Smart Money Is Betting Big In VST Options

Author: Benzinga Insights | April 09, 2024 12:00pm

Investors with a lot of money to spend have taken a bullish stance on Vistra (NYSE:VST).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with VST, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 10 uncommon options trades for Vistra.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 50%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $226,970, and 6 are calls, for a total amount of $397,457.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $60.0 to $77.5 for Vistra over the last 3 months.

Insights into Volume & Open Interest

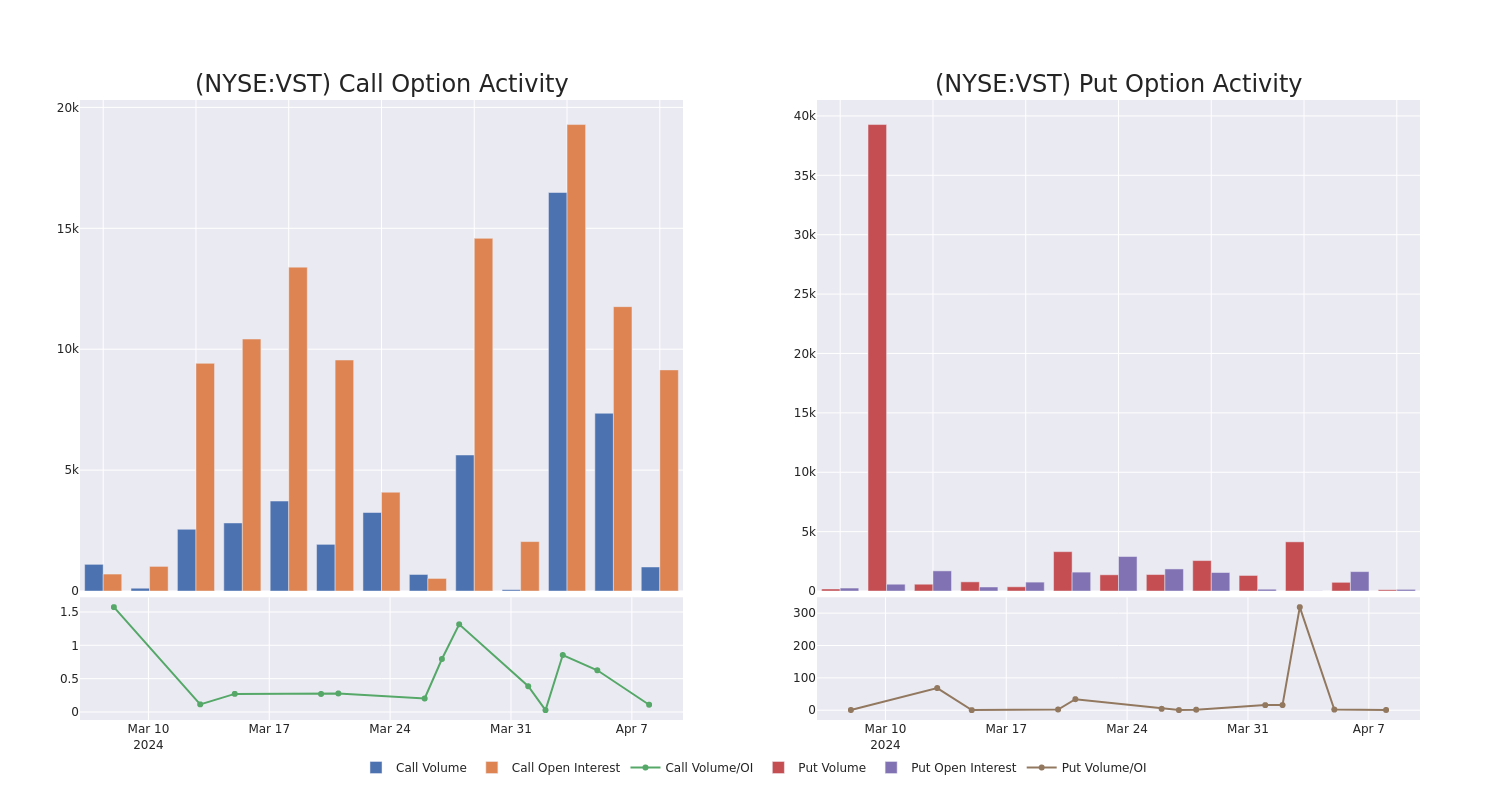

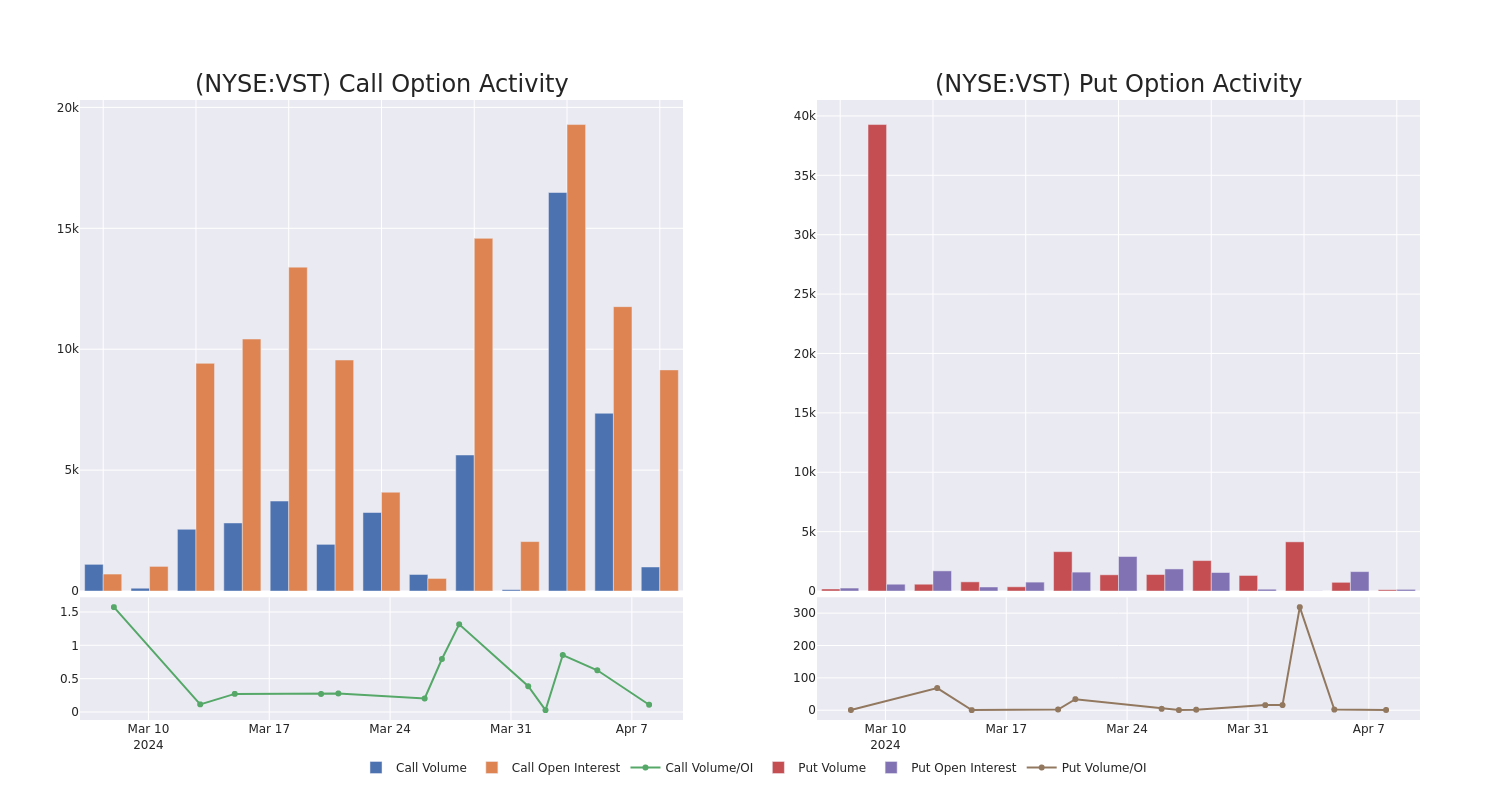

In today's trading context, the average open interest for options of Vistra stands at 1129.8, with a total volume reaching 2,458.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Vistra, situated within the strike price corridor from $60.0 to $77.5, throughout the last 30 days.

Vistra 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| VST |

CALL |

SWEEP |

BULLISH |

06/21/24 |

$7.0 |

$6.7 |

$7.0 |

$70.00 |

$163.1K |

1.3K |

240 |

| VST |

CALL |

SWEEP |

BULLISH |

06/21/24 |

$4.4 |

$3.8 |

$4.3 |

$77.50 |

$107.5K |

142 |

252 |

| VST |

PUT |

SWEEP |

BULLISH |

04/17/25 |

$6.6 |

$6.2 |

$6.2 |

$60.00 |

$75.0K |

148 |

0 |

| VST |

PUT |

SWEEP |

BEARISH |

04/19/24 |

$2.35 |

$2.25 |

$2.35 |

$70.00 |

$69.3K |

1.1K |

803 |

| VST |

PUT |

SWEEP |

BEARISH |

04/17/25 |

$10.5 |

$10.2 |

$10.5 |

$70.00 |

$52.5K |

0 |

0 |

About Vistra

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

Having examined the options trading patterns of Vistra, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Vistra

- Trading volume stands at 4,046,881, with VST's price up by 0.51%, positioned at $74.8.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 28 days.

Professional Analyst Ratings for Vistra

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $76.75.

- An analyst from Morgan Stanley persists with their Overweight rating on Vistra, maintaining a target price of $78.

- An analyst from Evercore ISI Group persists with their Outperform rating on Vistra, maintaining a target price of $79.

- An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Vistra, which currently sits at a price target of $72.

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on Vistra, which currently sits at a price target of $78.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Vistra, Benzinga Pro gives you real-time options trades alerts.

Posted In: VST