A Closer Look at Progressive's Options Market Dynamics

Author: Benzinga Insights | April 04, 2024 04:45pm

Deep-pocketed investors have adopted a bullish approach towards Progressive (NYSE:PGR), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PGR usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for Progressive. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 54% leaning bullish and 45% bearish. Among these notable options, 2 are puts, totaling $123,040, and 9 are calls, amounting to $2,152,975.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $195.0 to $310.0 for Progressive over the last 3 months.

Insights into Volume & Open Interest

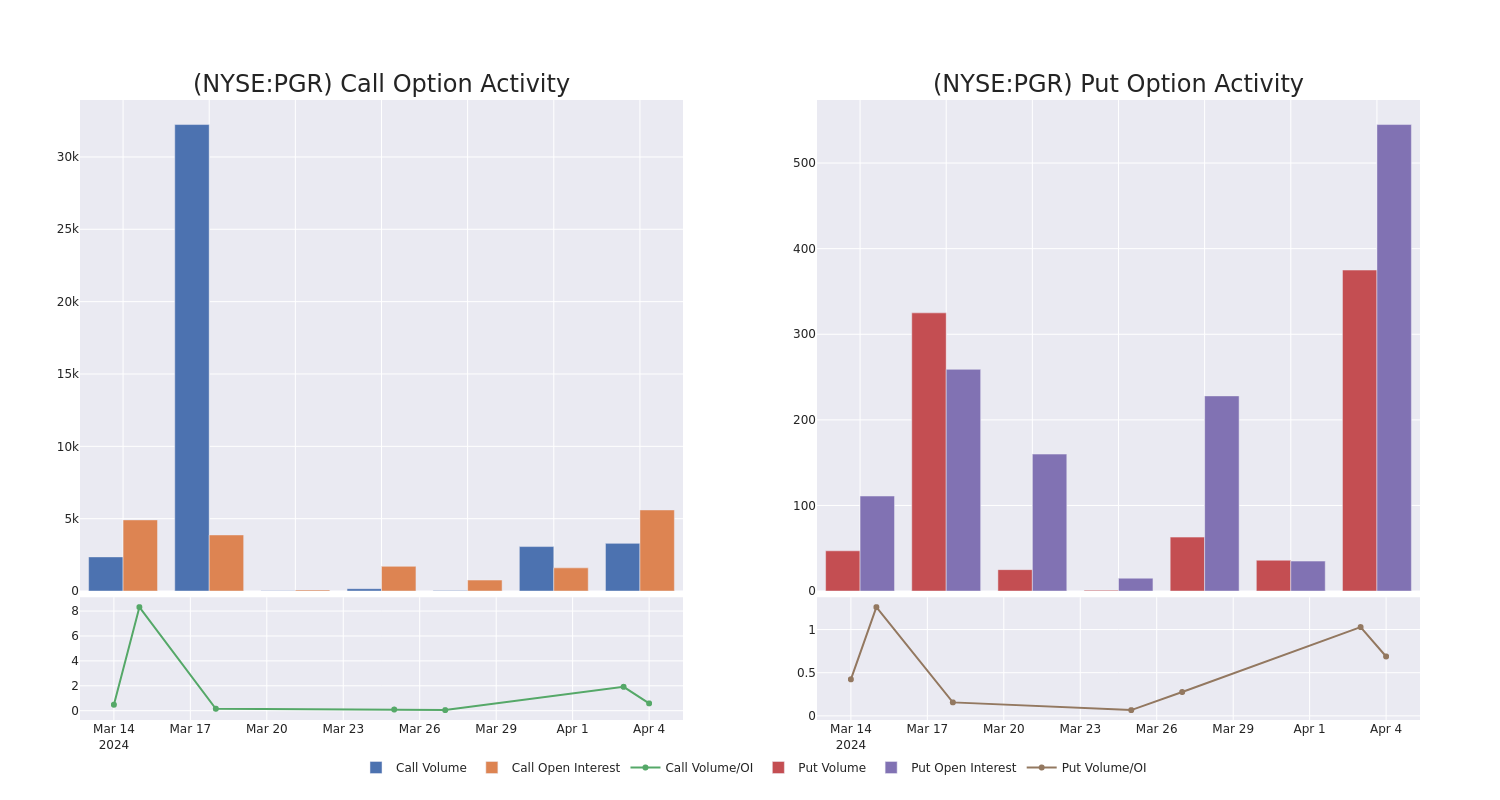

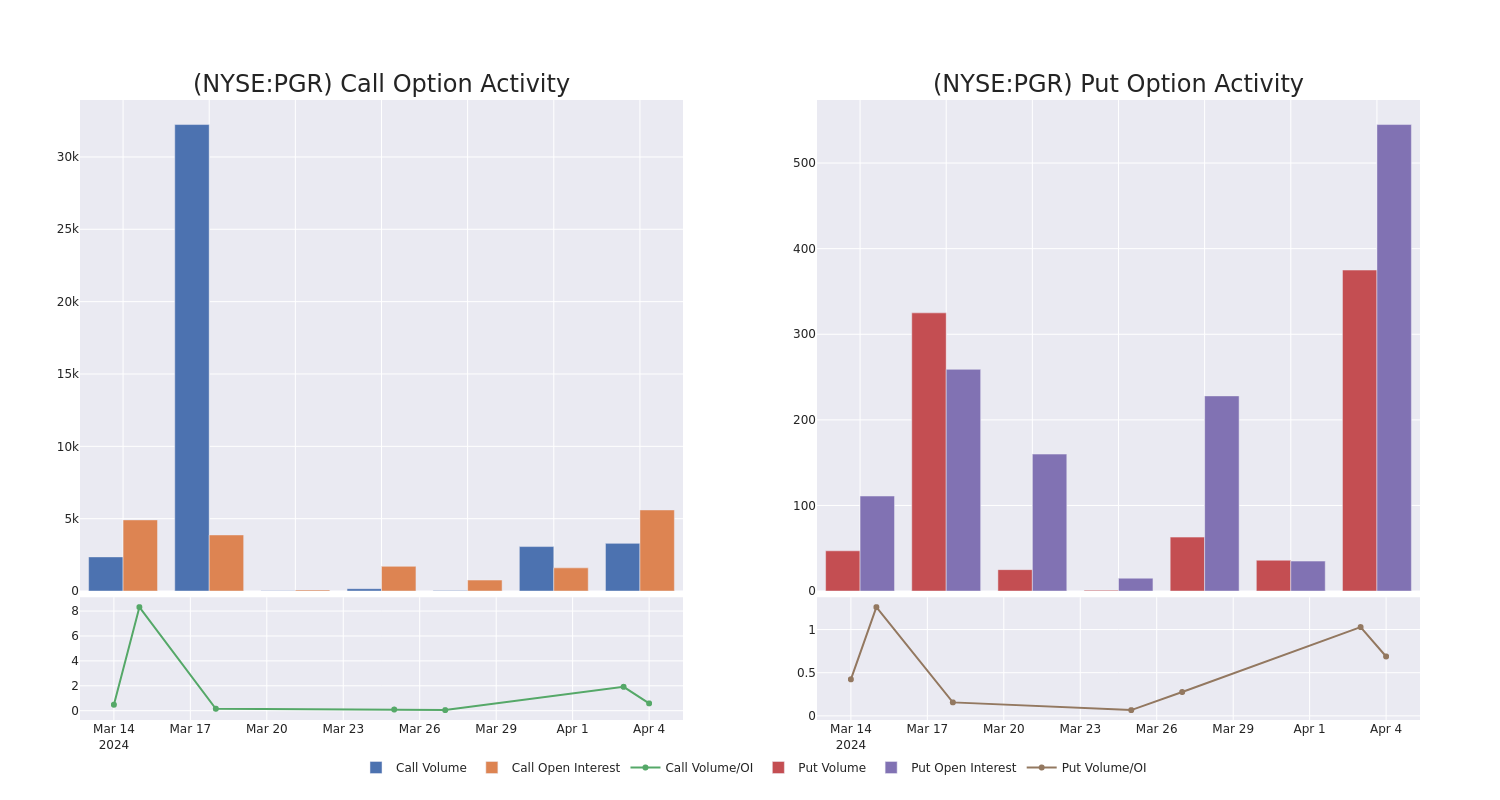

In today's trading context, the average open interest for options of Progressive stands at 1024.83, with a total volume reaching 3,670.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Progressive, situated within the strike price corridor from $195.0 to $310.0, throughout the last 30 days.

Progressive Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| PGR |

CALL |

SWEEP |

BULLISH |

08/16/24 |

$9.5 |

$9.4 |

$9.5 |

$220.00 |

$947.1K |

1.9K |

1.0K |

| PGR |

CALL |

TRADE |

BEARISH |

01/17/25 |

$17.8 |

$17.2 |

$17.3 |

$220.00 |

$432.5K |

2.7K |

440 |

| PGR |

CALL |

SWEEP |

BULLISH |

01/17/25 |

$17.7 |

$17.2 |

$17.3 |

$220.00 |

$320.0K |

2.7K |

190 |

| PGR |

CALL |

SWEEP |

BULLISH |

08/16/24 |

$9.8 |

$9.4 |

$9.6 |

$220.00 |

$289.9K |

1.9K |

1.3K |

| PGR |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$6.7 |

$6.4 |

$6.5 |

$210.00 |

$66.9K |

545 |

140 |

About Progressive

Progressive underwrites private and commercial auto insurance and specialty lines; it has about 18 million personal auto policies in force and is one of the largest auto insurers in the United States. Progressive markets its policies through independent insurance agencies in the U.S. and Canada and directly via the internet and telephone. Its premiums are split roughly equally between the agent and the direct channel. The company also offers commercial auto policies and entered homeowners insurance through an acquisition in 2015.

In light of the recent options history for Progressive, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Progressive

- Currently trading with a volume of 2,503,601, the PGR's price is down by -0.73%, now at $209.24.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 11 days.

Professional Analyst Ratings for Progressive

5 market experts have recently issued ratings for this stock, with a consensus target price of $219.8.

- An analyst from Keefe, Bruyette & Woods persists with their Market Perform rating on Progressive, maintaining a target price of $190.

- Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Progressive with a target price of $202.

- Showing optimism, an analyst from Morgan Stanley upgrades its rating to Overweight with a revised price target of $227.

- An analyst from B of A Securities persists with their Buy rating on Progressive, maintaining a target price of $264.

- An analyst from Goldman Sachs persists with their Neutral rating on Progressive, maintaining a target price of $216.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Progressive, Benzinga Pro gives you real-time options trades alerts.

Posted In: PGR