A Closer Look at Tesla's Options Market Dynamics

Author: Benzinga Insights | March 27, 2024 09:46am

Investors with a lot of money to spend have taken a bearish stance on Tesla (NASDAQ:TSLA).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with TSLA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 31 uncommon options trades for Tesla.

This isn't normal.

The overall sentiment of these big-money traders is split between 41% bullish and 58%, bearish.

Out of all of the special options we uncovered, 13 are puts, for a total amount of $672,462, and 18 are calls, for a total amount of $993,520.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $170.0 and $300.0 for Tesla, spanning the last three months.

Insights into Volume & Open Interest

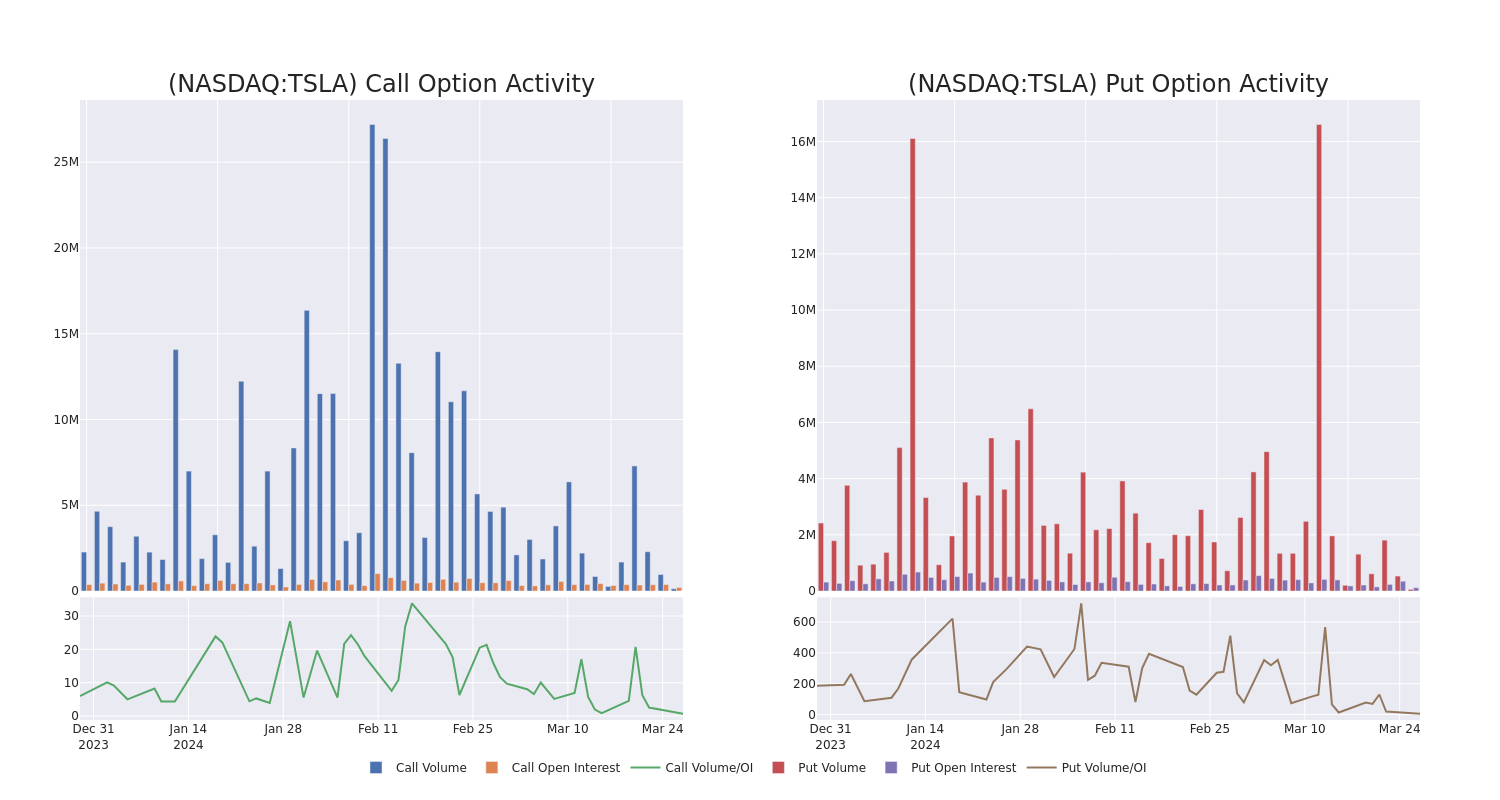

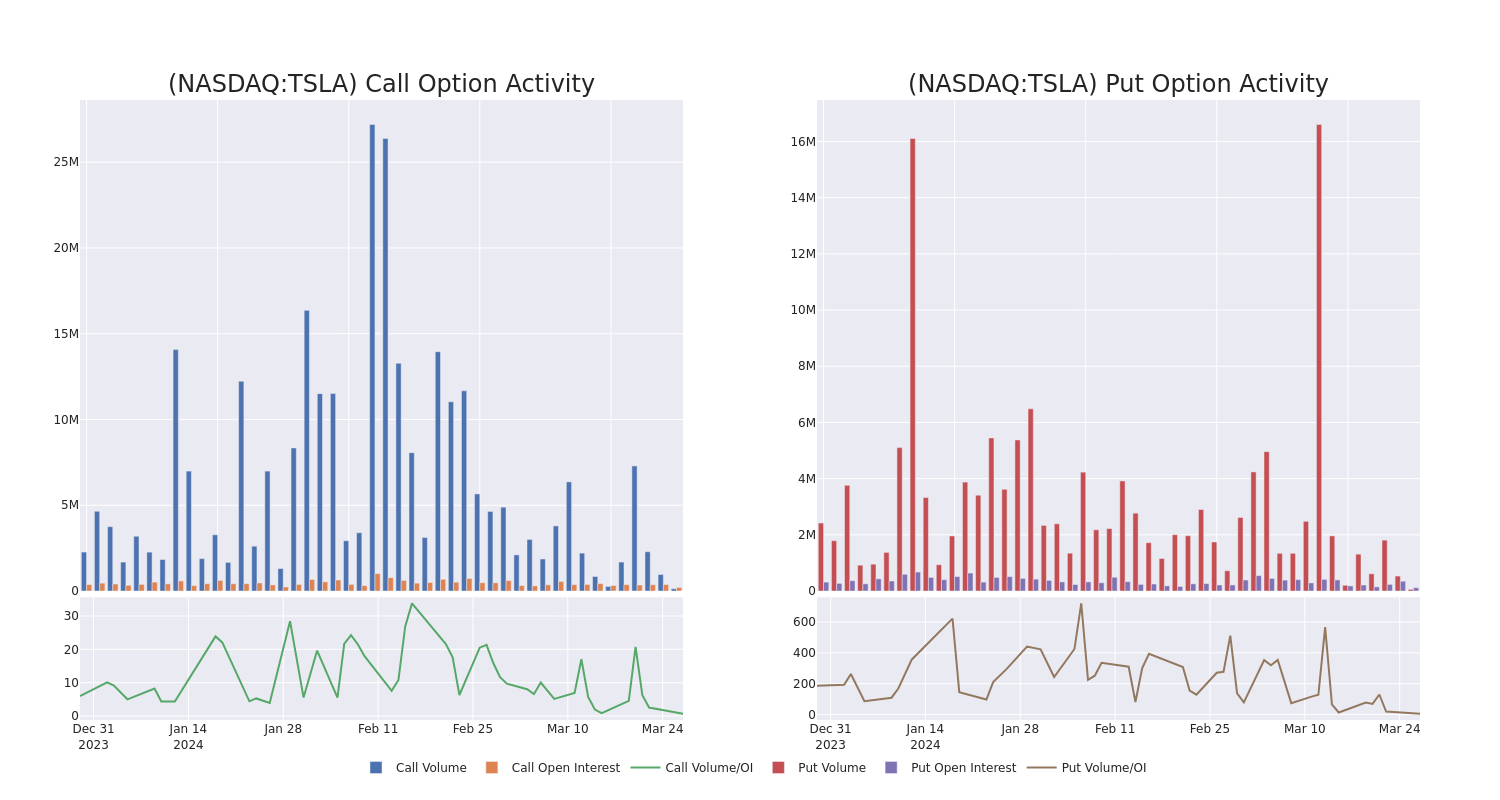

In today's trading context, the average open interest for options of Tesla stands at 19341.47, with a total volume reaching 194,354.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Tesla, situated within the strike price corridor from $170.0 to $300.0, throughout the last 30 days.

Tesla 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| TSLA |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$170.00 |

$131.2K |

41.7K |

1.4K |

| TSLA |

CALL |

SWEEP |

BULLISH |

03/28/24 |

$180.00 |

