UnitedHealth Group Unusual Options Activity

Author: Benzinga Insights | March 22, 2024 03:45pm

Financial giants have made a conspicuous bearish move on UnitedHealth Group. Our analysis of options history for UnitedHealth Group (NYSE:UNH) revealed 15 unusual trades.

Delving into the details, we found 46% of traders were bullish, while 53% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $252,475, and 9 were calls, valued at $467,039.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $480.0 to $550.0 for UnitedHealth Group during the past quarter.

Analyzing Volume & Open Interest

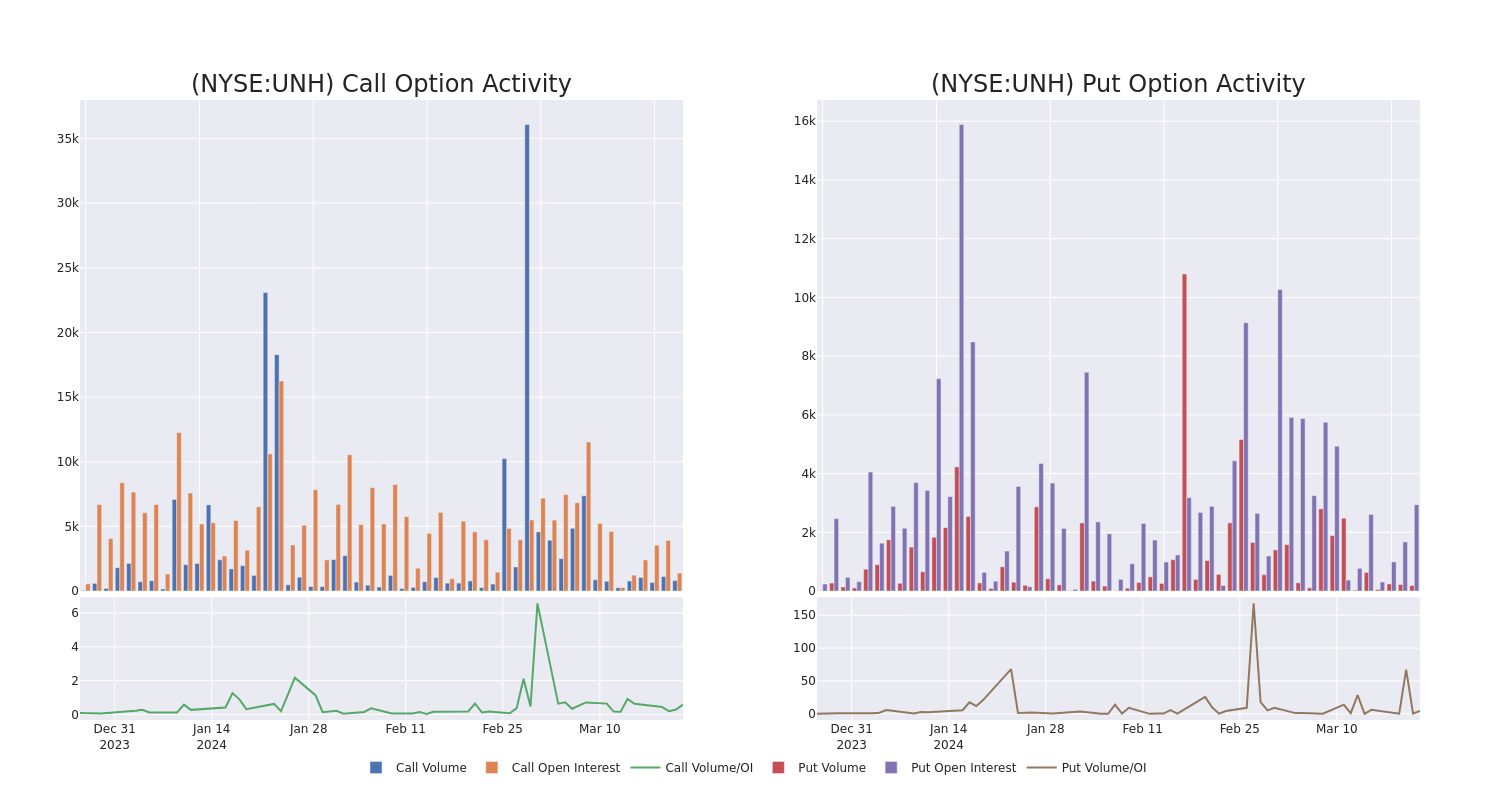

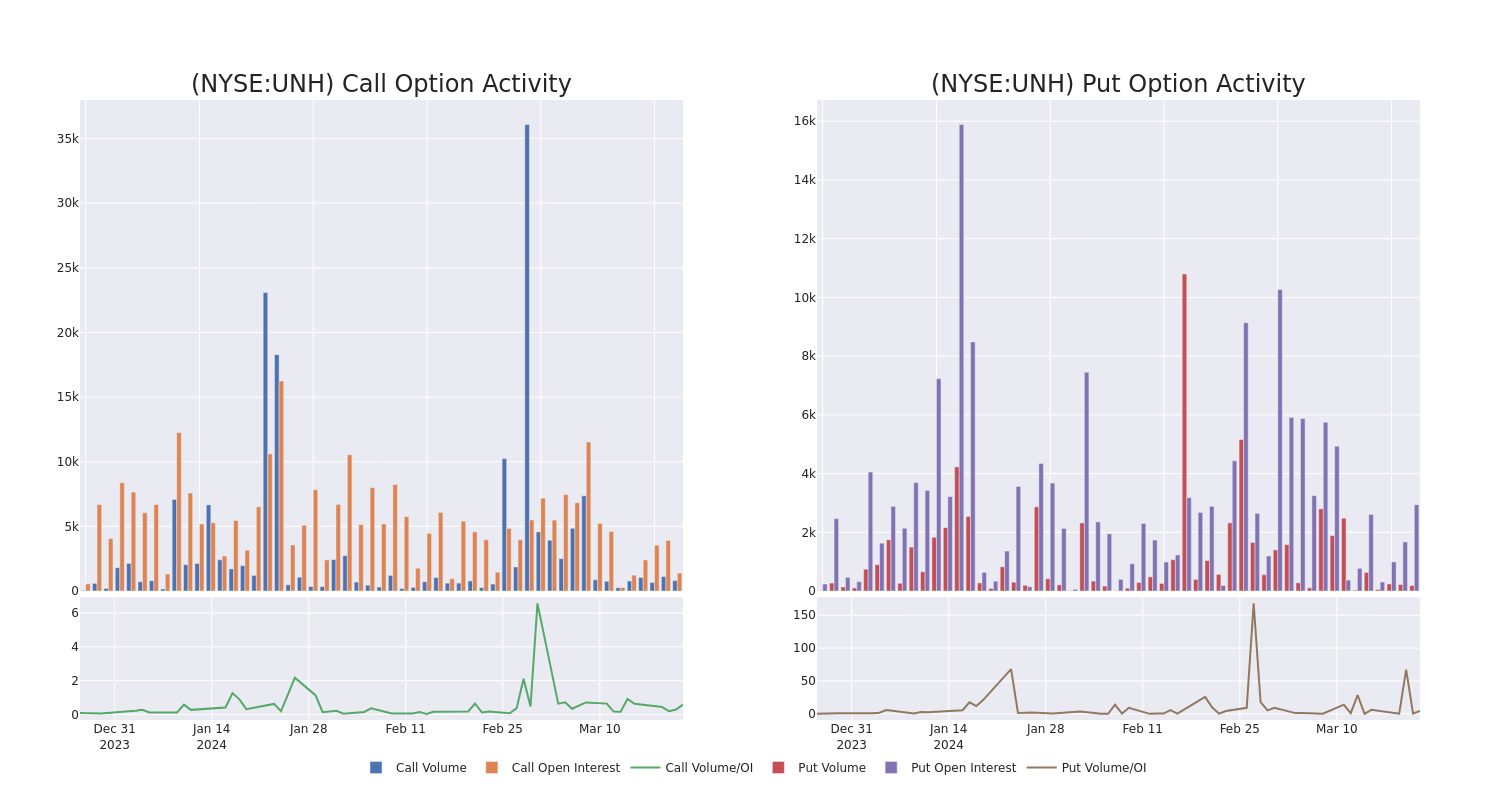

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for UnitedHealth Group's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of UnitedHealth Group's whale trades within a strike price range from $480.0 to $550.0 in the last 30 days.

UnitedHealth Group Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| UNH |

CALL |

SWEEP |

BULLISH |

03/28/24 |

$480.00 |

$78.1K |

152 |

50 |

| UNH |

CALL |

SWEEP |

BULLISH |

03/28/24 |

$480.00 |

$78.0K |

152 |

50 |

| UNH |

PUT |

SWEEP |

BULLISH |

04/05/24 |

$492.50 |

$75.4K |

27 |

117 |

| UNH |

PUT |

SWEEP |

BEARISH |

04/19/24 |

$500.00 |

$60.9K |

1.8K |

40 |

| UNH |

CALL |

SWEEP |

BULLISH |

08/16/24 |

$520.00 |

$55.8K |

17 |

31 |

About UnitedHealth Group

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to about 53 million members globally, including 5 million outside the U.S. as of mid-2023. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth's continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

After a thorough review of the options trading surrounding UnitedHealth Group, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of UnitedHealth Group

- Currently trading with a volume of 1,617,492, the UNH's price is up by 0.47%, now at $494.0.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 25 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for UnitedHealth Group with Benzinga Pro for real-time alerts.

Posted In: UNH