Market Whales and Their Recent Bets on ISRG Options

Author: Benzinga Insights | April 05, 2024 02:45pm

Financial giants have made a conspicuous bearish move on Intuitive Surgical. Our analysis of options history for Intuitive Surgical (NASDAQ:ISRG) revealed 28 unusual trades.

Delving into the details, we found 42% of traders were bullish, while 57% showed bearish tendencies. Out of all the trades we spotted, 17 were puts, with a value of $886,098, and 11 were calls, valued at $714,180.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $330.0 to $480.0 for Intuitive Surgical over the recent three months.

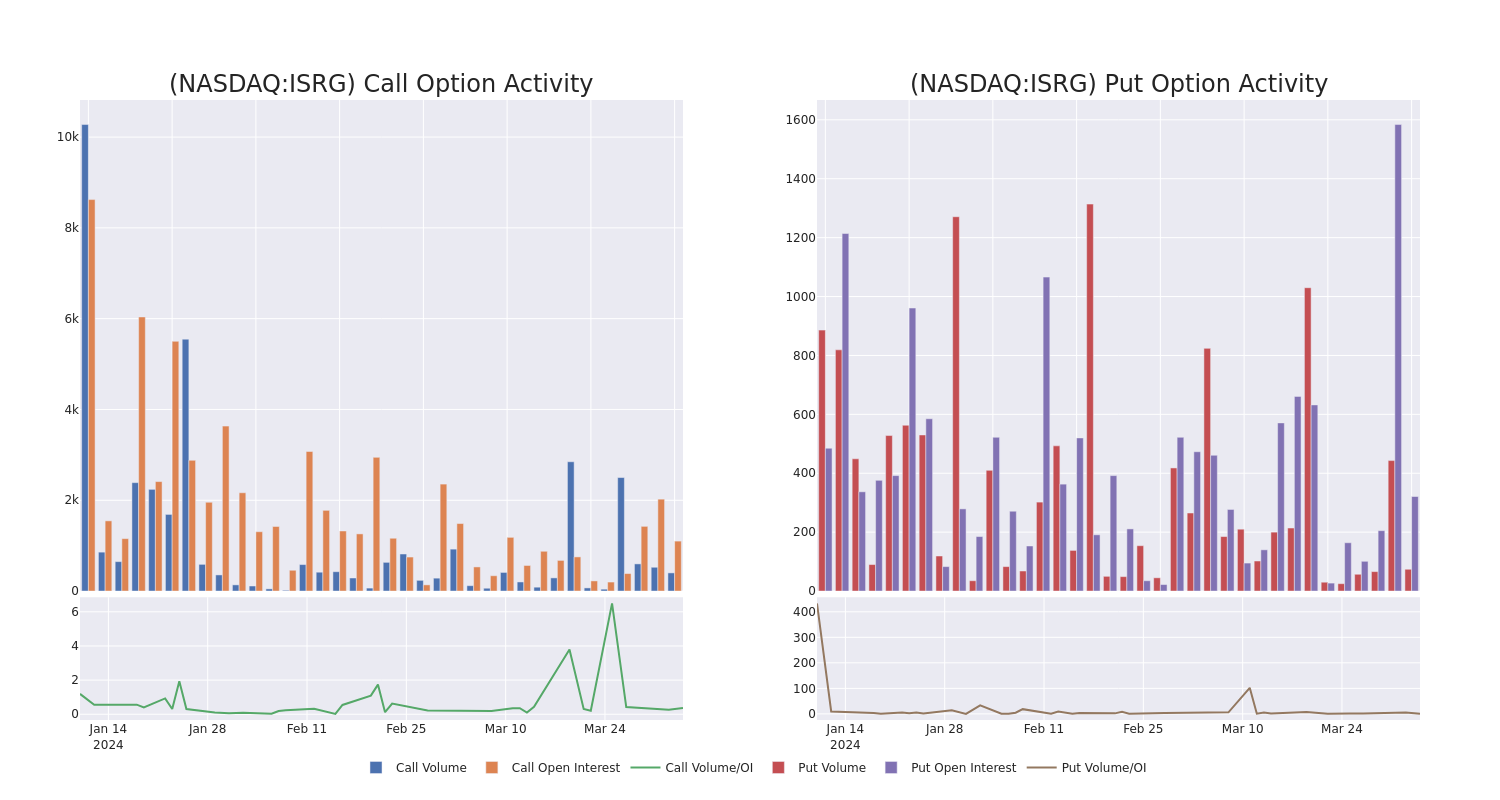

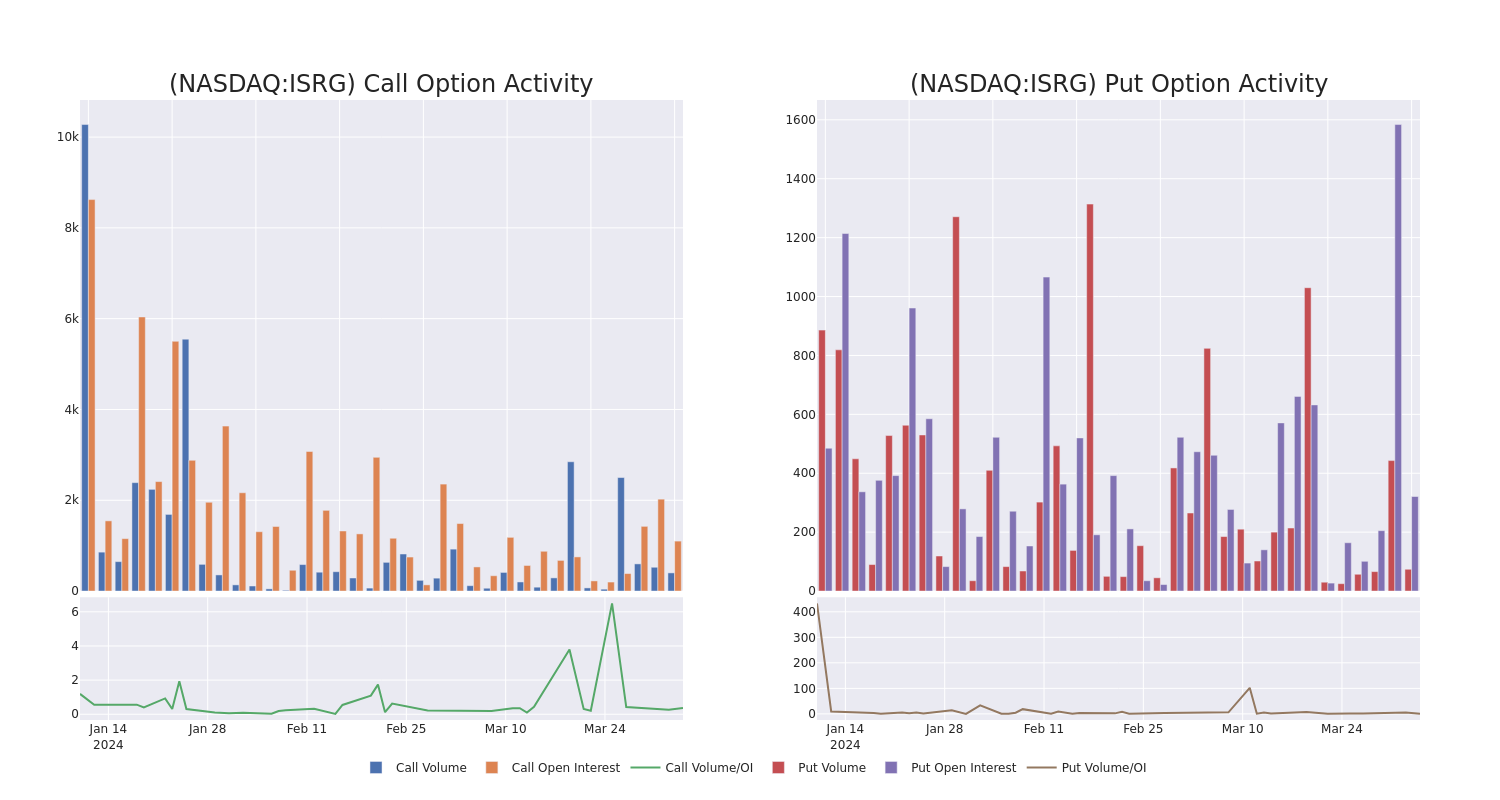

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Intuitive Surgical's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Intuitive Surgical's whale trades within a strike price range from $330.0 to $480.0 in the last 30 days.

Intuitive Surgical 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| ISRG |

CALL |

TRADE |

BEARISH |

06/21/24 |

$28.8 |

$28.6 |

$28.6 |

$385.00 |

$214.5K |

86 |

0 |

| ISRG |

CALL |

SWEEP |

BEARISH |

01/17/25 |

$54.0 |

$53.5 |

$53.5 |

$390.00 |

$197.9K |

407 |

0 |

| ISRG |

PUT |

SWEEP |

BULLISH |

10/18/24 |

$20.3 |

$18.7 |

$18.7 |

$360.00 |

$134.6K |

35 |

73 |

| ISRG |

PUT |

TRADE |

BEARISH |

04/19/24 |

$11.2 |

$11.2 |

$11.2 |

$385.00 |

$82.8K |

408 |

804 |

| ISRG |

PUT |

TRADE |

BEARISH |

04/19/24 |

$11.1 |

$10.9 |

$11.1 |

$385.00 |

$81.0K |

408 |

627 |

About Intuitive Surgical

Intuitive Surgical develops, produces, and markets a robotic system for assisting minimally invasive surgery. It also provides the instrumentation, disposable accessories, and warranty services for the system. The company has placed more than 8,600 da Vinci systems in hospitals worldwide, with more than 5,000 installations in the US and a growing number in emerging markets.

Intuitive Surgical's Current Market Status

- With a trading volume of 815,763, the price of ISRG is up by 0.52%, reaching $380.88.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 13 days from now.

Professional Analyst Ratings for Intuitive Surgical

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $441.0.

- In a cautious move, an analyst from Stifel downgraded its rating to Buy, setting a price target of $420.

- An analyst from Citigroup persists with their Buy rating on Intuitive Surgical, maintaining a target price of $462.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Intuitive Surgical, Benzinga Pro gives you real-time options trades alerts.

Posted In: ISRG