Where Marathon Petroleum Stands With Analysts

Author: Benzinga Insights | April 05, 2024 09:01am

Across the recent three months, 10 analysts have shared their insights on Marathon Petroleum (NYSE:MPC), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

4 |

4 |

0 |

0 |

| Last 30D |

0 |

1 |

1 |

0 |

0 |

| 1M Ago |

1 |

2 |

3 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

1 |

0 |

0 |

0 |

0 |

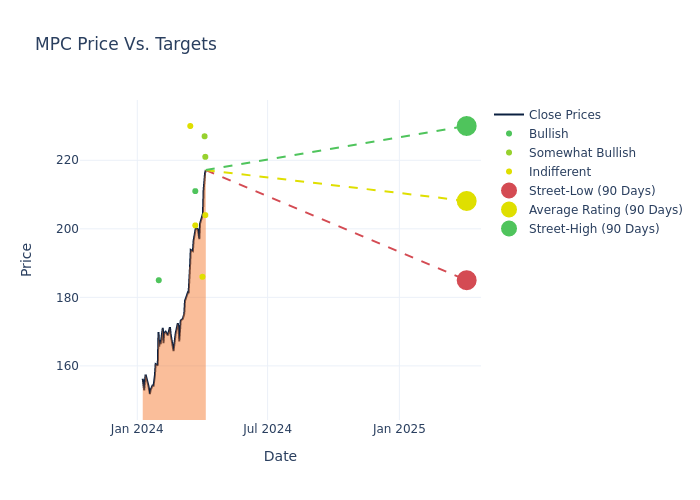

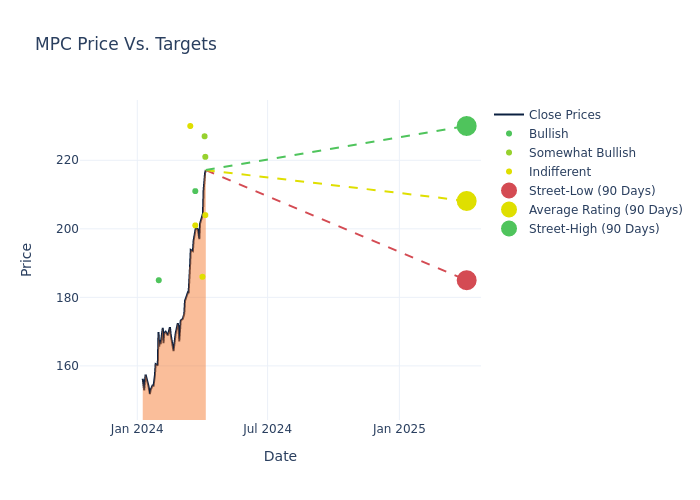

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $204.7, along with a high estimate of $230.00 and a low estimate of $168.00. This upward trend is apparent, with the current average reflecting a 16.77% increase from the previous average price target of $175.30.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of Marathon Petroleum's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Theresa Chen |

Barclays |

Raises |

Overweight |

$221.00 |

$168.00 |

| Ryan Todd |

Piper Sandler |

Raises |

Neutral |

$204.00 |

$159.00 |

| Roger Read |

Wells Fargo |

Raises |

Overweight |

$227.00 |

$214.00 |

| John Royall |

JP Morgan |

Raises |

Neutral |

$186.00 |

$172.00 |

| Neil Mehta |

Goldman Sachs |

Raises |

Buy |

$211.00 |

$175.00 |

| Nitin Kumar |

Mizuho |

Raises |

Neutral |

$201.00 |

$159.00 |

| Roger Read |

Wells Fargo |

Raises |

Overweight |

$214.00 |

$183.00 |

| Doug Leggate |

B of A Securities |

Raises |

Neutral |

$230.00 |

$185.00 |

| Theresa Chen |

Barclays |

Raises |

Overweight |

$168.00 |

$163.00 |

| Justin Jenkins |

Raymond James |

Raises |

Strong Buy |

$185.00 |

$175.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Marathon Petroleum. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Marathon Petroleum compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Marathon Petroleum's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Marathon Petroleum's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Marathon Petroleum analyst ratings.

About Marathon Petroleum

Marathon Petroleum is an independent refiner with 13 refineries in the midcontinent, West Coast, and Gulf Coast of the United States with total throughput capacity of 3.0 million barrels per day. Its Dickinson, North Dakota, facility produces 184 million gallons a year of renewable diesel. Its Martinez, California, facility will have the ability to produce 730 million gallons a year of renewable diesel once converted. The firm also owns and operates midstream assets primarily through its listed master limited partnership, MPLX.

Breaking Down Marathon Petroleum's Financial Performance

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Decline in Revenue: Over the 3 months period, Marathon Petroleum faced challenges, resulting in a decline of approximately -8.94% in revenue growth as of 31 December, 2023. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Energy sector.

Net Margin: Marathon Petroleum's net margin excels beyond industry benchmarks, reaching 4.0%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Marathon Petroleum's ROE stands out, surpassing industry averages. With an impressive ROE of 5.77%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Marathon Petroleum's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.65% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Marathon Petroleum's debt-to-equity ratio is below the industry average. With a ratio of 1.17, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: MPC