A Closer Look at PDD Holdings's Options Market Dynamics

Author: Benzinga Insights | March 25, 2024 10:01am

Financial giants have made a conspicuous bullish move on PDD Holdings. Our analysis of options history for PDD Holdings (NASDAQ:PDD) revealed 15 unusual trades.

Delving into the details, we found 60% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $179,250, and 12 were calls, valued at $684,266.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $110.0 and $140.0 for PDD Holdings, spanning the last three months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for PDD Holdings options trades today is 2163.88 with a total volume of 1,614.00.

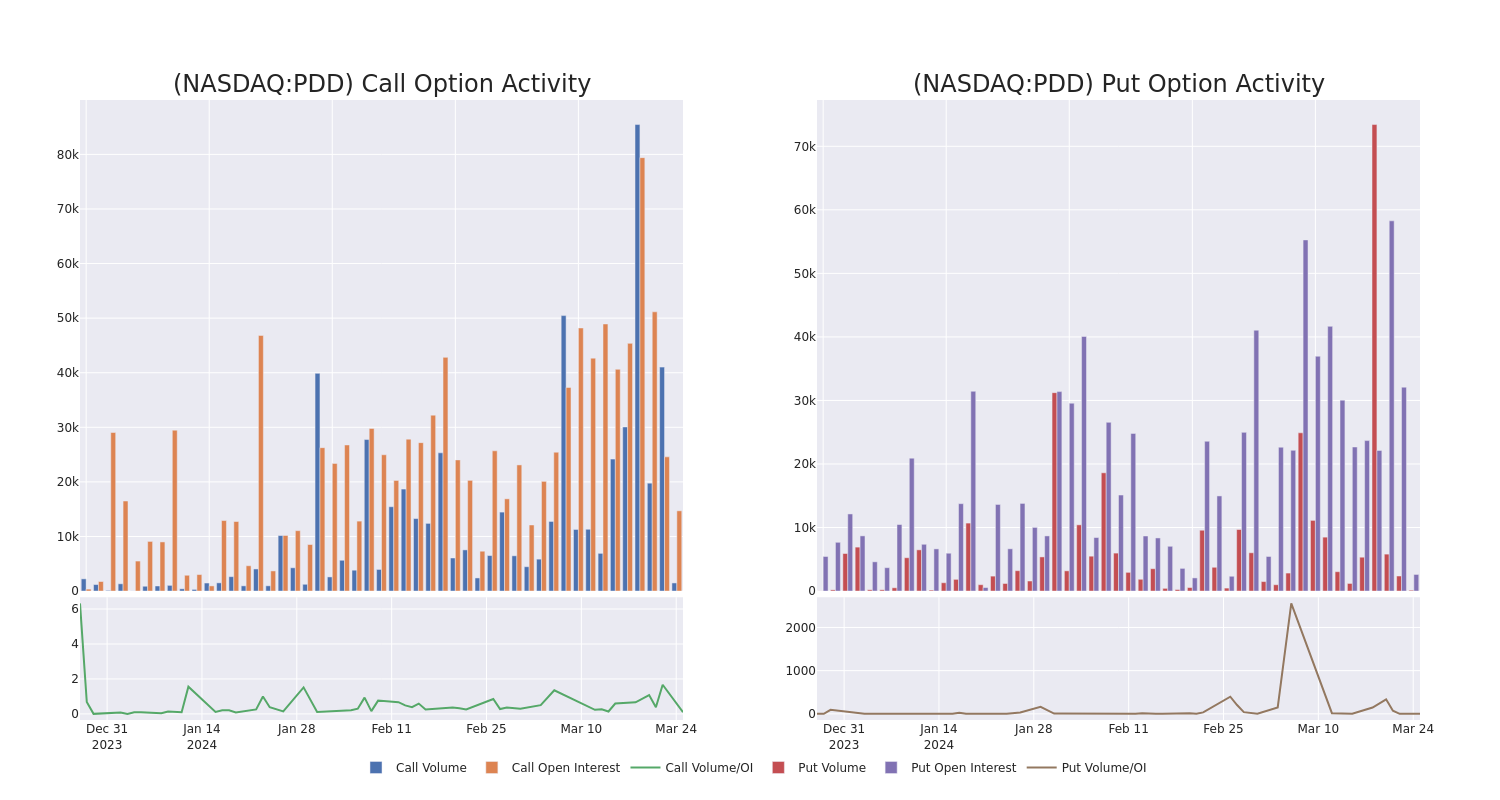

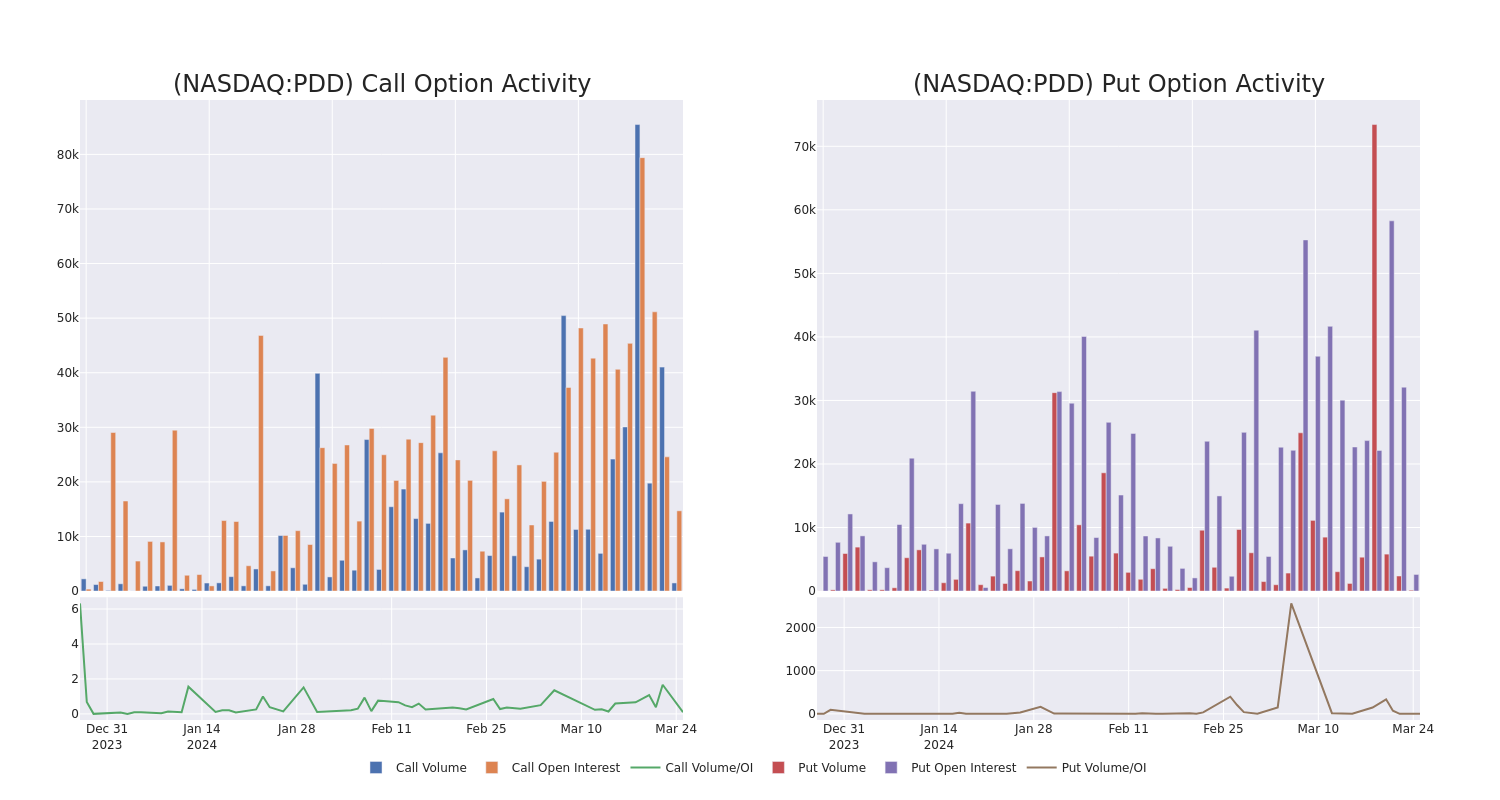

In the following chart, we are able to follow the development of volume and open interest of call and put options for PDD Holdings's big money trades within a strike price range of $110.0 to $140.0 over the last 30 days.

PDD Holdings Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| PDD |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$110.00 |

$153.0K |

195 |

0 |

| PDD |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$110.00 |

$122.4K |

195 |

180 |

| PDD |

PUT |

SWEEP |

BULLISH |

04/05/24 |

$120.00 |

$105.4K |

598 |

0 |

| PDD |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$110.00 |

$94.5K |

195 |

250 |

| PDD |

CALL |

SWEEP |

BULLISH |

04/26/24 |

$126.00 |

$51.2K |

457 |

111 |

About PDD Holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

In light of the recent options history for PDD Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is PDD Holdings Standing Right Now?

- Trading volume stands at 2,161,092, with PDD's price up by 0.52%, positioned at $123.63.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 60 days.

What Analysts Are Saying About PDD Holdings

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $182.6.

- Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for PDD Holdings, targeting a price of $185.

- Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for PDD Holdings, targeting a price of $220.

- An analyst from Jefferies upgraded its action to Buy with a price target of $157.

- An analyst from Jefferies persists with their Buy rating on PDD Holdings, maintaining a target price of $161.

- An analyst from JP Morgan has decided to maintain their Overweight rating on PDD Holdings, which currently sits at a price target of $190.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for PDD Holdings, Benzinga Pro gives you real-time options trades alerts.

Posted In: PDD