ConocoPhillips's Options: A Look at What the Big Money is Thinking

Author: Benzinga Insights | April 04, 2024 10:32am

Investors with a lot of money to spend have taken a bearish stance on ConocoPhillips (NYSE:COP).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with COP, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 9 uncommon options trades for ConocoPhillips.

This isn't normal.

The overall sentiment of these big-money traders is split between 22% bullish and 77%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $350,258, and 4 are calls, for a total amount of $181,107.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $90.0 to $130.0 for ConocoPhillips during the past quarter.

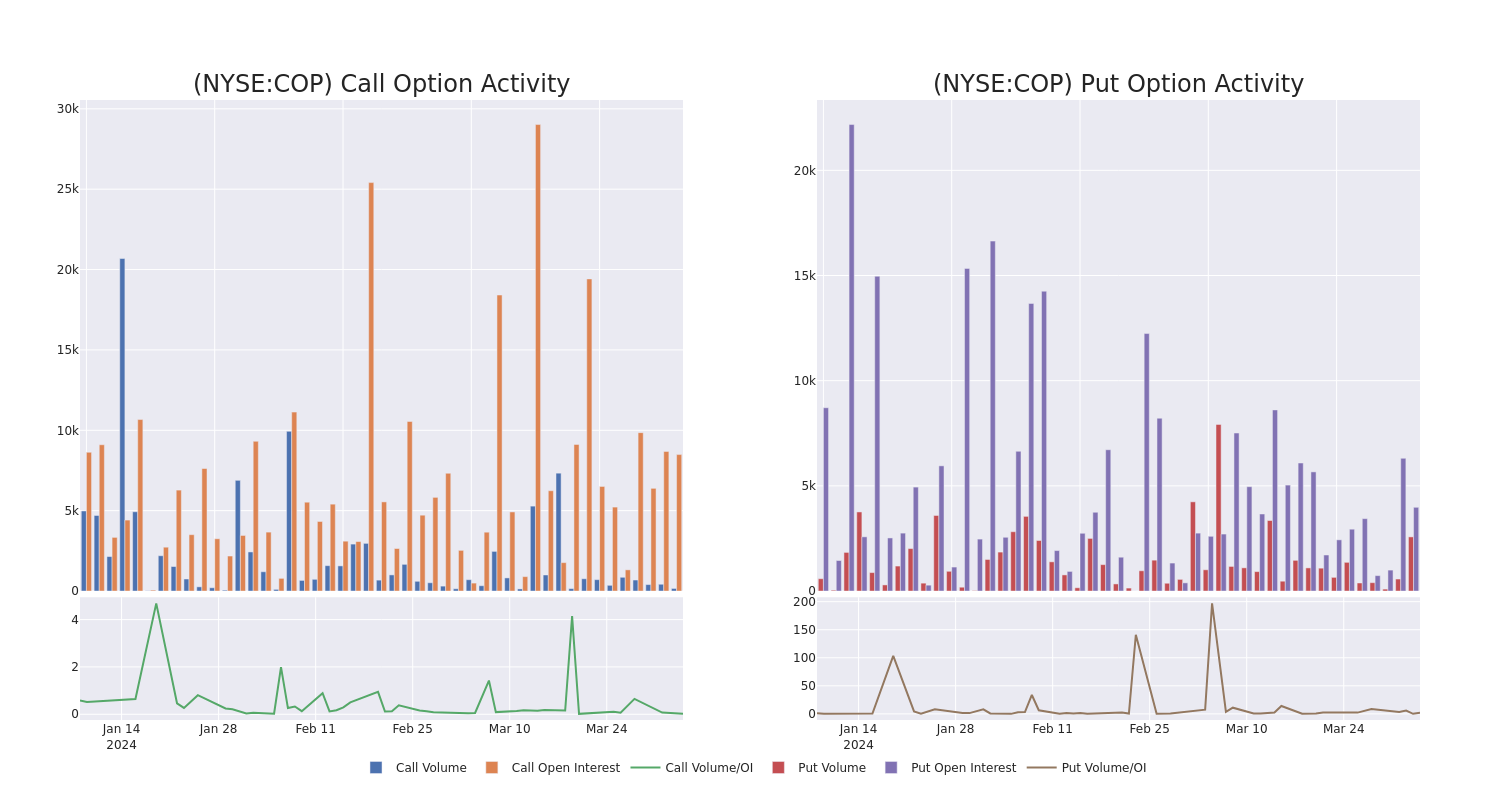

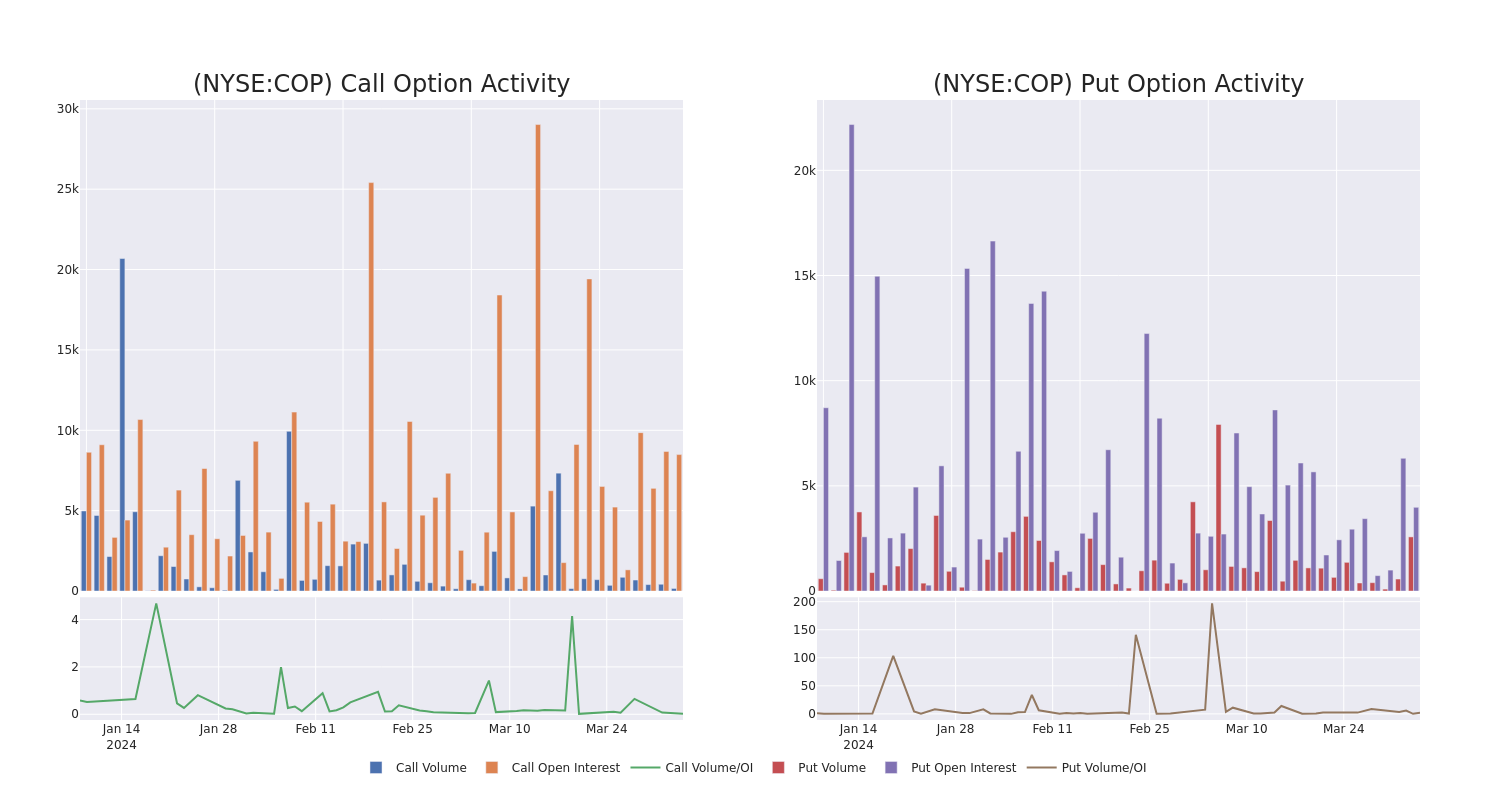

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for ConocoPhillips's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ConocoPhillips's whale trades within a strike price range from $90.0 to $130.0 in the last 30 days.

ConocoPhillips Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| COP |

PUT |

TRADE |

BEARISH |

01/17/25 |

$1.15 |

$1.08 |

$1.18 |

$90.00 |

$94.4K |

2.7K |

801 |

| COP |

PUT |

SWEEP |

BEARISH |

07/19/24 |

$5.15 |

$5.1 |

$5.15 |

$130.00 |

$93.7K |

199 |

170 |

| COP |

CALL |

SWEEP |

BEARISH |

06/21/24 |

$7.4 |

$6.7 |

$6.7 |

$130.00 |

$75.7K |

2.9K |

95 |

| COP |

PUT |

SWEEP |

BEARISH |

