Looking At Target's Recent Unusual Options Activity

Author: Benzinga Insights | April 03, 2024 03:15pm

Whales with a lot of money to spend have taken a noticeably bearish stance on Target.

Looking at options history for Target (NYSE:TGT) we detected 19 trades.

If we consider the specifics of each trade, it is accurate to state that 15% of the investors opened trades with bullish expectations and 84% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $241,123 and 11, calls, for a total amount of $1,190,706.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $55.0 to $260.0 for Target over the recent three months.

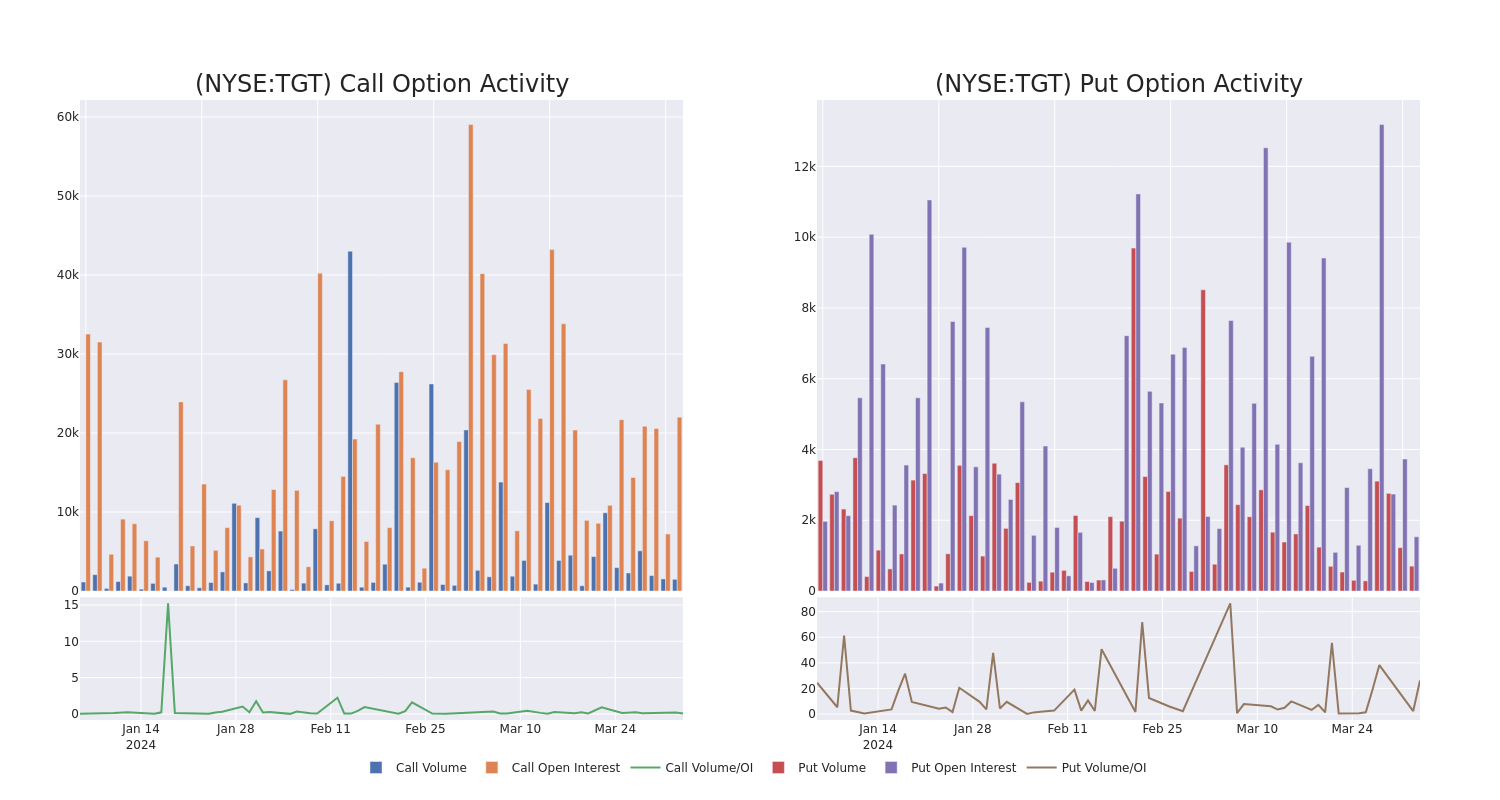

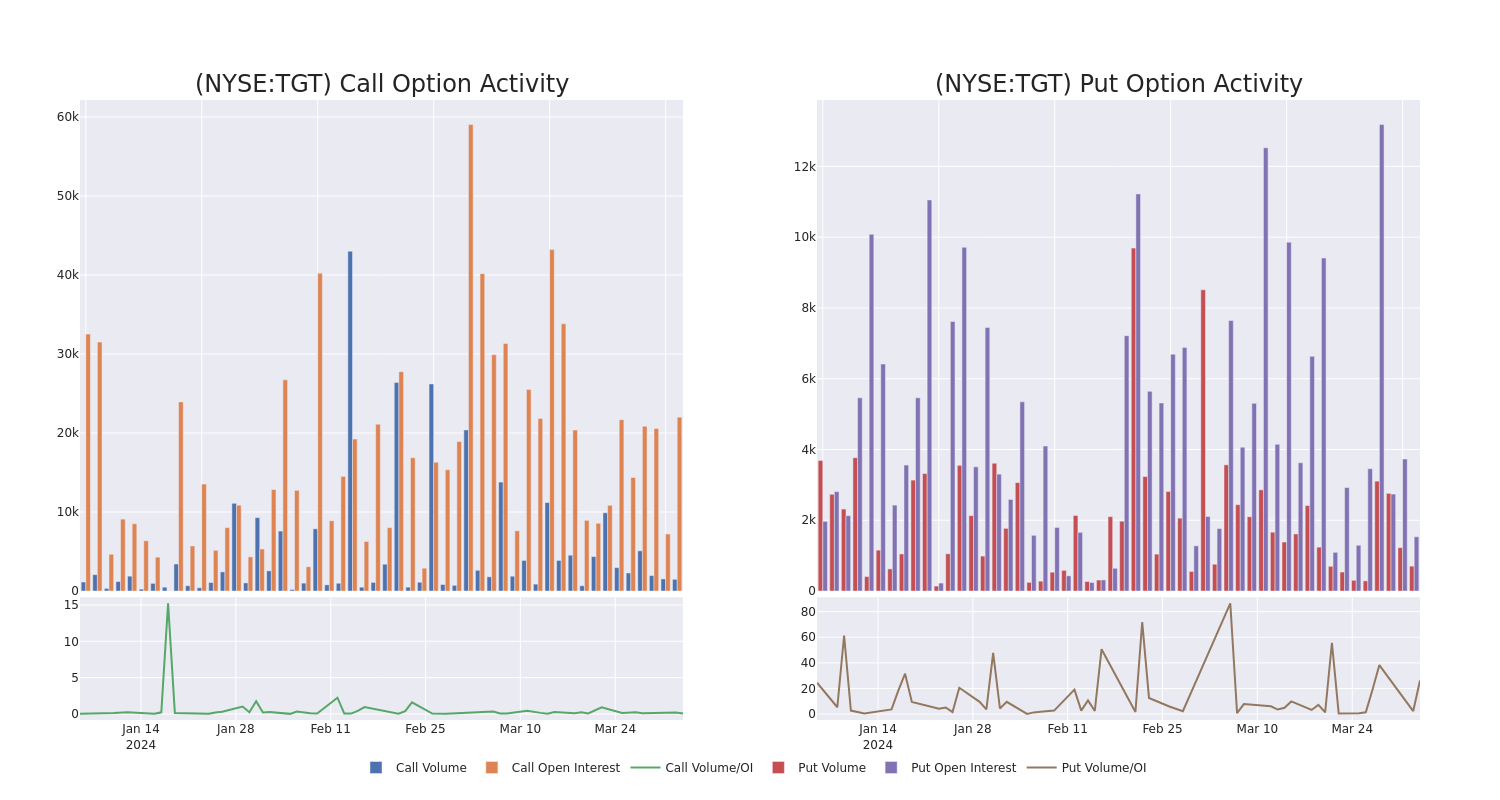

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Target's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Target's whale trades within a strike price range from $55.0 to $260.0 in the last 30 days.

Target 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| TGT |

CALL |

TRADE |

BEARISH |

04/19/24 |

$22.4 |

$22.25 |

$22.25 |

$155.00 |

$703.1K |

3.4K |

316 |

| TGT |

CALL |

TRADE |

NEUTRAL |

01/16/26 |

$123.5 |

$118.5 |

$120.75 |

$55.00 |

$120.7K |

8 |

0 |

| TGT |

CALL |

SWEEP |

BEARISH |

01/17/25 |

$9.95 |

$9.9 |

$9.9 |

$200.00 |

$61.3K |

1.0K |

121 |

| TGT |

CALL |

TRADE |

NEUTRAL |

04/19/24 |

$27.05 |

$25.65 |

$26.45 |

$150.00 |

$52.9K |

3.7K |

20 |

| TGT |

CALL |

TRADE |

NEUTRAL |

01/17/25 |

$9.95 |

$9.85 |

$9.9 |

$200.00 |

$49.5K |

1.0K |

265 |

About Target