$114.0K |

39.2K |

211 |

| TSLA |

CALL |

SWEEP |

BEARISH |

03/28/24 |

$180.00 |

$101.2K |

39.2K |

21.4K |

| TSLA |

CALL |

SWEEP |

BEARISH |

03/28/24 |

$180.00 |

$100.8K |

39.2K |

19.3K |

| TSLA |

PUT |

TRADE |

BULLISH |

04/05/24 |

$170.00 |

$95.0K |

26.1K |

650 |

About Tesla

Founded in 2003 and based in Palo Alto, California, Tesla is a vertically integrated sustainable energy company that also aims to transition the world to electric mobility by making electric vehicles. The company sells solar panels and solar roofs for energy generation plus batteries for stationary storage for residential and commercial properties including utilities. Tesla has multiple vehicles in its fleet, which include luxury and midsize sedans and crossover SUVs. The company also plans to begin selling more affordable sedans and small SUVs, a light truck, a semi truck, and a sports car. Global deliveries in 2023 were a little over 1.8 million vehicles.

After a thorough review of the options trading surrounding Tesla, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Tesla

- With a volume of 2,979,611, the price of TSLA is up 2.14% at $181.48.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 21 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Tesla options trades with real-time alerts from Benzinga Pro.

Posted In: TSLA