06/21/24 |

$4.6 |

$4.5 |

$4.55 |

$130.00 |

$62.3K |

1.0K |

333 |

| COP |

PUT |

SWEEP |

BEARISH |

06/21/24 |

$4.55 |

$4.5 |

$4.55 |

$130.00 |

$61.4K |

1.0K |

144 |

About ConocoPhillips

ConocoPhillips is a U.S.-based independent exploration and production firm. In 2022, it produced 1.2 million barrels per day of oil and natural gas liquids and 3.1 billion cubic feet per day of natural gas, primarily from Alaska and the Lower 48 in the United States and Norway in Europe and several countries in Asia-Pacific and the Middle East. Proven reserves at year-end 2022 were 6.6 billion barrels of oil equivalent.

Where Is ConocoPhillips Standing Right Now?

- With a volume of 411,074, the price of COP is up 0.37% at $132.12.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 28 days.

What The Experts Say On ConocoPhillips

3 market experts have recently issued ratings for this stock, with a consensus target price of $133.66666666666666.

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on ConocoPhillips, which currently sits at a price target of $129.

- An analyst from Mizuho has revised its rating downward to Neutral, adjusting the price target to $139.

- An analyst from Piper Sandler persists with their Overweight rating on ConocoPhillips, maintaining a target price of $133.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for ConocoPhillips, Benzinga Pro gives you real-time options trades alerts.

Posted In: COP