Unpacking the Latest Options Trading Trends in Marathon Petroleum

Author: Benzinga Insights | April 01, 2024 04:00pm

High-rolling investors have positioned themselves bullish on Marathon Petroleum (NYSE:MPC), and it's important for retail traders to take note.

\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in MPC often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 9 options trades for Marathon Petroleum. This is not a typical pattern.

The sentiment among these major traders is split, with 55% bullish and 44% bearish. Among all the options we identified, there was one put, amounting to $50,104, and 8 calls, totaling $1,587,380.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $65.0 to $200.0 for Marathon Petroleum during the past quarter.

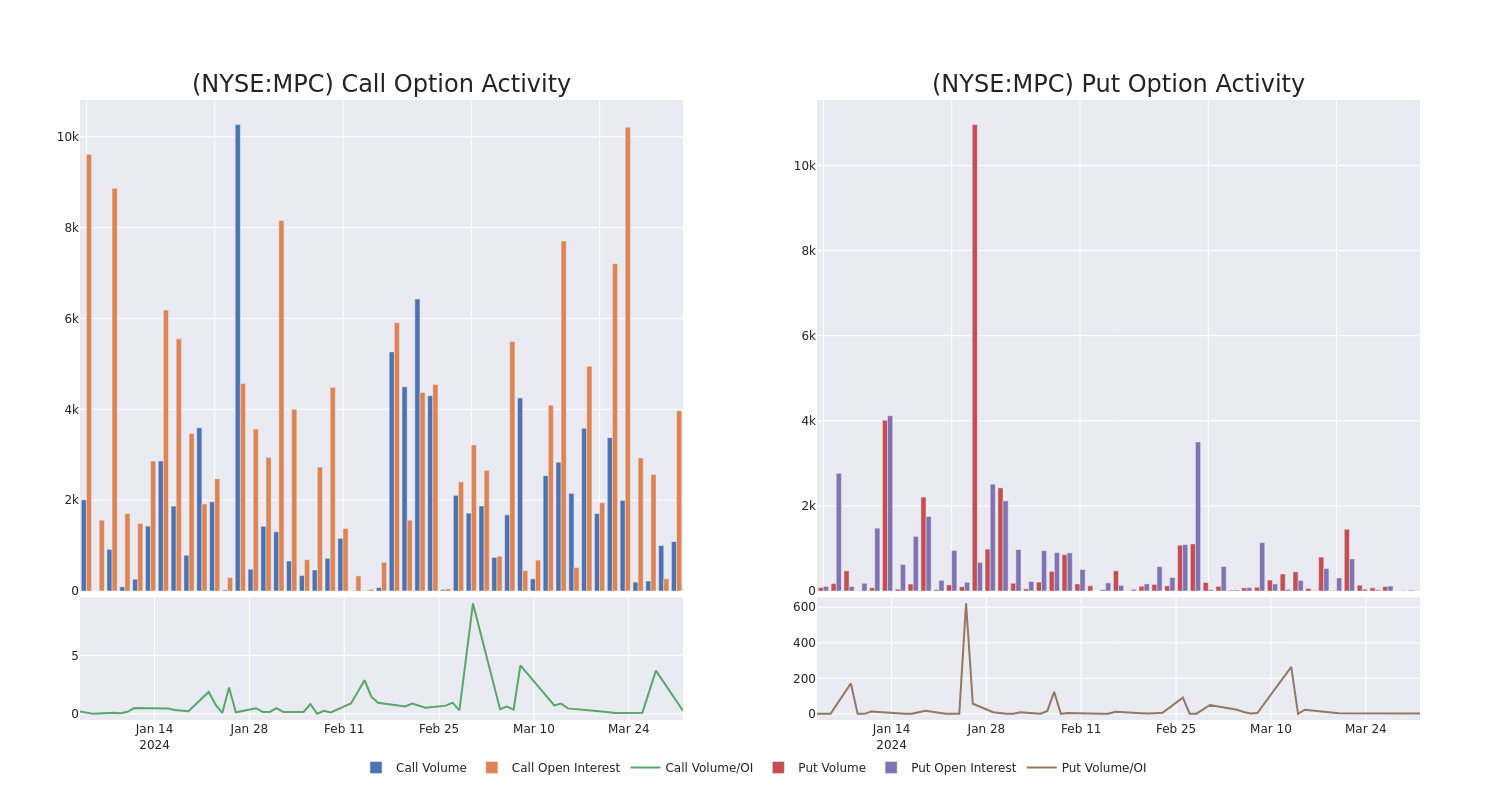

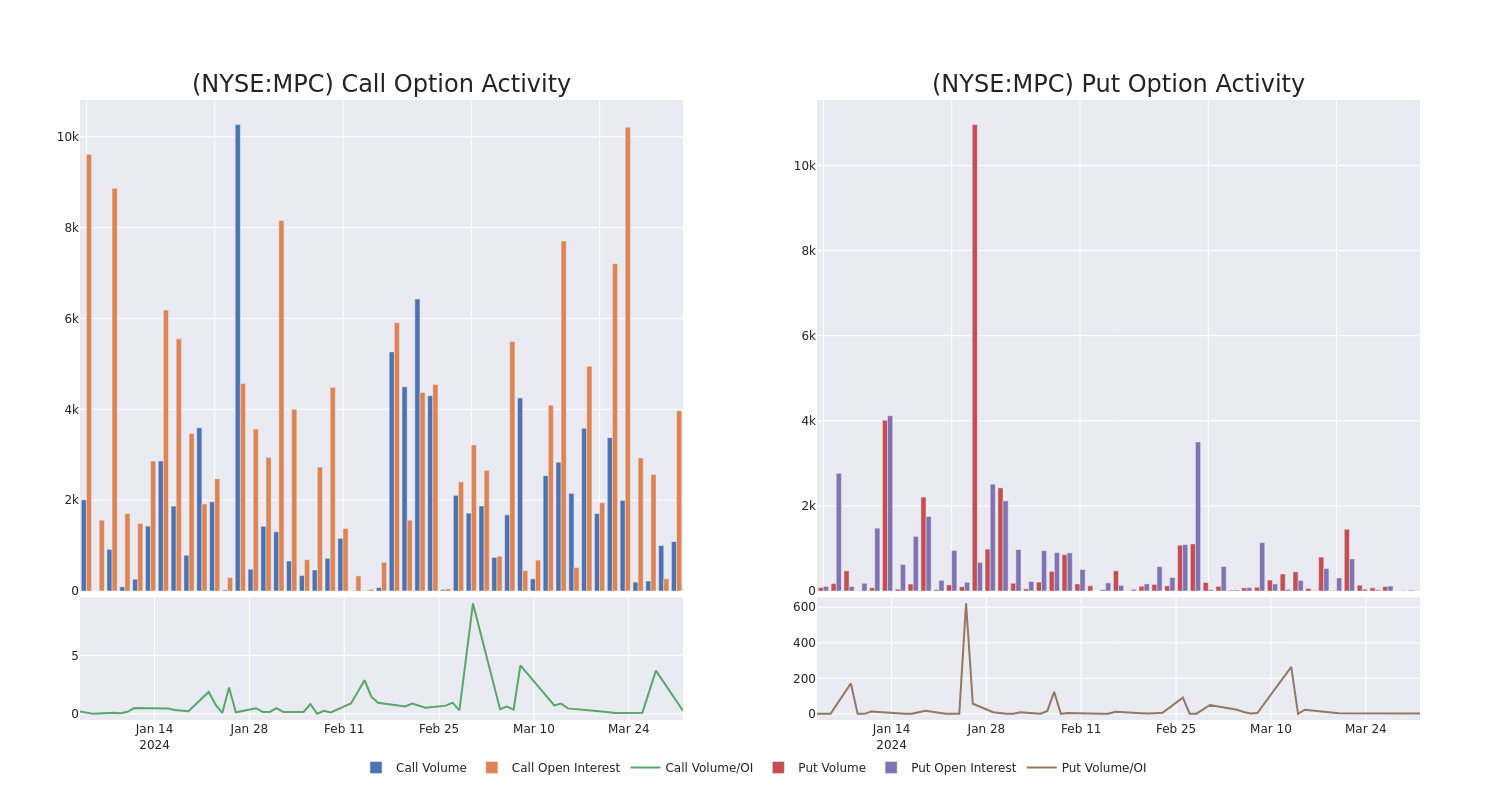

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Marathon Petroleum's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Marathon Petroleum's whale trades within a strike price range from $65.0 to $200.0 in the last 30 days.

Marathon Petroleum Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MPC |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$10.4 |

$10.35 |

$10.35 |

$200.00 |

$537.1K |

1.2K |

934 |

| MPC |

CALL |

TRADE |

BEARISH |

05/17/24 |

$10.45 |

$10.3 |

$10.3 |

$200.00 |

$412.0K |

1.2K |

15 |

| MPC |

CALL |

SWEEP |

BULLISH |

04/19/24 |

$27.8 |

$27.0 |

$27.8 |

$175.00 |

$225.1K |

1.0K |

1 |

| MPC |

CALL |

TRADE |

BULLISH |

01/16/26 |

$60.0 |

$59.5 |

$60.0 |

$165.00 |

$180.0K |

9 |

30 |

| MPC |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$10.4 |

$10.4 |

