MongoDB Unusual Options Activity For March 26

Author: Benzinga Insights | March 26, 2024 04:15pm

Financial giants have made a conspicuous bearish move on MongoDB. Our analysis of options history for MongoDB (NASDAQ:MDB) revealed 15 unusual trades.

Delving into the details, we found 26% of traders were bullish, while 73% showed bearish tendencies. Out of all the trades we spotted, 11 were puts, with a value of $1,515,767, and 4 were calls, valued at $171,400.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $310.0 to $430.0 for MongoDB over the last 3 months.

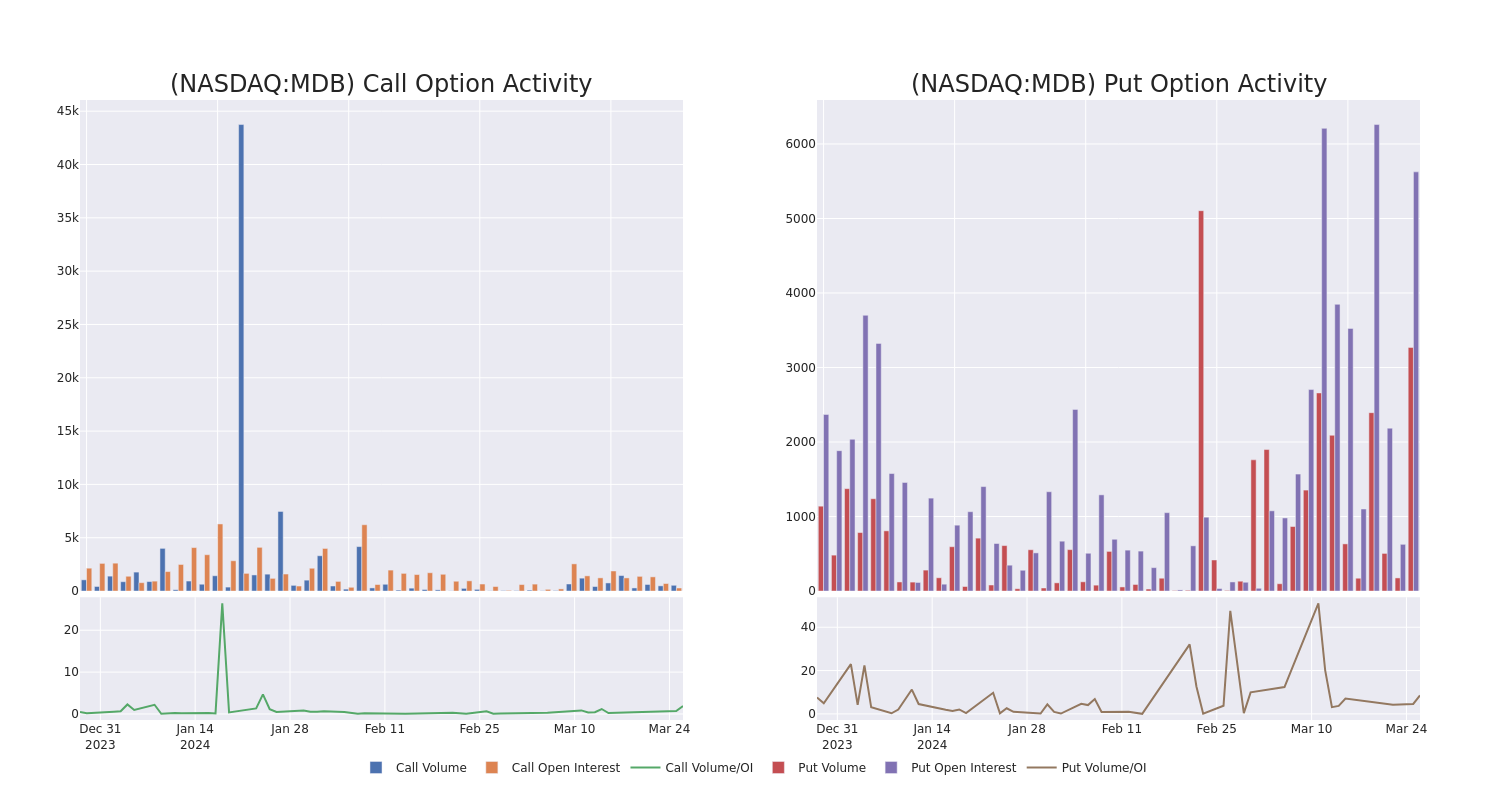

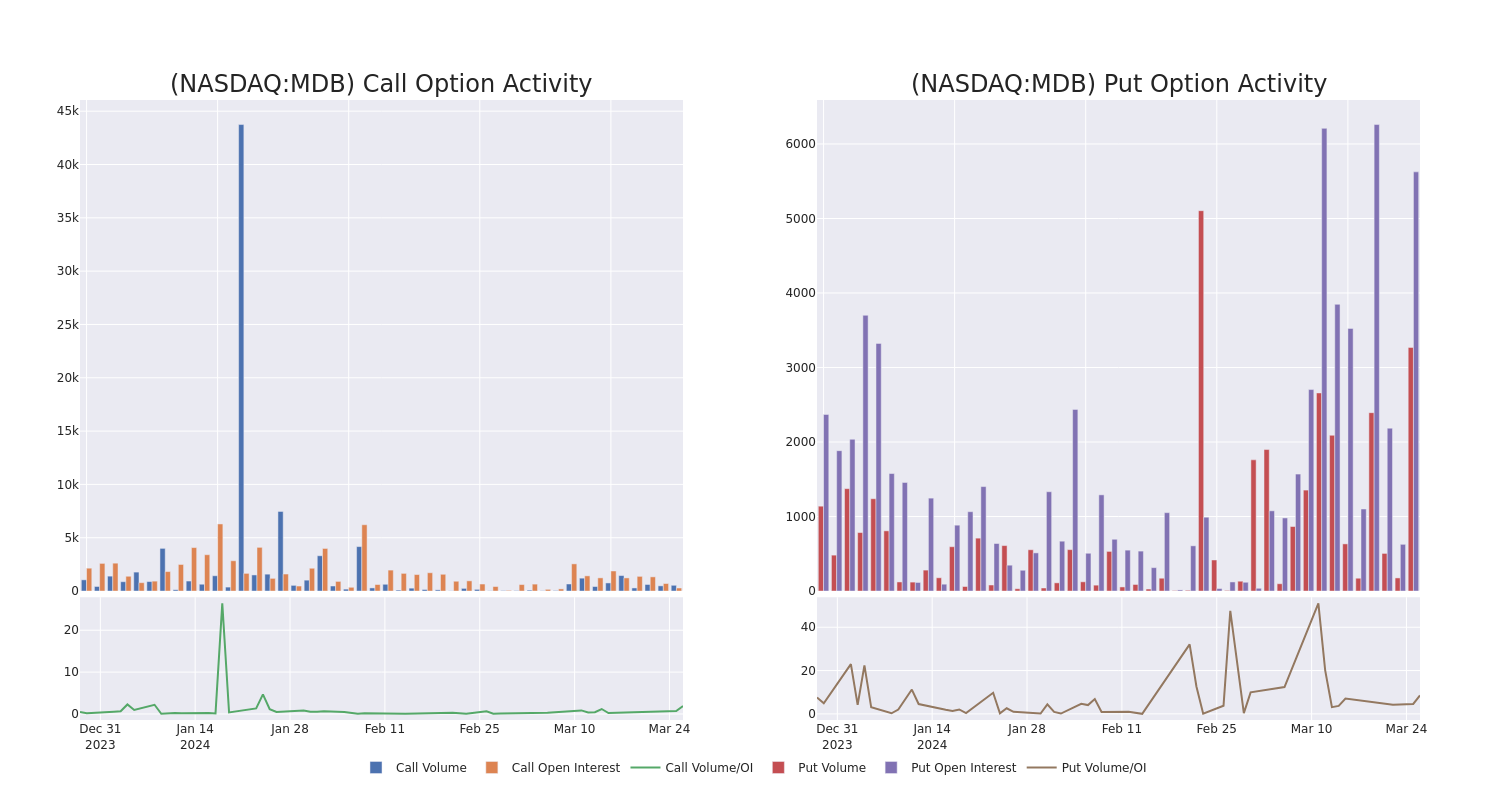

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for MongoDB's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MongoDB's whale trades within a strike price range from $310.0 to $430.0 in the last 30 days.

MongoDB 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MDB |

PUT |

TRADE |

BULLISH |

05/17/24 |

$310.00 |

$889.2K |

2.9K |

1.2K |

| MDB |

PUT |

TRADE |

NEUTRAL |

03/28/24 |

$390.00 |

$130.7K |

37 |

194 |

| MDB |

PUT |

TRADE |

BEARISH |

01/17/25 |

$370.00 |

$83.3K |

230 |

12 |

| MDB |

PUT |

SWEEP |

BULLISH |

04/19/24 |

$430.00 |

$78.4K |

132 |

10 |

| MDB |

CALL |

TRADE |

BEARISH |

04/12/24 |

$405.00 |

$73.7K |

126 |

484 |

About MongoDB

Founded in 2007, MongoDB is a document-oriented database with nearly 33,000 paying customers and well past 1.5 million free users. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB's database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

After a thorough review of the options trading surrounding MongoDB, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of MongoDB

- Currently trading with a volume of 960,619, the MDB's price is up by 0.16%, now at $354.12.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 65 days.

What Analysts Are Saying About MongoDB

5 market experts have recently issued ratings for this stock, with a consensus target price of $474.0.

- Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for MongoDB, targeting a price of $550.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for MongoDB, targeting a price of $435.

- In a cautious move, an analyst from RBC Capital downgraded its rating to Outperform, setting a price target of $475.

- An analyst from Piper Sandler has decided to maintain their Overweight rating on MongoDB, which currently sits at a price target of $480.

- In a positive move, an analyst from DA Davidson has upgraded their rating to Buy and adjusted the price target to $430.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest MongoDB options trades with real-time alerts from Benzinga Pro.

Posted In: MDB