HubSpot's Options: A Look at What the Big Money is Thinking

Author: Benzinga Insights | March 28, 2024 03:30pm

Benzinga's options scanner just detected over 11 options trades for HubSpot (NYSE:HUBS) summing a total amount of $381,840.

At the same time, our algo caught 9 for a total amount of 411,420.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $550.0 to $720.0 for HubSpot over the recent three months.

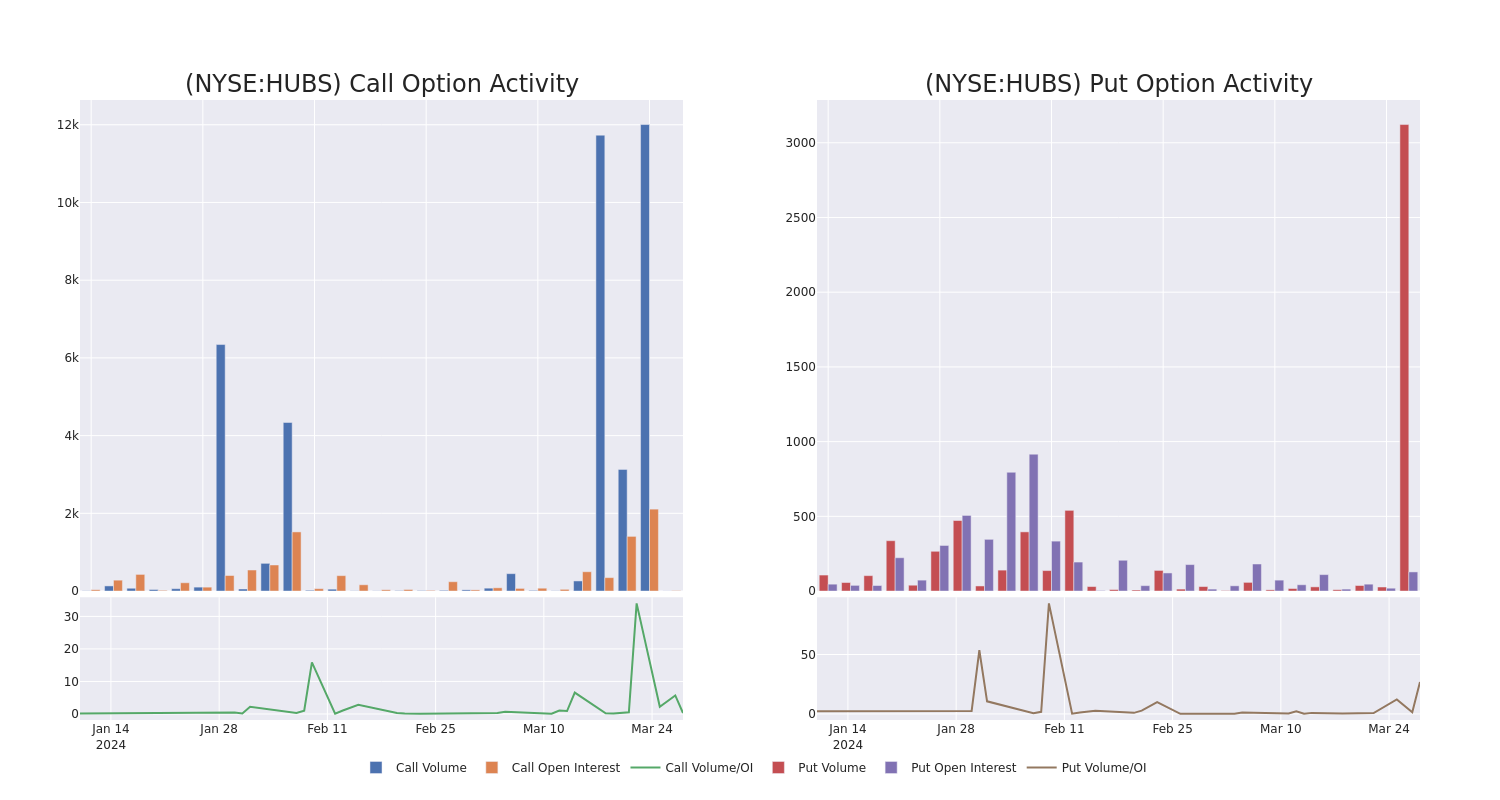

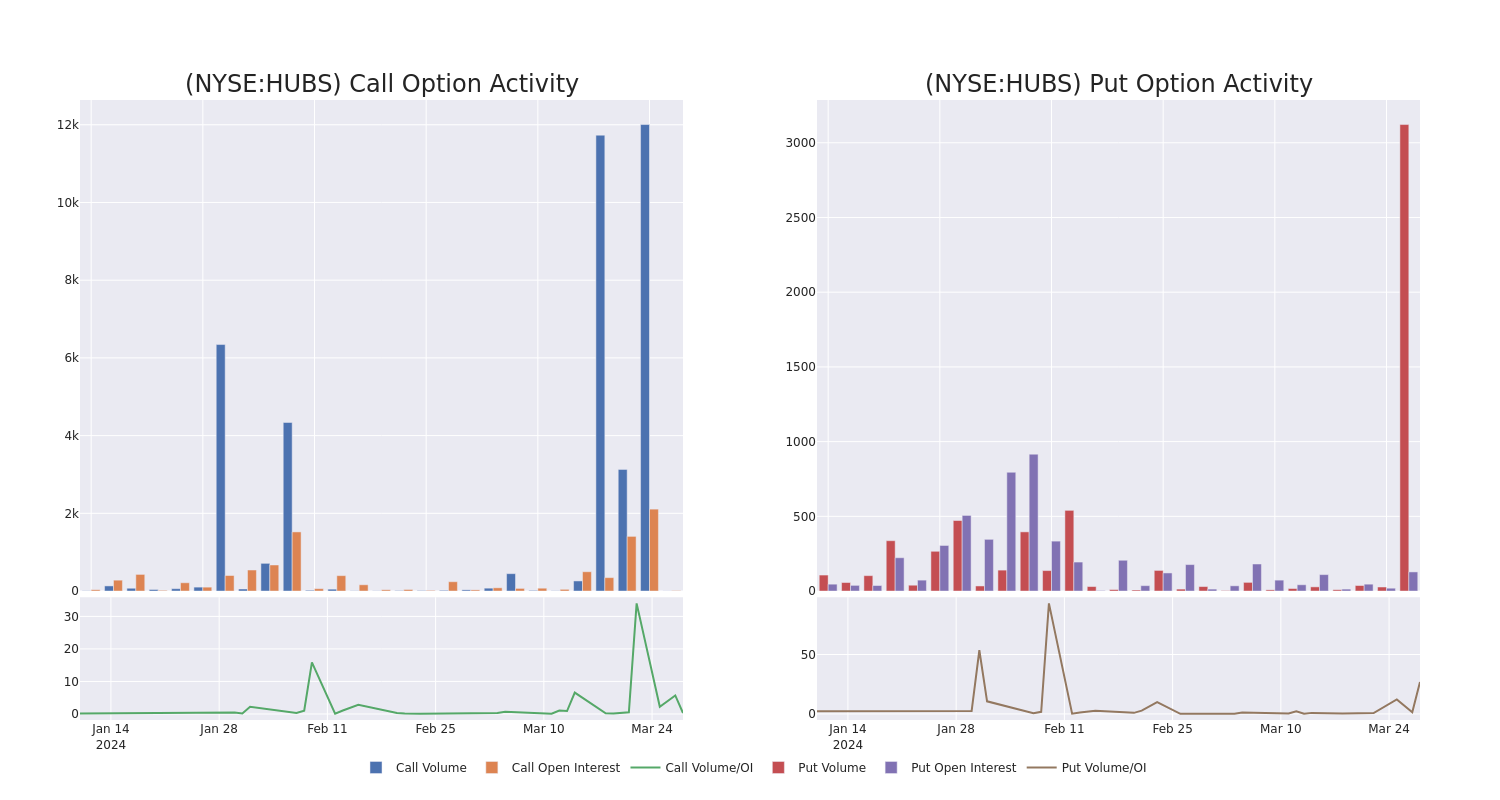

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for HubSpot's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of HubSpot's whale trades within a strike price range from $550.0 to $720.0 in the last 30 days.

HubSpot Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| HUBS |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$9.1 |

$8.9 |

$8.9 |

$590.00 |

$55.1K |

118 |

232 |

| HUBS |

PUT |

TRADE |

BEARISH |

01/17/25 |

$139.6 |

$131.0 |

$136.2 |

$720.00 |

$54.4K |

10 |

4 |

| HUBS |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$11.0 |

$10.3 |

$10.3 |

$590.00 |

$52.5K |

118 |

602 |

| HUBS |

PUT |

SWEEP |

BEARISH |

04/19/24 |

$10.4 |

$9.8 |

$10.34 |

$590.00 |

$51.5K |

118 |

700 |

| HUBS |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$12.6 |

$10.0 |

$10.0 |

$590.00 |

$50.0K |

118 |

510 |

About HubSpot

HubSpot provides a cloud-based marketing, sales, and customer service software platform referred to as the growth platform. The applications are available ala carte or packaged together. HubSpot's mission is to help companies grow better and has expanded from its initial focus on inbound marketing to embrace marketing, sales, and service more broadly. The company was founded in 2006, completed its initial public offering in 2014, and is headquartered in Cambridge, Massachusetts.

Following our analysis of the options activities associated with HubSpot, we pivot to a closer look at the company's own performance.

Present Market Standing of HubSpot

- Trading volume stands at 231,762, with HUBS's price down by 0.0%, positioned at $623.33.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 34 days.

Expert Opinions on HubSpot

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $520.0.

- In a cautious move, an analyst from Keybanc downgraded its rating to Underweight, setting a price target of $520.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest HubSpot options trades with real-time alerts from Benzinga Pro.

Posted In: HUBS