Spotlight on FedEx: Analyzing the Surge in Options Activity

Author: Benzinga Insights | March 27, 2024 04:30pm

Financial giants have made a conspicuous bearish move on FedEx. Our analysis of options history for FedEx (NYSE:FDX) revealed 17 unusual trades.

Delving into the details, we found 41% of traders were bullish, while 58% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $280,630, and 10 were calls, valued at $500,446.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $135.0 to $305.0 for FedEx during the past quarter.

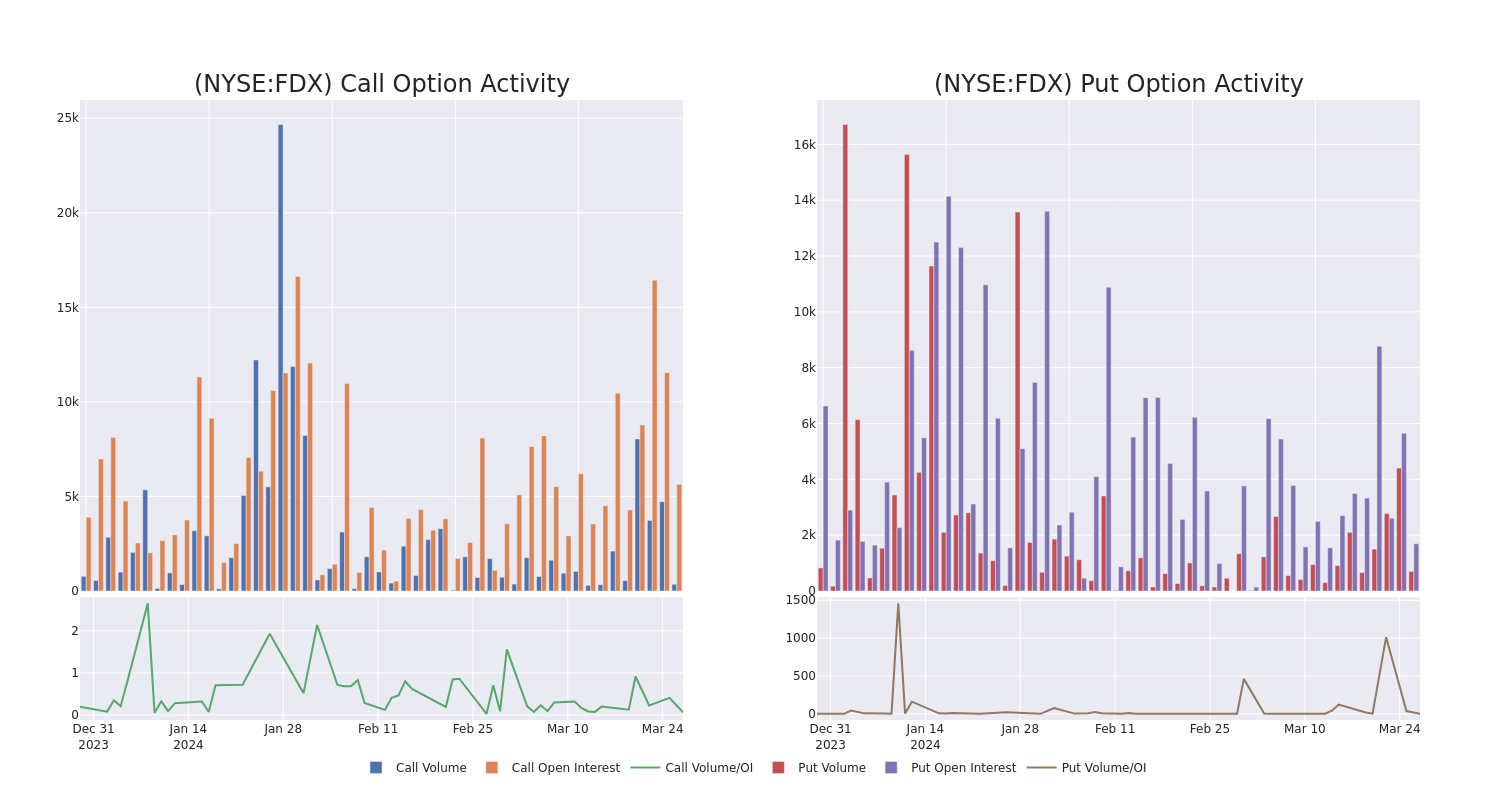

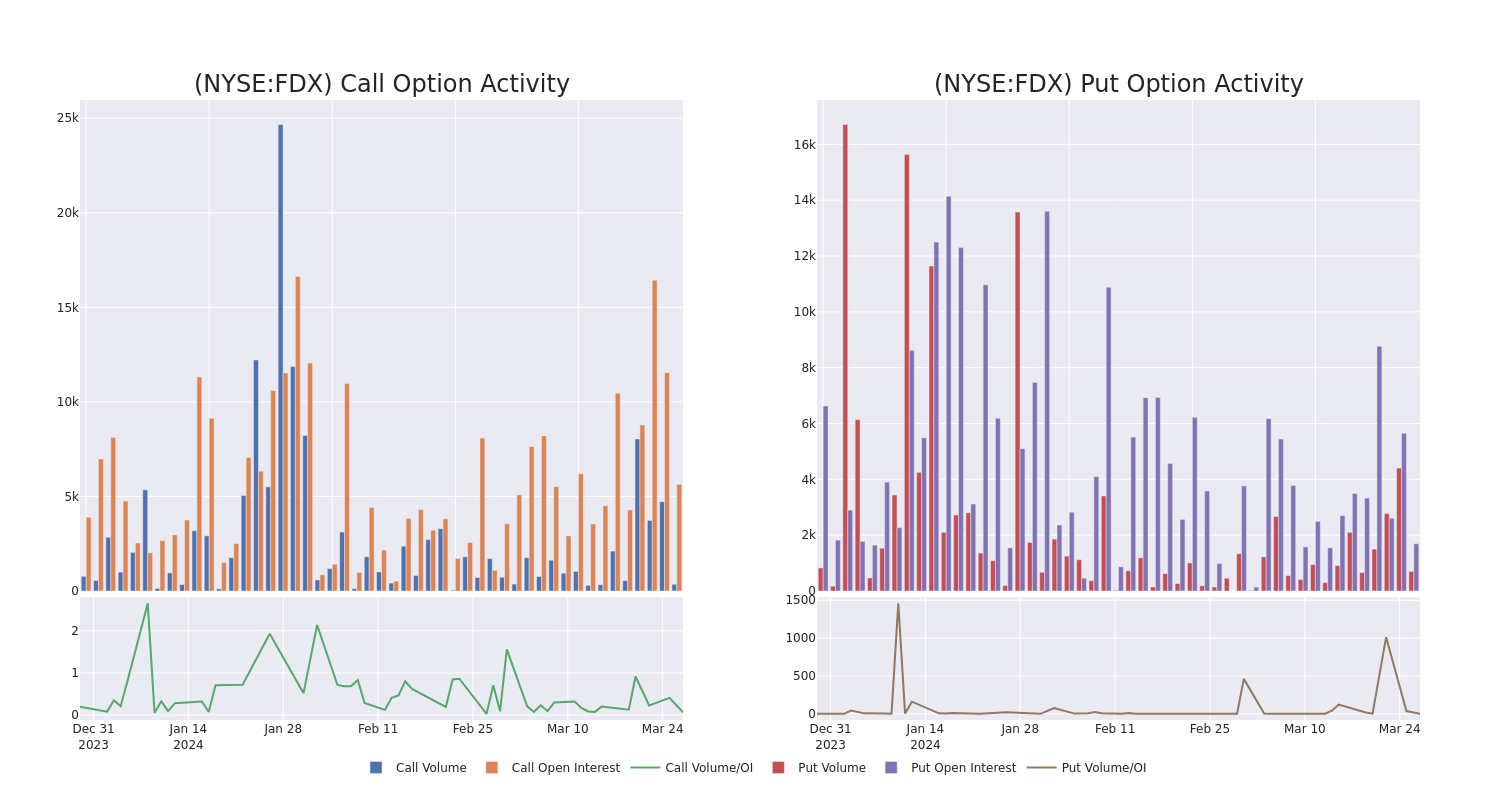

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for FedEx's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of FedEx's whale trades within a strike price range from $135.0 to $305.0 in the last 30 days.

FedEx Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| FDX |

CALL |

SWEEP |

BULLISH |

06/21/24 |

$270.00 |

$136.6K |

2.2K |

72 |

| FDX |

PUT |

SWEEP |

BULLISH |

09/19/25 |

$240.00 |

$84.0K |

576 |

0 |

| FDX |

CALL |

SWEEP |

BULLISH |

01/16/26 |

$300.00 |

$69.7K |

599 |

19 |

| FDX |

CALL |

SWEEP |

BEARISH |

06/21/24 |

$270.00 |

$59.4K |

2.2K |

100 |

| FDX |

CALL |

TRADE |

BULLISH |

07/19/24 |

$270.00 |

$46.3K |

541 |

35 |

About FedEx

FedEx pioneered overnight delivery in 1973 and remains the world's largest express package provider. In its fiscal 2023, which ended May 2023, FedEx derived 47% of revenue from its express division, 37% from ground, and 11% from freight, its asset-based less-than-truckload shipping segment. The remainder comes from other services, including FedEx Office, which provides document production/shipping, and FedEx Logistics, which provides global forwarding. FedEx acquired Dutch parcel delivery firm TNT Express in 2016. TNT was previously the fourth-largest global parcel delivery provider.

Having examined the options trading patterns of FedEx, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of FedEx

- Currently trading with a volume of 1,785,798, the FDX's price is down by -0.38%, now at $287.88.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 83 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest FedEx options trades with real-time alerts from Benzinga Pro.

Posted In: FDX