This Is What Whales Are Betting On Sea

Author: Benzinga Insights | April 05, 2024 04:30pm

Whales with a lot of money to spend have taken a noticeably bearish stance on Sea.

Looking at options history for Sea (NYSE:SE) we detected 17 trades.

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 58% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $522,402 and 12, calls, for a total amount of $522,578.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $25.0 to $60.0 for Sea during the past quarter.

Analyzing Volume & Open Interest

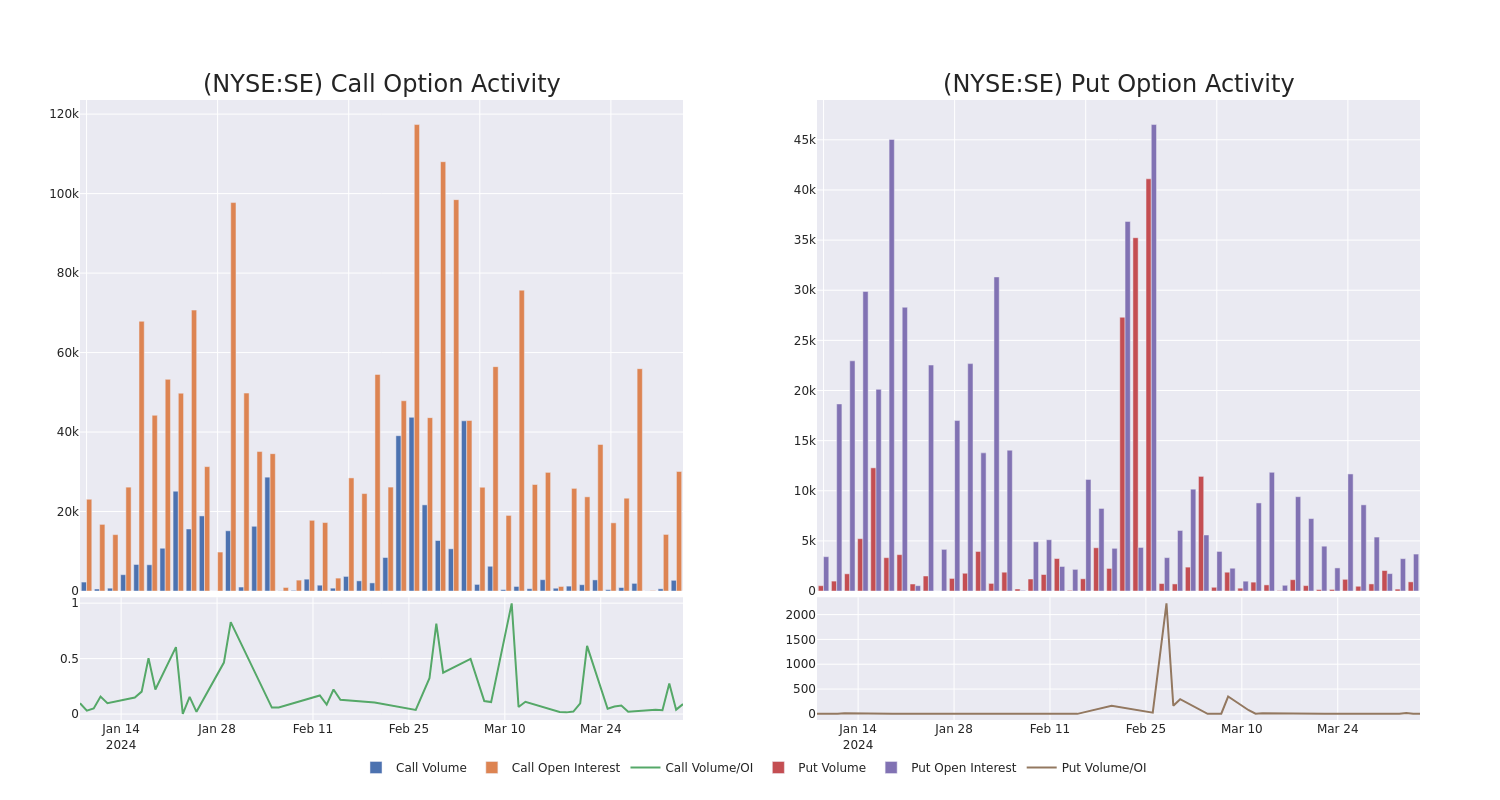

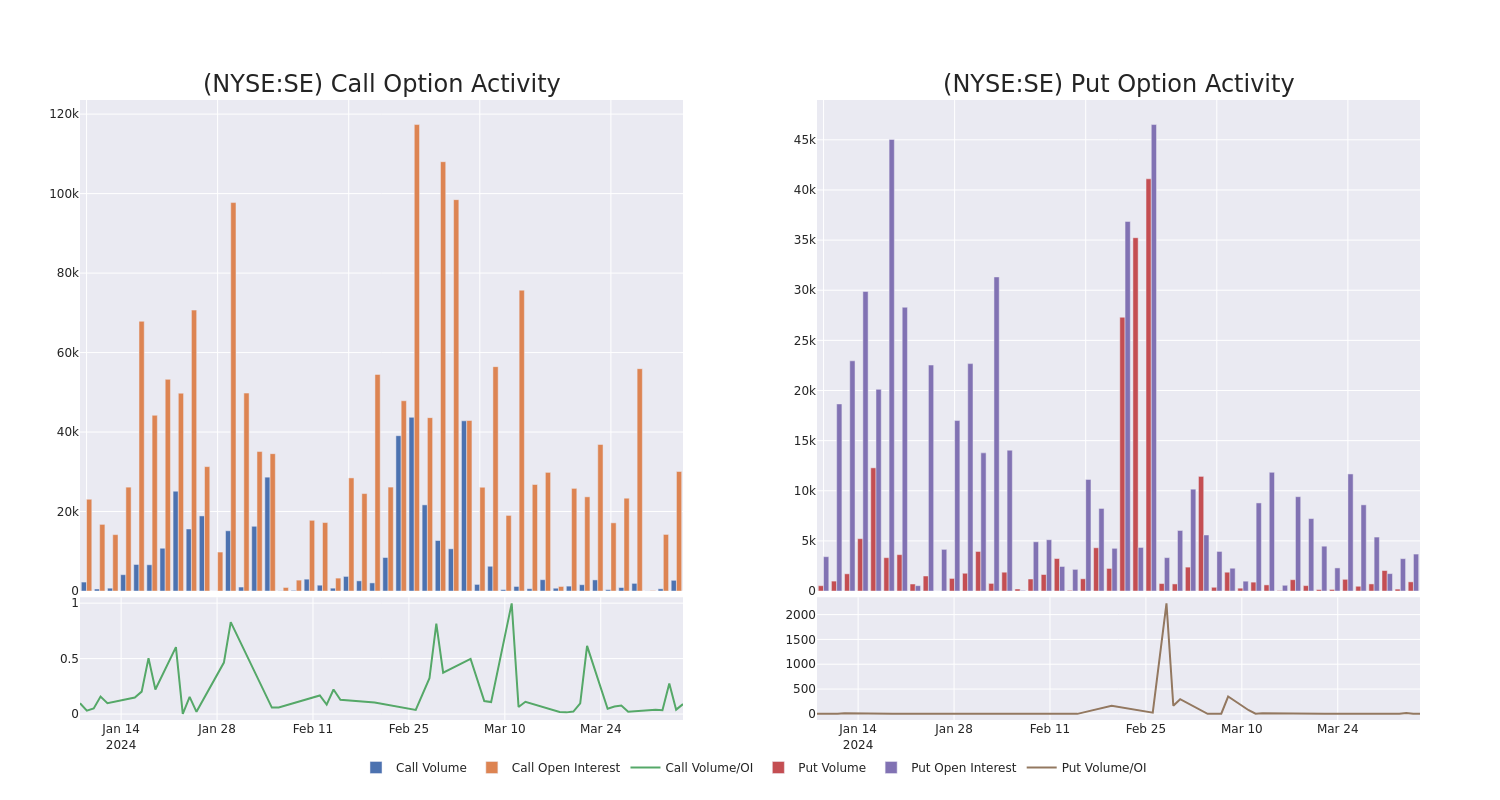

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Sea's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Sea's whale activity within a strike price range from $25.0 to $60.0 in the last 30 days.

Sea Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| SE |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$5.45 |

$5.35 |

$5.35 |

$55.00 |

$159.4K |

1.8K |

301 |

| SE |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$5.35 |

$5.25 |

$5.35 |

$55.00 |

$156.7K |

1.8K |

294 |

| SE |

PUT |

SWEEP |

BULLISH |

09/20/24 |

$8.3 |

$8.15 |

$8.15 |

$55.00 |

$142.6K |

1.6K |

175 |

| SE |

CALL |

SWEEP |

BEARISH |

08/16/24 |

$11.1 |

$11.0 |

$11.0 |

$50.00 |

$81.4K |

589 |

84 |

| SE |

CALL |

SWEEP |

BEARISH |

04/12/24 |

$1.4 |

$1.32 |

$1.34 |

$55.00 |

$68.7K |

844 |

1.1K |

About Sea

Sea operates Southeast Asia's largest e-commerce company, Shopee, in terms of gross merchandise value and number of transactions. Sea started as a gaming business, Garena, but in 2015 expanded into e-commerce, which is now the main growth driver. Shopee is a hybrid C2C and B2C marketplace platform operating in eight core markets. Indonesia accounts for 35% of GMV, with the rest split mainly among Taiwan, Vietnam, Thailand, Malaysia, and the Philippines. For Garena, Free Fire was the most downloaded game in January 2022 and accounted for 74% of gaming revenue in 2021. Sea's third business, SeaMoney, provides mostly credit lending.

Following our analysis of the options activities associated with Sea, we pivot to a closer look at the company's own performance.

Current Position of Sea

- With a trading volume of 5,572,195, the price of SE is up by 3.44%, reaching $55.27.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 39 days from now.

What The Experts Say On Sea

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $70.0.

- Maintaining their stance, an analyst from Bernstein continues to hold a Outperform rating for Sea, targeting a price of $70.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Sea, Benzinga Pro gives you real-time options trades alerts.

Posted In: SE