This Is What Whales Are Betting On Trade Desk

Author: Benzinga Insights | March 26, 2024 03:45pm

Financial giants have made a conspicuous bearish move on Trade Desk. Our analysis of options history for Trade Desk (NASDAQ:TTD) revealed 32 unusual trades.

Delving into the details, we found 43% of traders were bullish, while 56% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $436,922, and 24 were calls, valued at $1,377,951.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $110.0 for Trade Desk over the last 3 months.

Insights into Volume & Open Interest

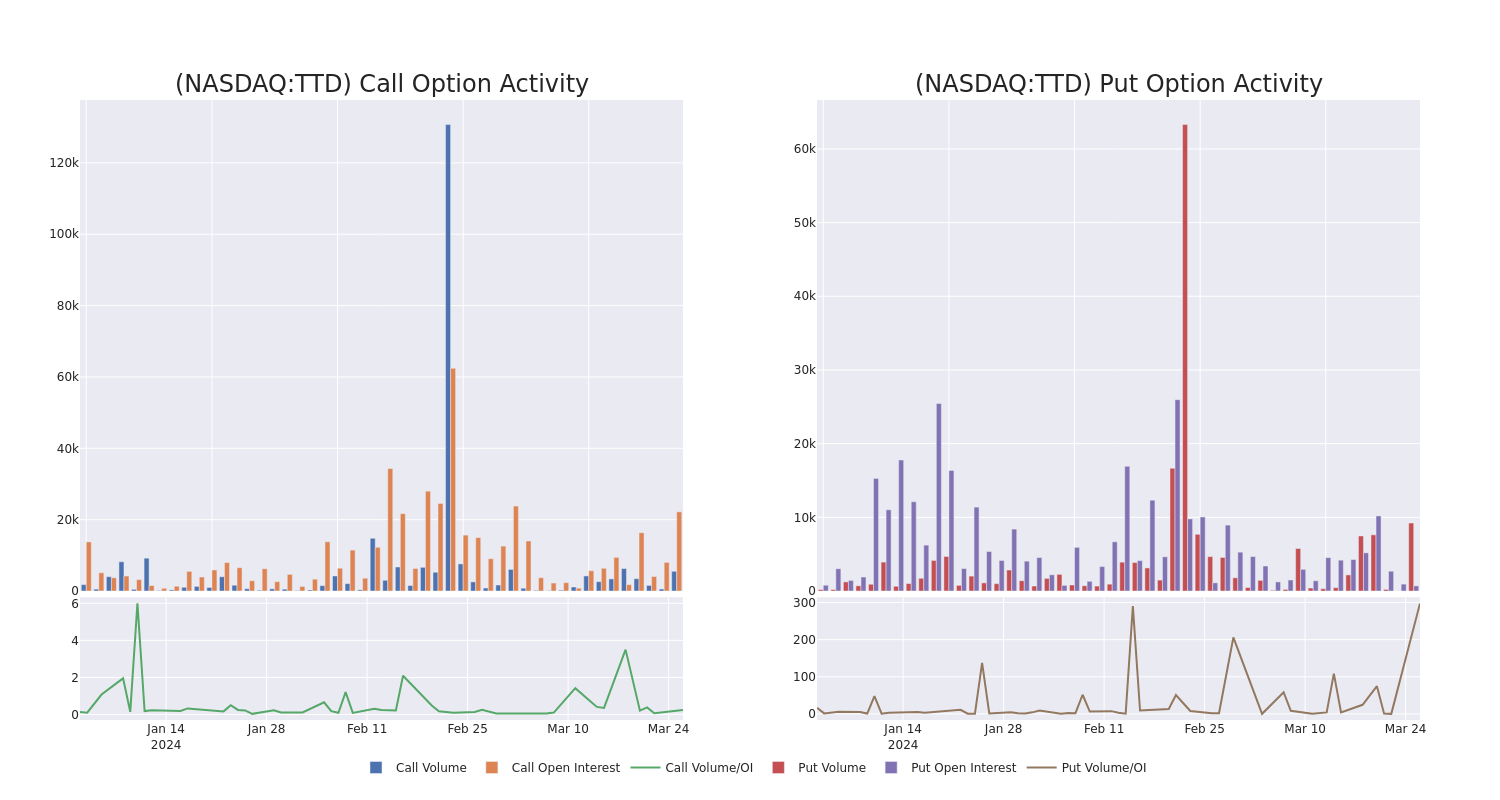

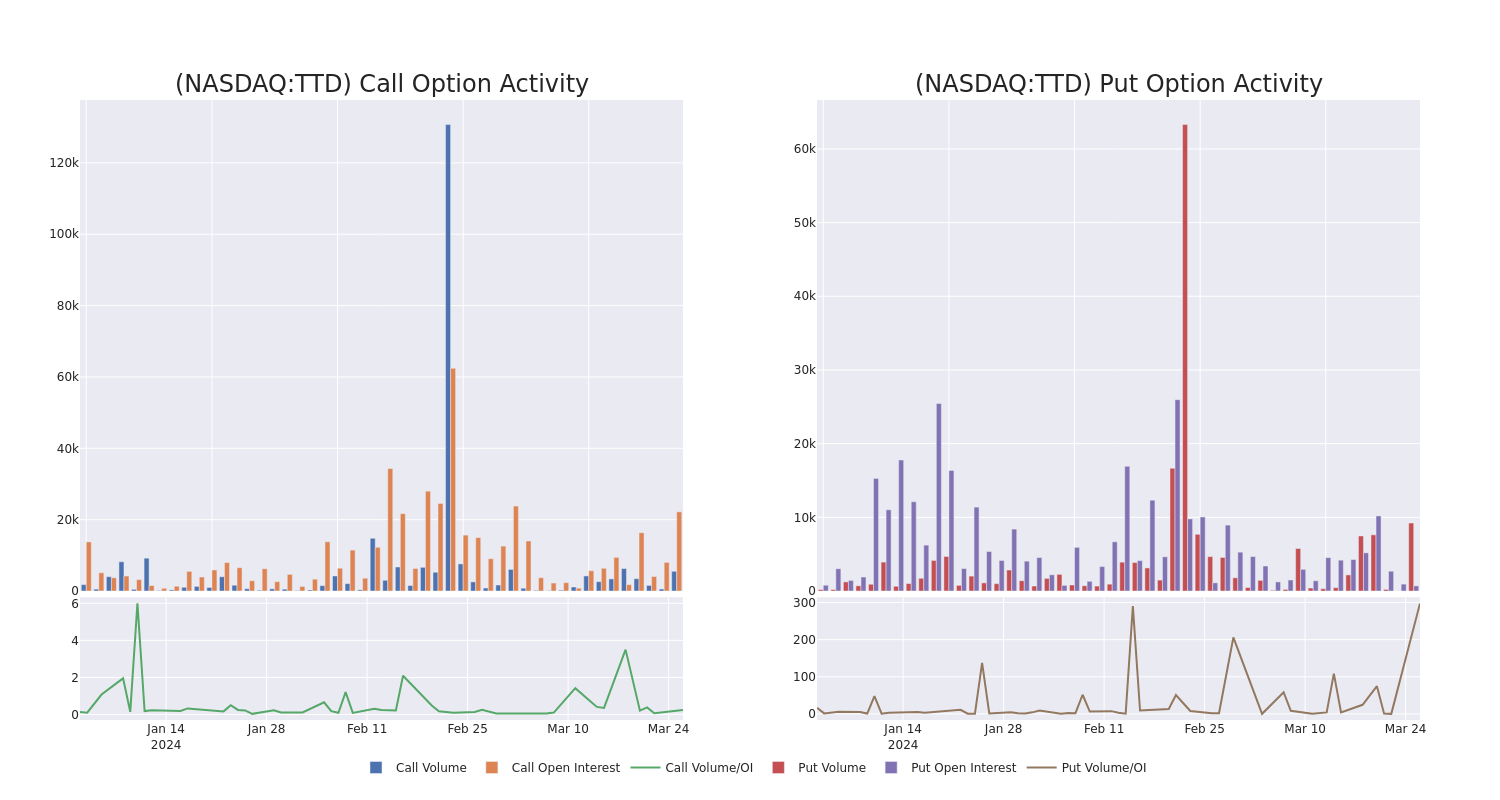

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Trade Desk's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Trade Desk's significant trades, within a strike price range of $55.0 to $110.0, over the past month.

Trade Desk Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| TTD |

PUT |

SWEEP |

BEARISH |

04/19/24 |

$87.50 |

$162.6K |

30 |

1.8K |

| TTD |

CALL |

SWEEP |

NEUTRAL |

03/28/24 |

$84.00 |

$160.4K |

870 |

371 |

| TTD |

CALL |

SWEEP |

BULLISH |

04/05/24 |

$80.00 |

$104.2K |

500 |

132 |

| TTD |

CALL |

SWEEP |

BULLISH |

07/19/24 |

$110.00 |

$97.1K |

90 |

301 |

| TTD |

CALL |

SWEEP |

BULLISH |

04/05/24 |

$80.00 |

$77.7K |

500 |

253 |

About Trade Desk

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on different devices like computers, smartphones, and connected TVs. It utilizes data to optimize the performance of ad impressions purchased. The firm's platform is referred to as a demand-side platform in the digital ad industry. The firm generates its revenue from fees based on a percentage of what its clients spend on advertising.

In light of the recent options history for Trade Desk, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Trade Desk's Current Market Status

- With a volume of 2,728,071, the price of TTD is up 0.63% at $88.1.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 43 days.

What Analysts Are Saying About Trade Desk

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $100.0.

- An analyst from Needham downgraded its action to Buy with a price target of $100.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Trade Desk with Benzinga Pro for real-time alerts.

Posted In: TTD