Looking At ON Semiconductor's Recent Unusual Options Activity

Author: Benzinga Insights | April 03, 2024 12:31pm

Financial giants have made a conspicuous bullish move on ON Semiconductor. Our analysis of options history for ON Semiconductor (NASDAQ:ON) revealed 9 unusual trades.

Delving into the details, we found 66% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $110,100, and 6 were calls, valued at $359,035.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $70.0 for ON Semiconductor, spanning the last three months.

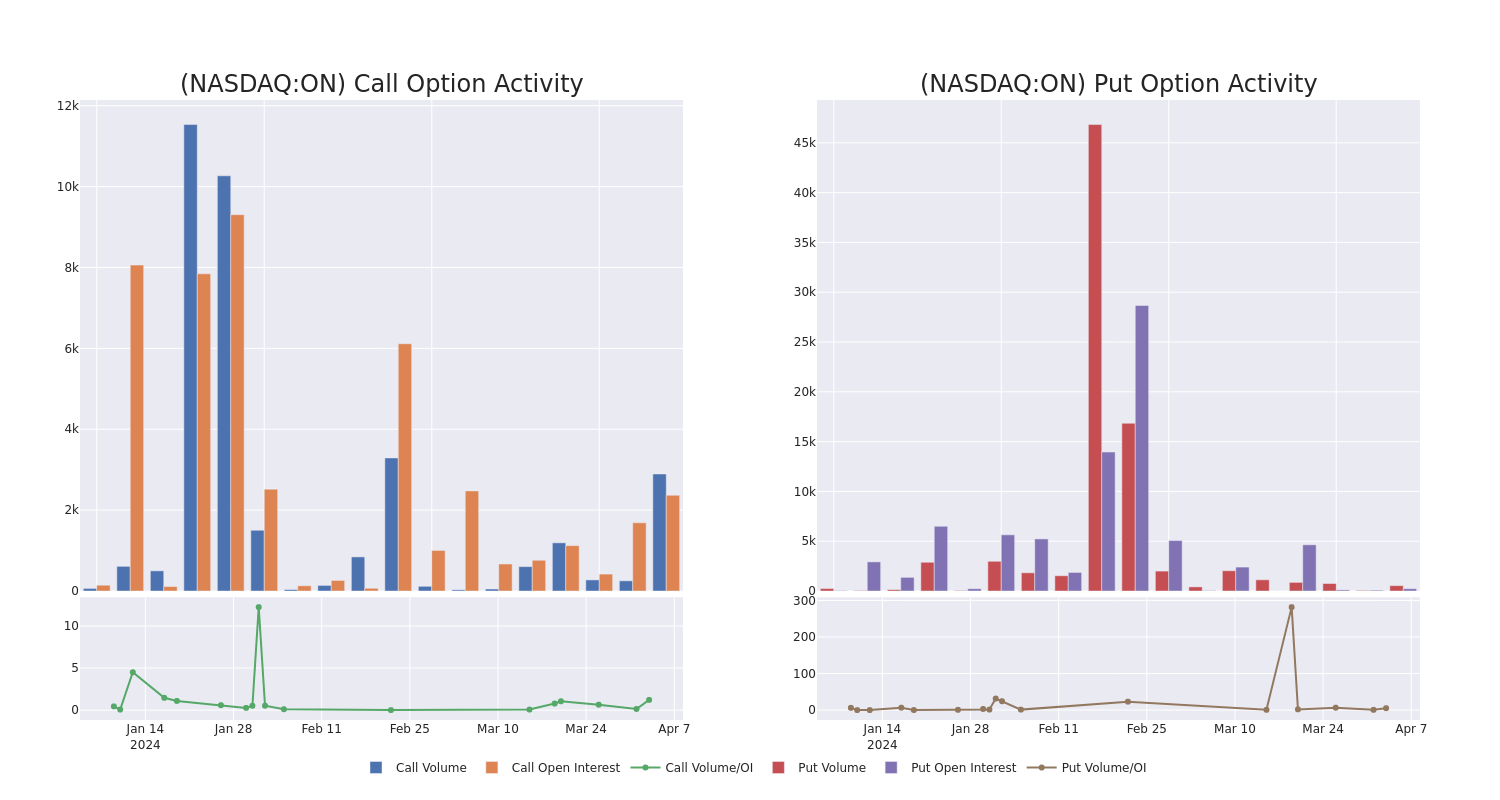

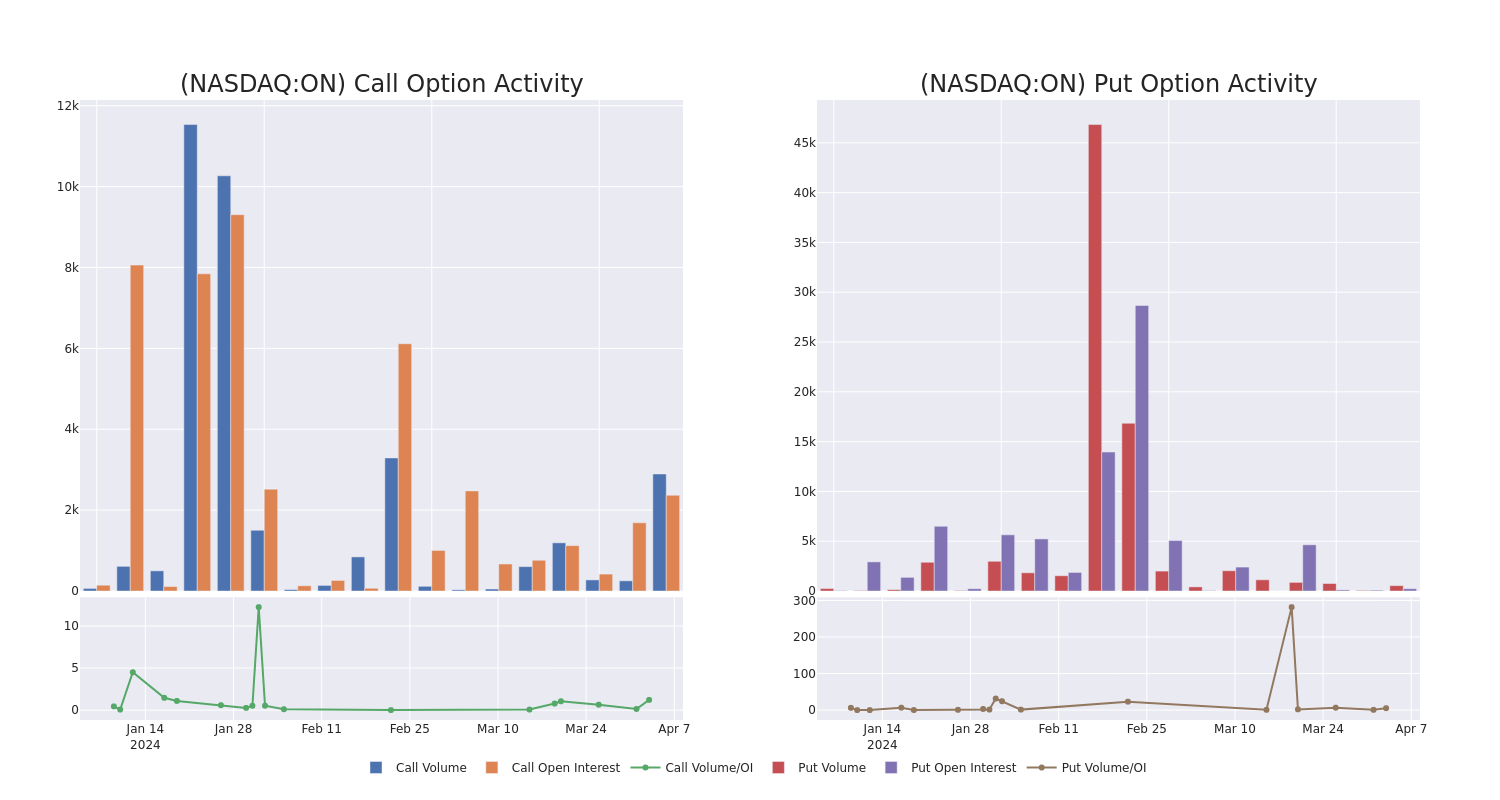

Volume & Open Interest Trends

In today's trading context, the average open interest for options of ON Semiconductor stands at 650.5, with a total volume reaching 3,435.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ON Semiconductor, situated within the strike price corridor from $50.0 to $70.0, throughout the last 30 days.

ON Semiconductor Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| ON |

CALL |

SWEEP |

BULLISH |

04/19/24 |

$3.55 |

$3.5 |

$3.5 |

$70.00 |

$88.9K |

2.3K |

776 |

| ON |

CALL |

SWEEP |

BULLISH |

04/19/24 |

$3.5 |

$3.4 |

$3.45 |

$70.00 |

$86.2K |

2.3K |

1.0K |

| ON |

CALL |

SWEEP |

BULLISH |

04/19/24 |

$2.89 |

$2.85 |

$2.85 |

$70.00 |

$69.5K |

2.3K |

244 |

| ON |

CALL |

SWEEP |

