This Is What Whales Are Betting On Netflix

Author: Benzinga Insights | March 26, 2024 11:15am

Financial giants have made a conspicuous bearish move on Netflix. Our analysis of options history for Netflix (NASDAQ:NFLX) revealed 71 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 63% showed bearish tendencies. Out of all the trades we spotted, 17 were puts, with a value of $2,955,299, and 54 were calls, valued at $3,353,255.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $480.0 to $750.0 for Netflix over the recent three months.

Analyzing Volume & Open Interest

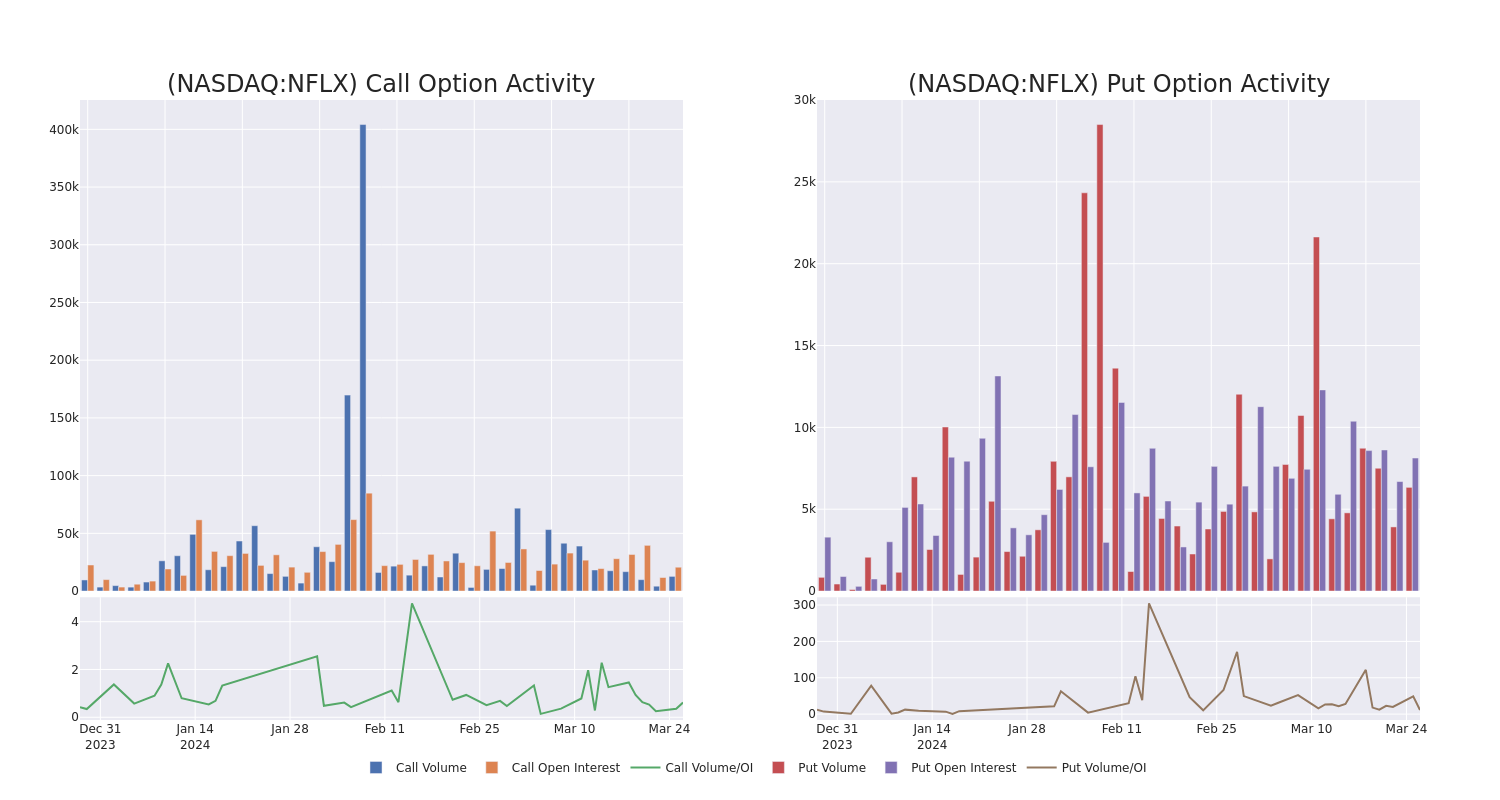

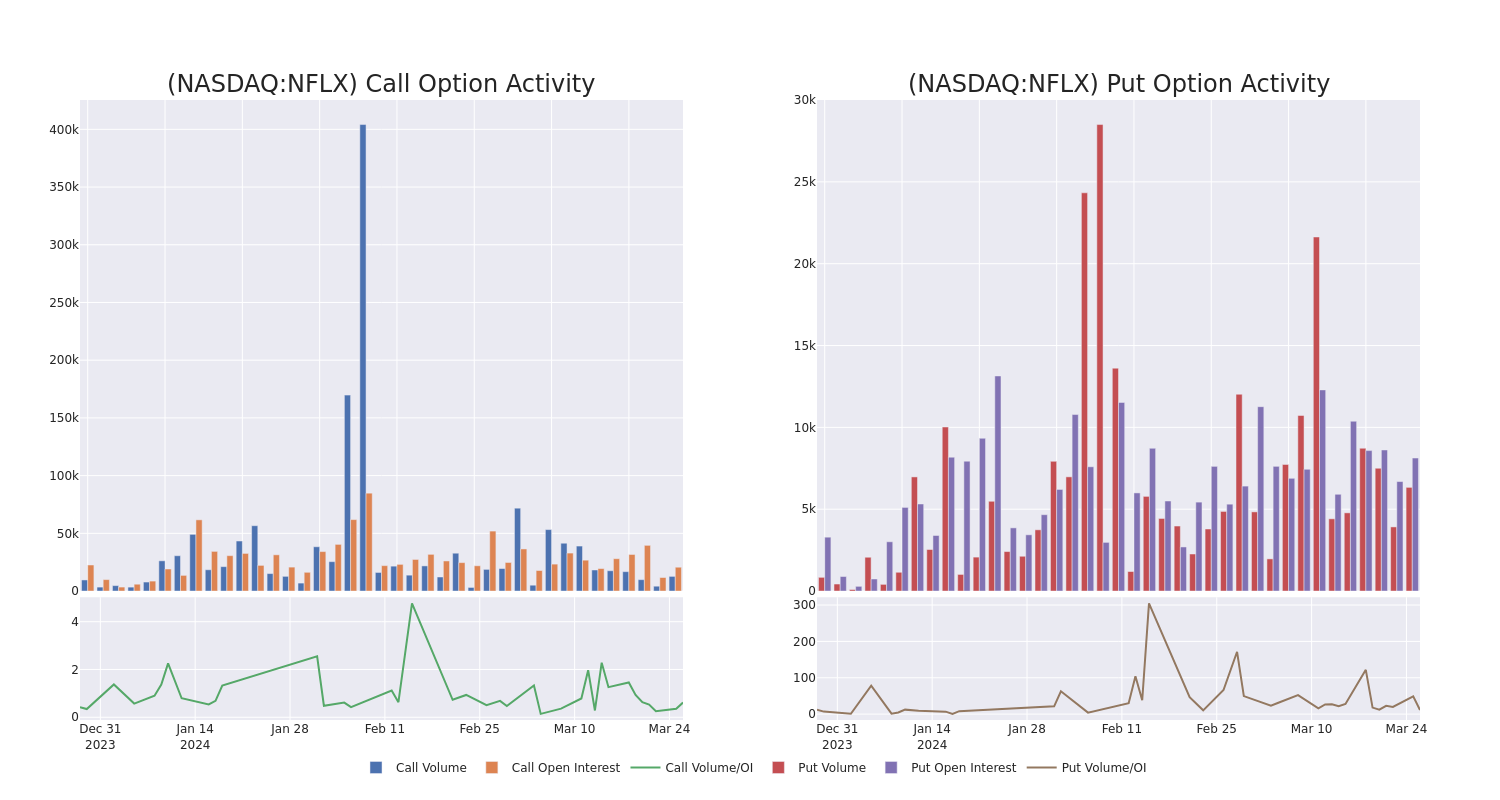

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Netflix's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Netflix's whale trades within a strike price range from $480.0 to $750.0 in the last 30 days.

Netflix Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| NFLX |

PUT |

TRADE |

BULLISH |

04/19/24 |

$630.00 |

$1.5M |

185 |

509 |

| NFLX |

CALL |

SWEEP |

NEUTRAL |

03/28/24 |

$600.00 |

$372.2K |

380 |

217 |

| NFLX |

CALL |

TRADE |

BULLISH |

05/17/24 |

$640.00 |

$348.2K |

1.0K |

174 |

| NFLX |

PUT |

TRADE |

NEUTRAL |

04/19/24 |

$640.00 |

$179.1K |

70 |

93 |

| NFLX |

PUT |

TRADE |

NEUTRAL |

04/19/24 |

$635.00 |

$165.3K |

199 |

51 |

About Netflix

Netflix's relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with almost 250 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm recently began introducing ad-supported subscription plans, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

Following our analysis of the options activities associated with Netflix, we pivot to a closer look at the company's own performance.

Present Market Standing of Netflix

- Trading volume stands at 767,795, with NFLX's price down by -0.35%, positioned at $625.25.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 23 days.

Expert Opinions on Netflix

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $686.0.

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Netflix, targeting a price of $660.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Netflix, targeting a price of $640.

- An analyst from Loop Capital persists with their Buy rating on Netflix, maintaining a target price of $700.

- Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Netflix, targeting a price of $705.

- An analyst from Oppenheimer persists with their Outperform rating on Netflix, maintaining a target price of $725.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Netflix options trades with real-time alerts from Benzinga Pro.

Posted In: NFLX