$10.4 |

$200.00 |

$72.8K |

1.2K |

934 |

About Marathon Petroleum

Marathon Petroleum is an independent refiner with 13 refineries in the midcontinent, West Coast, and Gulf Coast of the United States with total throughput capacity of 3.0 million barrels per day. Its Dickinson, North Dakota, facility produces 184 million gallons a year of renewable diesel. Its Martinez, California, facility will have the ability to produce 730 million gallons a year of renewable diesel once converted. The firm also owns and operates midstream assets primarily through its listed master limited partnership, MPLX.

Present Market Standing of Marathon Petroleum

- Currently trading with a volume of 1,602,654, the MPC's price is up by 0.19%, now at $201.89.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 29 days.

Expert Opinions on Marathon Petroleum

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $208.4.

- An analyst from B of A Securities persists with their Neutral rating on Marathon Petroleum, maintaining a target price of $230.

- An analyst from Goldman Sachs persists with their Buy rating on Marathon Petroleum, maintaining a target price of $211.

- An analyst from Mizuho has decided to maintain their Neutral rating on Marathon Petroleum, which currently sits at a price target of $201.

- An analyst from Wells Fargo persists with their Overweight rating on Marathon Petroleum, maintaining a target price of $214.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Neutral rating on Marathon Petroleum with a target price of $186.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Marathon Petroleum, Benzinga Pro gives you real-time options trades alerts.

Posted In: MPC