Albemarle Options Trading: A Deep Dive into Market Sentiment

Author: Benzinga Insights | April 08, 2024 01:31pm

Deep-pocketed investors have adopted a bullish approach towards Albemarle (NYSE:ALB), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ALB usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for Albemarle. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 72% leaning bullish and 27% bearish. Among these notable options, 2 are puts, totaling $91,290, and 9 are calls, amounting to $404,374.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $90.0 to $135.0 for Albemarle during the past quarter.

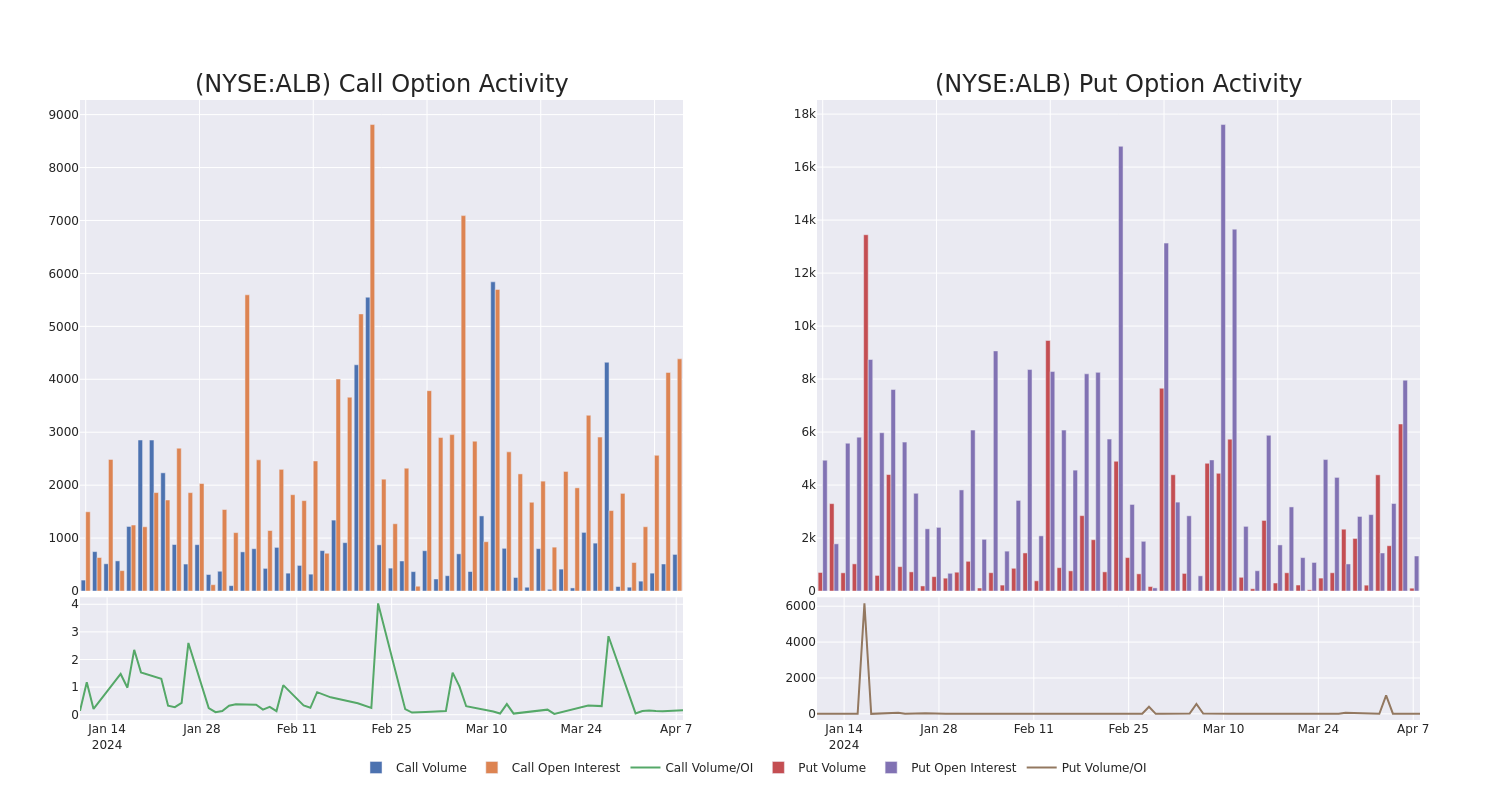

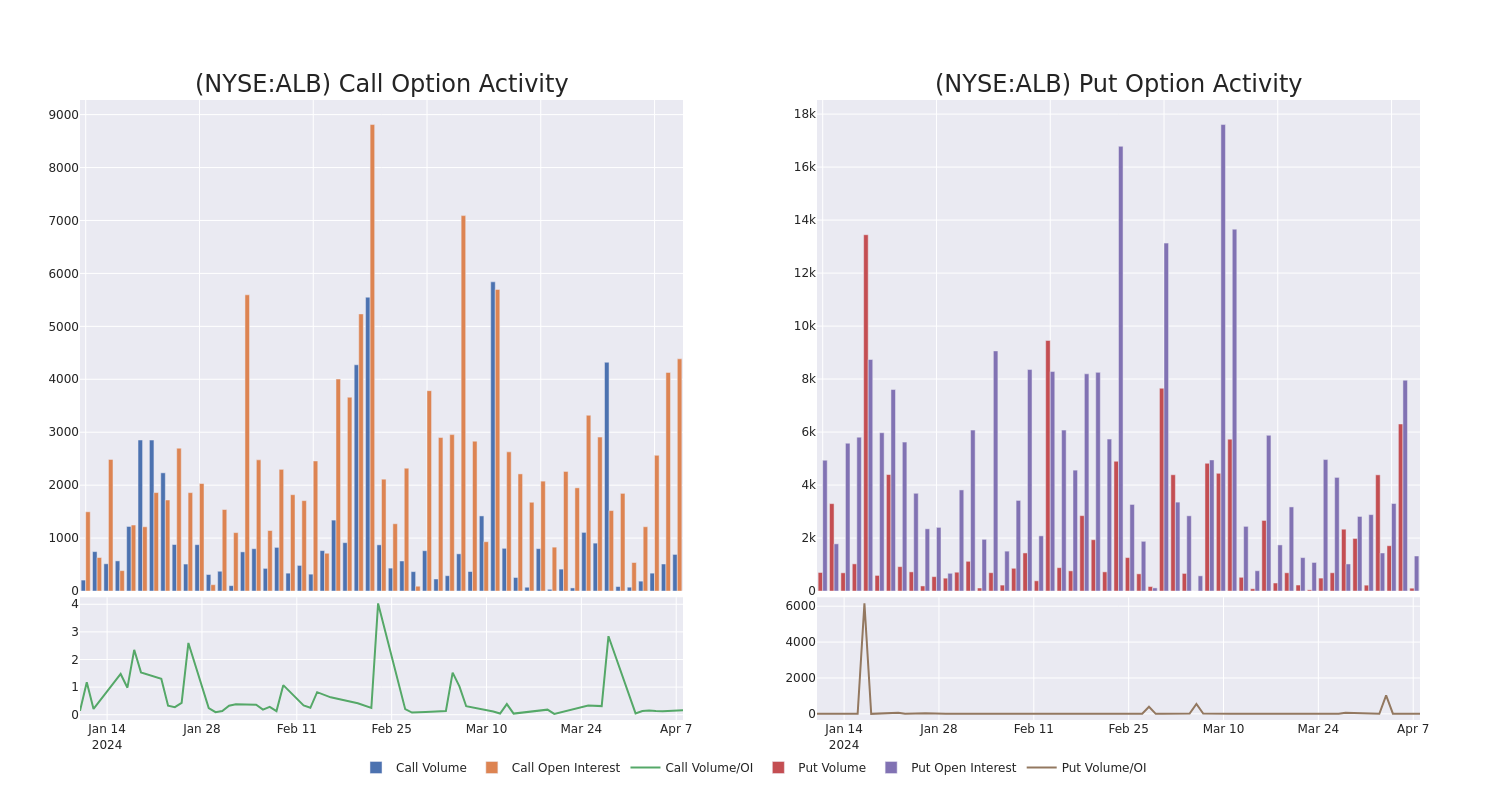

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Albemarle's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Albemarle's whale trades within a strike price range from $90.0 to $135.0 in the last 30 days.

Albemarle Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| ALB |

CALL |

TRADE |

BULLISH |

04/19/24 |

$6.35 |

$6.25 |

$6.35 |

$128.00 |

$85.7K |

262 |

14 |

| ALB |

PUT |

TRADE |

BULLISH |

09/20/24 |

$11.8 |

$11.4 |

$11.55 |

$120.00 |

$48.5K |

841 |

46 |

| ALB |

CALL |

SWEEP |

NEUTRAL |

04/12/24 |

$3.3 |

$3.25 |

$3.25 |

$129.00 |

$47.7K |

230 |

382 |

| ALB |

CALL |

SWEEP |

NEUTRAL |

05/03/24 |

$9.5 |

$9.25 |

$9.25 |

$125.00 |

$45.3K |

92 |

13 |

| ALB |

CALL |

TRADE |

BULLISH |

06/21/24 |

$22.5 |

$21.65 |

$22.5 |

$110.00 |

$45.0K |

397 |

0 |

About Albemarle

Albemarle is one of the world's largest lithium producers. In the lithium industry, the majority of demand comes from batteries, where lithium is used as the energy storage material, particularly in electric vehicles. Albemarle is a fully integrated lithium producer. Its upstream resources include salt brine deposits in Chile and the U.S. and two hard rock mines in Australia, both of which are joint ventures. The company operates lithium refining plants in Chile, the U.S., Australia, and China. Albemarle is a global leader in the production of bromine, used in flame retardants. It is also a major producer of oil refining catalysts.

After a thorough review of the options trading surrounding Albemarle, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Albemarle

- Currently trading with a volume of 1,735,382, the ALB's price is up by 6.76%, now at $131.8.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 23 days.

Professional Analyst Ratings for Albemarle

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $121.5.

- Maintaining their stance, an analyst from Loop Capital continues to hold a Buy rating for Albemarle, targeting a price of $162.

- An analyst from Morgan Stanley has decided to maintain their Underweight rating on Albemarle, which currently sits at a price target of $81.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Albemarle, Benzinga Pro gives you real-time options trades alerts.

Posted In: ALB