Decoding Whirlpool's Options Activity: What's the Big Picture?

Author: Benzinga Insights | March 25, 2024 01:45pm

Investors with a lot of money to spend have taken a bearish stance on Whirlpool (NYSE:WHR).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with WHR, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 11 options trades for Whirlpool.

This isn't normal.

The overall sentiment of these big-money traders is split between 36% bullish and 63%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $100,056, and 10, calls, for a total amount of $510,270.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $95.0 and $125.0 for Whirlpool, spanning the last three months.

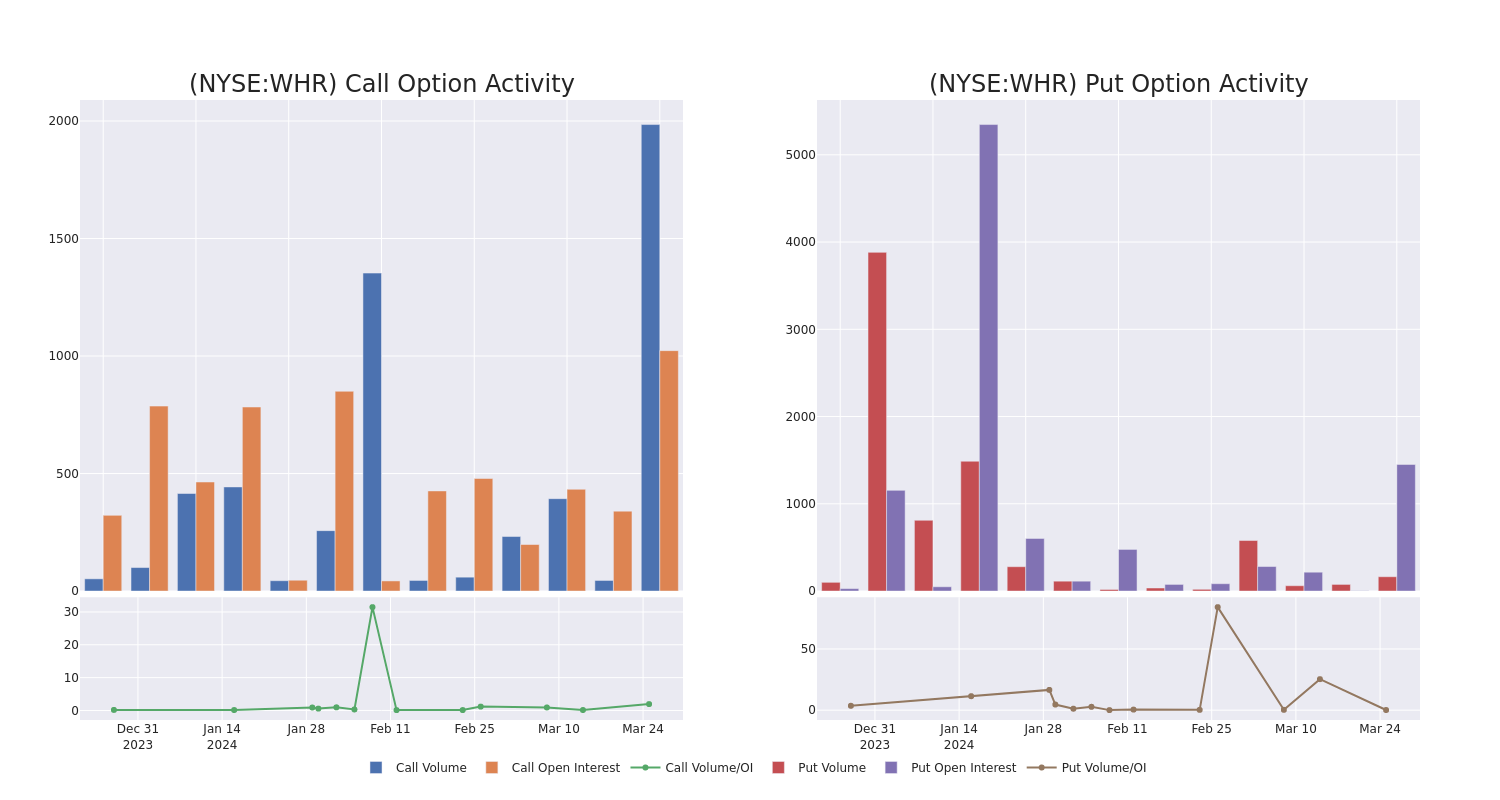

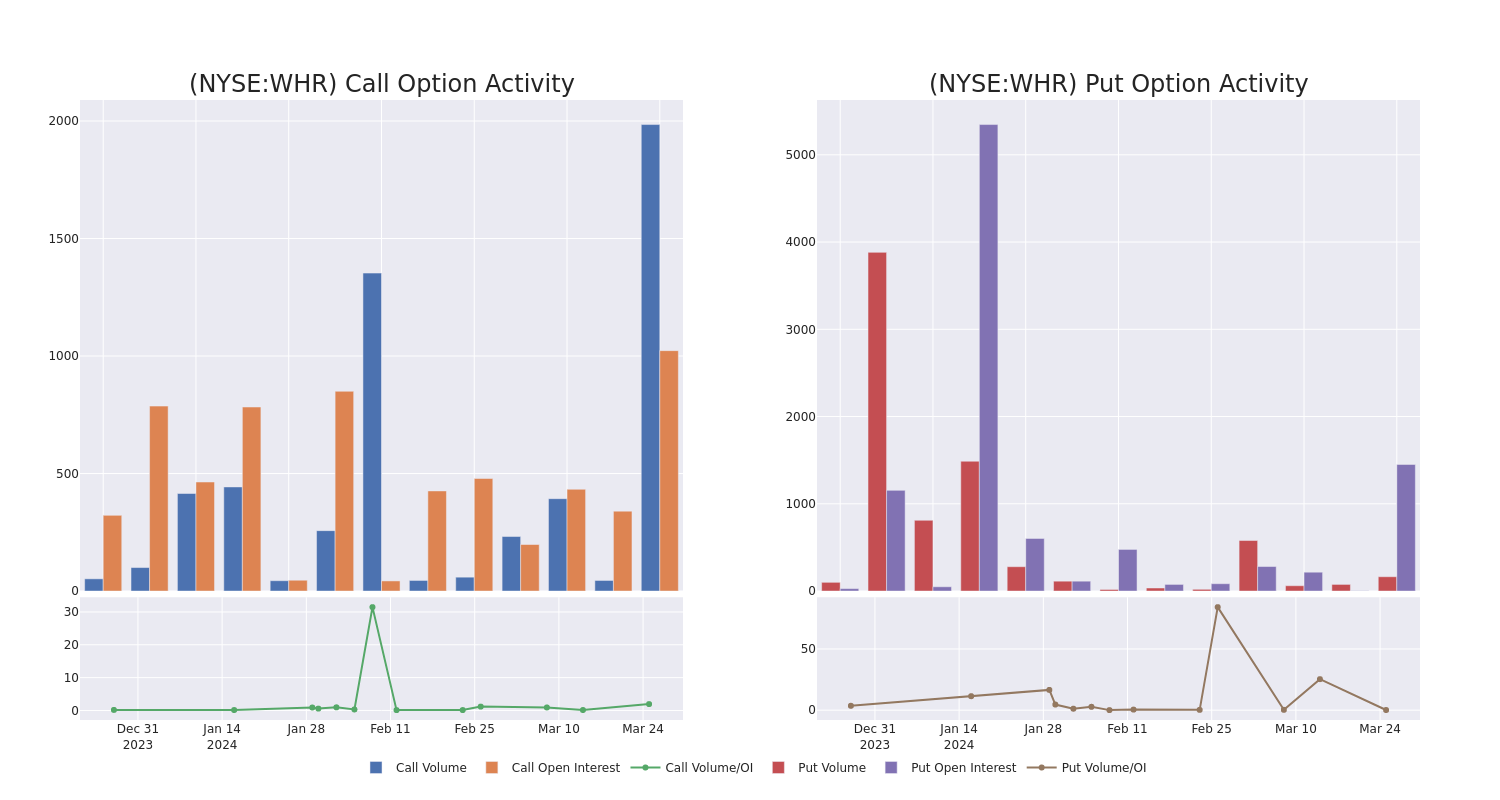

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Whirlpool's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Whirlpool's significant trades, within a strike price range of $95.0 to $125.0, over the past month.

Whirlpool Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| WHR |

PUT |

SWEEP |

BULLISH |

01/17/25 |

$95.00 |

$100.0K |

1.4K |

164 |

| WHR |

CALL |

TRADE |

BEARISH |

04/19/24 |

$107.00 |

$77.0K |

79 |

0 |

| WHR |

CALL |

TRADE |

BULLISH |

05/17/24 |

$115.00 |

$61.9K |

215 |

832 |

| WHR |

CALL |

TRADE |

BEARISH |

05/17/24 |

$115.00 |

$61.6K |

215 |

832 |

| WHR |

CALL |

TRADE |

BEARISH |

05/17/24 |

$95.00 |

$60.3K |

31 |

30 |

About Whirlpool

Whirlpool Corp is a manufacturer and marketer of home appliances and related products. Its reportable segments consist of five operating segments, which consist of Domestic Appliances (MDA) North America; MDA Europe, MDA Latin America; MDA Asia; and Small Domestic Appliances (SDA). Product categories include refrigeration, laundry, cooking, and dishwashing. The company has also a portfolio of small domestic appliances, including the KitchenAid stand mixer. The company's international brands include Whirlpool, KitchenAid, Maytag, Consul, and Brastemp among others.

Current Position of Whirlpool

- Trading volume stands at 552,142, with WHR's price up by 0.32%, positioned at $111.18.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 28 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Whirlpool options trades with real-time alerts from Benzinga Pro.

Posted In: WHR