Where Cigna Group Stands With Analysts

Author: Benzinga Insights | April 10, 2024 10:00am

Throughout the last three months, 16 analysts have evaluated Cigna Group (NYSE:CI), offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

5 |

9 |

2 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

3 |

5 |

0 |

0 |

0 |

| 3M Ago |

2 |

3 |

2 |

0 |

0 |

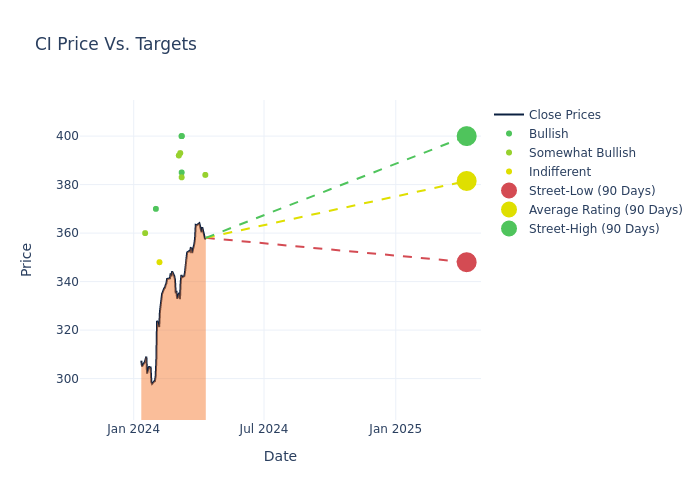

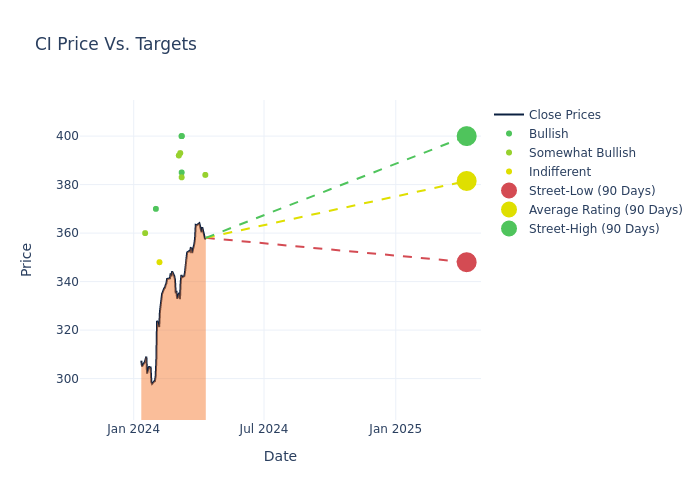

Analysts have recently evaluated Cigna Group and provided 12-month price targets. The average target is $375.06, accompanied by a high estimate of $400.00 and a low estimate of $334.00. This current average reflects an increase of 4.37% from the previous average price target of $359.36.

Analyzing Analyst Ratings: A Detailed Breakdown

The perception of Cigna Group by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Sarah James |

Cantor Fitzgerald |

Maintains |

Overweight |

$384.00 |

- |

| Sarah James |

Cantor Fitzgerald |

Raises |

Overweight |

$384.00 |

$372.00 |

| Kevin Caliendo |

UBS |

Raises |

Buy |

$400.00 |

$385.00 |

| Ben Hendrix |

RBC Capital |

Raises |

Outperform |

$383.00 |

$354.00 |

| Ann Hynes |

Mizuho |

Raises |

Buy |

$385.00 |

$370.00 |

| David Macdonald |

Truist Securities |

Raises |

Buy |

$400.00 |

$380.00 |

| Andrew Mok |

Barclays |

Announces |

Overweight |

$393.00 |

- |

| Erin Wright |

Morgan Stanley |

Raises |

Overweight |

$392.00 |

$382.00 |

| Sarah James |

Cantor Fitzgerald |

Maintains |

Overweight |

$372.00 |

- |

| Stephen Baxter |

Wells Fargo |

Raises |

Equal-Weight |

$348.00 |

$334.00 |

| Ann Hynes |

Mizuho |

Raises |

Buy |

$370.00 |

$360.00 |

| Sarah James |

Cantor Fitzgerald |

Raises |

Overweight |

$372.00 |

$334.00 |

| Frank Morgan |

RBC Capital |

Raises |

Outperform |

$354.00 |

$327.00 |

| George Hill |

Deutsche Bank |

Raises |

Buy |

$370.00 |

$355.00 |

| Sarah James |

Cantor Fitzgerald |

Maintains |

Neutral |

$334.00 |

- |

| Michael Wiederhorn |

Oppenheimer |

Maintains |

Outperform |

$360.00 |

- |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Cigna Group. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Cigna Group compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Cigna Group's stock. This examination reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Cigna Group's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Cigna Group analyst ratings.

Unveiling the Story Behind Cigna Group

Cigna primarily provides pharmacy benefit management and health insurance services. Its PBM and specialty pharmacy services, which were greatly expanded by its 2018 merger with Express Scripts, are mostly sold to health insurance plans and employers. Its largest PBM contract is the Department of Defense, and it recently won a deal with top-tier insurer Centene. In health insurance and other benefits, Cigna mostly serves employers through self-funding arrangements, and the company operates mostly in the US with 18 million US medical members covered as of December 2023.

Cigna Group's Financial Performance

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Positive Revenue Trend: Examining Cigna Group's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 11.72% as of 31 December, 2023, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Cigna Group's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 2.01%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Cigna Group's ROE stands out, surpassing industry averages. With an impressive ROE of 2.24%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Cigna Group's ROA stands out, surpassing industry averages. With an impressive ROA of 0.68%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Cigna Group's debt-to-equity ratio is below the industry average at 0.67, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CI