Target serves as the nation's sixth-largest retailer, with its strategy predicated on delivering a gratifying in-store shopping experience and a wide product assortment of trendy apparel, home goods, and household essentials at competitive prices. Target's upscale and stylish image began to carry national merit in the 1990s—a decade in which the brand saw its top line grow threefold to almost $30 billion—and has since cemented itself as a top US retailer.Today, Target operates over 1,950 stores in the United States, generates over $100 billion in sales, and fulfills over 2 billion customer orders annually. The firm's vast physical footprint is typically concentrated in urban and suburban markets as the firm seeks to attract a more affluent consumer base.

In light of the recent options history for Target, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Target Standing Right Now?

- Currently trading with a volume of 1,729,912, the TGT's price is down by -0.17%, now at $175.94.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 42 days.

Expert Opinions on Target

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $180.8.

- An analyst from UBS persists with their Buy rating on Target, maintaining a target price of $174.

- Maintaining their stance, an analyst from Jefferies continues to hold a Buy rating for Target, targeting a price of $195.

- An analyst from Deutsche Bank upgraded its action to Buy with a price target of $206.

- An analyst from Barclays persists with their Equal-Weight rating on Target, maintaining a target price of $169.

- In a cautious move, an analyst from Telsey Advisory Group downgraded its rating to Outperform, setting a price target of $160.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Target with Benzinga Pro for real-time alerts.

Posted In: TGT