A Closer Look at Devon Energy's Options Market Dynamics

Author: Benzinga Insights | April 09, 2024 10:16am

Investors with a lot of money to spend have taken a bearish stance on Devon Energy (NYSE:DVN).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DVN, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 8 options trades for Devon Energy.

This isn't normal.

The overall sentiment of these big-money traders is split between 12% bullish and 87%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $113,400, and 7, calls, for a total amount of $477,837.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $40.0 and $57.5 for Devon Energy, spanning the last three months.

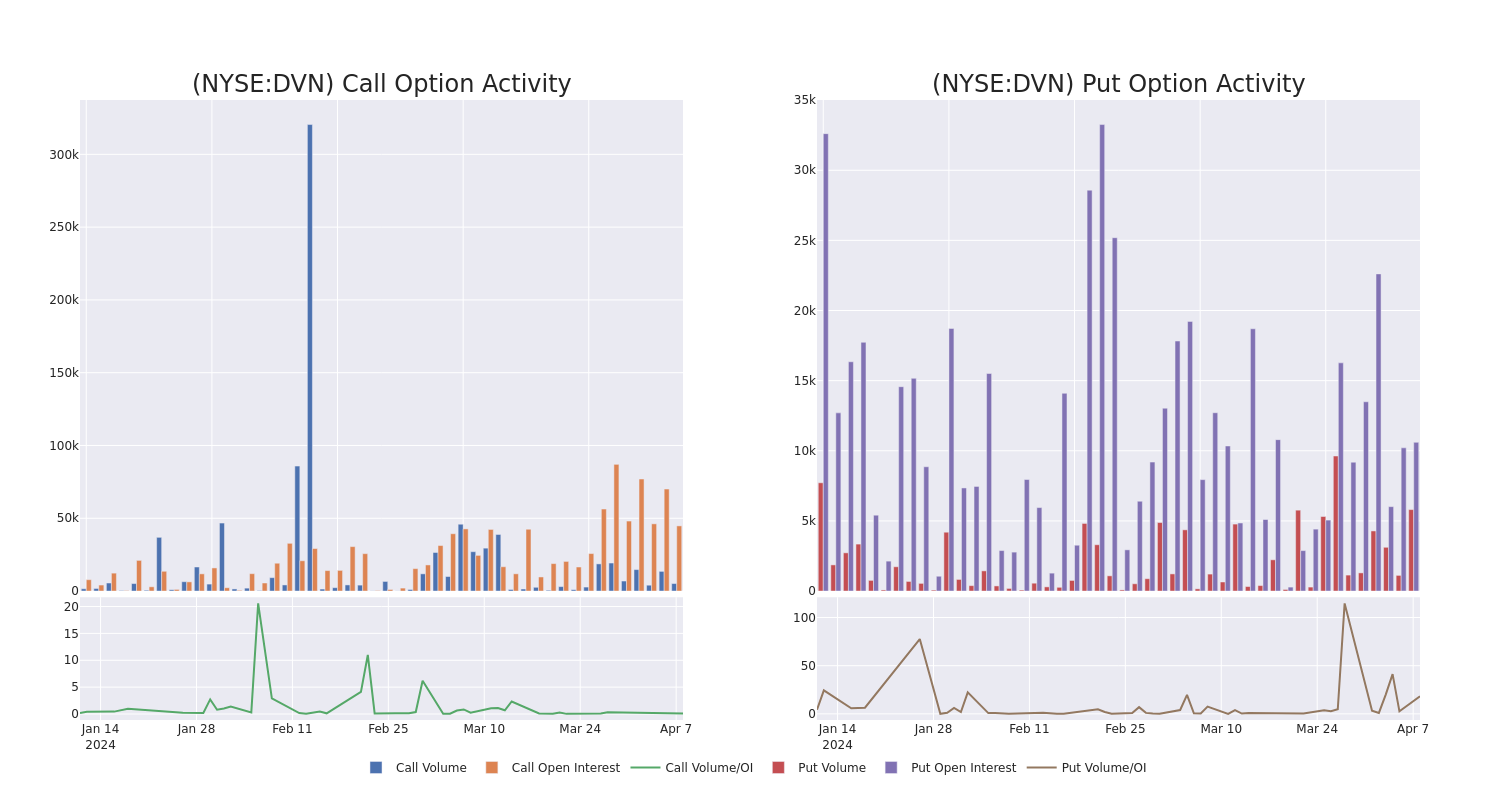

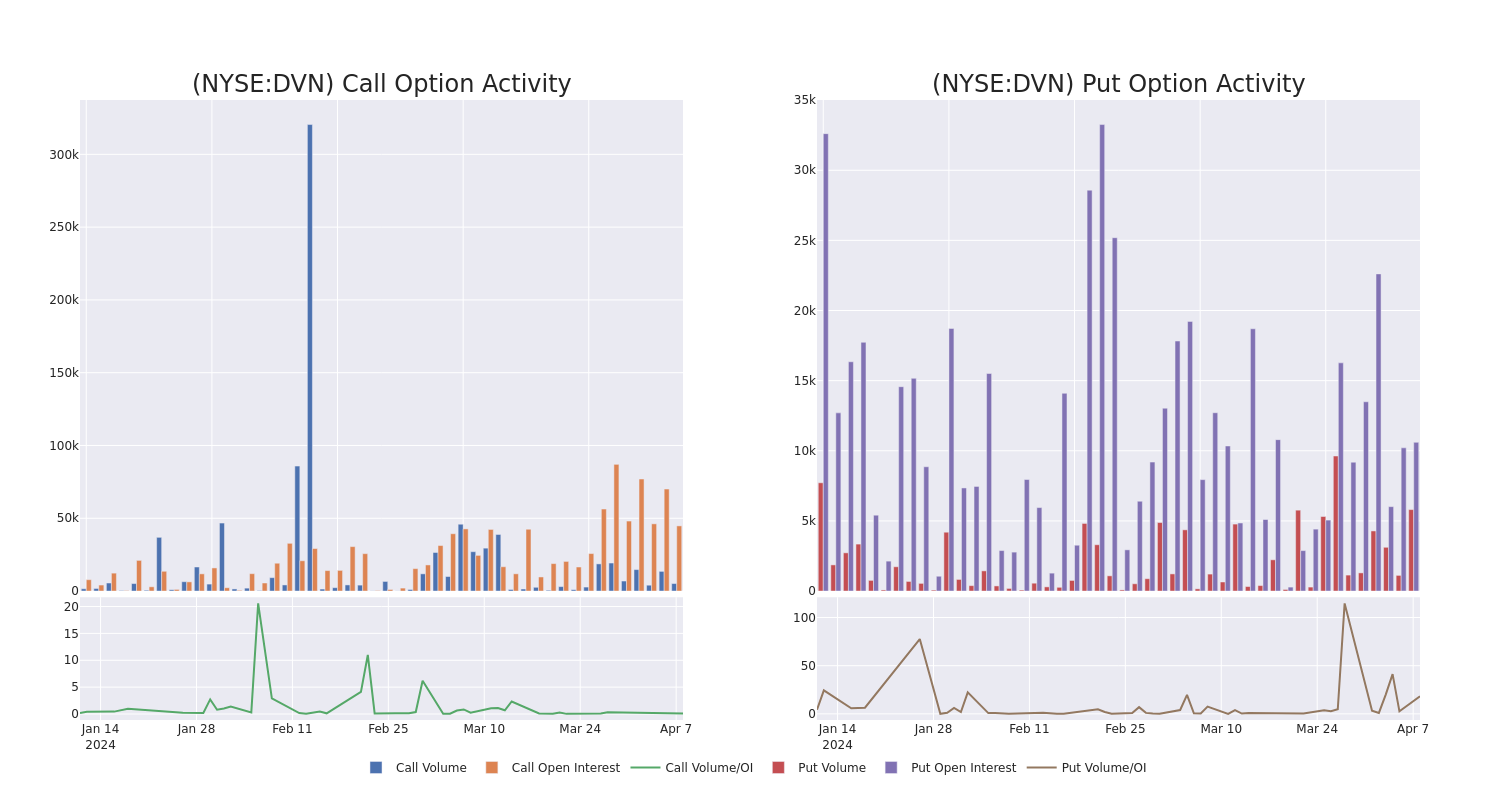

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Devon Energy's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Devon Energy's substantial trades, within a strike price spectrum from $40.0 to $57.5 over the preceding 30 days.

Devon Energy Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| DVN |

PUT |

SWEEP |

BULLISH |

05/17/24 |

$4.3 |

$4.2 |

$4.2 |

$57.50 |

$113.4K |

18 |

0 |

| DVN |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$3.9 |

$3.8 |

$3.8 |

$52.50 |

$113.2K |

2.9K |

291 |

| DVN |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$3.85 |

$3.8 |

$3.8 |

$52.50 |

$104.1K |

2.9K |

275 |

| DVN |

CALL |

TRADE |

NEUTRAL |

01/16/26 |

$17.5 |

$13.0 |

$14.9 |

$42.50 |

$96.8K |

690 |

2 |

| DVN |

CALL |

SWEEP |

BEARISH |

04/19/24 |

$1.46 |

$1.41 |

$1.42 |

$53.00 |

$61.6K |

697 |

443 |

About Devon Energy

