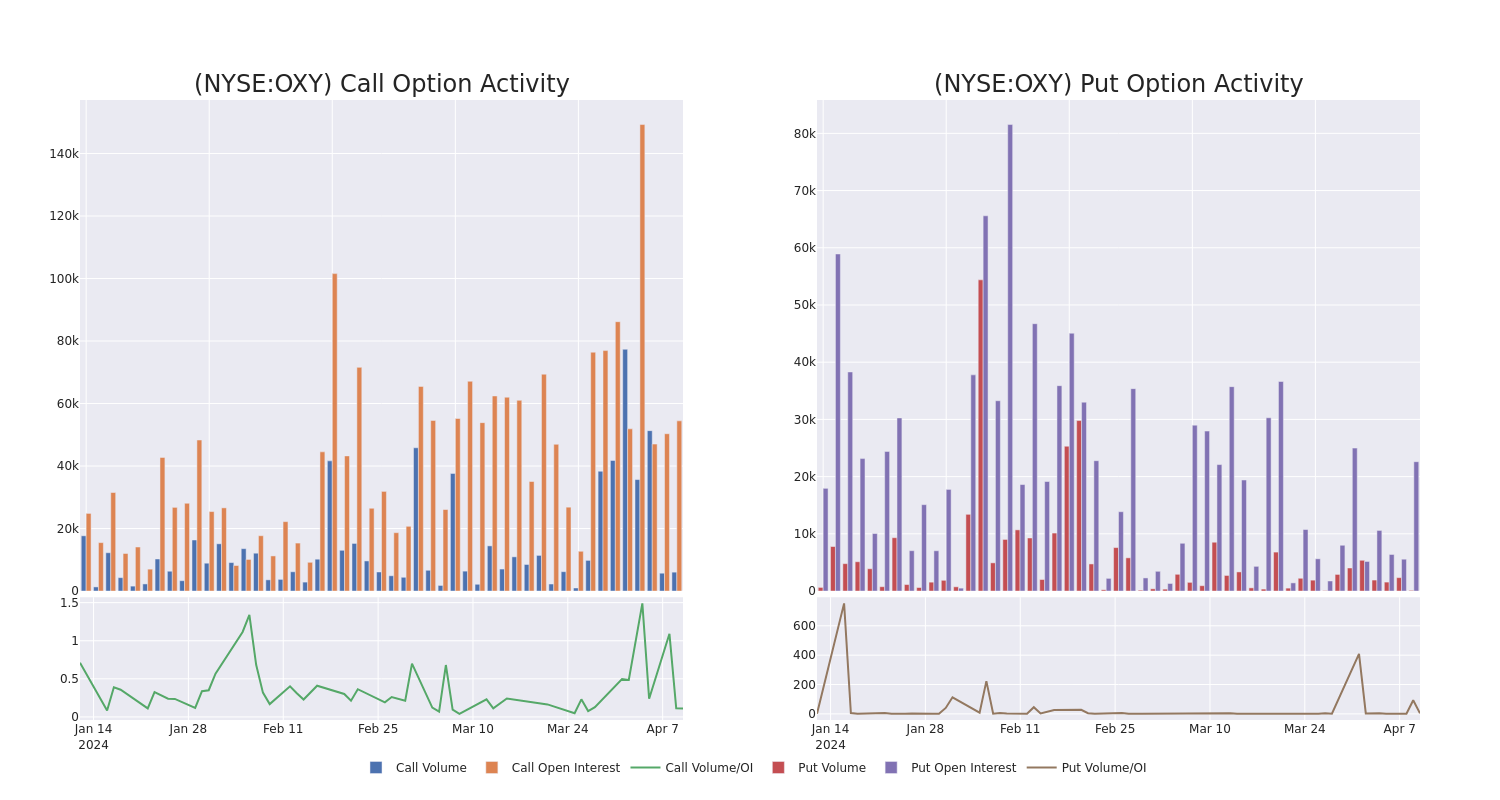

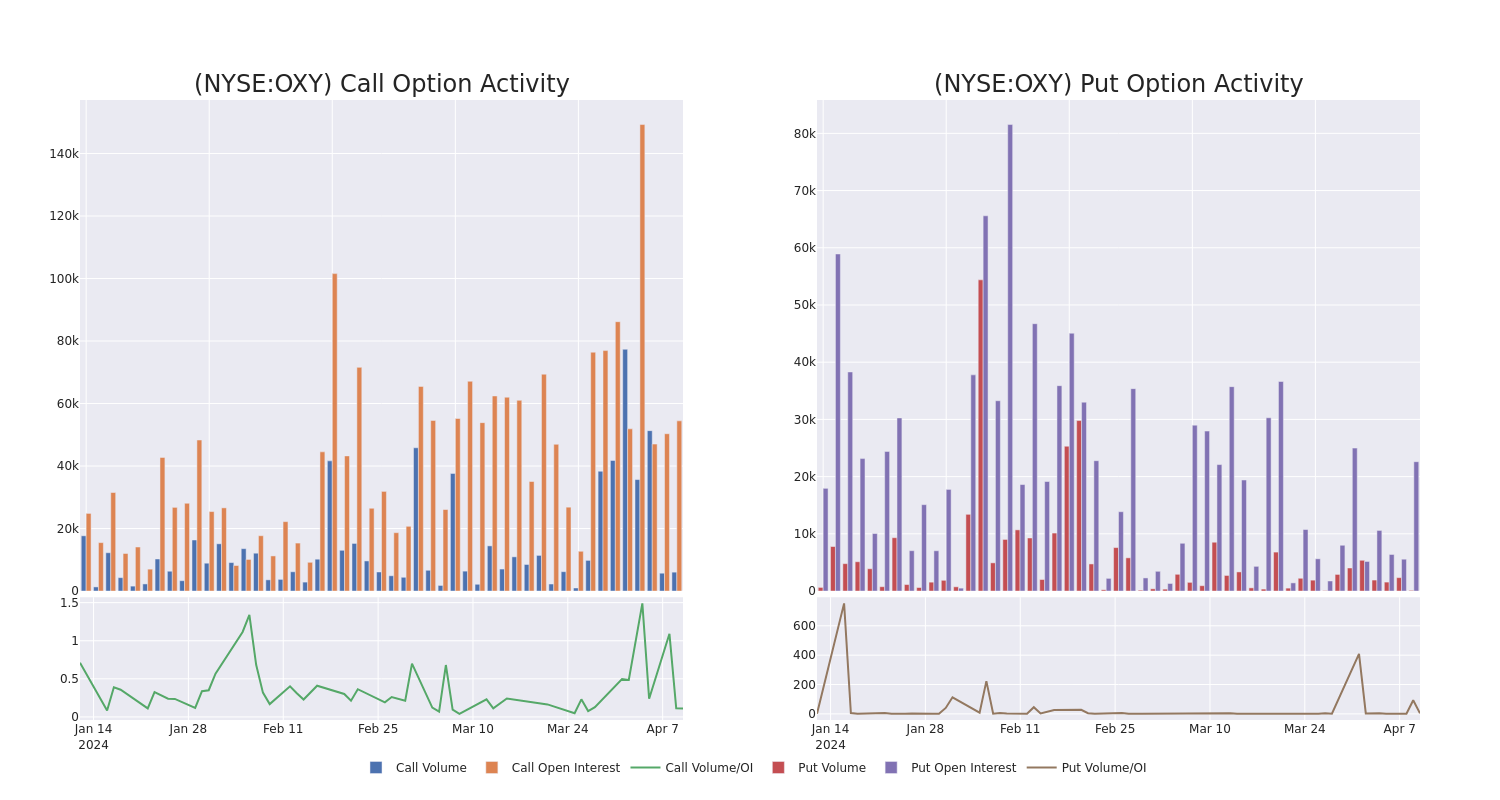

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Occidental Petroleum's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Occidental Petroleum's substantial trades, within a strike price spectrum from $55.0 to $85.0 over the preceding 30 days.

Occidental Petroleum Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| OXY |

PUT |

TRADE |

BULLISH |

01/17/25 |

$1.32 |

$1.29 |

$1.29 |

$55.00 |

$193.5K |

21.4K |

0 |

| OXY |

CALL |

TRADE |

BULLISH |

07/19/24 |

$3.2 |

$3.15 |

$3.2 |

$70.00 |

$160.0K |

5.4K |

0 |

| OXY |

CALL |

TRADE |

BEARISH |

06/21/24 |

$2.67 |

$2.62 |

$2.63 |

$70.00 |

$134.1K |

9.0K |

1.0K |

| OXY |

CALL |

SWEEP |

BULLISH |

04/19/24 |

$1.16 |

$1.15 |

$1.16 |

$69.00 |

$118.3K |

11.1K |

2.1K |

| OXY |

CALL |

SWEEP |

BEARISH |

06/21/24 |

$9.6 |

$9.55 |

$9.55 |

$60.00 |

$66.8K |

4.5K |

41 |

About Occidental Petroleum

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

Following our analysis of the options activities associated with Occidental Petroleum, we pivot to a closer look at the company's own performance.

Occidental Petroleum's Current Market Status

- With a trading volume of 4,387,129, the price of OXY is down by -0.66%, reaching $68.1.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 27 days from now.

Professional Analyst Ratings for Occidental Petroleum

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $74.5.

- Consistent in their evaluation, an analyst from Mizuho keeps a Neutral rating on Occidental Petroleum with a target price of $69.

- Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Occidental Petroleum with a target price of $84.

- In a cautious move, an analyst from Barclays downgraded its rating to Equal-Weight, setting a price target of $73.

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on Occidental Petroleum, which currently sits at a price target of $72.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Occidental Petroleum options trades with real-time alerts from Benzinga Pro.

Posted In: OXY