BEARISH |

04/12/24 |

$8.2 |

$6.8 |

$6.8 |

$64.00 |

$57.1K |

0 |

84 |

| ON |

PUT |

TRADE |

BULLISH |

09/20/24 |

$1.4 |

$1.2 |

$1.24 |

$50.00 |

$49.6K |

93 |

402 |

About ON Semiconductor

Onsemi is a supplier of power semiconductors and sensors focused on the automotive and industrial markets. Onsemi is the second-largest power chipmaker in the world and the largest supplier of image sensors to the automotive market. While the firm used to be highly vertically integrated, it now pursues a hybrid manufacturing strategy for flexible capacity. Onsemi is pivoting to focus on emerging applications like electric vehicles, autonomous vehicles, industrial automation, and renewable energy.

Current Position of ON Semiconductor

- Trading volume stands at 1,596,114, with ON's price down by -0.51%, positioned at $70.12.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 26 days.

Professional Analyst Ratings for ON Semiconductor

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $82.0.

- Reflecting concerns, an analyst from Stifel lowers its rating to Hold with a new price target of $82.

- Reflecting concerns, an analyst from Stifel lowers its rating to Hold with a new price target of $82.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for ON Semiconductor, Benzinga Pro gives you real-time options trades alerts.

Posted In: ON