Devon Energy, based in Oklahoma City, is one of the largest independent exploration and production companies in North America. The firm's asset base is spread throughout onshore North America and includes exposure to the Delaware, STACK, Eagle Ford, Powder River Basin, and Bakken plays. At year-end 2023, net production totaled roughly 658 thousand boe/d, of which oil and natural gas liquids made up roughly three-quarters of production, with natural gas accounting for the remainder.

After a thorough review of the options trading surrounding Devon Energy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Devon Energy

- Trading volume stands at 752,231, with DVN's price up by 0.13%, positioned at $53.5.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 22 days.

Expert Opinions on Devon Energy

5 market experts have recently issued ratings for this stock, with a consensus target price of $58.0.

- An analyst from JP Morgan has decided to maintain their Overweight rating on Devon Energy, which currently sits at a price target of $62.

- An analyst from Wells Fargo has elevated its stance to Overweight, setting a new price target at $59.

- An analyst from Morgan Stanley persists with their Overweight rating on Devon Energy, maintaining a target price of $49.

- An analyst from Stifel persists with their Buy rating on Devon Energy, maintaining a target price of $65.

- An analyst from Citigroup has decided to maintain their Buy rating on Devon Energy, which currently sits at a price target of $55.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Devon Energy, Benzinga Pro gives you real-time options trades alerts.

Posted In: DVN