Smart Money Is Betting Big In NOW Options

Author: Benzinga Insights | March 27, 2024 10:16am

Financial giants have made a conspicuous bullish move on ServiceNow. Our analysis of options history for ServiceNow (NYSE:NOW) revealed 12 unusual trades.

Delving into the details, we found 66% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $416,626, and 4 were calls, valued at $181,400.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $600.0 to $1180.0 for ServiceNow over the last 3 months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for ServiceNow options trades today is 285.43 with a total volume of 299.00.

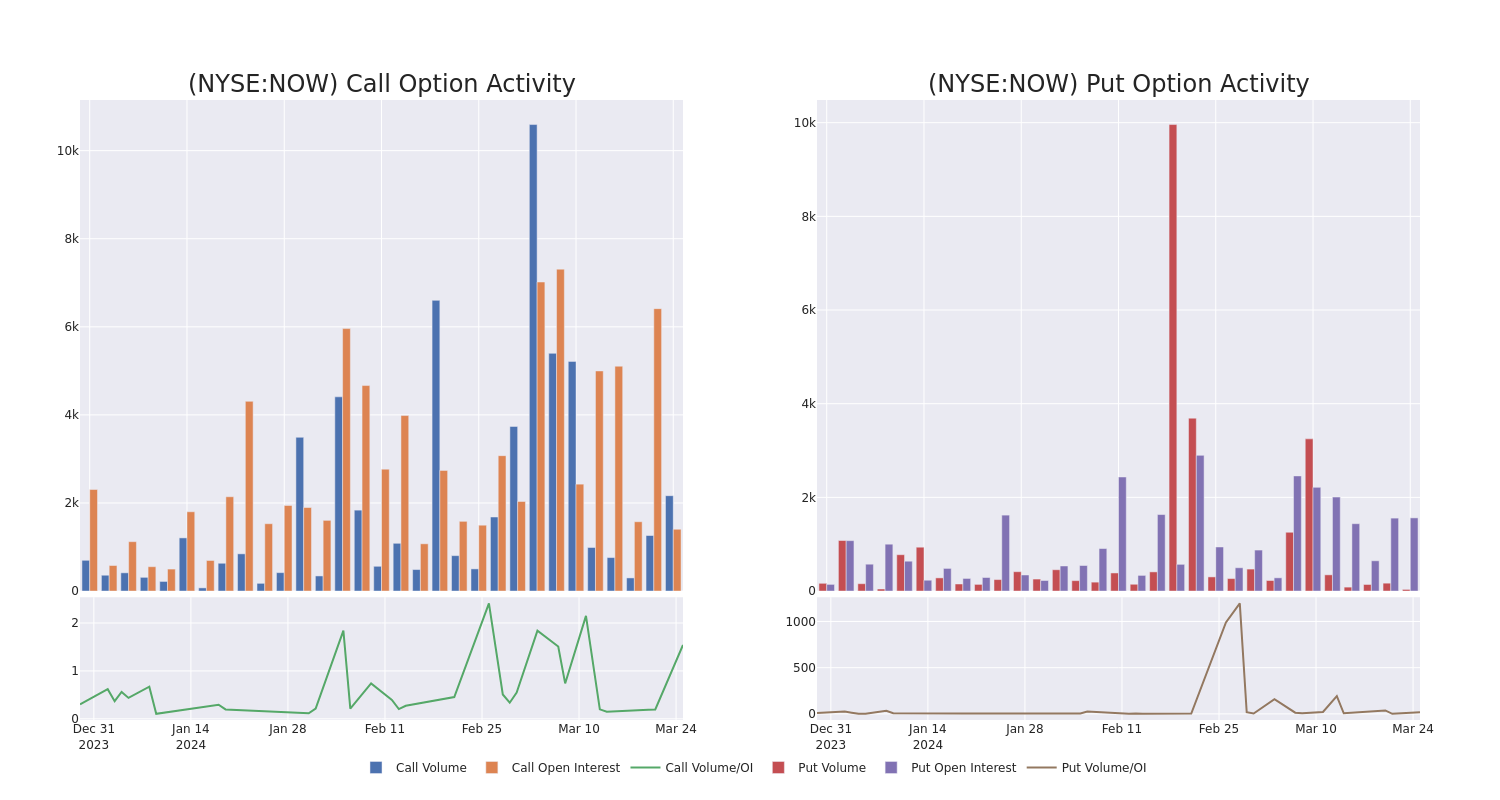

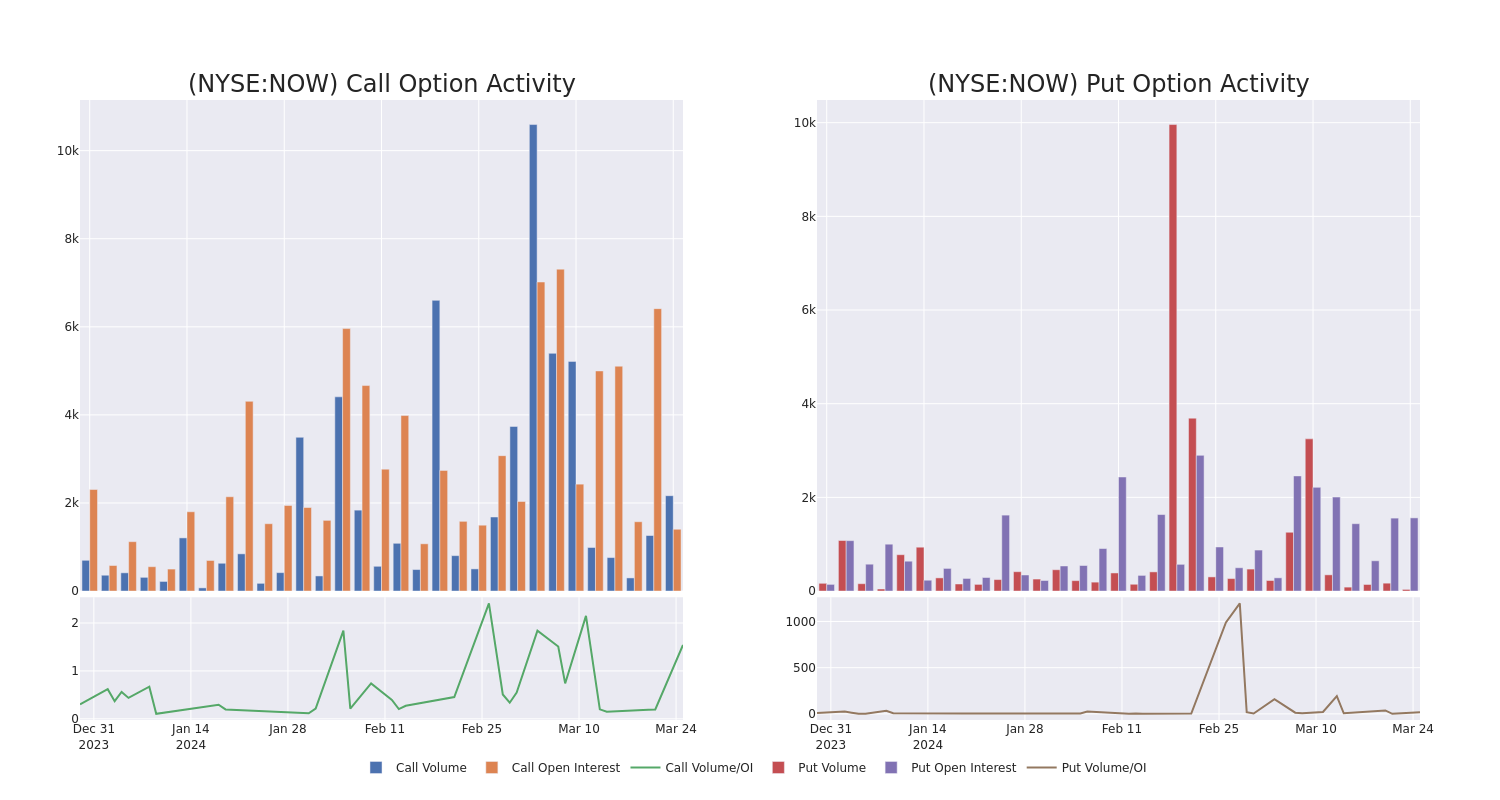

In the following chart, we are able to follow the development of volume and open interest of call and put options for ServiceNow's big money trades within a strike price range of $600.0 to $1180.0 over the last 30 days.

ServiceNow 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| NOW |

PUT |

SWEEP |

BULLISH |

04/12/24 |

$785.00 |

$83.5K |

38 |

30 |

| NOW |

PUT |

SWEEP |

BULLISH |

05/17/24 |

$770.00 |

$60.6K |

153 |

63 |

| NOW |

PUT |

TRADE |

BULLISH |

05/17/24 |

$770.00 |

$52.3K |

153 |

12 |

| NOW |

PUT |

TRADE |

BULLISH |

05/17/24 |

$770.00 |

$51.9K |

153 |

87 |

| NOW |

PUT |

TRADE |

BULLISH |

05/17/24 |

$770.00 |

$51.8K |

153 |

75 |

About ServiceNow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

After a thorough review of the options trading surrounding ServiceNow, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is ServiceNow Standing Right Now?

- Trading volume stands at 137,196, with NOW's price up by 0.7%, positioned at $784.0.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 28 days.

Professional Analyst Ratings for ServiceNow

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $880.0.

- Reflecting concerns, an analyst from Stifel lowers its rating to Buy with a new price target of $820.

- An analyst from Keybanc downgraded its action to Overweight with a price target of $1000.

- An analyst from Stifel has revised its rating downward to Buy, adjusting the price target to $820.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ServiceNow with Benzinga Pro for real-time alerts.

Posted In: NOW